India Microbiology Testing Market Size, Share, Trends and Forecast by Test Type, Product, Indication, Application, End-User, and Region, 2025-2033

India Microbiology Testing Market Overview:

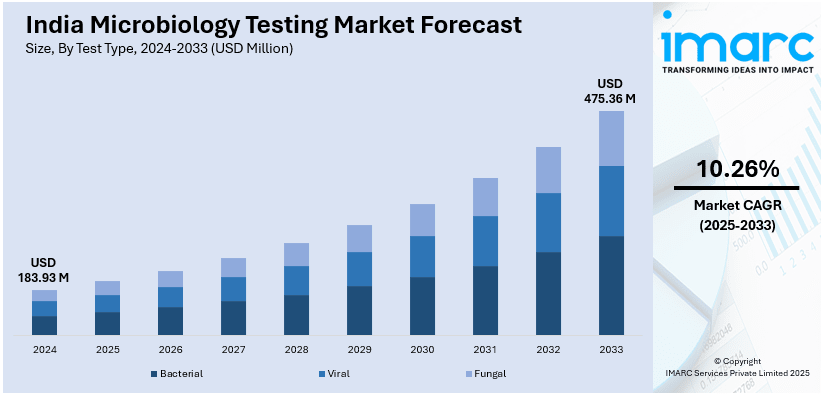

The India microbiology testing market size reached USD 183.93 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 475.36 Million by 2033, exhibiting a growth rate (CAGR) of 10.26% during 2025-2033. The India microbiology testing market share is expanding, driven by the increasing reliance on advanced tests to detect bacterial, viral, and fungal infections accurately, along with the rising development of new medicines that need microbiology testing to study microbial behavior.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 183.93 Million |

| Market Forecast in 2033 | USD 475.36 Million |

| Market Growth Rate 2025-2033 | 10.26% |

India Microbiology Testing Market Trends:

Growing incidence of infectious diseases

The increasing incidence of infectious diseases is offering a favorable India microbiology testing market outlook. With outbreaks of diseases like tuberculosis, dengue, and antimicrobial-resistant infections becoming more common, healthcare providers need efficient diagnostic solutions to manage and control the spread of illnesses. According to industry reports, the Municipal Corporation of Delhi (MCD) confirmed that the total number of dengue infections in the city surpassed 4,000 in 2024, with 467 new cases recorded in the weekly cycle that concluded on November 2. Microbiology testing aids in identifying pathogens, guiding treatment decisions, and preventing complications, making it a crucial part of the healthcare system. The growing concerns about hospital-acquired infections is also encouraging more hospitals to adopt routine microbiology testing to ensure patient safety. Additionally, the rise in lifestyle diseases, such as diabetes, weakens immunity, making individuals more vulnerable to infections, creating the need for accurate testing. The expansion of diagnostic chains and healthcare facilities, especially in rural areas, is making microbiology testing more accessible. Government initiatives to strengthen disease surveillance and control, along with efforts to improve public healthcare infrastructure, are also playing a key role in catalyzing the demand for these tests. With ongoing innovations in diagnostic technology, microbiology testing is becoming faster and more reliable, assuring better patient outcomes and supporting the high requirement for efficient disease management across the country.

To get more information on this market, Request Sample

Rising applications in biotechnology industry

Increasing applications in the biotechnology industry are fueling the India microbiology testing market growth. Biotech companies rely on these tests for research, drug development, and quality control. With increasing investments in pharmaceuticals, vaccines, and bio-based products, microbiology testing is being employed to ensure the safety and efficacy of biotechnological innovations. Companies developing new medicines and therapies need microbiology testing to detect contamination and maintain regulatory compliance. The rise of biopharmaceuticals, including monoclonal antibodies and gene therapies, is further creating the need for precise microbial analysis. In agricultural biotechnology, microbiology testing assists in studying soil microbes, manufacturing biofertilizers, and improving crop protection methods. Additionally, advancements in synthetic biology and genetic engineering require continuous microbiological monitoring to maintain sterility and ensure successful outcomes. Government initiatives promoting biotechnology research and startups are also driving the demand for microbiology testing services. As the biotechnology industry thrives, modern testing techniques, such as automation, molecular diagnostics, and next-generation sequencing, are making microbiology testing more efficient, supporting its increasing utilization across research labs and pharmaceutical firms in India. As per the IMARC Group, the India biotechnology market is set to attain USD 110.3 Billion by 2033, showing a growth rate (CAGR) of 13.78% during 2025-2033.

