India Minimally Invasive Biopsy Techniques Market Size, Share, Trends and Forecast by Product Offered, Technique, Circulating Biomarker, Application, End User, and Region, 2025-2033

India Minimally Invasive Biopsy Techniques Market Overview:

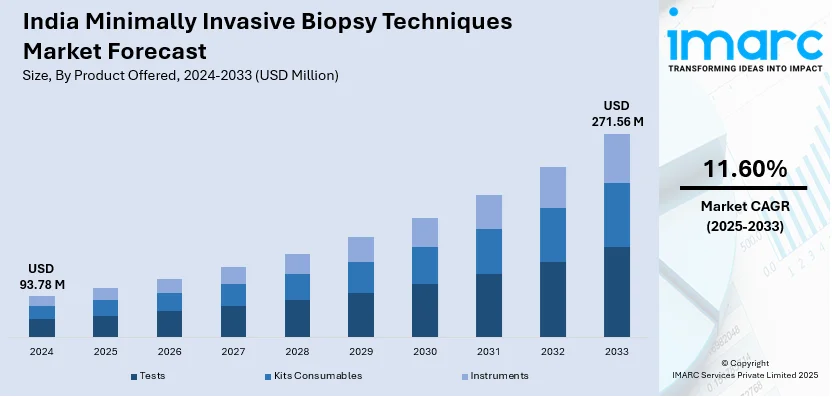

The India minimally invasive biopsy techniques market size reached USD 93.78 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 271.56 Million by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. The India minimally invasive biopsy techniques market is driven by advancements in liquid biopsy technology, increasing cancer cases, government healthcare initiatives, expanding diagnostic infrastructure, rising preference for less invasive procedures, improved imaging modalities, private sector investments, and enhanced accessibility to precision diagnostics across urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 93.78 Million |

| Market Forecast in 2033 | USD 271.56 Million |

| Market Growth Rate (2025-2033) | 11.60% |

India Minimally Invasive Biopsy Techniques Market Trends:

Rising Incidence of Cancer

The rise in cancer prevalence in India has been a strong contributor to the need for enhanced diagnostic procedures, such as minimally invasive biopsies. The Indian Council of Medical Research (ICMR) estimated over 1.4 million cancer cases in 2023 in India. This prevalence of cancer cases requires effective and precise diagnostic tests. Minimally invasive biopsies are beneficial in numerous ways compared to conventional methods, including less pain for the patient, quicker recovery periods, and fewer complications. These factors render them especially apt for the detection and treatment of cancer at the initial stages, in line with the healthcare system's focus on enhanced patient outcomes. The National Cancer Registry Programme (NCRP) instituted by the ICMR in 1982 has played an important role in monitoring cancer incidence and trends throughout the country. NCRP's collected data point toward influence burden of cancer, reinforcing the necessity for effective methods of diagnosis. The introduction of minimally invasive biopsy procedures is a reactive measure to this necessity, enabling timely and accurate diagnosis, which is essential for proper treatment planning. In addition, public health programs for cancer awareness and early detection have led to more people presenting themselves for diagnostic testing. With higher awareness, more patients are choosing minimally invasive procedures because they are less invasive and have shorter recovery times. This patient preference also propels the market for these advanced diagnostic methods.

To get more information on this market, Request Sample

Government Initiatives and Increased Healthcare Funding

Indian government's efforts to enhance healthcare infrastructure and services have been instrumental in encouraging the use of cutting-edge medical technologies, such as minimally invasive biopsy methods. In the Union Budget 2021-22, the government provided INR 2,23,846 crore for healthcare, a significant upsurge compared to earlier years. The emphasis on the development of healthcare services has seen the creation of health and wellness centers in rural and urban regions, improving diagnostic service accessibility. The construction of public health laboratory integration and critical care blocks in hospitals has enhanced the infrastructure in place for the enactment of advanced diagnostic methods, such as minimally invasive biopsies. These programs ensure that patients from all regions gain access to timely and reliable diagnostic services, hence promoting the widespread use of these methods. Additionally, the government's focus on universal health coverage and decreasing out-of-pocket spending has brought expensive diagnostic procedures within reach. The Economic Survey 2022-23 pointed out that the budgeted spending of the Central and State Governments on the health sector surged to 2.1% of GDP in FY23 from 1.6% in FY21. This substantial funding has made it possible to make investments in sophisticated medical equipment and provide training for health practitioners to enable the efficient deployment of minimally invasive biopsy procedures nationwide.

India Minimally Invasive Biopsy Techniques Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product offered, technique, circulating biomarker, application, and end user.

Product Offered Insights:

- Tests

- Kits Consumables

- Instruments

The report has provided a detailed breakup and analysis of the market based on the product offered. This includes tests, kits consumables, and instruments.

