India Mobile Wallet Market Size, Share, Trends and Forecast by Type, Application and Region, 2025-2033

India Mobile Wallet Market Overview:

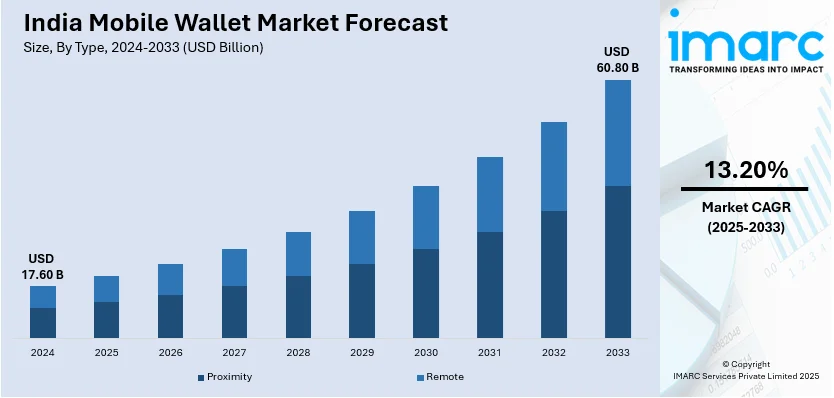

The India mobile wallet market size reached USD 17.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.80 Billion by 2033, exhibiting a growth rate (CAGR) of 13.20% during 2025-2033. The market is driven by increasing digital payments, UPI integration, and financial service adoption, with customers using wallets for peer-to-peer transactions, bill payments, and investments, while regulatory support, fintech innovation, and rising smartphone penetration enhance accessibility and financial inclusion across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.60 Billion |

| Market Forecast in 2033 | USD 60.80 Billion |

| Market Growth Rate 2025-2033 | 13.20% |

India Mobile Wallet Market Trends:

Increasing Adoption of UPI and Digital Payments

India's mobile wallet space is growing at a fast pace because of the rapid uptake of Unified Payments Interface (UPI) and digital payments. The convenience of instant money transfers, bill payments, and QR-based transactions has turned mobile wallets into the consumer's first choice in urban as well as rural markets. Initiatives by the government for promoting digital payments and financial inclusion have further spurred the transition. According to the reports, in October 2024, Paytm got the approval of the National Payments Corporation of India (NPCI) to add new UPI users, after its banking unit was earlier banned by the regulator. This approval is an important milestone for reviving its digital payments business. Moreover, street vendors and small businesses are also embracing mobile wallet payments, cutting down on cash-based transactions. Furthermore, interoperability of UPI and mobile wallets enables users to make easy payments between platforms. Boosting smartphone penetration and low-cost internet connectivity has broadened the usage of mobile wallets beyond urban cities, bringing digital payments within reach. As security features advance with such benefits as two-factor authentication and biometric authentication, consumer confidence in mobile wallets keeps building, resulting in continued market growth in India's digital payments environment.

To get more information on this market, Request Sample

Growth in Mobile Wallet-Based Financial Services

Indian mobile wallets are moving beyond peer-to-peer transactions and merchant payments to a wider array of financial services. Customers can now avail themselves of credit, insurance, investment, and loan facilities through their mobile wallets. The addition of buy now, pay later (BNPL) plans, micro-loans, and savings features is drawing customers looking for instant and easy financial solutions. The rising popularity of digital gold investment and mutual fund buying via mobile wallets adds to their attraction. Also, the fact that bills for utilities, mobile recharges, and tickets can be booked through a single app makes mobile wallets an end-to-end financial management app. Regulatory encouragement to digital lending and credit scoring based on mobile wallet transaction history is also increasing financial inclusion. For instance, in March 2023, Sarvatra Technologies collaborated with ICICI Bank, IDFC First Bank, and Pine Labs to facilitate foreign tourists from the G20 nations to make local UPI payments in India. It became the first payment provider to cover three of the four RBI-chosen organizations for this purpose. Further, with ongoing fintech advancements, mobile wallets are setting themselves up as a portal to convenient and accessible financial services that serve a range of consumers.

Strengthening Security and Fraud Prevention Measures

As mobile wallet transactions accelerate, the priority has become ensuring data protection and fraud protection. Advanced security features like end-to-end encryption, biometric authentication, and AI-based fraud detection are being used to further secure users. Mandatory know your customer (KYC) requirements have been made compulsory by regulatory bodies to curb identity theft and financial fraud. Mobile wallets are also embracing tokenization technology, which substitutes sensitive card data with encrypted tokens to minimize fraud threats. Transaction alerts, spending limits, and remote wallet locking are features that give users more control over their mobile transactions. Awareness campaigns on phishing scams, fake QR codes, and unauthorized payment requests are also informing users about secure mobile wallet use. With further advancements in cybersecurity technology, better fraud protection mechanisms will instill greater confidence in consumers and help drive the broader adoption of mobile wallets throughout India.

India Mobile Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Proximity

- Remote

The report has provided a detailed breakup and analysis of the market based on the type. This includes proximity and remote.

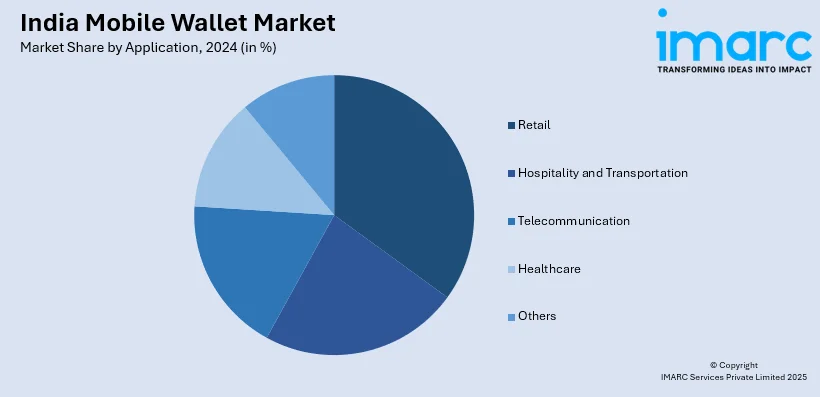

Application Insights:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality and transportation, telecommunication, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Wallet Market News:

- In January 2025, Cred launched access to RBI’s e-rupee, becoming India’s first fintech to support the digital currency. Facilitated by YES Bank, the rollout targets select users. The RBI expanded e-rupee access to payment firms, enabling fintech participation in India's evolving digital currency ecosystem.

- In April 2023, PhonePe launched Pincode, a shopping app for consumers based on the ONDC platform, that was first available in Bengaluru. The app links consumers to nearby stores, providing online ordering, discounts, refunds, and returns, benefiting MSMEs and retailers while increasing PhonePe's e-commerce footprint in India.

India Mobile Wallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proximity, Remote |

| Applications Covered | Retail, Hospitality and Transportation, Telecommunication, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile wallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile wallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile wallet market in India was valued at USD 17.60 Billion in 2024.

The India mobile wallet market is projected to exhibit a CAGR of 13.20% during 2025-2033, reaching a value of USD 60.80 Billion by 2033.

The key factors driving the India mobile wallet market include the rapid adoption of smartphones, increasing internet penetration, growing digital payment awareness, government initiatives promoting cashless transactions, and the rise of e-commerce and online services. Additionally, convenience, security, and promotional offers further support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)