India Micro Speakers Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

India Micro Speakers Market Overview:

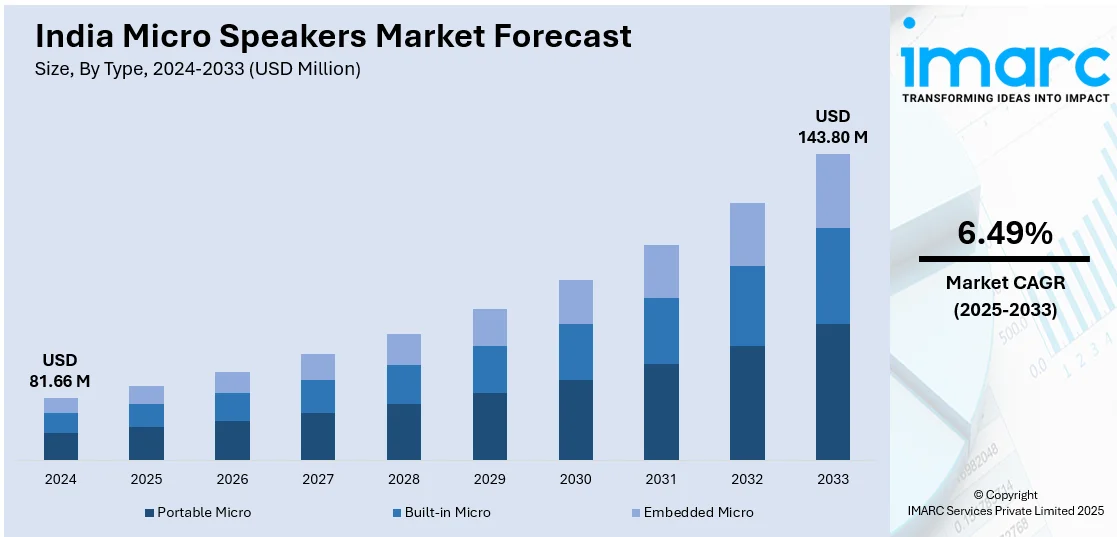

The India micro speakers market size reached USD 81.66 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 143.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.49% during 2025-2033. The India micro speakers market share is expanding, driven by the growing focus on enhancing audio quality to attract buyers and improve sales, along with the rising execution of government initiatives that support local electronics manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 81.66 Million |

| Market Forecast in 2033 | USD 143.80 Million |

| Market Growth Rate 2025-2033 | 6.49% |

India Micro Speakers Market Trends:

Increasing demand for smartphones

The rising demand for smartphones is impelling the India micro speakers market growth. As per industry reports, India's smartphone market became the second largest in the world by unit volume and the third largest by value during Q3 2024. India represented 15.5% of worldwide smartphone shipments. With smartphone sales increasing due to affordable pricing, better internet connectivity, and frequent upgrades, the need for high-performance micro speakers is growing. People expect clear and immersive sound for music, gaming, and video streaming, encouraging brands to invest in better speaker technology. Features like stereo speakers, artificial intelligence (AI)-enhanced sound, and noise cancellation are becoming standard, further driving the demand for advanced micro speakers. The ongoing shift towards 5G smartphones and high-resolution content is also creating the need for superior audio output, leading to innovations in speaker design. As mobile gaming gains popularity, especially with esports and multiplayer games, users prefer phones with powerful sound systems for an immersive experience. Additionally, the rise of voice assistants and hands-free communication is making high-quality microphones and speakers essential in smartphones. Local and international smartphone manufacturers are continuously improving speaker components to offer premium sound without increasing device size.

