India Milk Alternatives Market Size, Share, Trends and Forecast by Source, Flavor, Packaging, Distribution Channel, and Region, 2025-2033

India Milk Alternatives Market Overview:

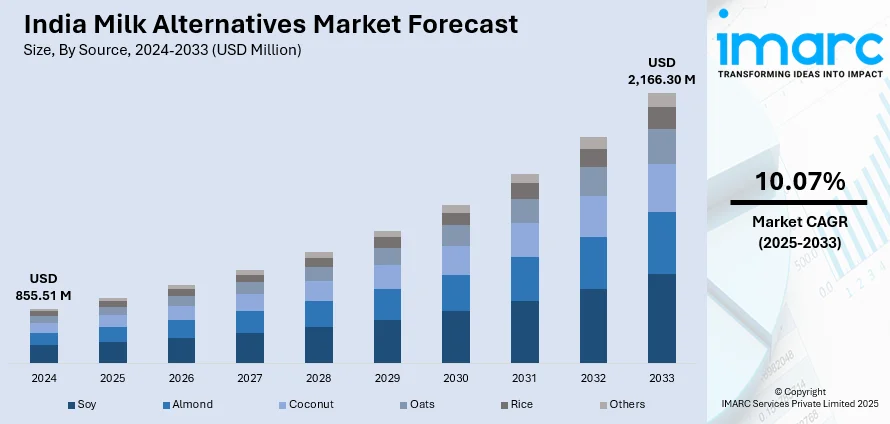

The India milk alternatives market size reached USD 855.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,166.30 Million by 2033, exhibiting a growth rate (CAGR) of 10.07% during 2025-2033. The market is fueled by increasing demand for plant-based beverages such as almond, soy, oat, coconut, and rice milk. The products are sold in flavored and unflavored forms, with various packaging formats, through both online and offline distribution channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 855.51 Million |

| Market Forecast in 2033 | USD 2,166.30 Million |

| Market Growth Rate (2025-2033) | 10.07% |

India Milk Alternatives Trends:

Growing Demand for Plant-Based Milk Alternatives

The Indian milk alternatives market is growing strongly with consumers increasingly going for plant-based diets and making healthier choices. Plant-based milk substitutes like almond, soy, coconut, oat, and rice milk are proving popular because of their health merits, including their natural lactose-free status and high content of vitamins and minerals. For instance, in September 2023, epigamia introduced the "Oat Beverage Classic" in India, a lactose-free, low-calorie, barista-approved oat milk alternative, catering to lactose-intolerant consumers and encouraging healthier, plant-based options. Moreover, growing acceptance of veganism, healthy lifestyle trends, and rising instances of lactose intolerance are the key drivers of the trend. Millennials and Gen Z, especially, are spearheading the transition to sustainable and ethical food consumption. The versatility of milk alternatives, being usable in cooking, baking, and beverages, adds to their popularity. Moreover, the market is witnessing boosted availability in mainstream retail channels, such as supermarkets, convenience stores, and online platforms. With heightening awareness of the environment and health benefits, the Indian market for milk alternatives is poised to grow, and this will also create scope for new product innovations.

To get more information on this market, Request Sample

Fortified Milk Alternatives Catering to Nutritional Needs

With increasing interest in health and nutrition, fortified plant-based milk products are gaining more popularity in India. Customers not only want milk alternatives that provide dairy-free nutrition but also essentials such as calcium, vitamin D, and vitamin B12. Fortification plays a role in filling nutritional deficits, thus providing plant-based milk as a preferable choice for individuals of all age groups, whether children, adults, or older adults. These fortified products are especially attractive to athletes, vegans, and consumers with dietary restrictions like lactose intolerance. Demand for fortified products has also been driven by the focus on immunity and general wellness. Numerous milk alternatives now contain added proteins and omega-3 fatty acids to help promote bone health, muscle function, and heart health. As customers grow more label-savvy and look for functional foods, fortified milk products will continue to be a top-performing category in the Indian market.

