India Molybdenum Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End Use, and Region, 2025-2033

India Molybdenum Market Overview:

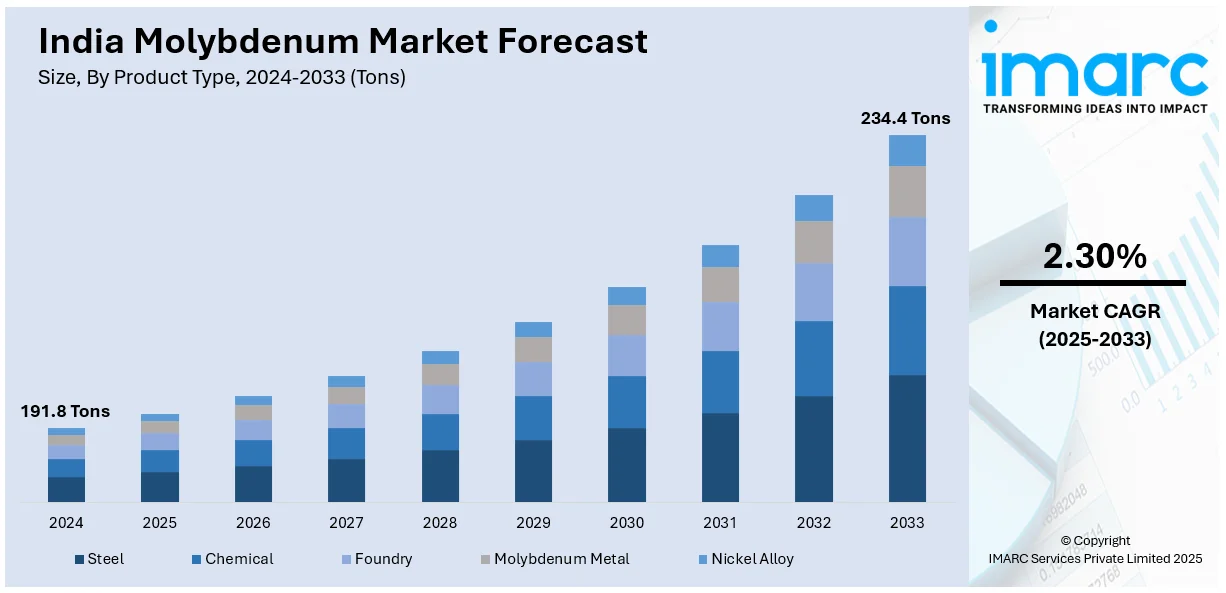

The India molybdenum market size reached 191.8 Tons in 2024. Looking forward, IMARC Group expects the market to reach 234.4 Tons by 2033, exhibiting a growth rate (CAGR) of 2.30% during 2025-2033. The market is expanding due to its growing use in steel, energy, and chemical sectors. Increased demand for high-strength alloys and cleaner energy applications is supporting steady domestic consumption, along with new investment in refining and recycling capacities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 191.8 Tons |

| Market Forecast in 2033 | 234.4 Tons |

| Market Growth Rate 2025-2033 | 2.30% |

India Molybdenum Market Trends:

Growing Alloy Use in Steel

Molybdenum’s strength-enhancing and anti-corrosive qualities are supporting its rising use in steel manufacturing across India. Infrastructure expansion and precision engineering projects are pushing demand for specialized steel grades that include molybdenum. Manufacturers are gradually shifting toward producing higher-performance stainless and structural steel, which requires consistent molybdenum inputs. Industrial construction, bridges, and chemical plants are key demand points. During 2024, steel producers initiated new sourcing contracts for molybdenum to stabilize supply amid growing project pipelines. This indicates an effort to secure alloy materials as domestic demand accelerates. Supply chain adjustments are also underway to reduce reliance on spot imports and improve delivery timelines. Simultaneously, recovery of molybdenum from metallurgical waste is gaining attention as a supplemental source. The move toward efficient raw material use and higher-grade outputs is placing molybdenum at the center of India’s shift to durable and specialized steel products.

To get more information on this market, Request Sample

Refining Sector Driving Catalyst Need

In the refining and petrochemical industries, molybdenum serves as a core element in catalyst systems for desulfurization and hydroprocessing. With regulatory pressure on emissions and fuel quality, the need for high-performing catalysts is rising. Refineries are modifying their operational strategies to extend catalyst life and improve molybdenum recovery. In the second half of 2024, upgrades in catalyst regeneration capacity were introduced to enhance local processing and reduce molybdenum wastage. These changes reflect an ongoing effort to optimize input use in refining while aligning with clean energy targets. Catalyst manufacturers are reporting steady demand from processing units across fuel, chemical, and lubricant production. Additionally, there is more focus on balancing imports with refined or recycled molybdenum content to manage operational costs. As energy efficiency measures deepen, molybdenum’s utility in supporting reaction stability and process performance is becoming more embedded in industrial strategies.

