India Metal Sheets Market Size, Share, Trends and Forecast by Material Type, Thickness, Application, and Region, 2025-2033

India Metal Sheets Market Overview:

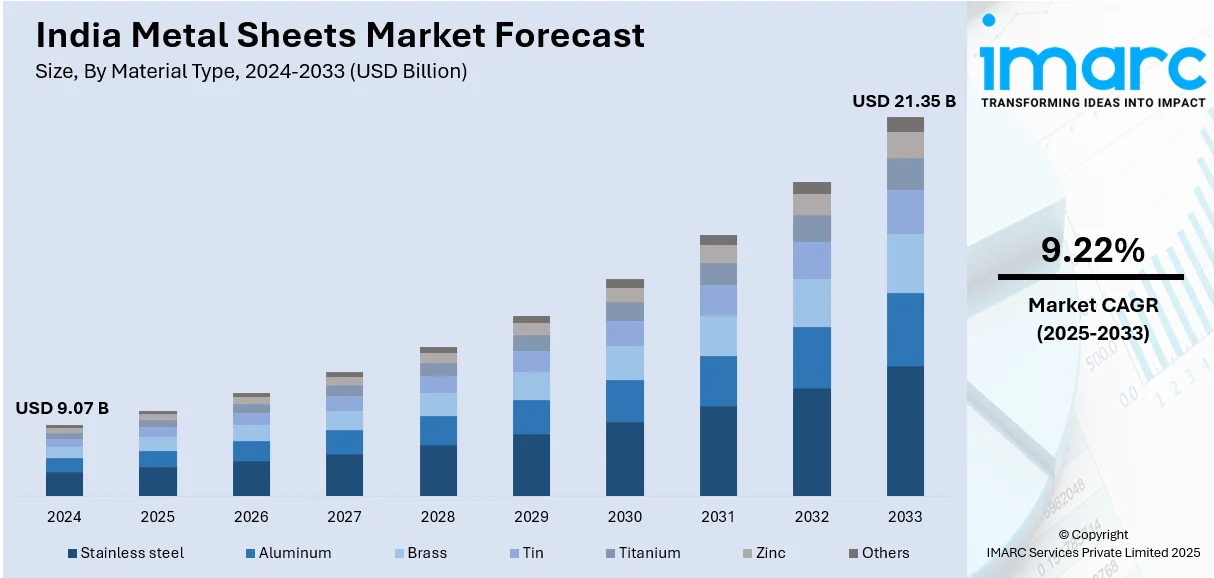

The India metal sheets market size reached USD 9.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.35 Billion by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. The rising infrastructure development, advancements in manufacturing technologies, government initiatives supporting industrial expansion, and the growing emphasis on sustainable building materials are propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.07 Billion |

| Market Forecast in 2033 | USD 21.35 Billion |

| Market Growth Rate (2025-2033) | 9.22% |

India Metal Sheets Market Trends:

Rapid Infrastructure Development and Urbanization

India’s fast-paced urbanization and expansive infrastructure projects are significantly driving the demand for metal sheets. With initiatives like the Smart Cities Mission and Atmanirbhar Bharat bolstering construction investments, metal sheets have become a preferred material in modern building designs—used extensively for roofing, cladding, and façade solutions. In 2023, infrastructure spending in India increased by approximately 10%, fueling a surge in the construction of commercial complexes, residential projects, and industrial units. Moreover, the shift towards sustainable construction practices is acting as another significant growth-inducing factor, since metal sheets are favored for their durability, recyclability, and energy efficiency. In 2023, demand for high-performance metal sheets in urban construction witnessed a 12% increase compared to the previous year, as developers sought cost-effective and eco-friendly solutions. Additionally, forecasts indicate that the ongoing wave of new housing and infrastructure projects will continue to lift demand, with anticipated capital investments exceeding $150 billion by 2025. This growth is further supported by continuous advancements in manufacturing processes that enhance product quality and application versatility.

To get more information on this market, Request Sample

Adoption of Advanced Manufacturing Technologies

The integration of cutting-edge manufacturing technologies is reshaping the metal sheets market in India by enhancing efficiency, quality, and customization. Manufacturers are increasingly investing in automation, digitalization, and Industry 4.0 solutions to streamline production. In 2023, nearly 40% of leading metal sheet producers implemented robotic automation in their production lines, resulting in operational cost reductions of up to 20%. Industry forecasts now suggest that by 2025, over 55% of manufacturers will adopt these advanced digital systems to remain competitive in a fast-evolving market. Furthermore, a surge in R&D investments is also contributing to the market expansion, with a 15–20% increase in expenditure on innovative production techniques recorded in 2023. These technological advancements have led to a 30% improvement in quality control processes, ensuring more consistent product performance and reduced wastage. Enhanced monitoring systems leveraging IoT and AI have also contributed to a 25% boost in production efficiency from 2023 to 2024. Such developments not only help meet the increasing domestic demand but also adhere to international standards, thereby impelling the market growth.

