India Microcrystalline Cellulose Market Size, Share, Trends and Forecast by Source Type, Route of Synthesis, End User, and Region, 2025-2033

India Microcrystalline Cellulose Market Overview:

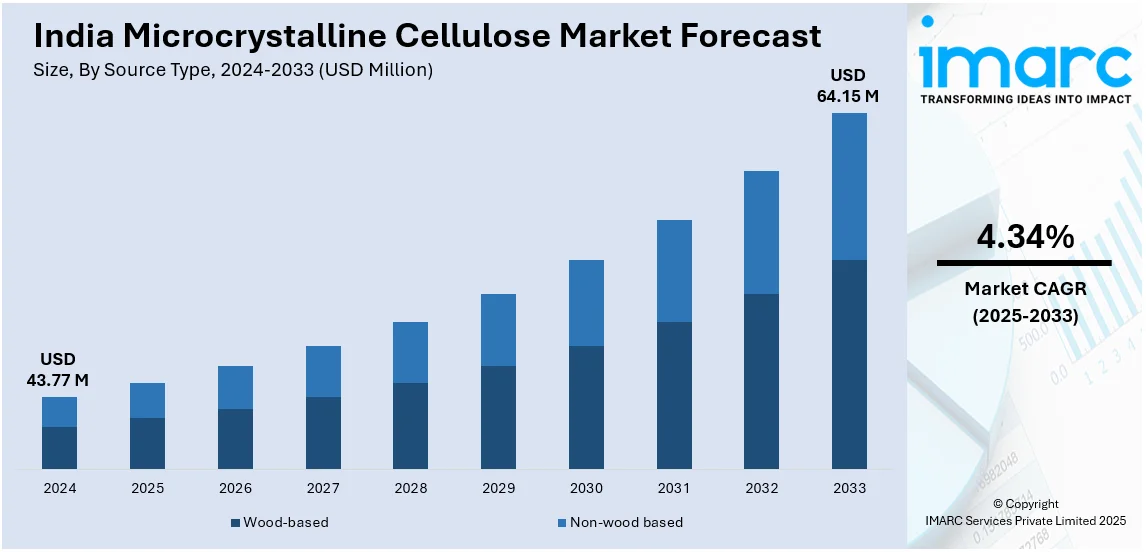

The India microcrystalline cellulose market size reached USD 43.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 64.15 Million by 2033, exhibiting a growth rate (CAGR) of 4.34% during 2025-2033. The India microcrystalline cellulose market share is expanding, driven by the growing user awareness about eco-friendly packaging and stringent environmental regulations, along with increasing investments in research, enabling the development of refined items with better water absorption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.77 Million |

| Market Forecast in 2033 | USD 64.15 Million |

| Market Growth Rate (2025-2033) | 4.34% |

India Microcrystalline Cellulose Market Trends:

Increasing demand in paper and packaging industry

The rising demand in the paper and packaging industry is offering a favorable India microcrystalline cellulose market outlook. Microcrystalline cellulose is widely employed in paper manufacturing to improve the strength, texture, and durability of paper items. Its natural fiber structure enhances paper quality by providing better bonding between fibers, resulting in improved tensile strength and smoother surfaces. This makes microcrystalline cellulose particularly useful in producing high-quality printing paper, specialty papers, and packaging materials. As the packaging industry is expanding to meet the growing demand for sustainable and biodegradable solutions, microcrystalline cellulose emerges as an ideal additive due to its non-toxic, renewable, and environment friendly properties. It helps in refining the stiffness and thickness of paperboard and carton packaging without adding significant weight, improving product protection during transit. Additionally, microcrystalline cellulose’s moisture-absorbing capabilities make it valuable in food and pharmaceutical packaging, wherein maintaining product freshness is crucial. With increasing user awareness about eco-friendly packaging and stricter environmental regulations in the country, the paper and packaging industry is actively adopting microcrystalline cellulose to replace synthetic additives. As this industry continues to broaden, the need for microcrystalline cellulose to support sustainable practices is rising. According to the India Brand Equity Foundation, India remained at the forefront of the paper industry, as domestic usage of packaging paper and paperboard increased by 8.2% in 2023-24.

To get more information on this market, Request Sample

Growing investments in research and development (R&D) activities

The rising expenditure on R&D activities is propelling the India microcrystalline cellulose market growth. With the increasing application across industries like pharmaceuticals, companies are wagering on R&D projects to develop microcrystalline cellulose grades with better functionality, stability, and performance. For example, in February 2025, Sigachi Industries revealed plans to spend USD 1 Million on establishing a new R&D facility in Hyderabad, India. The firm focused on manufacturing microcrystalline cellulose, an essential component utilized in food and beverages (F&B) and cosmetics. This initiative sought to boost innovations, refine pharmaceutical solutions, and reinforce the company's emphasis on cutting-edge research. In the pharmaceutical sector, R&D efforts focus on enhancing microcrystalline cellulose’s binding, disintegration, and controlled-release properties, improving its role in tablet formulations. In the F&B industry, researchers are creating variants of microcrystalline cellulose that offer refined texture, stability, and fat-replacement capabilities in processed food items. Additionally, R&D investments also enable the development of microcrystalline cellulose with enhanced water absorption, making it more effective in personal care products and cosmetics. With continuous advancements, manufacturers are expanding its utilization in sectors, such as 3D printing materials, coatings, and biodegradable packaging.

