India Mineral Exploration Equipment Market Size, Share, Trends and Forecast by Equipment Type, Mineral Type, End User, and Region, 2025-2033

India Mineral Exploration Equipment Market Overview:

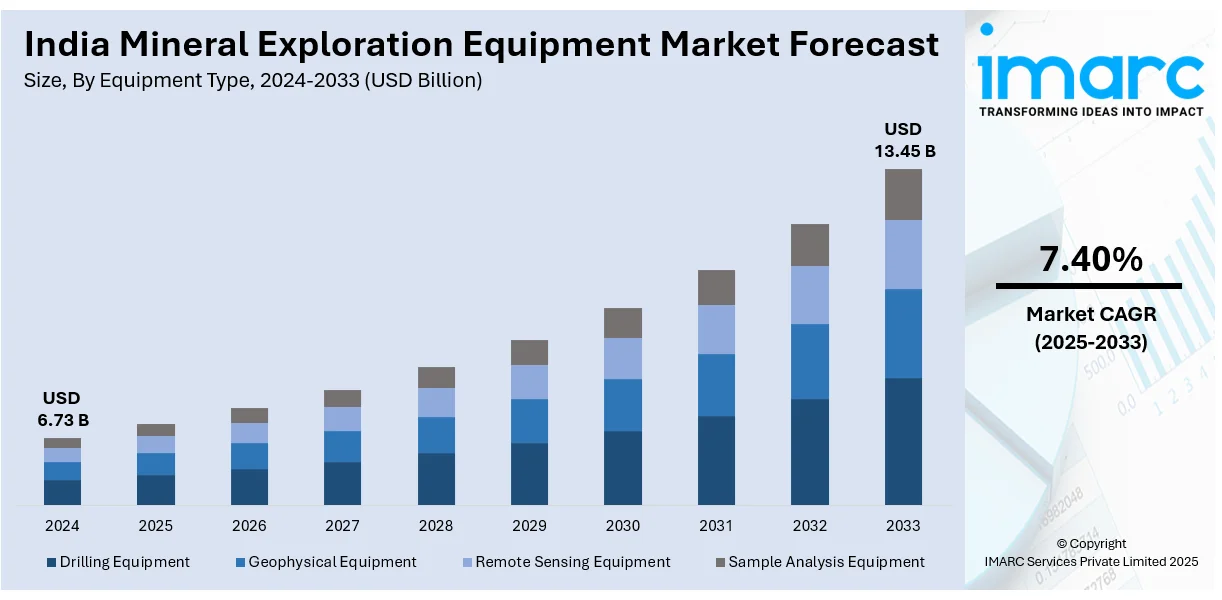

The India mineral exploration equipment market size reached USD 6.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.45 Billion by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is witnessing significant growth, driven by the escalating demand for advanced and automated exploration technologies and the government policy reforms and public-private collaboration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.73 Billion |

| Market Forecast in 2033 | USD 13.45 Billion |

| Market Growth Rate 2025-2033 | 7.40% |

India Mineral Exploration Equipment Market Trends:

Rising Demand for Advanced and Automated Exploration Technologies

India’s mineral exploration equipment market is witnessing a significant shift toward advanced and automated technologies to improve efficiency, accuracy, and safety in exploration activities. As the mining sector increasingly embraces digitization, demand is growing for state-of-the-art equipment equipped with GPS, GIS, remote sensing, and real-time data analysis capabilities. These technologies are enabling geologists and exploration firms to conduct detailed subsurface assessments with greater precision, reducing both time and cost per project. Automated drilling rigs, geophysical survey instruments, and 3D mapping tools are gaining traction across both government-led and private sector mineral exploration initiatives. The adoption of integrated software platforms for data management and interpretation is also facilitating better decision-making during early exploration stages. With India seeking to reduce its reliance on imported minerals and increase domestic production under initiatives such as “Make in India” and “Atmanirbhar Bharat,” the modernization of exploration practices is becoming a strategic priority. For instance, in November 2024, India announced its first offshore mineral exploration round, offering 13 blocks, three each for lime mud and construction sand and seven for polymetallic nodules and crusts—targeting infrastructure, high-tech, and energy sectors. Equipment manufacturers are responding by offering modular, scalable systems compatible with rugged terrains and varying geological conditions across the country. This trend is expected to continue as mining firms and public agencies increasingly prioritize productivity, resource optimization, and sustainability in mineral exploration.