India Metal Sheets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material type, thickness, and application.

Material Type Insights:

- Stainless steel

- Aluminum

- Brass

- Tin

- Titanium

- Zinc

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, aluminum, brass, tin, titanium, zinc, and others.

Thickness Insights:

- < 1 mm

- 1-6 mm

- > 6mm

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes < 1 mm, 1-6 mm, and > 6mm.

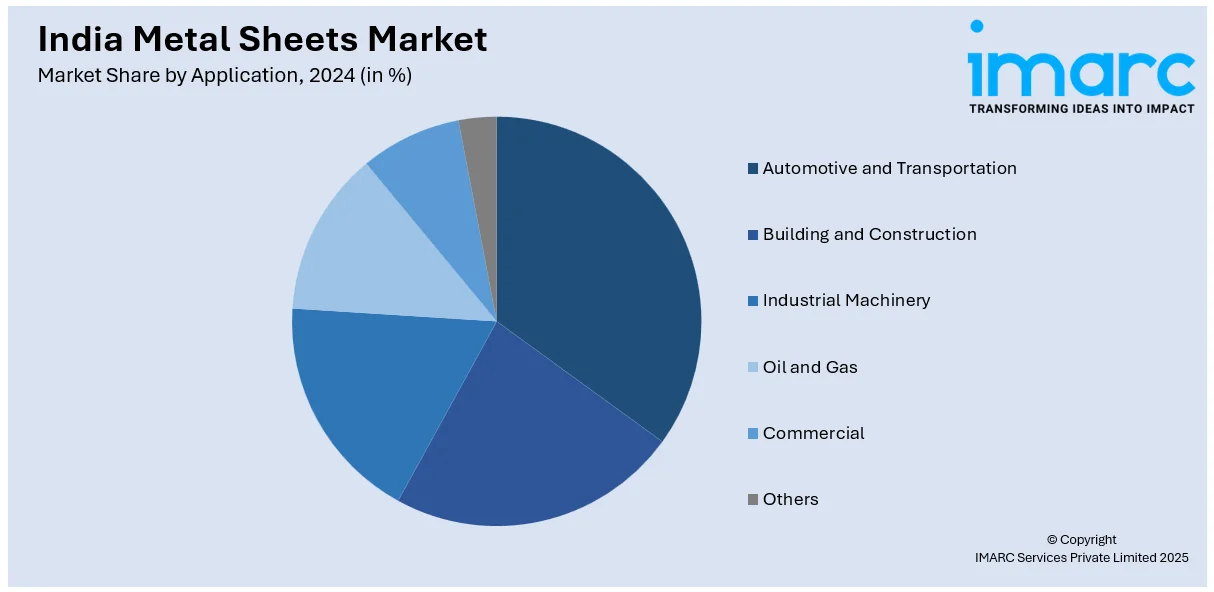

Application Insights:

- Automotive and Transportation

- Building and Construction

- Industrial Machinery

- Oil and Gas

- Commercial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, building and construction, industrial machinery, oil and gas, commercial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Sheets Market News:

- November 2024: Jindal (India) Ltd. secured a 30% market share in Assam's coated steel segment with a 0.6 million MT capacity expansion to enhance sheet production for sectors like solar and home appliances. Its premium Jindal Neucolor+ sheets and Jindalume aluminum-zinc sheets saw strong demand.

- September 2024: Jindal Stainless partnered with BrahMos Aerospace Pvt. Ltd to manufacture and supply steel sheets and plates from its Hisar plant in Haryana. This follows a rigorous quality assessment by BrahMos, confirming Jindal Stainless as a qualified vendor for materials vital to defense applications.

India Metal Sheets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Aluminum, Brass, Tin, Titanium, Zinc, Others |

| Thickness Covered | < 1 mm, 1-6 mm, > 6mm |

| Applications Covered | Automotive and Transportation, Building and Construction, Industrial Machinery, Oil and Gas, Commercial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India metal sheets market performed so far and how will it perform in the coming years?

- What is the breakup of the India metal sheets market on the basis of material type?

- What is the breakup of the India metal sheets market on the basis of thickness?

- What is the breakup of the India metal sheets market on the basis of application?

- What are the various stages in the value chain of the India metal sheets market?

- What are the key driving factors and challenges in the India metal sheets market?

- What is the structure of the India metal sheets market and who are the key players?

- What is the degree of competition in the India metal sheets market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal sheets market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal sheets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal sheets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)