India Methyl Ethyl Ketone (MEK) Market Size, Share, Trends and Forecast by Application, Form, Grade, and Region, 2025-2033

India Methyl Ethyl Ketone (MEK) Market Overview:

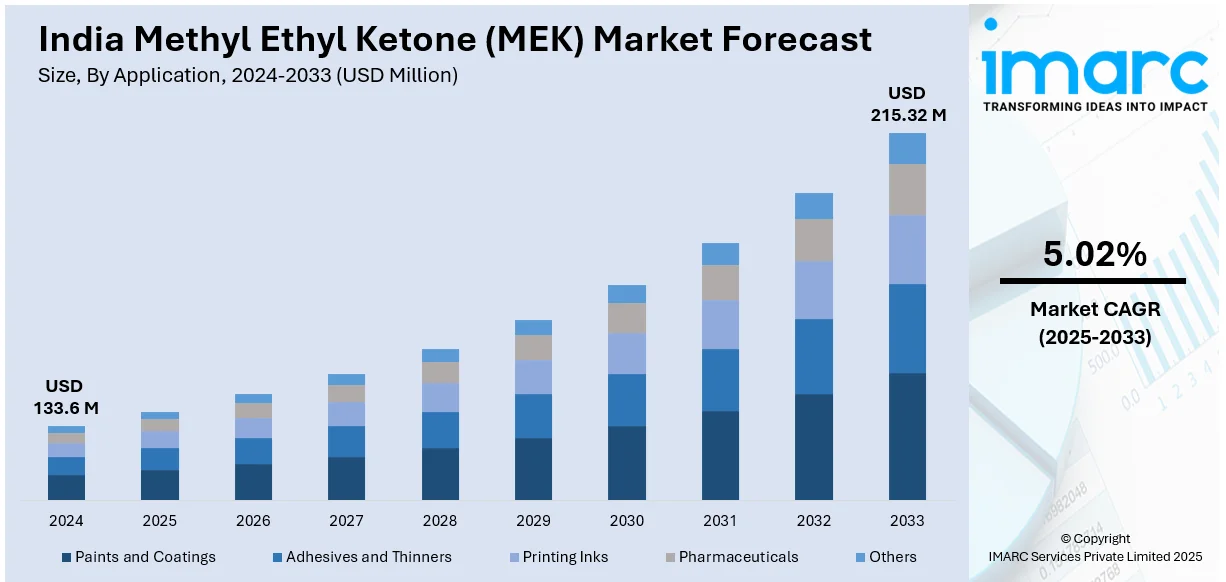

The India methyl ethyl ketone (MEK) market size reached USD 133.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 215.32 Million by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. Growing demand from the paints, coatings, and adhesives industries, supported by rising construction and automotive activities, are some of the factors propelling the growth of the market. Expanding pharmaceutical and printing sectors, along with increased infrastructure investments, further contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 133.6 Million |

| Market Forecast in 2033 | USD 215.32 Million |

| Market Growth Rate 2025-2033 | 5.02% |

India Methyl Ethyl Ketone (MEK) Market Trends:

Increasing Solvent Demand Driven by Paint Sector

The paint sector significantly influences solvent demand, particularly for Methyl Ethyl Ketone (MEK). Decorative paints hold a dominant position, driven by construction and urban development activities. Industrial coatings also contribute to solvent consumption, supported by growth in the automotive and infrastructure sectors. A limited number of major companies maintain strong control over the market, ensuring consistent procurement of raw materials. As real estate expansion and industrial growth continue, solvent-based coatings remain a preferred choice, driving steady demand for MEK in various manufacturing processes. This reliance on solvents underscores their importance in maintaining production efficiency and meeting the evolving needs of the paint and coatings industry. According to industry reports, the Indian paint industry, valued at INR 62,000 Crore in FY2023, accounted for around 70% of the market, with Asian Paints, Berger Paints, Kansai Nerolac, Akzo Nobel, and Indigo Paints controlling 90% of this segment. Decorative paints lead with a 70% share, driven by real estate, while industrial paints account for 30%.

