India Mobile Cloud Market Size, Share, Trends and Forecast by Service, Deployment, User, Application, and Region, 2025-2033

India Mobile Cloud Market Overview:

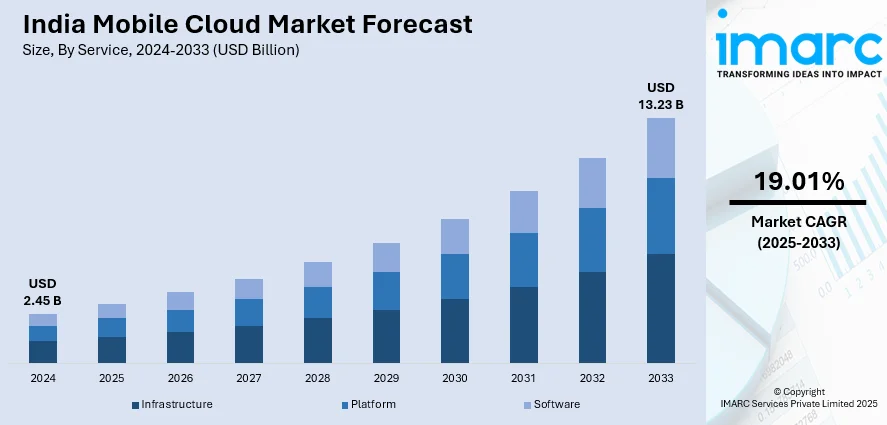

The India mobile cloud market size reached USD 2.45 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.23 Billion by 2033, exhibiting a growth rate (CAGR) of 19.01% during 2025-2033. The market is driven by 5G adoption, increasing smartphone penetration, rising demand for remote work solutions, expanding digital transformation, growing cloud storage needs, and government initiatives supporting cloud infrastructure and data security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 13.23 Billion |

| Market Growth Rate (2025-2033) | 19.01% |

India Mobile Cloud Market Trends:

Expansion of 5G and High-Speed Internet Connectivity

Indian mobile cloud sector experiences substantial growth because 5G technology deployment delivers slowed-down data transmission coupled with shorter response time and stronger network capabilities. Speed improvements through 5G technology allow everyone to connect easily with mobile cloud applications and storage via their mobile devices. The government’s push for digital infrastructure development, including BharatNet and Smart Cities initiatives, further accelerates cloud adoption. Better cloud service accessibility results from telecom operators' investments in fiber-optic network expansion as well as edge computing deployment. As mobile internet penetration grows, cloud-based services like gaming, video streaming, and enterprise collaboration tools are becoming more efficient and widespread, thus creating a positive India mobile cloud market outlook. For instance, in February 2025, Jio Platforms, the telecom and digital division of Reliance Industries, developed a cloud-based AI personal computer that will work with any consumer display and enable users to create compute-intensive AI applications, stated Aakash Ambani, chairman of Reliance Jio Infocomm.

To get more information on this market, Request Sample

Growing Demand for Remote Work and Enterprise Cloud Solutions

The adoption of hybrid work models combined with industry-wide digital transformation drives Indian companies to seek mobile cloud solutions for their digital needs. New business operations depend on cloud-based collaboration tools like Microsoft Teams, Zoom and Google Workspace because they enable remote work capabilities. Secure cloud storage and automation solutions and customer service management systems have been implemented by the BFSI healthcare and IT sectors. Additionally, enterprises are leveraging AI, machine learning, and big data analytics through cloud platforms, boosting productivity and operational efficiency. As organizations prioritize business continuity and scalability, the adoption of mobile cloud solutions continues to accelerate, thereby driving the India mobile cloud market growth. For instance, in April 2024, Telecom provider Vodafone Idea introduced its latest cloud gaming service. The service provider teamed up with CareGame, based in Paris, to introduce a mobile cloud gaming service called Cloud Play. The company announces that Cloud Play provides a diverse array of top-tier AAA games spanning multiple genres such as action, adventure, arcade, racing, sports, and strategy.