Technique Insights:

- Liquid Biopsy

- Optical Biopsy

- Brush Biopsy

- Pigmented Lesion Assays

- Others

A detailed breakup and analysis of the market based on technique have also been provided in the report. This includes liquid biopsy, optical biopsy, brush biopsy, pigmented lesion assays, and others.

Circulating Biomarker Insights:

- Circulating Tumor Cells (CTCs)

- Cell Free DNA (cfDNA)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vesicles

- Others

A detailed breakup and analysis of the market based on the circulating biomarker have also been provided in the report. This includes circulating tumor cells (CTCs), cell free DNA (cfDNA), circulating tumor DNA (ctDNA), extracellular vesicles, and others.

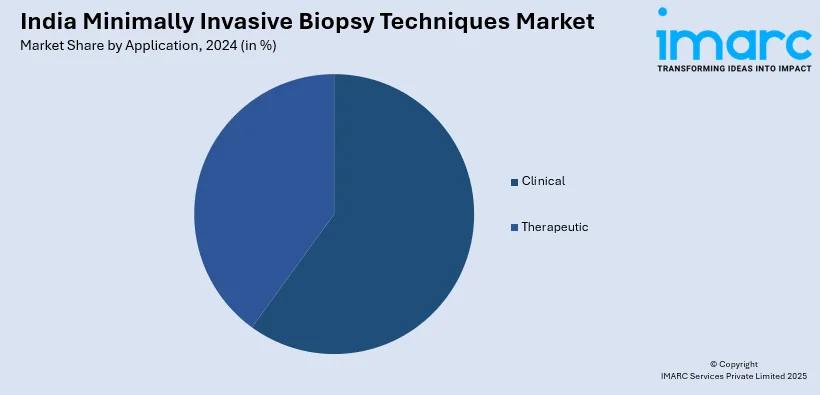

Application Insights:

- Clinical

- Treatment Monitoring

- Prognosis Recurrence Monitoring

- Treatment Selection

- Others

- Therapeutic

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes clinical (treatment monitoring, prognosis recurrence monitoring, treatment selection, and others) and therapeutic (breast cancer, lung cancer, prostate cancer, colorectal cancer, and others).

End User Insights:

- Hospitals Clinics

- Ambulatory Care Centers

- Academic Research Institutions

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals clinics, ambulatory care centers, and academic research institutions.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Minimally Invasive Biopsy Techniques Market News:

- September 2024: Strand Life Sciences launched the Somatic Advantage 74 Liquid Biopsy (SA74 LB) Test, detecting circulating tumor DNA in blood and screening 74 genes that have clinical relevance to assist cancer treatment decisions. This less invasive method provides a handy alternative to routine biopsies, conforming to the increasing trend towards fewer invasive diagnostic techniques. By offering in-depth genetic information with a straightforward blood test, the SA74 LB Test enhances the use of minimally invasive biopsy methods in India.

- February 2024: Fujifilm India launched the ALOKA ARIETTA 850, a sophisticated diagnostic ultrasound system for high-precision imaging during gastrointestinal and pancreatic procedures. With this technology, minimally invasive biopsies were made possible through enhanced real-time tissue evaluation and focused interventions. Its use broadened access to precise diagnostics, reinforcing the development of minimally invasive biopsy methods in India.

India Minimally Invasive Biopsy Techniques Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Offered Covered | Tests, Kits Consumables, Instruments |

| Techniques Covered | Liquid Biopsy, Optical Biopsy, Brush Biopsy, Pigmented Lesion Assays, Others |

| Circulating Biomarkers Covered | Circulating Tumor Cells (CTCs), Cell Free DNA (cfDNA), Circulating Tumor DNA (ctDNA), Extracellular Vesicles, Others |

| Applications Covered |

|

| End Users Covered | Hospitals Clinics, Ambulatory Care Centers, Academic Research Institutions |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India minimally invasive biopsy techniques market performed so far and how will it perform in the coming years?

- What is the breakup of the India minimally invasive biopsy techniques market on the basis of product offered?

- What is the breakup of the India minimally invasive biopsy techniques market on the basis of technique?

- What is the breakup of the India minimally invasive biopsy techniques market on the basis of circulating biomarker?

- What is the breakup of the India minimally invasive biopsy techniques market on the basis of application?

- What is the breakup of the India minimally invasive biopsy techniques market on the basis of end user?

- What are the various stages in the value chain of the India minimally invasive biopsy techniques market?

- What are the key driving factors and challenges in the India minimally invasive biopsy techniques market?

- What is the structure of the India minimally invasive biopsy techniques market and who are the key players?

- What is the degree of competition in the India minimally invasive biopsy techniques market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India minimally invasive biopsy techniques market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India minimally invasive biopsy techniques market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India minimally invasive biopsy techniques industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)