India Molybdenum Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, sales channel, and end use.

Product Type Insights:

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloy

The report has provided a detailed breakup and analysis of the market based on the product type. This includes steel, chemical, foundry, molybdenum metal, and nickel alloy.

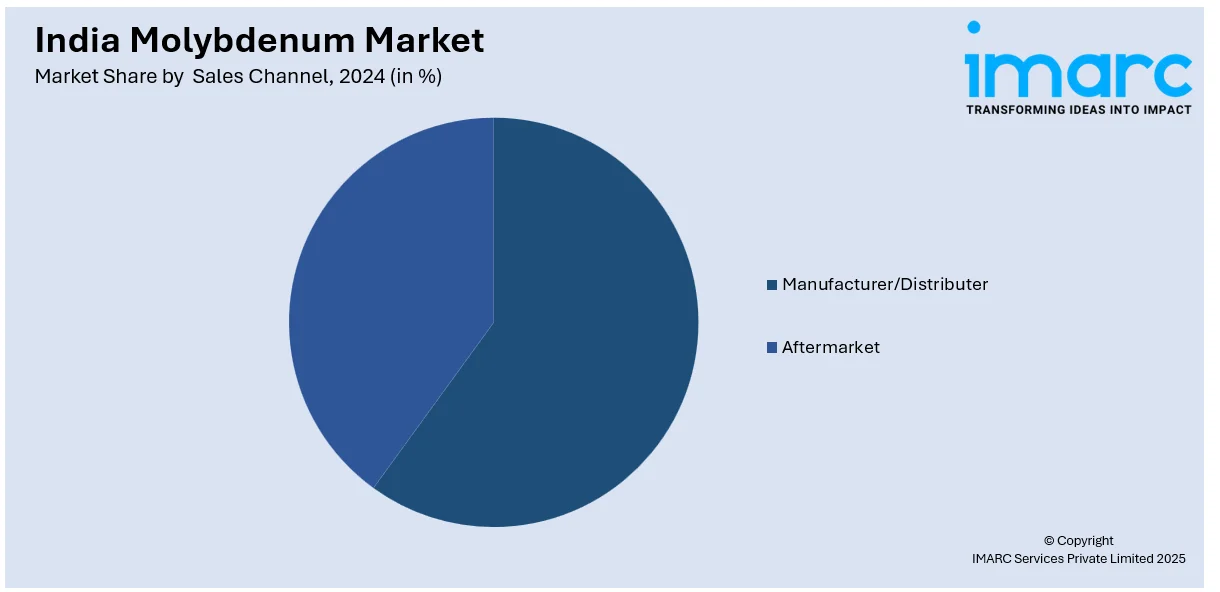

Sales Channel Insights:

- Manufacturer/Distributer

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes manufacturer/distributer and aftermarket.

End Use Insights:

- Oil and Gas

- Automotive

- Heavy Machinery

- Energy

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes oil and gas, automotive, heavy machinery, energy, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Molybdenum Market News:

- January 2025: Under the National Critical Minerals Mission India announced an INR 15,000–20,000 Crore plan, including molybdenum. This boosted exploration, auctions, and processing infrastructure, strengthening domestic molybdenum supply for EVs, semiconductors, and defense, while reducing import reliance and supporting long-term industrial self-reliance goals.

- July 2024: Jindal Stainless urged the removal of customs duties on ferro molybdenum to reduce input costs and improve domestic availability. This proposal aimed to support stainless steel manufacturing and strengthen India’s molybdenum industry by encouraging affordable sourcing aligned with the Make in India initiative.

India Molybdenum Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Steel, Chemical, Foundry, Molybdenum Metal, Nickel Alloy |

| Sales Channels Covered | Manufacturer/Distributer, Aftermarket |

| End Uses Covered | Oil and Gas, Automotive, Heavy Machinery, Energy, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India molybdenum market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India molybdenum market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India molybdenum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molybdenum market in India reached a volume of 191.8 Tons in 2024.

The India molybdenum market is projected to exhibit a CAGR of 2.30% during 2025-2033, reaching a volume of 234.4 Tons by 2033.

Industrial applications in steel production, chemical processes, and aerospace propel India’s molybdenum market. Demand is influenced by infrastructure development, automotive growth, and energy sectors. Molybdenum’s corrosion resistance, high-temperature performance, and alloying properties make it critical for high-strength and durable materials. Investments in advanced metallurgical processes and rising manufacturing activity support consistent market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)