India ModelOps Market Size, Share, Trends and Forecast by Offering, Deployment, Application, Vertical, Model, and Region, 2026-2034

India ModelOps Market Summary:

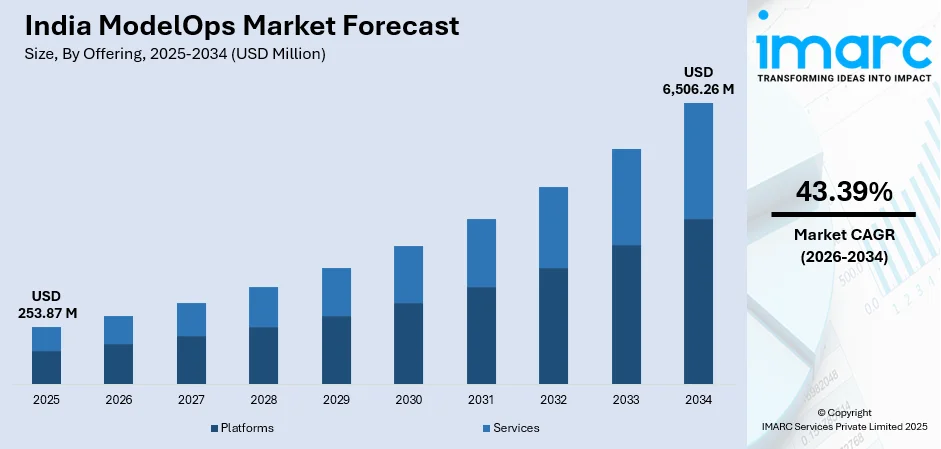

The India ModelOps market size was valued at USD 253.87 Million in 2025 and is projected to reach USD 6,506.26 Million by 2034, growing at a compound annual growth rate of 43.39% from 2026-2034.

The India ModelOps market is experiencing significant expansion driven by accelerating artificial intelligence adoption across enterprises seeking efficient machine learning (ML) lifecycle management. Organizations are prioritizing scalable model deployment, governance frameworks, and real-time decision-making capabilities. The convergence of cloud infrastructure advancement, digital transformation initiatives, and growing emphasis on responsible artificial intelligence (AI) practices is fueling the demand for comprehensive ModelOps solutions across multiple industry verticals.

Key Takeaways and Insights:

- By Offering: Platforms dominate the market with a share of 58% in 2025, driven by the increasing complexity of AI models requiring robust development, deployment, and monitoring capabilities across enterprise environments, with organizations prioritizing scalable infrastructure over project-specific implementations.

- By Deployment: Cloud leads the market with a share of 66% in 2025, owing to the flexibility of pay-as-you-go pricing models, seamless scalability for AI workloads, and the growing preference for hybrid architectures that enable rapid experimentation without heavy capital expenditure requirements.

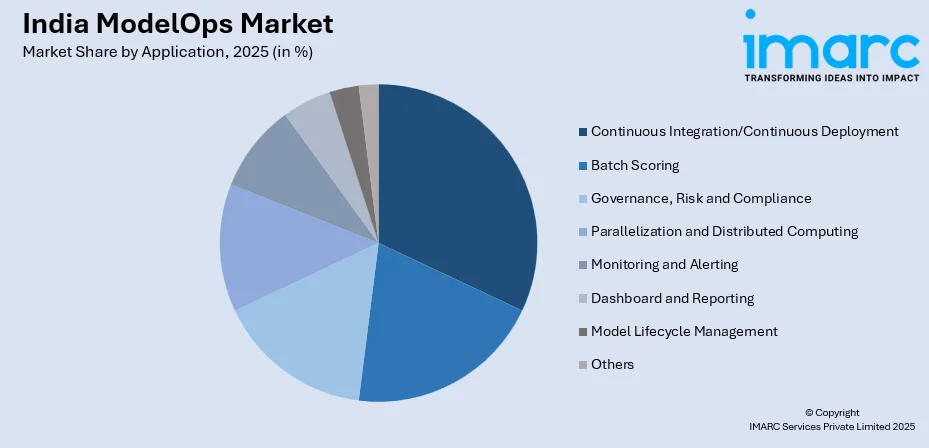

- By Application: Continuous integration/continuous deployment represents the largest segment with a market share of 18% in 2025. This dominance is driven by the enterprise shift towards agile methodologies and automated pipelines that accelerate model deployment cycles while ensuring consistency across production environments.

