India Motor Control Center Market Size, Share, Trends and Forecast by Type, Voltage, Component, Standard, End User Industry, and Region, 2025-2033

India Motor Control Center Market Overview:

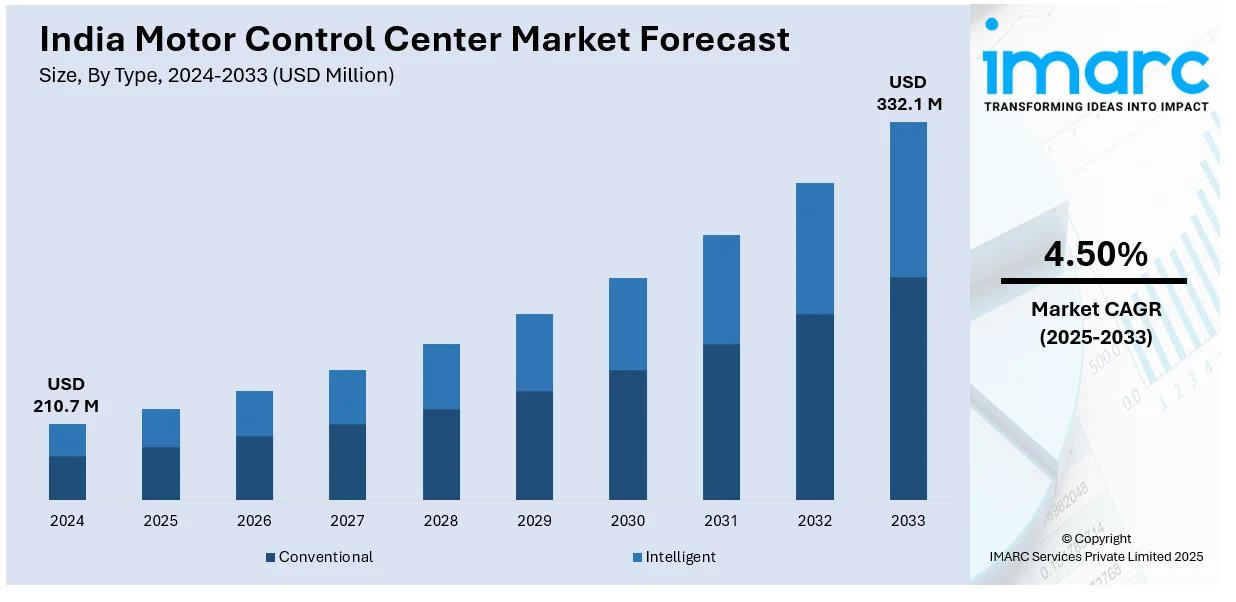

The India motor control center market size reached USD 210.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 332.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is growing due to increasing industrial automation, rising power distribution needs, and strong government infrastructure initiatives, along with surging demand from manufacturing, energy, and commercial sectors for intelligent and energy-efficient solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 210.7 Million |

| Market Forecast in 2033 | USD 332.1 Million |

| Market Growth Rate 2025-2033 | 4.50% |

India Motor Control Center Market Trends:

Growing Adoption of Intelligent and Energy-Efficient MCCs

The India Motor control center (MCC) market outlook is witnessing a significant shift toward intelligent and energy-efficient MCC solutions. The industrial automation movement and need for energy efficiency improvement have driven businesses to adopt sophisticated MCCs which integrate modern communication standards and remote control features as well as predictive maintenance functionality. In addition to this, the installation of smart MCCs delivers several operational benefits to manufacturing and power generation sectors and infrastructure installations, which makes them very attractive options. Moreover, the implementation of energy-efficient standards and carbon footprint minimization goals by governments leads to industry-wide MCC replacement programs with modern energy-efficient solutions. For instance, Wilson Power Solutions expanded its operations in India by building a new 14-acre factory in Chennai, focusing on energy-efficient electricity transformers. Such developments contribute to reducing carbon emissions and align with the industry's shift toward sustainable practices. Besides this, Indian industrial facilities have sped up their intelligent MCC adoption rate because of their commitment to sustainable practices and their increased implementation of Industry 4.0 technologies. Furthermore, the market demands require manufacturers to build new innovative products with design features for automation systems, improved safety features, and enhanced energy management capabilities, thus boosting the India MCC market share.

To get more information on this market, Request Sample

Rising Demand from Renewable Energy and Infrastructure Projects

The expansion of renewable energy (RE) and infrastructure projects in India is significantly driving the India MCC market growth. In line with this, India requires efficient electrical control and distribution solutions because the government actively supports renewable energy development, especially for solar power and wind power generation systems. For example, The Indian government's approval of the National Green Hydrogen Mission with an outlay of INR 19,744 crore aims to establish India as a global hub for green hydrogen production and export, potentially attracting over INR 8 lakh crore in investments by 2030. Concurrently, MCCs serve vital functions in these projects because they handle motor-driven systems and maintain dependable power distribution while boosting system operational efficiency. Additionally, rapid urbanization together with the expansion of smart cities drives MCC demand for water treatment plants as well as metro rail projects and commercial buildings, and industrial parks. In confluence with this, the market growth is driven by two main infrastructure modernization efforts, which include railway electrification and power distribution network improvements. As a result, MCC manufacturers aim to serve new large-scale infrastructure projects in renewable projects by developing specific solutions which enhance safety measures while improving faulty detection along with smooth integration to the current grid systems. This shift is further propelling the market forward.

