India Mobile Crane Market Size, Share, Trends and Forecast by Product Type, Capacity, Propulsion, End Use, and Region, 2025-2033

India Mobile Crane Market Overview:

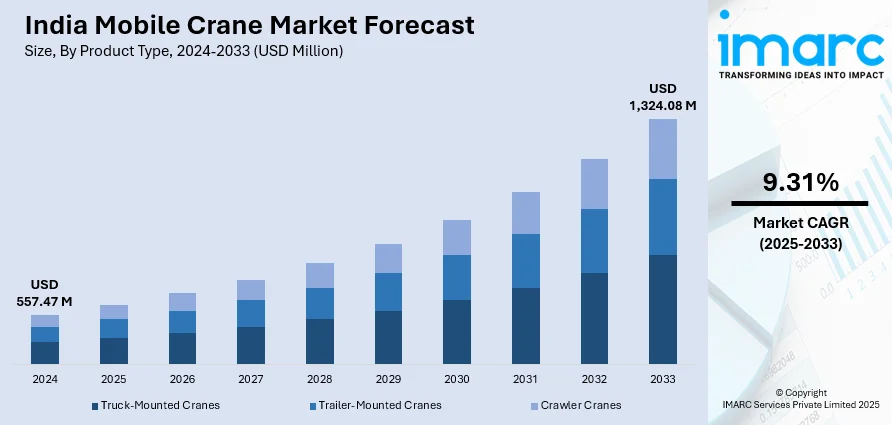

The India mobile crane market size reached USD 557.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,324.08 Million by 2033, exhibiting a growth rate (CAGR) of 9.31% during 2025-2033. The Indian mobile crane market is expanding due to rising infrastructure projects, disaster management needs, and growing demand for eco-friendly lifting solutions. In addition, advancements in heavy-duty and electric cranes, along with increasing government investments, are driving adoption across construction, logistics, and emergency response sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 557.47 Million |

| Market Forecast in 2033 | USD 1,324.08 Million |

| Market Growth Rate (2025-2033) | 9.31% |

India Mobile Crane Market Trends:

Growing Demand for Disaster Response Equipment

The growing incidence of natural disasters and emergencies has increased the demand for sophisticated lifting solutions in India. Mobile cranes are essential in disaster management as they enable rescue missions, clearing of debris, and restoration of infrastructure. With the intensification of climate-related disasters, government organizations and institutions are investing in mobile cranes to improve their response capacity. Furthermore, the capacity to rapidly mobilize heavy-duty lifting equipment is essential in minimizing damage and ensuring effective recovery operations. In July 2024, the Indian Army inducted 40 heavy-duty hydraulic mobile cranes from Tractor India Limited to strengthen its disaster management operations. These cranes offer improved efficiency, mobility, and precision, enabling the military to handle emergencies with greater effectiveness. Their use emphasizes the increasing acceptance of mobile cranes as vital national preparedness and infrastructure resilience tools. Urbanization and infrastructure expansion further fuel the demand as authorities look for trustworthy equipment to deal with emergencies in populous regions. Similarly, improved budgetary support for disaster readiness is spurring public and private sector investment in mobile cranes. As technology in lifting advances, demand for high-capacity, multifunctional cranes is also likely to rise, and these are likely to become a mainstay in India's emergency management and infrastructure initiatives.

To get more information on this market, Request Sample

Rising Adoption of Eco-Friendly Cranes

Sustainability has become a key focus in India’s construction and infrastructure sectors, prompting a shift toward energy-efficient and low-emission equipment. Mobile crane manufacturers are responding by developing eco-friendly models that reduce fuel consumption and carbon footprints. This transition is driven by stricter environmental regulations, growing awareness of sustainable construction practices, and the push for green infrastructure development. Companies are increasingly adopting electric and hybrid cranes to meet sustainability goals without compromising performance. In December 2024, Tadano Cranes India introduced the EVOLT eGR-1000XLL-1, the country’s first fully electric rough terrain crane with zero emissions and high lifting capacity. This innovation supports India’s efforts to reduce construction-related emissions while maintaining operational efficiency. The adoption of such advanced cranes marks a significant step toward greener construction and infrastructure development. Rising fuel costs and government incentives for clean energy solutions are further accelerating this trend. Construction firms and rental companies are now considering total lifecycle costs, where energy savings and lower maintenance expenses make electric cranes a viable long-term investment. As demand for eco-friendly lifting solutions grows, mobile crane manufacturers are expected to introduce more sustainable models, reshaping India’s construction equipment market and reinforcing the country’s commitment to environmental responsibility.