- By Vertical: BFSI prevails the market with a share of 26% in 2025. This leadership stems from stringent regulatory compliance requirements, the need for transparent and explainable AI models in financial decision-making, and substantial investments in fraud detection and personalized customer service solutions.

- By Model: ML models comprise the largest segment with a market share of 50% in 2025, driven by their proven capability to decipher intricate patterns and furnish data-driven forecasts across diverse applications, including credit scoring, risk assessment, and predictive maintenance.

- Key Players: The India ModelOps market exhibits intensifying competitive dynamics, with established global technology providers competing alongside specialized domestic platforms offering comprehensive AI lifecycle management, governance frameworks, and industry-specific deployment solutions tailored to regional enterprise requirements.

To get more information on this market Request Sample

The India ModelOps landscape reflects the nation's rapid transformation into a global AI hub, supported by robust digital infrastructure and strategic government investments. As per IMARC Group, the India AI market size reached USD 1,251.79 Million in 2024. Growing data volumes, cloud migration, and automation strategies are strengthening the need for faster model deployment, monitoring, and governance. The expanding startup ecosystem and strong presence of global information technology (IT) service providers are further accelerating the adoption. As businesses are aiming for operational efficiency and better decision-making, ModelOps is becoming a core part of enterprise architecture. Overall, the market is expected to see steady growth, supported by digital transformation initiatives and a skilled analytics workforce.

India ModelOps Market Trends:

Rising Integration of Generative AI with Enterprise Operations

Indian enterprises are rapidly integrating generative AI capabilities into core business functions, necessitating advanced ModelOps frameworks for seamless deployment and governance. Public and private institutions are implementing private large language models trained on internal datasets to enhance credit underwriting, fraud detection, and customer personalization. In September 2025, India initiated eight homegrown foundational model projects to enhance its AI ecosystem, concentrating on multilingual, healthcare, scientific, industrial, governance, and agricultural uses. The Ministry of Electronics and Information Technology (MeitY) announced this in preparation for the India-AI Impact Summit 2026, set to be conducted in New Delhi on 19-20 February 2026. This shift towards customized AI systems delivering targeted value is accelerating the demand for ModelOps solutions that manage model lifecycle from development through continuous optimization and retraining.

Expansion of Edge and Hybrid Deployment Architectures

Organizations are increasingly deploying AI models across distributed environments combining cloud, on-premises, and edge infrastructure to reduce latency and support real-time decision-making. The growth of edge data centers enables enterprises to process AI workloads closer to data sources while maintaining centralized governance. In October 2025, the Hon’ble Minister for IT, Electronics and Communications, Real Time Governance and Human Resources Development, Government of Andhra Pradesh, Nara Lokesh, inaugurated the groundwork for Vishakhapatnam’s inaugural 50MW AI-enabled Edge Data Centre and Open Cable Landing Station (CLS), which was set to be constructed by Sify Infinit Spaces Limited, a branch of Nasdaq-listed Sify Technologies. This architectural evolution requires sophisticated ModelOps platforms capable of managing models seamlessly across heterogeneous computing environments.

Increasing Regulatory and Compliance Awareness

As AI-driven decisions increasingly impact customers, finances, and operations, concerns around transparency, fairness, and accountability are growing. Organizations are under pressure to track how models are built, trained, deployed, and updated. ModelOps enables auditability, explainability, and governance across the model lifecycle. Industries handling financial transactions, healthcare records, and consumer data face strict accountability requirements, making unmanaged models a major compliance risk. ModelOps frameworks ensure role-based access, version records, performance logs, and policy enforcement. The ability to roll back flawed models and monitor data drift reduces risk exposure. Enterprises are investing in ModelOps not just to improve performance but to protect brand reputation and legal standing. As regulatory frameworks around data privacy and algorithmic fairness develop, ModelOps becomes essential infrastructure for building trustworthy and compliant AI systems rather than experimental technology.