India Microbiology Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on test type, product, indication, application, and end-user.

Test Type Insights:

- Bacterial

- Viral

- Fungal

The report has provided a detailed breakup and analysis of the market based on the test type. This includes bacterial, viral, and fungal.

Product Insights:

- Instruments

- Reagents

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes instruments and reagents.

Indication Insights:

- Respiratory Diseases

- Bloodstream Infections

- Gastrointestinal Diseases

- Sexually Transmitted Diseases

- Urinary Tract Infection

- Periodontal Diseases

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes respiratory diseases, bloodstream infections, gastrointestinal diseases, sexually transmitted diseases, urinary tract infection, periodontal diseases, and others.

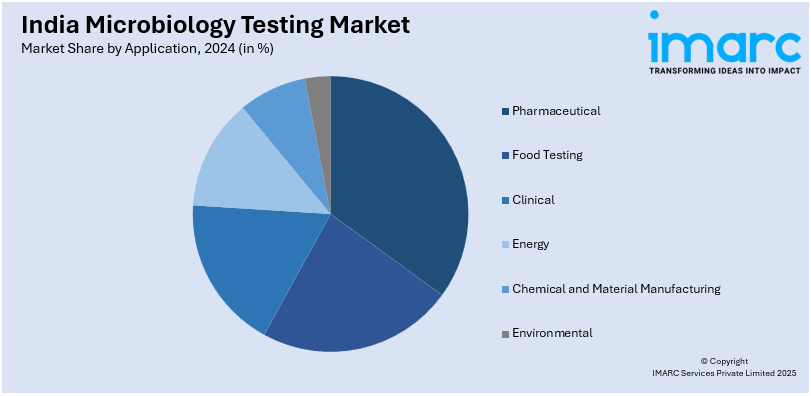

Application Insights:

- Pharmaceutical

- Food Testing

- Clinical

- Energy

- Chemical and Material Manufacturing

- Environmental

The report has provided a detailed breakup and analysis of the market based on the application. This includes pharmaceutical, food testing, clinical, energy, chemical and material manufacturing, and environmental.

End-User Insights:

- Hospitals and Diagnostic Centers

- Custom Lab Service Providers

- Academic and Research Institutes

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals and diagnostic centers, custom lab service providers, and academic and research institutes.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Microbiology Testing Market News:

- In February 2025, the Health Department of India set up Jaipur's inaugural government-run microbiology lab to analyze food samples for bacteria and various microorganisms. The facility was aimed at ensuring food safety by identifying different microorganisms, such as pathogens, in food items.

- In January 2025, the Food Safety Department of India set up a new microbiology lab with advanced facilities for analyzing different food items in Thiruvananthapuram. The newly established microbiology testing lab was outfitted with state-of-the-art facilities. It also aimed to enhance the efforts of the regional analytical labs in Ernakulam and Kozhikode.

India Microbiology Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Bacterial, Viral, Fungal |

| Products Covered | Instruments, Reagents |

| Indications Covered | Respiratory Diseases, Bloodstream Infections, Gastrointestinal Diseases, Sexually Transmitted Diseases, Urinary Tract Infection, Periodontal Diseases, Others |

| Applications Covered | Pharmaceutical, Food Testing, Clinical, Energy, Chemical and Material Manufacturing, Environmental |

| End-Users Covered | Hospitals and Diagnostic Centers, Custom Lab Service Providers, Academic and Research Institutes |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India microbiology testing market performed so far and how will it perform in the coming years?

- What is the breakup of the India microbiology testing market on the basis of test type?

- What is the breakup of the India microbiology testing market on the basis of product?

- What is the breakup of the India microbiology testing market on the basis of indication?

- What is the breakup of the India microbiology testing market on the basis of application?

- What is the breakup of the India microbiology testing market on the basis of end-user?

- What is the breakup of the India microbiology testing market on the basis of region?

- What are the various stages in the value chain of the India microbiology testing market?

- What are the key driving factors and challenges in the India microbiology testing market?

- What is the structure of the India microbiology testing market and who are the key players?

- What is the degree of competition in the India microbiology testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India microbiology testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India microbiology testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India microbiology testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)