India Minimally Invasive Surgery Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

Market Overview:

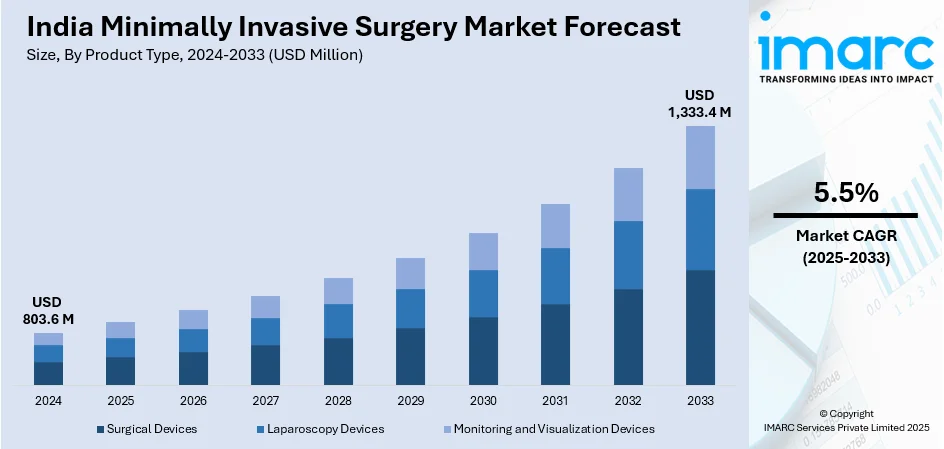

The India minimally invasive surgery market size reached USD 803.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,333.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.5% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 803.6 Million |

|

Market Forecast in 2033

|

USD 1,333.4 Million |

| Market Growth Rate 2025-2033 | 5.5% |

Minimally invasive (MI) surgery is a surgical technique that makes use of small tools, cameras and lights for making cuts and incisions during surgical operations. It is considered a safer procedure than the traditional open surgeries as it involves lesser complications, quicker recovery, minimal blood loss, and shorter hospital stay. In India, minimally invasive surgical techniques are preferred by surgeons as this procedure aims to minimize the damage to human tissues. Moreover, the integration of robotic technology with MI surgeries has offered improved outcomes and allowed precise control of the process.

To get more information on this market, Request Sample

The India minimally invasive surgery market is primarily driven by the growing geriatric population with an increased risk of arthritis, cancer, and cardiovascular diseases. The fewer risks and minimal procedural trauma associated with minimally invasive surgeries have resulted in higher success rates of these procedures, which, in turn, is catalyzing the market growth. Additionally, extensive investments made by the Government of India in the healthcare sector to develop advanced equipment are also providing a significant impact on the market. The utilization of new technologies, such as narrow-band imaging endoscopes and HD cameras, is further creating a positive outlook for the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India minimally invasive surgery market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, application and end user.

Breakup by Product Type:

- Surgical Devices

- Laparoscopy Devices

- Monitoring and Visualization Devices

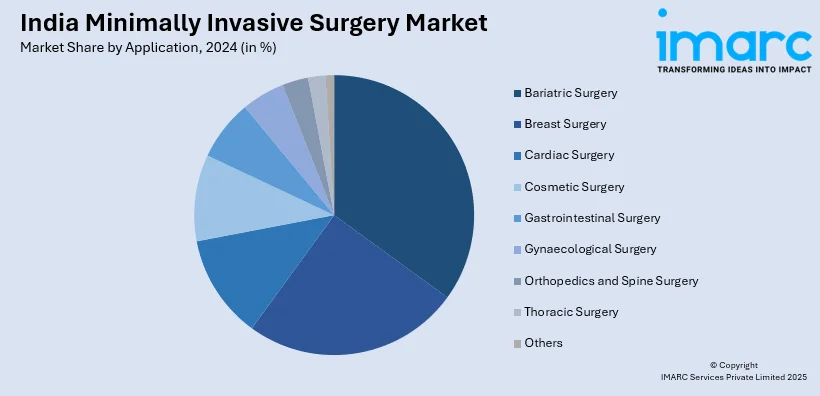

Breakup by Application:

- Bariatric Surgery

- Breast Surgery

- Cardiac Surgery

- Cosmetic Surgery

- Gastrointestinal Surgery

- Gynaecological Surgery

- Orthopedics and Spine Surgery

- Thoracic Surgery

- Others

Breakup by End User:

- Hospitals

- Clinics

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Application, End User, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India minimally invasive surgery market to exhibit a CAGR of 5.5% during 2025-2033.

The growing risk of arthritis, cancer, and cardiovascular diseases, along with the rising adoption of minimally invasive surgical techniques for minimizing damage to the human tissues with fewer risks and lesser procedural trauma, is primarily driving the India minimally invasive surgery market.

The sudden outbreak of the COVID-19 pandemic had led to postponement of numerous elective surgical procedures to reduce the risk of the coronavirus infection upon hospital visits and interaction with medical equipment, thereby limiting the demand for minimally invasive surgeries across the nation.

Based on the product type, the India minimally invasive surgery market can be segmented into surgical devices, laparoscopy devices, and monitoring and visualization devices. Currently, surgical devices hold the majority of the total market share.

Based on the application, the India minimally invasive surgery market has been divided into bariatric surgery, breast surgery, cardiac surgery, cosmetic surgery, gastrointestinal surgery, gynaecological surgery, orthopedics and spine surgery, thoracic surgery, and others. Among these, cardiac surgery currently exhibits a clear dominance in the market.

Based on the end user, the India minimally invasive surgery market can be categorized into hospitals, clinics, and others. Currently, hospitals account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where South India currently dominates the India minimally invasive surgery market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)