India Microcrystalline Cellulose Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on source type, route of synthesis, and end user.

Source Type Insights:

- Wood-based

- Non-wood based

The report has provided a detailed breakup and analysis of the market based on the source types. This includes wood-based and non-wood based.

Route of Synthesis Insights:

- Reactive Extrusion

- Enzyme Mediated

- Steam Explosion

- Acid Hydrolysis

- Mechanical Grinding

- Ultrasonication

A detailed breakup and analysis of the market based on the routes of synthesis have also been provided in the report. This includes reactive extrusion, enzyme mediated, steam explosion, acid hydrolysis, mechanical grinding, and ultrasonication.

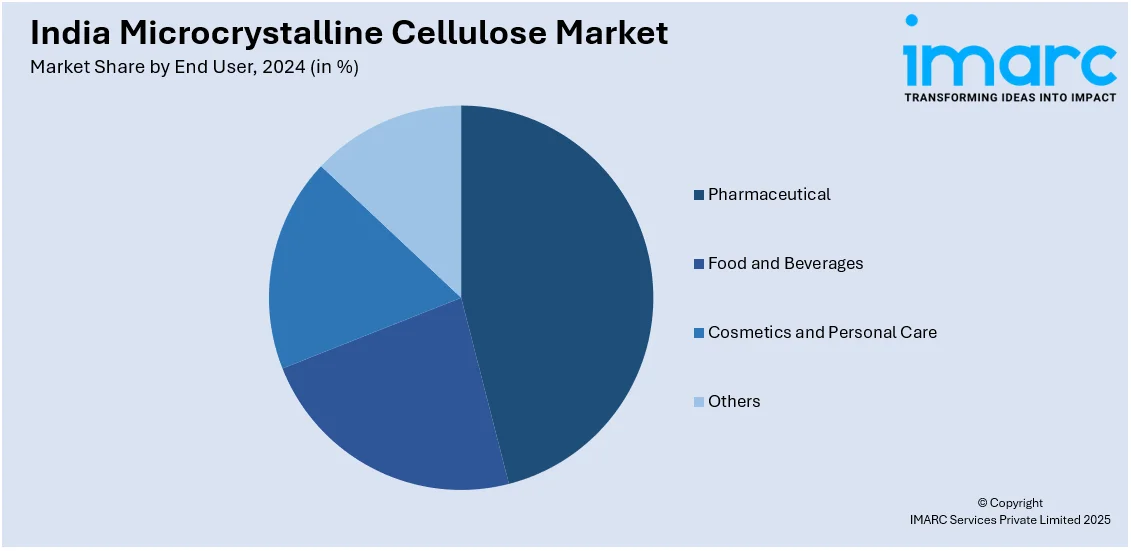

End User Insights:

- Pharmaceutical

- Food and Beverages

- Cosmetics and Personal Care

- Others

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes pharmaceutical, food and beverages, cosmetics and personal care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Microcrystalline Cellulose Market News:

- In March 2025, Oji Holdings acquired a strategic sale of BDA Partners, with the assistance of the latter’s clients, Chemfield Cellulose Pvt Ltd., a prominent Indian producer and developer of microcrystalline cellulose excipients and their derivatives. The firm sought to grow in the high-value-added sector by establishing a comprehensive production and sales system for pulp-based items, including microcrystalline cellulose, as a downstream extension of its pulp raw material operations in the country.

- In September 2023, Nitika Pharmaceuticals Specialty Private Limited, a contract manufacturing firm, opened the largest microcrystalline cellulose production facility in Nagpur, India. The facility featured state-of-the-art technology and infrastructure, boasting an installed capacity of 1200 MT.

India Microcrystalline Cellulose Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Source Types Covered | Wood-based, Non-wood based |

| Routes of Synthesis Covered | Reactive Extrusion, Enzyme Mediated, Steam Explosion, Acid Hydrolysis, Mechanical Grinding, Ultrasonication |

| End Users Covered | Pharmaceutical, Food and Beverages, Cosmetics and Personal Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India microcrystalline cellulose market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India microcrystalline cellulose market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India microcrystalline cellulose industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The microcrystalline cellulose market in india was valued at USD 43.77 Million in 2024.

The India microcrystalline cellulose market is projected to exhibit a CAGR of 4.34% during 2025-2033, reaching a value of USD 64.15 Million by 2033.

The market is growing due to rising demand in the paper and packaging industry, strict environmental rules, increasing investments in research and development (R&D) initiatives, and user preference for eco-friendly packaging to develop advanced grades with better performance and water absorption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)