India Mobile Security Market Size, Share, Trends and Forecast by Offering, Deployment Mode, Operating System, Vertical, End User, and Region, 2025-2033

India Mobile Security Market Overview:

The India mobile security market size reached USD 0.23 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.77 Billion by 2033, exhibiting a growth rate (CAGR) of 14.58% during 2025-2033. The surge in smartphone usage, rising cyber threats, growing adoption of mobile banking and digital payments, increasing corporate bring your own device (BYOD) policies, the launch of government initiatives to strengthen data protection, and escalating consumer demand for privacy-centric apps are among the primary factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.23 Billion |

| Market Forecast in 2033 | USD 0.77 Billion |

| Market Growth Rate 2025-2033 | 14.58% |

India Mobile Security Market Trends:

Proliferation of Mobile Devices and Increasing Cyber Threats

The rapid proliferation of smartphones and mobile devices across India has significantly expanded the nation's digital footprint, thereby enhancing connectivity and promoting digital inclusion. However, this widespread mobile usage has simultaneously created higher scope for attacks from cybercriminals, making mobile platforms prime targets for malicious activity. Between 2023 and 2024, India witnessed a 37% rise in cyberattacks targeting mobile devices, highlighting the growing vulnerability of mobile users. With India’s smartphone user base projected to exceed 1 billion by the end of 2025, the urgency to address mobile cybersecurity threats is critical. In response to this escalating risk, both individuals and organizations are increasingly adopting advanced mobile security measures such as antivirus applications, data encryption tools, and secure access protocols. These solutions are essential for protecting personal and corporate data, ensuring privacy, and maintaining user trust in the digital ecosystem.

.webp)

To get more information on this market, Request Sample

Expansion of Mobile Payment Systems and Regulatory Compliance

The exponential rise of mobile payment platforms and digital wallets in India has transformed the financial services landscape, offering users unmatched convenience and accessibility. This digital shift is evident in the surge of transaction volumes, which grew from 2.071 billion in FY 2017–18 to an estimated 18.737 billion in FY 2023–24, primarily driven by platforms such as UPI and RuPay. However, this growth has been accompanied by an uptick in financial fraud cases, emphasizing the urgent need for stronger mobile security measures. In response, the Reserve Bank of India (RBI) has implemented stringent regulatory mandates, including multi-factor authentication and end-to-end encryption, to safeguard consumer data and build trust in digital financial ecosystems. Consequently, banks and fintech firms are adopting advanced security frameworks, integrating features like biometric authentication, real-time fraud monitoring, and secure app development protocols. These developments are fueling demand for robust mobile security solutions, reinforcing the importance of cybersecurity in India’s rapidly evolving digital economy.

India Mobile Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on offering, deployment mode, operating system, vertical, and end user.

Offering Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes solutions and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Operating System Insights:

- iOS

- Android

- Windows

- Others

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes iOS, android, windows, and others.

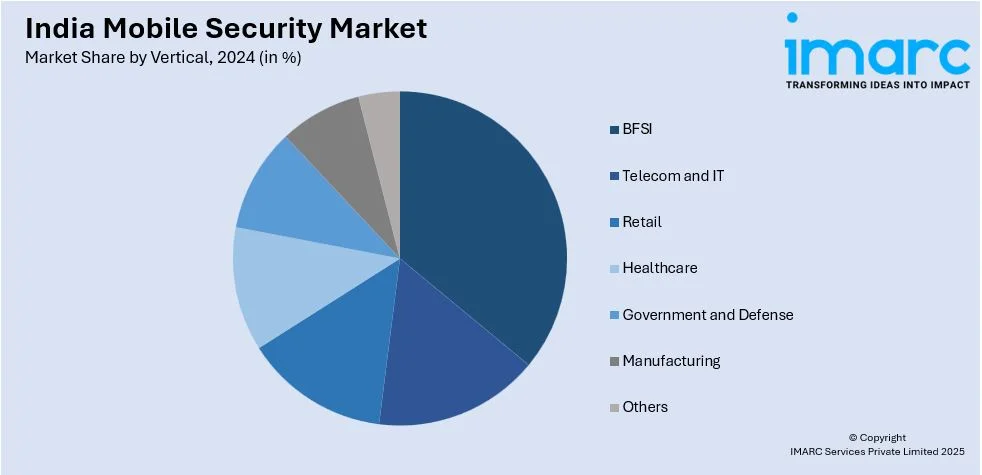

Vertical Insights:

- BFSI

- Telecom and IT

- Retail

- Healthcare

- Government and Defense

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, telecom and IT, retail, healthcare, government and defense, manufacturing, and others.

End User Insights:

- Individual

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual and enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Security Market News:

- April 2025: Axis Bank launched an In-App Mobile OTP feature on its ‘open’ app to boost mobile security. By generating time-based OTPs within the app, it eliminates telecom reliance, enabling faster and more secure authentication while reducing fraud risks related to OTP scams.

- March 2025: Protecttt.ai, a cybersecurity firm specializing in mobile application security, secured INR 76 crore in its Series A funding round, led by Bessemer Venture Partners. The funding will primarily be allocated to developing AI-driven security solutions and strengthening Protectt.ai's mobile threat intelligence search capabilities.

- January 2025: The Department of Telecommunications (DoT) launched the Sanchar Saathi smartphone app to combat fraud calls and enhance mobile security for Indian users. The app is designed for ease of use and allows users to report suspicious activities directly from their call logs.

India Mobile Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Solutions, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Operating Systems Covered | iOS, Android, Windows, Others |

| Verticals Covered | BFSI, Telecom and IT, Retail, Healthcare, Government and Defense, Manufacturing, Others |

| End Users Covered | Individual, Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India mobile security market performed so far and how will it perform in the coming years?

- What is the breakup of the India mobile security market on the basis of offering?

- What is the breakup of the India mobile security market on the basis of deployment mode?

- What is the breakup of the India mobile security market on the basis of operating system?

- What is the breakup of the India mobile security market on the basis of vertical?

- What is the breakup of the India mobile security market on the basis of end user?

- What are the various stages in the value chain of the India mobile security market?

- What are the key driving factors and challenges in the India mobile security market?

- What is the structure of the India mobile security market and who are the key players?

- What is the degree of competition in the India mobile security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)