Flavor and Packaging Innovations in Milk Alternatives

Flavor and packaging innovation is revolutionizing the milk alternative business in India. Historically characterized by unflavored alternatives, the business is now witnessing growth in unusual and rich flavors, such as chocolate, vanilla, caramel, coffee, and fruit combinations. The flavors meet different tastes, especially among children and families in search of diversity in their meals. In addition to flavor innovation, packaging innovation is also on the rise to boost convenience and sustainability. Brands are launching sustainable packaging like cartons and glass bottles, as well as varying sizes of packs ranging from single-serve packs suitable for eating on the go to family packs. Smart packaging that protects freshness and increases shelf life is also being explored. For instance, in March 2023, India's Dancing Cow introduced "Oatish," a plant-based milk produced using oats, millet, and mung beans, in Extra Creamy and Rich Chocolate flavors with a shelf life of 9-12 months. Additionally, such innovations enhance the appeal of products as well as support consumer demands for convenience, quality, and environmentally friendly alternatives. These changing market dynamics are a combination of functionality, taste, and sustainable consumption.

India Milk Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on source, flavor, packaging, and distribution channel

Source Insights:

- Soy

- Almond

- Coconut

- Oats

- Rice

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, almond, coconut, oats, rice, and others.

Flavor Insights:

- Flavored

- Unflavored

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes flavored and unflavored.

Packaging Insights:

- Cartons

- Glass bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes cartons, glass bottles, and others.

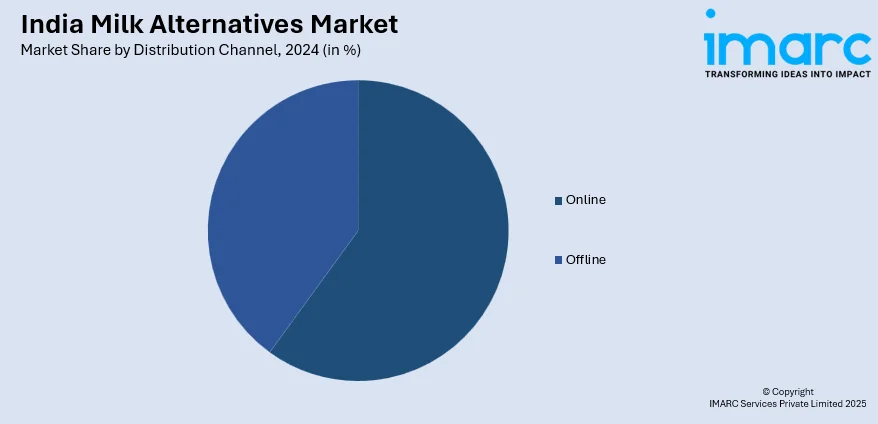

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Milk Alternatives Market News:

- In September 2024, Oxbow Brands opened the "Vegan Drink Company" (VDC) in India, selling a variety of plant-based alternatives to milk from almond, oats, millet, soy, and coconut. These lactose-free and vegan options appeal to target lactose-intolerant as well as vegan customers and can be found for purchase on the web, stores, and specialized regional markets.

- In August 2024, 1.5 Degree introduced a variety of plant-based dairy options at the 7th India International Hospitality Expo in Greater Noida. The range comprises Oat Milk, Soy Milk, milkshakes with various flavors, cold coffee, and vegan gelato, following the UN's 1.5°C target of global warming through innovation and sustainability.

India Milk Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Almond, Coconut, Oats, Rice, Others |

| Flavors Covered | Flavored, Unflavored |

| Packagings Covered | Cartons, Glass Bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India milk alternatives market performed so far and how will it perform in the coming years?

- What is the breakup of the India milk alternatives market on the basis of source?

- What is the breakup of the India milk alternatives market on the basis of flavor?

- What is the breakup of the India milk alternatives market on the basis of packaging?

- What is the breakup of the India milk alternatives market on the basis of distribution channel?

- What is the breakup of the India milk alternatives market on the basis of region?

- What are the various stages in the value chain of the India milk alternatives market?

- What are the key driving factors and challenges in the India milk alternatives?

- What is the structure of the India milk alternatives market and who are the key players?

- What is the degree of competition in the India milk alternatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India milk alternatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India milk alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India milk alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)