To get more information on this market, Request Sample

Rising MEK Demand from Expanding Printing Sector

The expansion of the flexographic printing market in India is contributing to increased demand for solvents like Methyl Ethyl Ketone (MEK). Advanced printing technologies, including laser-engraved sleeves and elastomer plates, offer enhanced resistance to solvents, making them well-suited for high-quality packaging and labeling applications. The growing packaging industry, driven by e-commerce, retail, and FMCG sectors, further supports the use of solvent-based inks. As businesses prioritize durable and efficient printing solutions, the reliance on MEK remains steady. This shift towards advanced printing materials and processes is set to reinforce MEK’s role in maintaining high-quality production standards within the printing and packaging industries. For instance, in May 2022, Vintex Rubber Rollers Industries entered the flexographic printing market in India, introducing laser-engraved sleeves and elastomer plates. These plates are known for their resistance to solvents like methyl ethyl ketone (MEK), a key component in printing inks. This development is expected to drive MEK demand in the country, supported by the growing packaging and labeling sectors.

India Methyl Ethyl Ketone (MEK) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application, form, and grade.

Application Insights:

- Paints and Coatings

- Adhesives and Thinners

- Printing Inks

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coatings, adhesives and thinners, printing inks, pharmaceuticals, and others.

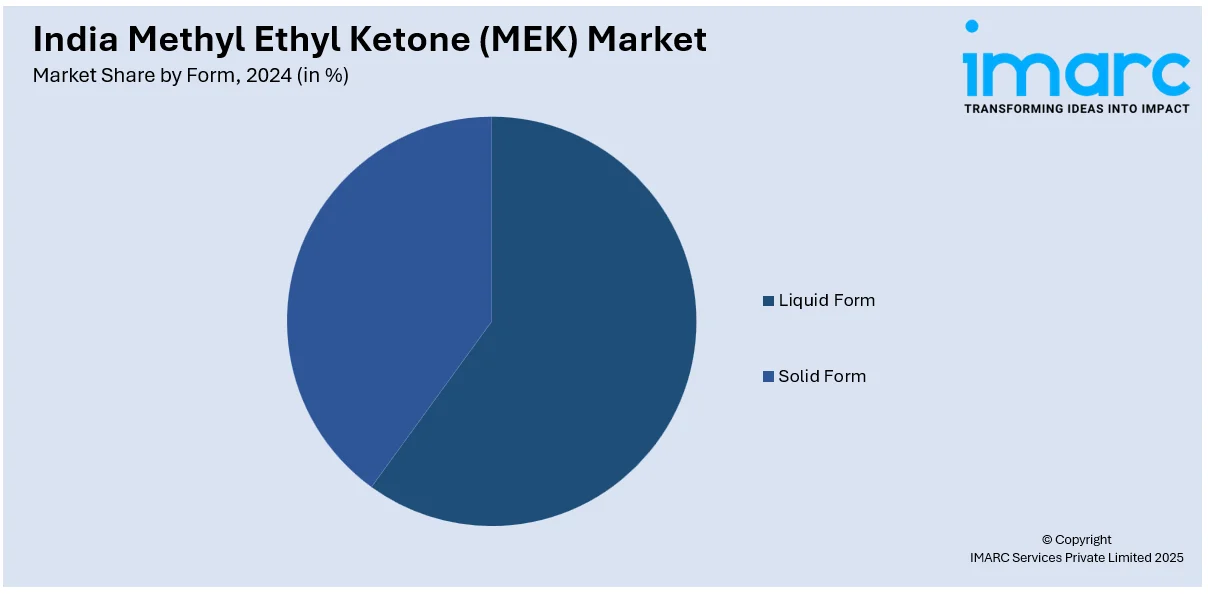

Form Insights:

- Liquid Form

- Solid Form

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid form and solid form.

Grade Insights:

- Regular Grade

- Urethane Grade

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes regular grade, urethane grade, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Methyl Ethyl Ketone (MEK) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Paints and Coatings, Adhesives and Thinners, Printing Inks, Pharmaceuticals, Others |

| Forms Covered | Liquid Form, Solid Form |

| Grades Covered | Regular Grade, Urethane Grade, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India methyl ethyl ketone (MEK) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India methyl ethyl ketone (MEK) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India methyl ethyl ketone (MEK) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India methyl ethyl ketone (MEK) market size reached USD 133.6 Million in 2024.

The India methyl ethyl ketone (MEK) market is expected to reach USD 215.32 Million by 2033, exhibiting a CAGR of 5.02% during 2025-2033.

The India methyl ethyl ketone (MEK) market is driven by increasing demand from the paints and coatings industry, rising use in adhesives and printing inks, and expanding applications across construction, automotive, and industrial manufacturing sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)