Market Outlook 2026-2034:

The convergence of government-backed AI initiatives, increasing cloud infrastructure investments, and the strategic shift from experimental AI implementations to production-grade deployments positions India as a high-growth market for ModelOps adoption across the banking, healthcare, retail, and manufacturing sectors. The market generated a revenue of USD 253.87 Million in 2025 and is projected to reach a revenue of USD 6,506.26 Million by 2034, growing at a compound annual growth rate of 43.39% from 2026-2034. This robust expansion reflects the intensifying enterprise demand for scalable AI model deployment, lifecycle management, and governance solutions.

India ModelOps Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Offering | Platforms | 58% |

| Deployment | Cloud | 66% |

| Application | Continuous Integration/Continuous Deployment | 18% |

| Vertical | BFSI | 26% |

| Model | ML Models | 50% |

Offering Insights:

- Platforms

- Services

Platforms dominate with a market share of 58% of the total India ModelOps market in 2025.

Platforms lead the market because enterprises prefer unified systems that manage the complete model lifecycle from development to deployment and monitoring. Instead of using multiple disconnected tools, organizations adopt centralized platforms that improve visibility, control, collaboration, and automation while reducing operational complexity across AI workflows.

ModelOps platforms offer built-in features, such as version control, performance tracking, retraining automation, security management, and governance, making them more attractive than standalone tools. Indian enterprises handling large data volumes need scalable systems that ensure reliability and compliance. Platforms also support integration with cloud environments, data pipelines, and enterprise applications, enabling faster deployment and predictable performance. With limited operational expertise in many organizations, platforms reduce dependency on specialized staff by standardizing processes.

Deployment Insights:

- Cloud

- On-premises

Cloud leads with a share of 66% of the total India ModelOps market in 2025.

Cloud deployment dominates the market as enterprises leverage the flexibility, scalability, and cost-efficiency of cloud-based AI infrastructure. The pay-as-you-go model eliminates substantial capital expenditure requirements while enabling rapid scaling of compute resources for AI workloads. Hyperscale providers are significantly expanding their footprint in India, with Microsoft announcing a USD 3 Billion investment in January 2025 to strengthen cloud computing and AI capabilities across the country.

Public cloud platforms have become the preferred deployment choice for generative AI workloads, with enterprises increasingly recognizing cloud as a strategic enabler of digital transformation. Cloud-based ModelOps allows enterprises to scale computing power on demand, making it ideal for handling fluctuating data volumes and workloads. It supports seamless integration with AI tools, data sources, and business applications, accelerating model development and deployment. For Indian organizations with distributed teams and growing digital operations, cloud ensures consistent performance across locations. Its subscription pricing models make advanced ModelOps technology affordable, especially for startups and mid-sized companies pursuing AI-driven growth and innovation strategies.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Continuous Integration/Continuous Deployment

- Batch Scoring

- Governance, Risk and Compliance

- Parallelization and Distributed Computing

- Monitoring and Alerting

- Dashboard and Reporting

- Model Lifecycle Management

- Others

Continuous integration/continuous deployment exhibits a clear dominance with a 18% share of the total India ModelOps market in 2025.

Continuous integration/continuous deployment enables rapid, reliable, and automated deployment of ML models into production environments. Organizations prefer continuous integration/continuous deployment pipelines to reduce manual errors, speed up releases, and ensure consistent performance when updating models across complex enterprise systems and digital platforms.

Continuous integration/continuous deployment allows teams to test, validate, and deploy models repeatedly without service disruption. In dynamic Indian markets, customer behavior and data patterns change frequently, requiring models to be updated quickly. Continuous integration/continuous deployment automates version control, quality checks, and rollback features, ensuring operational stability. It also improves collaboration between data scientists and IT teams by standardizing workflows. As enterprises scale AI deployments across departments, Continuous integration/continuous deployment becomes essential to handle multiple models efficiently, maintain reliability, and deliver faster business outcomes, driving its strong dominance in the India ModelOps market.

Vertical Insights:

- BFSI

- Retail and E-Commerce

- Healthcare and Life Sciences

- IT and Telecommunications

- Energy and Utilities

- Manufacturing

- Transportation and Logistics

- Others

BFSI represents the leading segment with a 26% share of the total India ModelOps market in 2025.

