India Mobile Advertising Market Size, Share, Trends and Forecast by Segment and Region, 2025-2033

India Mobile Advertising Market Overview:

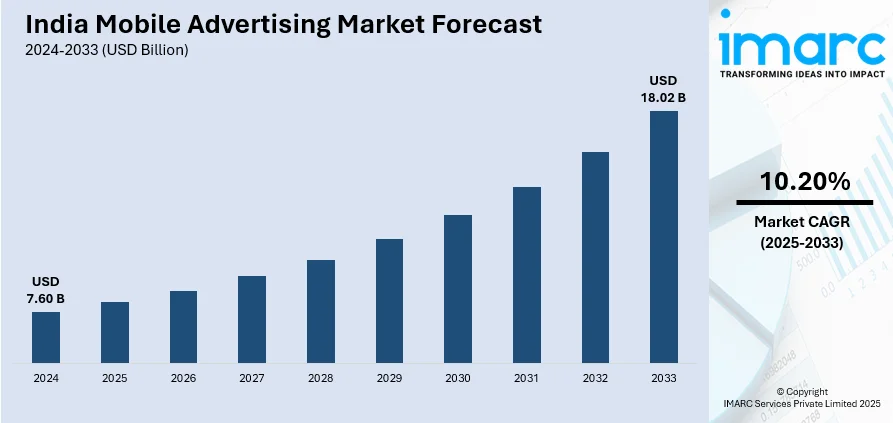

The India mobile advertising market size reached USD 7.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.02 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is driven by increasing smartphone penetration, affordable internet access, and rising digital content consumption. The growth of OTT platforms, mobile gaming, and social media further fuels the India mobile advertising market share. Advertisers are leveraging data-driven strategies, programmatic advertising, and video-based ads to enhance targeting, engagement, and ROI in a competitive digital landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.60 Billion |

| Market Forecast in 2033 | USD 18.02 Billion |

| Market Growth Rate 2025-2033 | 10.20% |

India Mobile Advertising Market Trends:

Rising Adoption of Programmatic Advertising

The significant shift towards programmatic advertising, driven by the increasing penetration of smartphones and affordable internet access is positively influencing the India mobile advertising market growth. As 2025 unfolds, India's alternative streaming (OTT) market currently encompasses more than 500 million active users and is projected to exceed USD 10 Billion in revenue by year-end. The need for regional content, the rollout of AI-driven personalization and flexible pricing are primarily responsible for that expansion. Programmatic advertising, which uses automated technology for ad buying, is gaining traction due to its efficiency, precision, and ability to deliver personalized ad experiences. Marketers are using data analytics and AI to reach precise segments, promising increased engagement and conversion. The rise of over-the-top (OTT) platforms and mobile gaming, which are popular and offer attractive opportunities for programmatic ad insertion, also contribute to this trend. As marketers aim to make the most of their ad expenditure and return on investment, programmatic advertising is likely to lead the mobile advertising market in India.

To get more information on this market, Request Sample

Rise in Video-Based Mobile Advertising

Video-based mobile advertising is emerging as a dominant trend in the India mobile advertising market outlook, driven by the increasing consumption of video content on smartphones. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day. With platforms such as YouTube, Instagram Reels, and TikTok-inspired apps gaining massive popularity, advertisers are investing heavily in video ads to capture user attention. The rise of short-form video content, coupled with affordable data plans, has made video ads more accessible and engaging for Indian consumers. Additionally, the integration of interactive features such as shoppable videos and in-video calls to action (CTAs) is enhancing user engagement and driving conversions. As 5G technology rolls out across the country, the quality and speed of video streaming are expected to improve, further enhancing the effectiveness of video-based mobile advertising. This trend underscores the growing preference for visually compelling and immersive ad formats in India's digital-first economy.

India Mobile Advertising Market Segmentation:

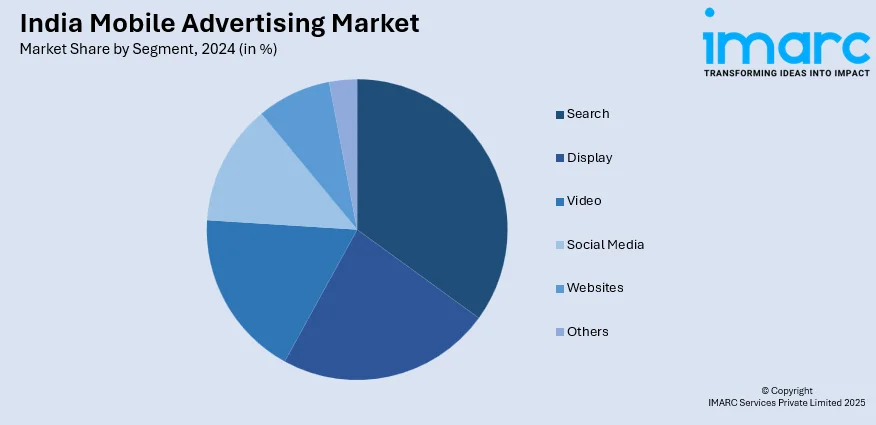

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on segment.

Segment Insights:

- Search

- Display

- Video

- Social Media

- Websites

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes search, display, video, social media, websites, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Advertising Market News:

- January 07, 2025: Aarki Inc. established Aarki Labs in Bangalore for AI-powered mobile advertising development, employing deep neural networks and maintaining user privacy. With a strong pool of tech talent in India, the lab aims to drive innovation, enhance user acquisition strategies, and improve efficiencies in-app marketing.

- November 19, 2024: Callpay, an AdTech startup headquartered in Mumbai, introduced a new mobile advertising model that integrates advertisements with phone calls, targeting outside social media platforms towards 700 million smartphone users. It aims to reduce the costs of digital marketing by over 70% and allow hyper-local targeting using PIN codes that provide brands with the upper hand of visibility. CallPay offers users cash rewards for setting this application as their default way to make calls. This new paradigm provides consumers with a way to reduce their phone bill while revolutionizing how companies engage consumers with mobile advertising.

India Mobile Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Search, Display, Video, Social Media, Websites, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mobile advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the India mobile advertising market on the basis of segment?

- What is the breakup of the India mobile advertising market on the basis of region?

- What are the various stages in the value chain of the India mobile advertising market?

- What are the key driving factors and challenges in the India mobile advertising market?

- What is the structure of the India mobile advertising market and who are the key players?

- What is the degree of competition in the India mobile advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)