India Mobile Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, capacity, propulsion, and end use.

Product Type Insights:

- Truck-Mounted Cranes

- Trailer-Mounted Cranes

- Crawler Cranes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes truck-mounted cranes, trailer-mounted cranes, and crawler cranes.

Capacity Insights:

- Up to 10 Tons

- 11 to 50 Tons

- Above 50 Ton

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 10 Tons, 11 to 50 Tons, and above 50 Ton.

Propulsion Insights:

- Internal Combustion Engine Cranes

- Electric Cranes

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes internal combustion engine cranes, and electric cranes.

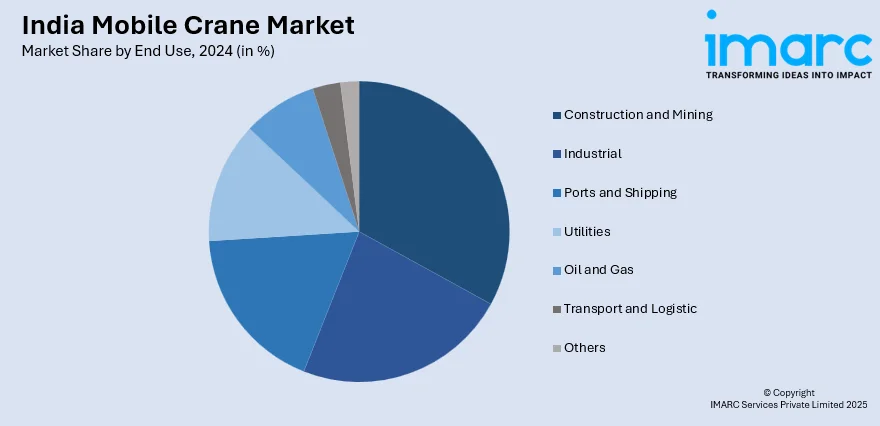

End Use Insights:

- Construction and Mining

- Industrial

- Ports and Shipping

- Utilities

- Oil and Gas

- Transport and Logistic

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes construction and mining, industrial, ports and shipping, utilities, oil and gas, transport and logistic, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Crane Market News:

- December 2024: ACE launched BS-V 30 & 35-ton mobile cranes at Bauma Conexpo 2024, featuring eco-friendly engines and high mobility. This innovation enhances lifting efficiency in metro, logistics, and industrial projects, driving demand for sustainable mobile cranes and accelerating India’s construction equipment market growth.

- July 2024: Liebherr’s LTM 1110-5.2 mobile crane, featuring the LICCON3 control system, enhances precision, safety, and handling. This advancement is expected to increase demand for high-tech mobile cranes in India, driving fleet expansion and adoption of modern lifting solutions across construction and infrastructure sectors.

India Mobile Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Truck-Mounted Cranes, Trailer-Mounted Cranes, Crawler Cranes |

| Capacities Covered | Up to 10 Tons, 11 to 50 Tons, Above 50 Ton |

| Propulsions Covered | Internal Combustion Engine Cranes, Electric Cranes |

| End Uses Covered | Construction and Mining, Industrial, Ports and Shipping, Utilities, Oil and Gas, Transport and Logistic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mobile crane market performed so far and how will it perform in the coming years?

- What is the breakup of the India mobile crane market on the basis of product type?

- What is the breakup of the India mobile crane market on the basis of capacity?

- What is the breakup of the India mobile crane market on the basis of propulsion?

- What is the breakup of the India mobile crane market on the basis of end use?

- What are the various stages in the value chain of the India mobile crane market?

- What are the key driving factors and challenges in the India mobile crane?

- What is the structure of the India mobile crane market and who are the key players?

- What is the degree of competition in the India mobile crane market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)