The BFSI sector maintains market leadership, as financial institutions are accelerating AI adoption for fraud detection, credit risk assessment, customer personalization, and regulatory compliance. Banks and insurance companies require sophisticated ModelOps frameworks to ensure AI models meet stringent governance standards while delivering measurable business outcomes. The EY Report, released in March 2025, indicated that generative AI is set to enhance productivity in Indian banking operations by as much as 46% by 2030, emphasizing the transformative potential that fuels ModelOps investments. The sector's emphasis on explainable and auditable AI models necessitates comprehensive lifecycle management capabilities.

ModelOps enables version control, audit trails, and performance validation to maintain accountability. Frequent changes in customer behavior require models to be updated and retrained regularly. BFSI organizations therefore prefer automated systems that ensure consistency and governance. As digital banking and online payments are expanding, institutions are deploying hundreds of models simultaneously. ModelOps helps manage this scale efficiently, providing visibility, stability, and risk control, which strongly drives adoption within India’s BFSI sector.

Model Insights:

- ML Models

- Graph-Based Models

- Rule and Heuristic Models

- Linguistic Models

- Agent-Based Models

- Others

ML models comprise the largest segment with a 50% share of the total India ModelOps market in 2025.

ML models are the most widely deployed across industries for forecasting, detection, and automation use cases. Businesses rely on machine learning for actionable insights, making reliable deployment, monitoring, and retraining of these models a priority within operational AI environments.

ML models are applied across banking, telecom, retail, healthcare, and logistics, driving everyday business decisions. Unlike rule-based systems, ML models depend heavily on data quality and patterns that change frequently. This makes continuous performance tracking essential. ModelOps ensures data drift detection, automated retraining, and controlled rollouts to prevent operational failures. Indian enterprises prioritize ML because it delivers immediate cost savings and process improvement. As organizations are developing hundreds of ML pipelines, the need for centralized management is becoming critical, positioning ML models as the dominant category within the ModelOps ecosystem.

Regional Insights:

- North India

- South India

- East India

- West India

South India holds prominence in the market, driven by the concentration of technology companies and global capability centers. Cities like Bengaluru, Hyderabad, Chennai, and Kochi drive demand through AI development hubs, tech startups, and multinational research and development (R&D) centers implementing scalable ModelOps frameworks.

North India demonstrates strong growth momentum with the NCR region emerging as a significant technology and AI hub. The region benefits from established IT infrastructure, proximity to government agencies, and growing enterprise digital transformation initiatives across diverse industry verticals.

East India represents an emerging growth opportunity with Kolkata developing as a data center hub attracting major infrastructure investments. Digital infrastructure development across tier-two cities is expanding cloud service availability and enabling broader ModelOps adoption.

West India exhibits robust expansion driven by Mumbai's financial services concentration and Gujarat's manufacturing sector digitalization. The region accounts for significant technology investments, with enterprises prioritizing AI-driven operational efficiency and competitive differentiation.

Market Dynamics:

Growth Drivers:

Why is the India ModelOps Market Growing?

Accelerating Enterprise AI Adoption Across Industries

Indian enterprises are rapidly transitioning from experimental AI implementations to production-grade deployments, creating substantial demand for ModelOps solutions that ensure scalable and reliable model operations. Financial institutions, healthcare providers, retailers, and manufacturers are recognizing AI as essential for maintaining competitive positioning in increasingly digital markets. In August 2024, the Reserve Bank of India announced the launch of the Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) for responsible integration of AI in the BFSI sector, addressing algorithmic bias and data privacy concerns while promoting ethical AI adoption across financial institutions. This widespread adoption necessitates sophisticated frameworks for model deployment, monitoring, and continuous optimization that ModelOps platforms provide.

Strategic Government Investments and Policy Support

The Indian government's commitment to establishing AI leadership is driving substantial investments in research capabilities. The IndiaAI Mission, approved with INR 10,300 crore allocation in March 2024, encompassed comprehensive initiatives, including compute capacity development, application creation, and safe trusted AI frameworks. Government-backed innovation hubs, data platforms, and skill development initiatives expand enterprise readiness for AI adoption. Policy frameworks that support data sharing and ethical AI boost the demand for governance and lifecycle management tools. As public institutions themselves adopt analytics-driven operations, private enterprises follow. This growing reliance on AI systems makes ModelOps an essential layer for scalability, accountability, and performance management across India’s expanding AI ecosystem.

