India Mobile Device Management Market Size, Share, Trends and Forecast by Type, Deployment Type, Organization Size, Vertical, and Region, 2026-2034

India Mobile Device Management Market Overview:

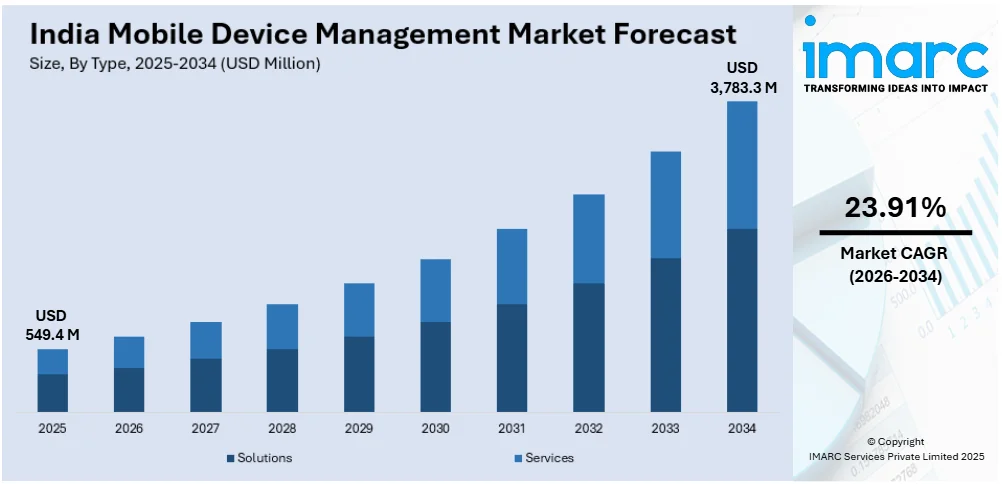

The India mobile device management market size reached USD 549.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,783.3 Million by 2034, exhibiting a growth rate (CAGR) of 23.91% during 2026-2034. The market is driven by the rapid adoption of smartphones, increasing remote work trends, and the need for secure BYOD policies. Growing cybersecurity concerns, regulatory compliance requirements, and the demand for scalable, cloud-based solutions further propel India mobile device management market growth, particularly among SMEs and large enterprises embracing digital transformation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 549.4 Million |

| Market Forecast in 2034 | USD 3,783.3 Million |

| Market Growth Rate 2026-2034 | 23.91% |

India Mobile Device Management Market Trends:

Increasing Adoption of Cloud-Based Mobile Device Management Solutions

Cloud solutions are seeing considerable adoption in the market. Due to factors such as scalability, cost-effectiveness, and ease of implementation, an increasing number of companies are adopting cloud-based Master Data Management (MDM) solutions. With the growing trend of remote work and the need for effective device management across teams located in different regions, cloud-based MDM solutions offer real-time monitoring, updates, and security management without needing on-site infrastructure. Additionally, the growing penetration of smartphones and tablets in both corporate and personal use is fueling the India mobile device management market share. An industry report indicates that 84% of smartphone users in India examine their devices within 15 minutes of waking up, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day. Besides this, small and medium-sized enterprises (SMEs) are particularly drawn to these solutions as they provide enterprise-grade security at a lower cost. As data privacy regulations tighten in India, cloud-based MDM solutions are also incorporating advanced encryption and compliance features, further driving their adoption.

To get more information on this market Request Sample

Rising Demand for Enhanced Security Features in MDM Solutions

The market is witnessing an uptrend in demand for superior security features in MDM solutions. As cyber-attacks and data breaches become more common, companies are seeking strong security features to safeguard sensitive business information accessed from mobile devices. By 2033, cyberattack targeting India is expected to jump to 1 trillion per year and further to 17 trillion per year by 2047. In 2023 alone, over 79 million occurrences had been noted, whereas 500 million attempted assaults had been blocked in the first quarter of 2024. These trends show that the country is facing increasing cyber threats and data breaches. Moreover, in early 2024, Indians incurred losses of more than ₹1,750 crore due to cybercriminals, highlighting the urgent need for robust security measures to ensure the use case of the country’s digital ecosystem. Administrative capabilities of MDM systems have also been bolstered with biometric authentication, endpoint detection and response (EDR), and AI-powered attack exposure reduction features. As Indian enterprises increasingly adopt bring-your-own-device (BYOD) policies, the requirement for secure MDM platforms has seen unprecedented growth. These solutions help to ensure that personal devices that have been brought into work by users adhere to company security policies such as the more stringent removal of data wiping and encryption at the application layer. As businesses in India continue to digitize their operations, the emphasis on secure MDM solutions is expected to grow, making security a key differentiator in the India mobile device management market outlook.