To get more information on this market, Request Sample

Rising government initiatives

The growing execution of government initiatives that support local electronics manufacturing is offering a favorable India micro speakers market outlook. Programs like ‘Make in India’ and the production-linked incentive (PLI) scheme are encouraging smartphone, laptop, and wearable device manufacturers to set up production facilities within the country, driving the demand for locally sourced micro speakers. With heavy investments in electronics manufacturing clusters and subsidies for component makers, more companies are focusing on improving speaker technology to meet rising user expectations. As brands transition from imports to Indian-made components, the market for micro speakers is expanding, leading to better affordability and innovations. The ongoing shift towards self-reliance in electronics is also attracting big companies to establish local partnerships, further boosting micro speaker production. Additionally, as the government promotes export-oriented manufacturing, Indian-made micro speakers are gaining traction in international markets. With continuous policy support, tax benefits, and investment incentives, local production of electronic items, including micro speakers, is increasing, making India a competitive hub for high-quality audio components. According to the IBEF, the Indian electronics manufacturing sector is expected to achieve USD 520 Billion by 2025. The demand for electronic items is set to rise to USD 400 Billion by FY25, up from USD 33 Billion in FY20.

India Micro Speakers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Portable Micro

- Built-in Micro

- Embedded Micro

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable micro, built-in micro, and embedded micro.

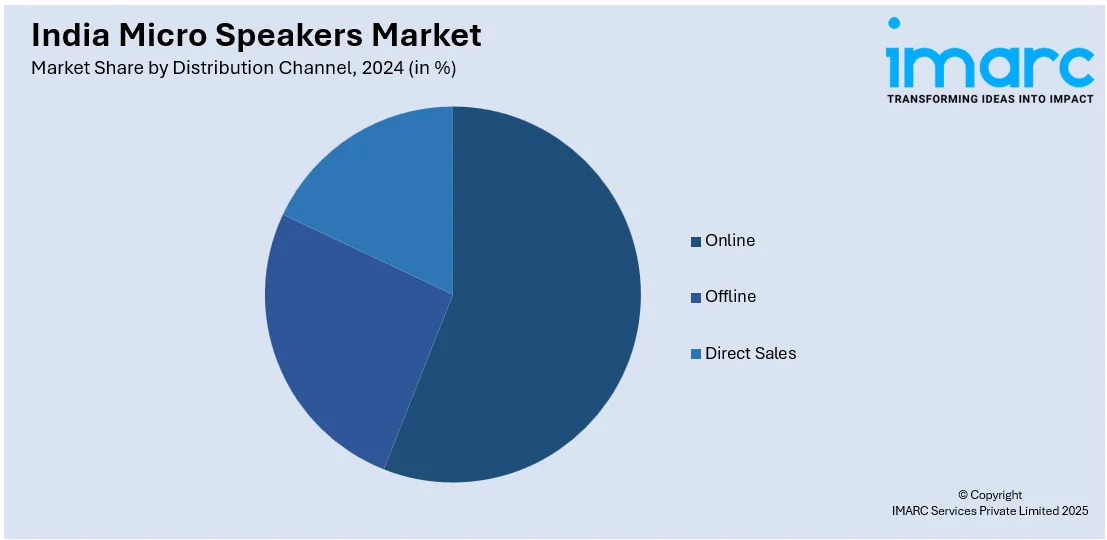

Distribution Channel Insights:

- Online

- Offline

- Direct Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online, offline, and direct sales.

End User Insights:

- Consumer Electronics

- Automotive

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer electronics, automotive, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Micro Speakers Market News:

- In November 2023, a research paper examined the advancements in micro-electro-mechanical-systems (MEMS) audio speaker along with the first commercial products offered in the Indian market. Owing to recent material discoveries and innovations in technology, research into MEMS speakers attracted interest and led to new item developments. A speaker design utilizing piezoelectric actuation or electrostatic actuation was advantageous at the MEMS scale.

India Micro Speakers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable Micro, Built-in Micro, Embedded Micro |

| Distribution Channels Covered | Online, Offline, Direct Sales |

| End Users Covered | Consumer Electronics, Automotive, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India micro speakers market performed so far and how will it perform in the coming years?

- What is the breakup of the India micro speakers market on the basis of type?

- What is the breakup of the India micro speakers market on the basis of distribution channel?

- What is the breakup of the India micro speakers market on the basis of end user?

- What is the breakup of the India micro speakers market on the basis of region?

- What are the various stages in the value chain of the India micro speakers market?

- What are the key driving factors and challenges in the India micro speakers market?

- What is the structure of the India micro speakers market and who are the key players?

- What is the degree of competition in the India micro speakers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India micro speakers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India micro speakers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India micro speakers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)