India Mobile Payment Market Size, Share, Trends and Forecast by Mode of Transaction, Application, and Region, 2025-2033

Market Overview:

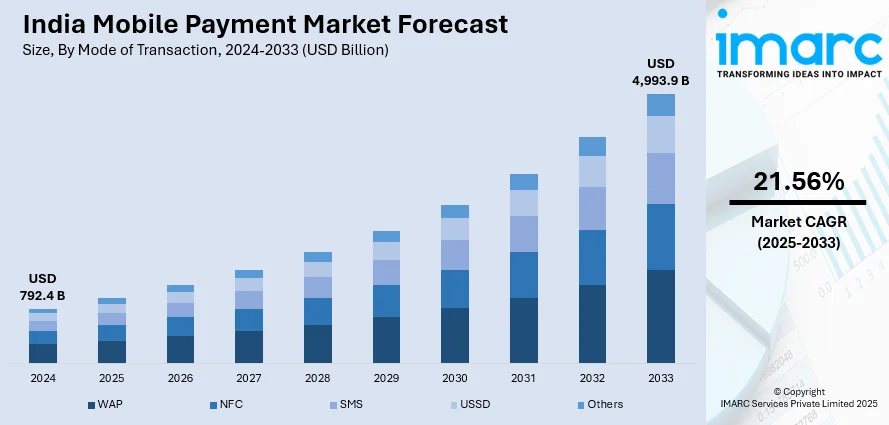

The India mobile payment market size reached USD 792.4 Billion in 2024. The market is projected to reach USD 4,993.9 Billion by 2033, exhibiting a growth rate (CAGR) of 21.56% during 2025-2033. The market growth is driven by increasing smartphone adoption, rising internet penetration, growing use of contactless payments, loyalty programs, and partnerships between tech companies and financial institutions.

Market Insights:

- The regional segmentation includes North India, West and Central India, South India, and East India.

- The market is segmented by mode of transaction into WAP, NFC, SMS, USSD, and others.

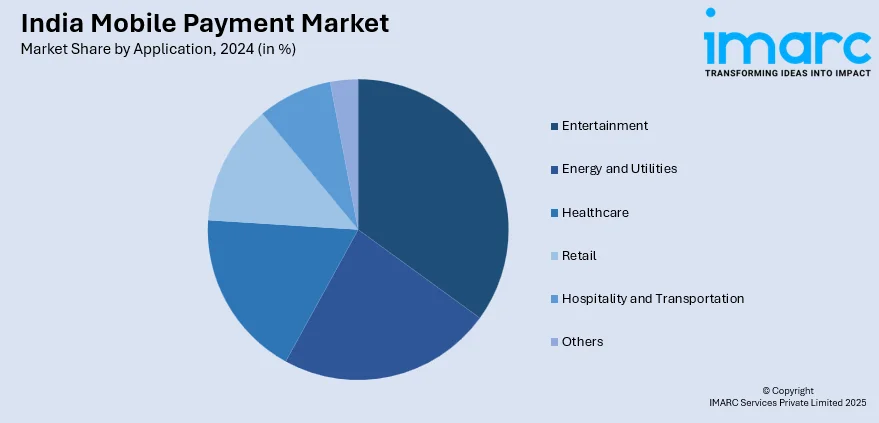

- The application segments include entertainment, energy and utilities, healthcare, retail, hospitality and transportation, and others.

Market Size and Forecast:

- 2024 Market Size: USD 792.4 Billion

- 2033 Projected Market Size: USD 4,993.9 Billion

- CAGR (2025–2033): 21.56%

Mobile payment refers to the process of transferring funds in exchange for products or services using a tablet or smartphone and payment instruments, such as a bank account, debit or credit card, gift cards and mobile wallet. As it is secure, convenient and easy-to-use, it is gaining traction over other forms of payments in India.

To get more information of this market, Request Sample

The rising sales of smartphones, in confluence with the increasing penetration of the internet, represents one of the key factors bolstering the growth of the mobile payment market in India. Moreover, loyalty and incentive programs associated with mobile payment solutions are contributing to the market growth. Apart from this, several companies are collaborating with financial institutions to provide innovative features. For instance, Google is supporting Unified Payment Interface (UPI) services from several Indian banks under its Google Pay app. Furthermore, the thriving e-commerce sector and the increasing utilization of contactless methods for making payments due to the mass outbreak of the coronavirus disease (COVID-19) are anticipated to influence the market growth in the coming years.

