India Mixed Xylene Market Size, Share, Trends and Forecast by Grade, End Use, and Region, 2025-2033

India Mixed Xylene Market Size and Share:

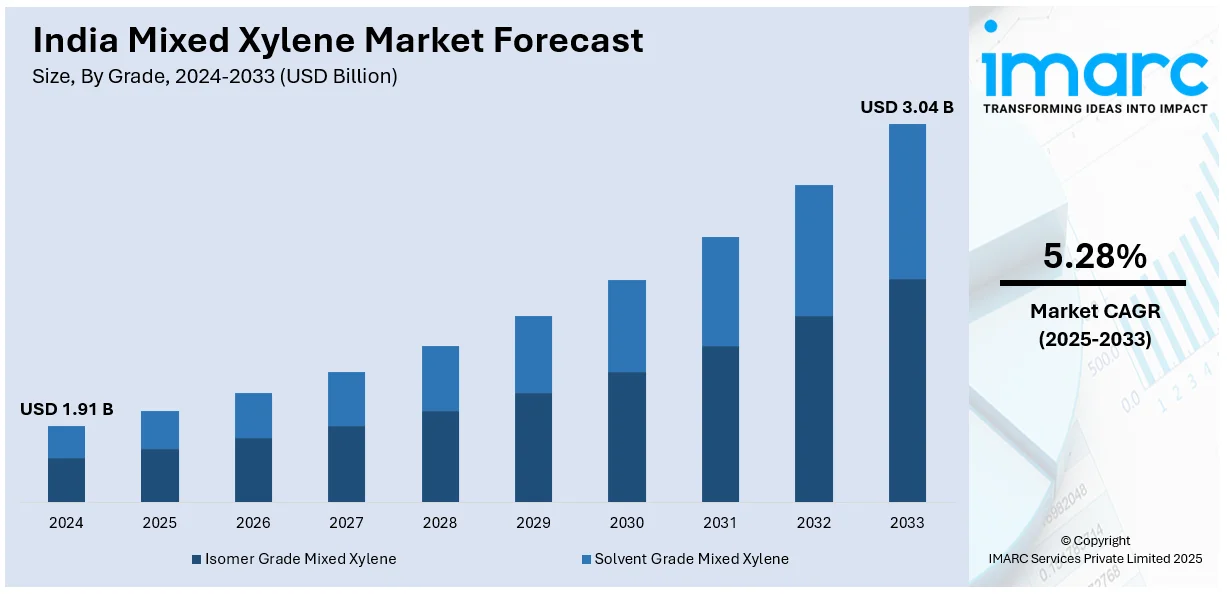

The India mixed xylene market size was valued at USD 1.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.04 Billion by 2033, exhibiting a CAGR of 5.28% during 2025-2033. The market is driven by robust demand from the paints and coatings industry, supported by urbanization, infrastructure growth, and government initiatives such as Housing for All, while the automotive sector further amplifies consumption through coatings and adhesives. Rising petrochemical demand, particularly for para-xylene in polyester and PET production, strengthens market dynamics, alongside steady pharmaceutical and agrochemical solvent needs. Moreover, advancements in production technologies and expanding industrial applications are further augmenting the India mixed xylene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.91 Billion |

|

Market Forecast in 2033

|

USD 3.04 Billion |

| Market Growth Rate 2025-2033 | 5.28% |

The market is primarily driven by the growing demand from the paints and coatings industry, which accounts for a significant share of product consumption. Rapid urbanization, infrastructure development, and increasing disposable incomes have enhanced the construction sector, fueling the need for paints and solvents. Additionally, the expanding automotive industry contributes to higher demand for coatings and adhesives, further propelling mixed xylene usage. Government initiatives smart city projects also play a crucial role in sustaining demand. India's Housing for All scheme, the Pradhan Mantri Awas Yojana (PMAY), is well on track after having approved 4.21 crore houses since its initiation, plus a recent cabinet approval of a further 3 crore households. This large-scale scheme directly spurs demand for construction products, including those derived from mixed xylene, which is used to make paints, coatings, and adhesives that are used in building finishes. With 2.62 crores rural and 83.67 lakhs urban homes already constructed, PMAY's emphasis on green and long-lasting building has a deep impact on the Indian mixed xylene sector by escalating the demand for associated building products.