India Motor Control Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, voltage, component, standard, and end user industry.

Type Insights:

- Conventional

- Intelligent

The report has provided a detailed breakup and analysis of the market based on the type. This includes conventional and intelligent.

Voltage Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low, medium, and high.

Component Insights:

- Busbars

- Overload Relays

- Variable Speed Drivers

- Soft Starters

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes busbars, overload relays, variable speed drivers, soft starters, and others.

Standard Insights:

- IEC

- NEMA

- Others

A detailed breakup and analysis of the market based on the standard have also been provided in the report. This includes IEC, NEMA, and others.

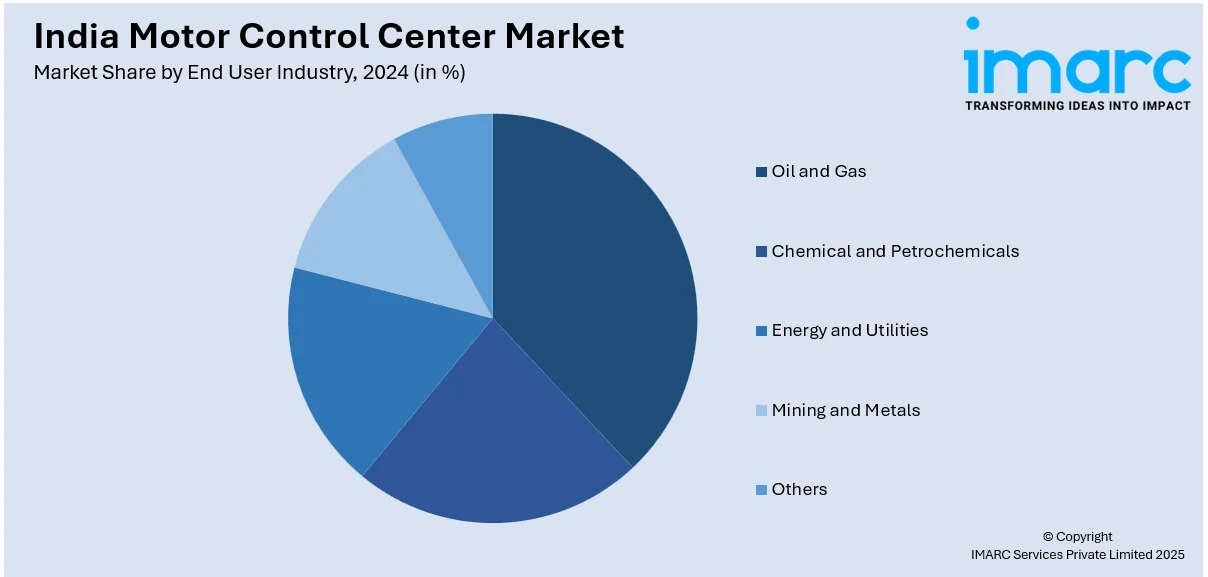

End User Industry Insights:

- Oil and Gas

- Chemical and Petrochemicals

- Energy and Utilities

- Mining and Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes oil and gas, chemical and petrochemicals, energy and utilities, mining and metals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Motor Control Center Market News:

- In November 2024, Suzuki Motor Corporation and Tata Elxsi launched a dedicated offshore development center in Pune. This collaboration focuses on advancing Suzuki's sustainable mobility initiatives by leveraging Tata Elxsi's expertise in lightweight design, safety, eco-friendly materials, and advanced engineering.

- In July 2024, Cummins India inaugurated its first IT Global Competency Center in Pune. This facility aims to enhance innovation across global operations by leveraging specialized talent and advanced technical capabilities, thereby improving operational efficiencies and accelerating product and service time-to-market.

India Motor Control Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Conventional, Intelligent |

| Voltages Covered | Low, Medium, High |

| Components Covered | Busbars, Overload Relays, Variable Speed Drivers, Soft Starters, Others |

| Standards Covered | IEC, NEMA, Others |

| End User Industries Covered | Oil and Gas, Chemical and Petrochemicals, Energy and Utilities, Mining and Metals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India motor control center market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India motor control center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India motor control center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India motor control center market was valued at USD 210.7 Million in 2024.

The India motor control center market is projected to exhibit a CAGR of 4.50% during 2025-2033, reaching a value of USD 332.1 Million by 2033.

The India motor control center market is driven by industrial automation, infrastructure growth, and increasing demand for energy-efficient systems. Expansion in manufacturing, power, and construction sectors also boosts adoption. Government initiatives promoting smart grids and renewable energy, along with technological advancements, further propel market growth across diverse industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)