India Methyl Chloride Market Size, Share, Trends and Forecast by Function, Application, and Region, 2025-2033

India Methyl Chloride Market Size and Share:

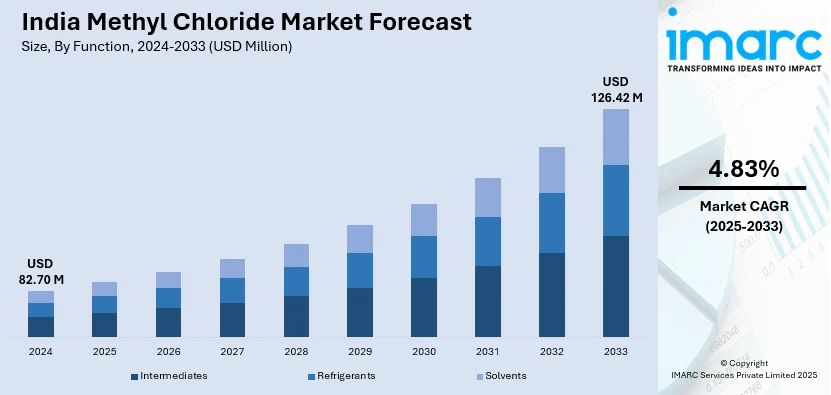

The India methyl chloride market size reached USD 82.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 126.42 Million by 2033, exhibiting a growth rate (CAGR) of 4.83% during 2025-2033. The market is spurred by increasing industrial demand, particularly in the production of silicones for automotive and construction sectors, significant advancements in agricultural practices utilizing methyl chloride-based agrochemicals, and economic development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.70 Million |

| Market Forecast in 2033 | USD 126.42 Million |

| Market Growth Rate 2025-2033 | 4.83% |

India Methyl Chloride Market Trends:

Expansion of the Silicone Industry

Methyl chloride, often known as chloromethane, is an important raw ingredient in the manufacture of silicone. The growing need for silicones in different sectors is driving the methyl chloride market in India. Silicones are appreciated for their flexibility, including uses in the automotive, construction, electronics, and healthcare industries. They are utilized in automobile lubricants, adhesives, and sealants, which improve vehicle longevity and performance. Silicones are used in the construction industry as sealants and coatings to improve building lifespan and energy efficiency. The electronics industry benefits from silicones in encapsulants and insulators, ensuring device reliability. This widespread adoption is driving the demand for methyl chloride as a precursor. Moreover, the Indian chloromethane market, encompassing methyl chloride, reached approximately 411.56 thousand metric tons in the fiscal year 2023, creating a positive outlook for market expansion. This growth is largely attributed to the expanding silicone industry, which relies on methyl chloride for production.

To get more information on this market, Request Sample

Increased Investments in the Petrochemical Sector

Significant investments in India's petrochemical sector are creating a conducive environment for the growth of the methyl chloride market. India is poised for significant growth in its petrochemical industry, with an estimated investment of $87 billion over the next decade to cater to increasing domestic demand. Currently valued at approximately $220 billion, the chemical and petrochemical sector is projected to expand to $300 billion by 2025. This substantial capital influx is expected to drive advancements in production capacity across various chemicals, including methyl chloride. Furthermore, India's overall petrochemical production is forecasted to rise significantly, increasing from 29.62 million tons to 46 million tons by 2030. This expansion indicates a robust growth trajectory for the sector, with methyl chloride production poised to benefit from the increased capacities. This positive outlook reflects the growing demand for chloromethanes, influenced by the expansion of the petrochemical industry.

India Methyl Chloride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on function, and application.

Function Insights:

- Intermediates

- Refrigerants

- Solvents

The report has provided a detailed breakup and analysis of the market based on the function. This includes intermediates, refrigerants, and solvents.

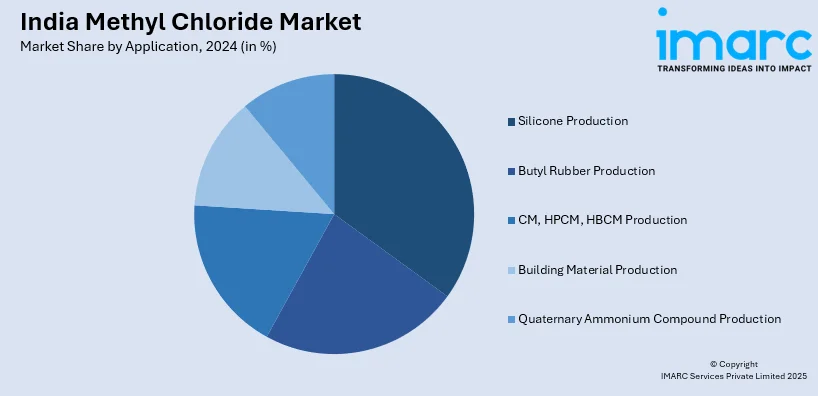

Application Insights:

- Silicone Production

- Butyl Rubber Production

- CM, HPCM, HBCM Production

- Building Material Production

- Quaternary Ammonium Compound Production

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes silicone production, butyl rubber production, CM, HPCM, HBCM production, building material production, and quaternary ammonium compound production.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Methyl Chloride Market News:

- March 2025: US-based manufacturing giant Jabil Inc. announced its intent to invest Rs 1,000 crore in a new silicon photonics manufacturing unit in Gujarat, marking its second facility in India. The investment has heightened the demand for methyl chloride as a raw material in silicone manufacturing.

- July 2020: SRF Ltd approved the establishment of an additional chloromethane facility in Dahej, Gujarat, at a cost of Rs 315 crore. The move follows a drop in earnings and profits during the first quarter of the year due to lower market demand caused by the COVID-19 pandemic. The company plans to add an additional 1,00,000 tonnes per annum capacity by January 2022.

India Methyl Chloride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Intermediates, Refrigerants, Solvents |

| Applications Covered | Silicone Production, Butyl Rubber Production, CM, HPCM, HBCM Production, Building Material Production, Quaternary Ammonium Compound Production |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India methyl chloride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India methyl chloride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India methyl chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India methyl chloride market size reached USD 82.70 Million in 2024.

The India methyl chloride market is expected to reach USD 126.42 Million by 2033, exhibiting a CAGR of 4.83% during 2025-2033.

The India methyl chloride market growth is driven by increasing demand from sectors like pharmaceuticals, agrochemicals, and silicone production, along with expanding industrial activities and favorable government policies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)