To get more information on this market, Request Sample

In addition, the rising demand for mixed xylene in the petrochemical sector, particularly for producing para-xylene, a vital raw material for polyester and PET manufacturing, is also favoring India mixed xylene market growth. India's petrochemical sector is poised for vast growth, with USD 8 Billion earmarked for a 5.5 MTPA growth in the manufacturing of plastics such as PTA, directly impacting the demand for mixed xylene. This expansion comes in line with the overall vision of the Chemicals and Petrochemicals (CPC) industry to reach USD 383 Billion in 2030, from around USD 250 Billion currently, with a target of reaching a 6% global market share. The industry has attracted USD 844 Million worth of foreign direct investment (FDI) for FY24, reflecting robust growth prospects. India’s growing textile and packaging industries rely heavily on these derivatives, supporting market growth. Furthermore, the pharmaceutical and agrochemical sectors utilize mixed xylene as a solvent, adding to its demand. Import dependency, due to limited domestic production, also shapes market trends, with supply chain disruptions affecting availability. Furthermore, technological advancements in production processes are expected to create new opportunities for market expansion.

India Mixed Xylene Market Trends

Expanding Automotive and Construction Demand Fuels Mixed Xylene

The market is experiencing significant push from the robust automotive and construction sectors. Mixed xylene is a critical component in the production of automotive coatings, resins, and adhesives, directly benefiting from the rise in vehicle manufacturing. For instance, in December 2024, the overall output of passenger vehicles, two-wheelers, three-wheelers, and quadricycles in India reached an impressive total of 1,921,268 units. This strong output from the automotive industry translates into a consistent and high demand for mixed xylene. Concurrently, the booming construction industry further amplifies this demand, as mixed xylene is essential for manufacturing paints, varnishes, and sealants used in various building applications. The ongoing infrastructure development and housing initiatives across India underpin this sustained growth, creating a positive India mixed xylene market outlook.

Electronics Manufacturing Growth Impacting the Consumption

The growing electronics industry in India is a major catalyst for the mixed xylene market, given its integral role in the production of electronic components and printed circuit boards. India's domestic electronics manufacturing has nearly doubled, soaring from USD 48 Billion in FY17 to an impressive USD 101 Billion in FY23. This rapid growth is particularly pronounced in mobile phone production, which accounts for 43% of the total electronic manufacturing output. The escalating demand for consumer electronics and continuous technological advancements directly correlate with an amplified need for high-quality mixed xylene. As India continues to solidify its position as a global manufacturing hub for electronics, the reliance on mixed xylene as a key raw material is expected to intensify, contributing significantly to its market expansion.

Petrochemical Sector's Strategic Contribution

The sustained expansion of India's petrochemical sector is a crucial factor in the growth trajectory of the mixed xylene market. Mixed xylene serves as a vital feedstock for producing various chemicals and solvents within the petrochemical industry. This inherent connection ensures a steady and increasing demand as the sector itself expands. According to projections, the chemicals and petrochemicals sector in India is set to reach nearly USD 300 Billion in 2025, a substantial increase from USD 220 Billion in 2024. This robust growth within the broader petrochemical landscape directly contributes to the heightened consumption of mixed xylene. The symbiotic relationship between mixed xylene and the expanding petrochemical industry positions it as an indispensable component, solidifying its trajectory of sustained growth within India's chemical landscape.

India Mixed Xylene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India mixed xylene market, along with forecasts at the regional and country/country and regional levels from 2025-2033. The market has been categorized based on grade and end use.