Increasing Smartphone Penetration and Mobile-First Digital Economy

India has one of the fastest-growing smartphone user bases, with over 1 billion mobile connections. The affordability of smartphones and cheaper data plans drive mobile-first cloud adoption, making services like cloud storage, SaaS (Software-as-a-Service), and AI-driven applications more accessible. According to industry reports, India exports approximately 145-150 million new smartphones annually for its domestic market, making it the second-largest globally after China in terms of yearly shipping volume. India has around 650 million smartphone users, representing roughly 46% smartphone penetration in the nation. Businesses are leveraging mobile cloud platforms for customer engagement, e-commerce, and digital payments, supporting the country's rapid shift towards a cashless and digitally connected economy. The demand for on-the-go productivity solutions, such as Google Drive, Microsoft OneDrive, and iCloud, continues to rise as users seek seamless data synchronization across multiple devices which is further fueling the India mobile cloud market share.

India Mobile Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on service, deployment, user, and application.

Service Insights:

- Infrastructure

- Platform

- Software

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure, platform, and software.

Deployment Insights:

- Public

- Private

- Hybrid

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes public, private, and hybrid.

User Insights:

- Enterprise

- Consumer

A detailed breakup and analysis of the market based on the user have also been provided in the report. This includes enterprise and consumer.

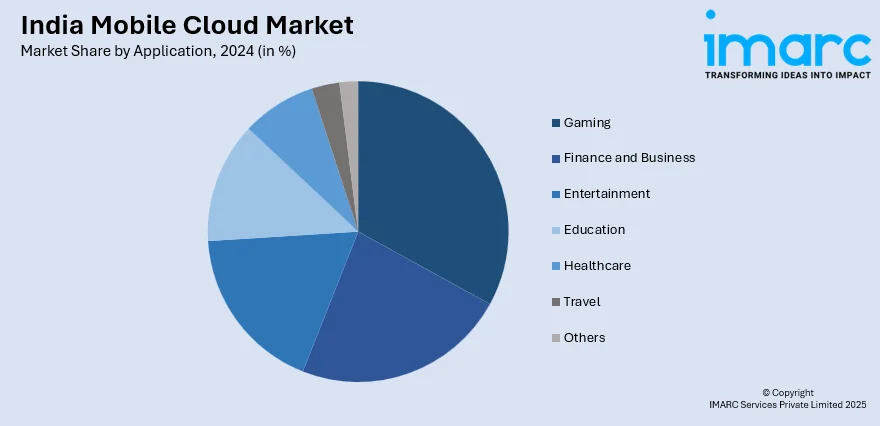

Application Insights:

- Gaming

- Finance and Business

- Entertainment

- Education

- Healthcare

- Travel

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gaming, finance and business, entertainment, education, healthcare, travel, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Cloud Market News:

- In October 2024, Zoom Video Communications launched Zoom Phone, its initial cloud phone service in India, approved by the Department of Telecommunications (DoT). Zoom Phone, aimed at offering secure, dependable, and adaptable voice communication, integrates effortlessly with the Zoom Workplace platform, improving collaboration through AI-driven capabilities.

India Mobile Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure, Platform, Software |

| Deployments Covered | Public, Private, Hybrid |

| Users Covered | Enterprise, Consumer |

| Applications Covered | Gaming, Finance and Business, Entertainment, Education, Healthcare, Travel, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mobile cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the India mobile cloud market on the basis of service?

- What is the breakup of the India mobile cloud market on the basis of deployment?

- What is the breakup of the India mobile cloud market on the basis of user?

- What is the breakup of the India mobile cloud market on the basis of application?

- What is the breakup of the India mobile cloud market on the basis of region?

- What are the various stages in the value chain of the India mobile cloud market?

- What are the key driving factors and challenges in the India mobile cloud market?

- What is the structure of the India mobile cloud market and who are the key players?

- What is the degree of competition in the India mobile cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)