To get more information on this market, Request Sample

Government Policy Reforms and Public-Private Collaboration

Policy reforms and increased collaboration between public agencies and private entities are playing a pivotal role in expanding India’s mineral exploration equipment market. The Government of India has introduced several key initiatives—such as the National Mineral Policy (2019), reforms under the Mines and Minerals (Development and Regulation) Act, and recent auction reforms—to encourage private sector participation in mineral exploration. For instance, in March 2025, GSI completed extensive geochemical and geophysical mapping, with NAGMP identifying 322 anomaly areas across 7 blocks for potential concealed mineral zones in India, to accelerate mineral exploration. These measures have improved transparency, streamlined licensing, and provided greater access to unexplored and underexplored mineral blocks. As a result, exploration activity has increased, driving up demand for specialized equipment required for geological surveys, drilling, and geochemical sampling. In addition, government-backed agencies like the Geological Survey of India (GSI) and Mineral Exploration & Consultancy Ltd. (MECL) are partnering with private firms and research institutions to expand exploration coverage using advanced equipment. The emphasis on critical minerals—such as lithium, cobalt, and rare earth elements—needed for electric vehicles and renewable energy technologies is also accelerating investments in exploration infrastructure. Furthermore, public funding and technology-sharing agreements are enabling startups and smaller players to access high-performance equipment, contributing to a more competitive and innovation-driven exploration ecosystem in India.

India Mineral Exploration Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on equipment type, mineral type, and end user.

Equipment Type Insights:

- Drilling Equipment

- Geophysical Equipment

- Remote Sensing Equipment

- Sample Analysis Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes drilling equipment, geophysical equipment, remote sensing equipment, and sample analysis equipment.

Mineral Type Insights:

- Metallic Minerals

- Non-Metallic Minerals

- Coal Exploration

A detailed breakup and analysis of the market based on the mineral type have also been provided in the report. This includes metallic minerals, non-metallic minerals, and coal exploration.

End User Insights:

.webp)

- Mining Companies

- Government and Research Institutions

- Contractors and Service Providers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes mining companies, government and research institutions, and contractors and service providers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mineral Exploration Equipment Market News:

- In February 2025, Oil India Limited (OIL) and Mineral Exploration and Consultancy Limited (MECL) signed an MoU to jointly develop critical mineral blocks. Their immediate focus is the graphite and vanadium block in Arunachal Pradesh, marking the beginning of a strategic partnership aimed at expanding domestic and international mineral development efforts.

India Mineral Exploration Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Drilling Equipment, Geophysical Equipment, Remote Sensing Equipment, Sample Analysis Equipment |

| Mineral Types Covered | Metallic Minerals, Non-Metallic Minerals, Coal Exploration |

| End Users Covered | Mining Companies, Government and Research Institutions, and Contractors, Service Providers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mineral exploration equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India mineral exploration equipment market on the basis of equipment type?

- What is the breakup of the India mineral exploration equipment market on the basis of mineral type?

- What is the breakup of the India mineral exploration equipment market on the basis of end user?

- What is the breakup of the India mineral exploration equipment market on the basis of region?

- What are the various stages in the value chain of the India mineral exploration equipment market?

- What are the key driving factors and challenges in the India mineral exploration equipment ?

- What is the structure of the India mineral exploration equipment market and who are the key players?

- What is the degree of competition in the India mineral exploration equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mineral exploration equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mineral exploration equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mineral exploration equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)