Analysis by Grade:

- Isomer Grade Mixed Xylene

- Solvent Grade Mixed Xylene

Isomer grade mixed xylene is a high-purity variant primarily used in the production of para-xylene, a key feedstock for polyester and PET manufacturing. This segment is driven by the growing textile and packaging industries, which rely heavily on polyester fibers and plastic bottles. According to the India mixed xylene market forecast, the demand is further fueled by changing consumer preferences toward packaged goods and rising disposable income levels. However, production complexities and dependence on crude oil derivatives make this segment sensitive to feedstock price fluctuations. Additionally, stringent environmental regulations on plastic usage pose challenges, though recycling initiatives and technological advancements in purification processes are expected to sustain growth. With India’s petrochemical sector expanding, isomer grade mixed xylene will remain crucial, driven by downstream industries and export opportunities in Asia.

Solvent grade mixed xylene is widely used in paints, coatings, adhesives, and pharmaceuticals due to its excellent solvency and evaporation properties. The segment benefits from India’s growing construction and automotive sectors, where demand for high-performance coatings and adhesives continues to rise. Government infrastructure projects, such as smart cities and metro expansions, further propel consumption. However, environmental concerns over VOC emissions have led to stricter regulations, pushing manufacturers to develop low-aromatic alternatives. Despite these challenges, solvent grade mixed xylene maintains steady demand due to its irreplaceable role in industrial applications. Innovations in eco-friendly formulations and increasing adoption in agrochemicals are expected to drive future growth, ensuring its sustained relevance in the Indian market.

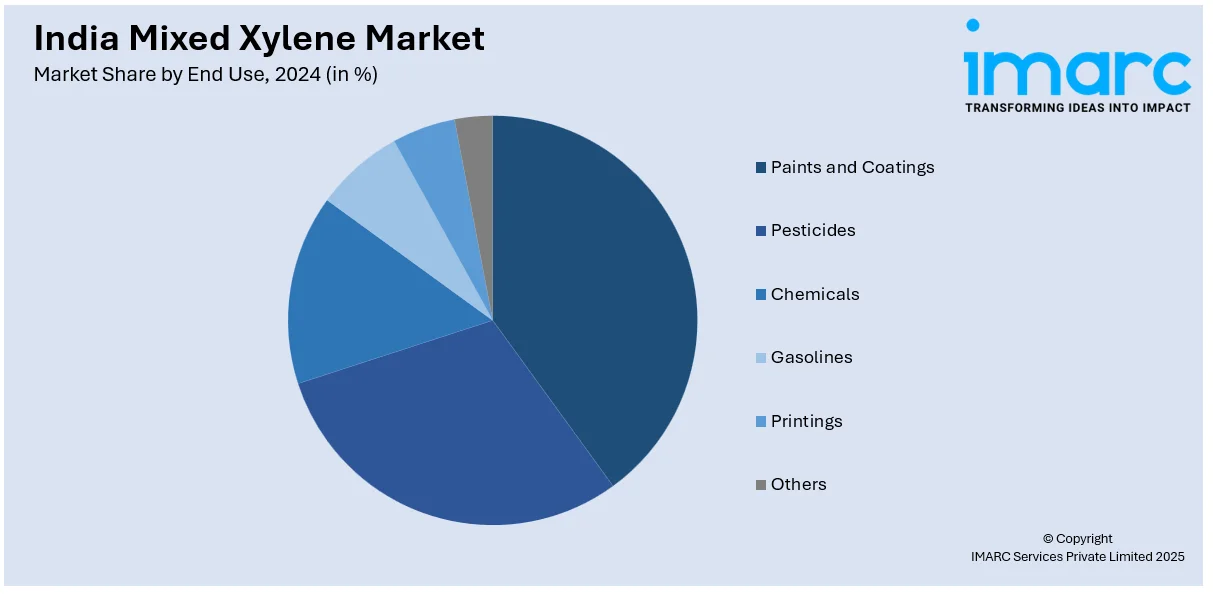

Analysis by End Use:

- Paints and Coatings

- Pesticides

- Chemicals

- Gasolines

- Printings

- Others

The paints and coatings industry is one of the largest consumers of mixed xylene in India, driven by rapid urbanization, infrastructure development, and rising demand for decorative and industrial coatings. Government initiatives, including Smart Cities Mission and Housing for All have significantly enhanced construction activities, increasing the need for high-performance solvents. Additionally, the automotive sector’s growth fuels demand for durable coatings and adhesives. However, stringent environmental regulations on VOC emissions are pushing manufacturers toward low-aromatic alternatives, posing a challenge. Despite this, the segment’s dominance persists due to mixed xylene’s superior solvency and drying properties. Innovations in water-based and eco-friendly coatings may reshape demand, but conventional solvent-based formulations will remain critical in heavy-duty applications, sustaining market growth.