India Mobile Device Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, deployment type, organization size, and vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Type Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

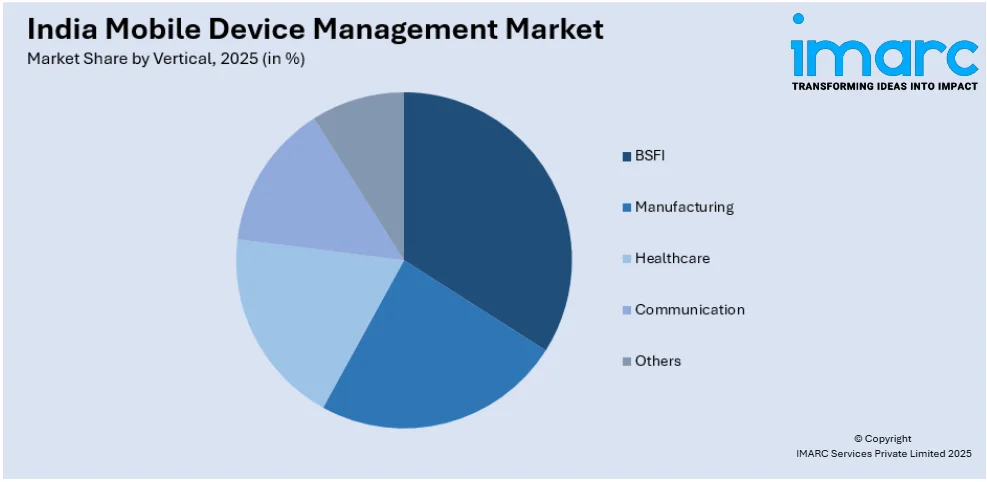

Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- BSFI

- Manufacturing

- Healthcare

- Communication

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BSFI, manufacturing, healthcare, communication, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Device Management Market News:

- December 09, 2024: Blue Cloud Softech Solutions secured a contract worth USD 15 Million for its BLUPORT Mobile Device Management (MDM) platform designed to enhance the management of biomedical devices in healthcare institutions while providing enhanced security and compliance with HIPAA standards. According to an official statement from India-based company, the features of BLUPORT are remote configuration, inventory, and firmware updates, all to make healthcare system more efficient and patient outcome better.

- September 18, 2024: Saankhya Labs announced plans with Sinclair and Free Stream Technologies to develop affordable Direct-to-Mobile (D2M) devices for consumer testing in the country, using Saankhya's Pruthvi-3 ATSC 3.0 chipsets. This move supports India's semiconductor development initiatives and aims to bring affordable D2M-enabled smartphones and accessories by 2025 that can address more than 300 million feature phone users and enhance mobile device management across the country.

- April 16, 2024: IIT Madras inaugurated the first mobile medical devices calibration facility in India, which guarantees precise and regular calibration of life-saving equipment throughout the nation, including in remote regions. This initiative is in accordance with UN Sustainable Development Goal 3, providing affordable and scalable healthcare solutions while improving the management of mobile devices for better diagnostics and treatment outcomes.

India Mobile Device Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Types Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Verticals Covered | BSFI, Manufacturing, Healthcare, Communication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile device management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile device management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile device management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India mobile device management market was valued at USD 549.4 Million in 2025.

The India mobile device management market is projected to exhibit a CAGR of 23.91% during 2026-2034, reaching a value of USD 3,783.3 Million by 2034.

The India mobile device management market is driven by increasing smartphone usage, the shift to remote work, adoption of BYOD policies, rising cybersecurity concerns, and the need for centralized device control. Government digital initiatives and enterprise demand for secure, efficient mobile management further support market growth across various industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)