Expanding Cloud Infrastructure and Digital Transformation

The rapid expansion of cloud computing infrastructure in India is removing traditional barriers to AI adoption while creating ideal conditions for ModelOps deployment. As per IMARC Group, the India cloud computing market size reached USD 37.1 Billion in 2025.Hyperscale providers are making significant investments to expand data center capacity across multiple cities, enabling enterprises to access sophisticated AI development and deployment capabilities. The growth of hybrid and multi-cloud architectures requires advanced ModelOps platforms that manage models seamlessly across distributed environments. Digital transformation initiatives across banking, manufacturing, and public sectors are accelerating cloud migration while creating demand for governance frameworks that ensure responsible AI deployment.

Market Restraints:

What Challenges the India ModelOps Market is Facing?

Acute Talent Shortage and Skill Gap

The ModelOps market is facing significant constraints from the shortage of professionals skilled in both ML development and operational practices. Organizations struggle to find specialists capable of bridging data science and production operations, leading to project delays and implementation challenges. The rapid evolution of AI technologies creates continuous learning requirements that existing training infrastructure cannot adequately address.

Legacy Infrastructure Integration Complexity

Many Indian enterprises operate decades-old systems with proprietary interfaces and extensive customizations that hinder straightforward integration with modern ModelOps platforms. Modernization requires substantial investment in redesigning codebases, managing data pipelines, and educating personnel on containerized frameworks. These complexities extend implementation timelines while increasing project costs and risk exposure.

Data Quality and Governance Challenges

Organizations face obstacles in ensuring representative, high-quality datasets essential for effective AI model training and deployment. The fragmented nature of enterprise data across legacy systems, combined with evolving privacy regulations, creates governance complexity that impacts ModelOps implementation effectiveness. Establishing robust data pipelines while maintaining compliance requires substantial organizational commitment.

Competitive Landscape:

The India ModelOps market features a dynamic competitive environment where global technology providers compete alongside specialized domestic platforms to capture enterprise demand. Established multinational corporations offer comprehensive suites integrating ModelOps with broader cloud and enterprise software ecosystems, providing organizations with unified solutions for AI lifecycle management. These providers leverage extensive research capabilities, global deployment experience, and established customer relationships to maintain market positioning across large enterprise segments. Domestic technology companies are developing India-specific ModelOps solutions that address regional requirements, including linguistic diversity, regulatory compliance, and industry-specific governance frameworks. Startups focusing on no-code and low-code ModelOps platforms target mid-market enterprises seeking accessible AI deployment capabilities without extensive technical expertise. The competitive landscape emphasizes partnerships, with enterprises increasingly combining platform capabilities with specialized consulting services to achieve comprehensive ModelOps implementations.

India ModelOps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Platforms, Services |

| Deployments Covered | Cloud, On-premises |

| Applications Covered | Continuous Integration/Continuous Deployment, Batch Scoring, Governance, Risk and Compliance, Parallelization and Distributed Computing, Monitoring and Alerting, Dashboard and Reporting, Model Lifecycle Management, Others |

| Verticals Covered | BFSI, Retail and E-Commerce, Healthcare and Life sciences, IT and Telecommunications, Energy and Utilities, Manufacturing, Transportation and Logistics, Others |

| Models Covered | ML Models, Graph-Based Models, Rule and Heuristic Models, Linguistic Models, Agent-Based Models, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India ModelOps market size was valued at USD 253.87 Million in 2025.

The India ModelOps market is expected to grow at a compound annual growth rate of 43.39% from 2026-2034 to reach USD 6,506.26 Million by 2034.

Platforms dominate the market with 58% share, driven by enterprise demand for comprehensive infrastructure to manage AI model development, deployment, and monitoring across complex production environments.

Key factors driving the India ModelOps market include accelerating enterprise AI adoption across industries, strategic government investments through the IndiaAI Mission, expanding cloud infrastructure, growing emphasis on responsible AI governance, and increasing demand for scalable model lifecycle management solutions.

Major challenges include acute talent shortage and skill gaps in combined ML and operations expertise, legacy infrastructure integration complexity, data quality and governance challenges, high implementation costs for smaller enterprises, and evolving regulatory compliance requirements across different industry sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)