India Mobile Payment Market Trends:

Growth Drivers of India Mobile Payment Market

The rapid rise in UPI transactions continues to be a key factor in the expansion of the India mobile payment market share. With the simplicity of QR-code based transfers and interoperability across banks and wallets, UPI has become a default mode for peer-to-peer and peer-to-merchant payments. Monthly transaction volumes have surpassed record highs, fueled by ease of use, zero charges, and smartphone penetration. The integration of mobile payments with e-commerce and m-commerce platforms is also accelerating adoption. Online retailers, food delivery services, travel apps, and even small vendors are offering embedded payment gateways, streamlining checkout and reducing cart abandonment, which represents one of the emerging India mobile payment market trends. Additionally, recurring mobile payments are growing due to rising subscriptions in OTT entertainment, digital news, online learning, and fitness platforms. These services rely heavily on auto-debit and in-app wallets, pushing digital payment use beyond one-time purchases.

Government Support in India Mobile Payment Market

The Indian government has played a proactive role in enabling the digital payment ecosystem throughout the country. Incentive schemes such as the Digital Payment Incentive Scheme have encouraged merchants to adopt digital acceptance tools, which is contributing to the India mobile payment market growth. Regulatory support through the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) has helped standardize systems like UPI, BHIM, and RuPay. Government-led campaigns like “Digital India” and Jan Dhan-Aadhaar-Mobile (JAM) trinity have expanded financial inclusion, bringing millions of previously unbanked individuals into the formal economy. Subsidized smartphone initiatives and zero-cost bank accounts have also laid the groundwork for mobile payment penetration across rural and semi-urban regions. These efforts have supported a robust backend infrastructure, paving the way for mobile payments to scale in both volume and diversity of use, and creating a favorable India mobile payment market outlook.

Shift Toward Contactless and Voice-Based Transactions

According to the India mobile payment market analysis, a notable trend shaping the mobile payment space is the growing adoption of contactless and voice-enabled payment technologies. NFC-based tap-to-pay options are gaining traction, particularly in urban transit, quick-service retail, and fuel stations, where speed and hygiene are priorities. In addition to this, wearable devices like smartwatches and fitness bands are increasingly being used to initiate contactless payments, offering consumers added convenience, faster checkout, and reducing the need to carry physical wallets or cards in daily routines. As per the India mobile payment market forecast, digital wallets and mobile banking apps are starting to integrate voice command features using AI-based assistants to cater to users with low digital literacy or limited typing ability. This voice-first approach is especially relevant in regional language markets and Tier II/III cities, where app-based payments are still gaining ground. Combined with biometric verification and tokenization, these innovations are making mobile transactions more accessible and secure, further widening the adoption base.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India mobile payment market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on mode of transaction and application.

Breakup by Mode of Transaction:

- WAP

- NFC

- SMS

- USSD

- Others

Breakup by Application:

- Entertainment

- Energy and Utilities

- Healthcare

- Retail

- Hospitality and Transportation

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- June 2025: BharatPe, serving as the tech partner for Unity Small Finance Bank, helped the bank reach a 100% UPI success rate with no technical or business declines, as per NPCI data. Unity was the only small finance bank to rank among the top 25 UPI performers in May. This highlights BharatPe’s growing influence in India’s mobile payments space, strengthening its role in delivering secure, high-scale transaction systems and driving broader digital payment adoption.

- June 2025: PhonePe acquired Gupshup’s GSPay technology stack to enable UPI-based payments for feature phone users, aiming to launch a customized UPI mobile app for new feature phones in India. The initiative will offer core UPI features like peer-to-peer transfers, offline QR payments, and interoperability with smartphone users, targeting the country’s 240 million feature phone users and an additional 150 million expected shipments in the next five years.

- April 2025: Resilient Payments Private Limited, a subsidiary of BharatPe, secured final approval from the Reserve Bank of India to function as an online payment aggregator. With this, BharatPe becomes the only Indian fintech to hold a PA license, an NBFC license through Trillion Loans, and ownership in Unity Small Finance Bank. This positions the company to scale its digital payments, lending, and investment offerings, backed by regulatory clearance and governance standards.

- September 2024: PhonePe introduced UPI Circle, a feature enabling primary users to manage payments for family members or trusted contacts who do not have bank accounts linked to UPI, supporting shared payments in the digital ecosystem. With UPI Circle, dependents can use their own UPI ID for payments while the primary user retains control over approvals, spending limits, and transaction history.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Mode of Transaction, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India mobile payment market was valued at USD 792.4 Billion in 2024.

We expect the India mobile payment market to exhibit a CAGR of 21.56% during 2025-2033.

The growing consumer awareness towards hassle-free transactions, secured payment gateways, and easy mobility offered by mobile payment solutions, is primarily driving the India mobile payment market.

In India, the sudden outbreak of the COVID-19 pandemic has led to the rising consumer inclination from conventional cash-based transaction methods towards digital payment solutions for mitigating the risk of disease transmission upon human interaction.

Based on the mode of transaction, the India mobile payment market has been segmented into WAP, NFC, SMS, USSD, and others. Currently, WAP payment mode holds the majority of the total market share.

Based on the application, the India mobile payment market can be divided into entertainment, energy and utilities, healthcare, retail, hospitality and transportation, and others. Among these, the retail industry exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India mobile payment market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)