Mixed xylene plays a vital role in pesticide formulations as a solvent for active ingredients, ensuring effective dispersion and application. India’s agriculture-dependent economy and the need for higher crop yields drive consistent demand in this segment. Government subsidies on agrochemicals and increasing awareness of pest control further support market growth. However, regulatory pressures to reduce toxic solvents and shift toward bio-based alternatives pose challenges. Despite this, mixed xylene remains preferred due to its cost-effectiveness and efficiency in pesticide manufacturing. The expansion of precision farming and integrated pest management practices may influence future demand, but its role as a key agrochemical solvent will persist in the near term.

In the chemical industry, mixed xylene serves as a crucial feedstock for producing para-xylene, ortho-xylene, and other derivatives used in polyester, PET, and plastic manufacturing. India’s growing textile and packaging industries heavily rely on these chemicals, sustaining demand. Additionally, it acts as a solvent in pharmaceuticals and specialty chemicals. Volatility in crude oil prices impacts production costs, but the petrochemical sector’s expansion offsets this challenge. Environmental regulations and the shift toward sustainable alternatives may reshape usage patterns, but mixed xylene’s versatility ensures its continued importance. Investments in downstream chemical processing and export-oriented production will further drive its consumption in this segment.

Mixed xylene is used as a gasoline blending component to enhance octane ratings and improve fuel efficiency. With India’s automotive sector expanding and fuel quality standards tightening, demand for high-octane additives remains steady. However, the rise of electric vehicles and ethanol-blended fuels could limit long-term growth. Regulatory policies promoting cleaner energy, such as BS-VI norms, also influence market dynamics. Despite these challenges, mixed xylene’s role in premium gasoline formulations ensures sustained demand, particularly in high-performance and aviation fuels. The segment’s growth will hinge on balancing fuel efficiency requirements with changing environmental mandates.

In the printing industry, mixed xylene is used as a solvent in inks, particularly for flexographic and gravure printing applications. The packaging sector’s growth, driven by e-commerce and FMCG demand, supports this segment. However, environmental concerns over VOC emissions are pushing the shift toward water-based and UV-curable inks, challenging traditional solvent-based formulations. Despite this, mixed xylene remains relevant due to its fast-drying properties and compatibility with high-speed printing processes. Innovations in eco-friendly solvents may alter demand trends, but their use in specialized printing applications will sustain their market presence in the near future.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India represents a significant market for mixed xylene, driven by robust demand from the paints and coatings and automotive sectors in industrial hubs such as the National Capital Region (NCR) and Uttar Pradesh. The region's thriving construction sector, supported by infrastructure projects and urban development initiatives, fuels solvent consumption. Additionally, agrochemical manufacturing in states such as Punjab and Haryana contributes to steady demand. However, stringent environmental regulations in Delhi-NCR pose challenges for solvent-based industries. Despite this, North India's well-established logistics network and proximity to key petrochemical clusters ensure a consistent supply. The region's growth will be shaped by balancing industrial expansion with sustainability mandates, maintaining its position as a key mixed xylene consumer.

West and Central India has a significant amount of mixed xylene consumption, housing major petrochemical hubs in Gujarat and Maharashtra. Gujarat's extensive refining and chemical manufacturing infrastructure, including the PCPIR region, drives substantial demand for feedstock and solvents. Mumbai-Pune's automotive and industrial coatings sector further enhances consumption. Madhya Pradesh's growing pesticide industry adds to regional demand. The area benefits from excellent port connectivity, facilitating imports and exports. However, water scarcity issues in some regions may impact production. With continued investments in chemical parks and refinery expansions, West and Central India are poised to strengthen their leadership in the mixed xylene market share, supported by strong industrial growth.

South India's mixed xylene market is propelled by strong demand from the textile, packaging, and pharmaceutical industries in Tamil Nadu, Karnataka, and Telangana. The region's thriving polyester value chain, supported by major PET manufacturers, drives isomer-grade xylene consumption. Additionally, Chennai and Bengaluru's automotive hubs sustain solvent demand for coatings. Kerala's agrochemical sector and Andhra Pradesh's upcoming petroleum corridors present growth opportunities. Challenges include stricter state-level environmental norms impacting solvent-based applications. However, South India's focus on technological innovation and sustainable alternatives positions it for steady growth. The region's well-developed ports and refining capacity ensure it remains a key player in the mixed xylene landscape.

East and Northeast India show emerging potential in the mixed xylene market, with growing industrial activities in West Bengal, Odisha, and Assam. The region's paints and coatings demand is rising due to infrastructure development and urbanization. Odisha's planned petroleum hubs and Assam's refinery expansions may enhance future supply. However, underdeveloped logistics and limited manufacturing bases currently constrain growth. The agrochemical sector in Bihar and Northeast states provides niche demand. While the region currently contributes modestly to national consumption, upcoming industrial projects and improved connectivity are also further supporting the market.

Competitive Landscape:

The competitive landscape of India's mixed xylene market is characterized by strategic capacity expansions, technological upgrades, and vertical integration initiatives by key industry participants. Leading producers are investing in backward integration to secure feedstock supplies and enhance cost efficiency, while simultaneously expanding distillation capacities to meet growing domestic demand. Several players are focusing on product differentiation by developing high-purity grades for specialty applications in pharmaceuticals and high-performance coatings. The market also sees increasing adoption of sustainable production methods to comply with stringent environmental regulations, with companies investing in cleaner technologies and waste reduction processes. Strategic partnerships with end-users and distributors are being forged to strengthen supply chain networks across key consumption hubs. Import-dependent players are diversifying sourcing strategies to mitigate geopolitical risks, while domestic manufacturers are leveraging India's refining capacity expansion to gain competitive pricing advantages.

The report provides a comprehensive analysis of the competitive landscape in the India mixed xylene market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: The Indian Oil Corporation Ltd (IOCL) announced that its Para-Xylene Purified Terephthalic Acid (PX-PTA) project is expected to be in commission starting June 2025. With an investment of INR 12,000 crore, the facility aims to manufacture 8 lakh tons of para-xylene, which is a type of mixed xylene, annually. The plant will also manufacture purified terephthalic acid (PTA).

- January 2025: Bharat Petroleum Corporation (BCPL) entered into an INR 31,802 crore loan deal with a six-bank consortium led by the State Bank of India for the financing of its refinery expansion project. The funding will also be used to establish a petrochemical plant in Bina, Madhya Pradesh, which will manufacture vital chemicals, such as mixed xylene, toluene, benzene, and polypropylene (PP).

- January 2025: Adani Group established a partnership with Indorama Resources, a Thailand-based manufacturer of various textile raw materials, including mixed and para-xylene, in order to enter the petrochemical, chemical, and refinery sectors. As part of this collaboration, Adani Petrochemicals Ltd., a division of Adani Enterprises Limited, created a joint venture (JV) with Indorama with equal shareholding.

India Mixed Xylene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Isomer Grade Mixed Xylene, Solvent Grade Mixed Xylene |

| End Uses Covered | Paints and Coatings, Pesticides, Chemicals, Gasolines, Printings, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mixed xylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mixed xylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mixed xylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mixed xylene market in India was valued at USD 1.91 Billion in 2024.

The India mixed xylene market is projected to exhibit a CAGR of 5.28% during 2025-2033, reaching a value of USD 3.04 Billion by 2033.

Key drivers include robust demand from the paints and coatings industry, fueled by urbanization and infrastructure growth. The expanding automotive sector's need for coatings/adhesives and rising petrochemical demand, particularly for para-xylene in polyester/PET production, also significantly propels the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)