India Motor Repair and Maintenance Market Size, Share, Trends, and Forecast by Type, Service, End Use Industry, and Region, 2025-2033

India Motor Repair and Maintenance Market Overview:

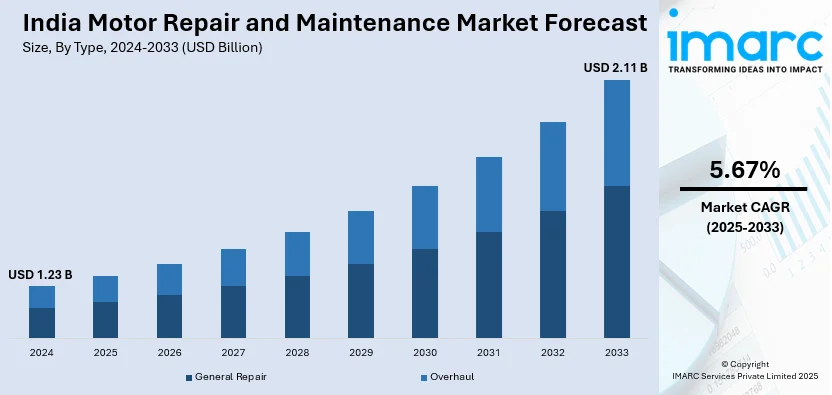

The India motor repair and maintenance market size reached USD 1.23 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.11 Billion by 2033, exhibiting a growth rate (CAGR) of 5.67% during 2025-2033. The market is being driven by rapid industrialization, growing manufacturing activity, and surging demand for dependable motor efficiency. The implementation of predictive maintenance, enactment of more stringent energy efficiency standards, and growing infrastructure projects are boosting service demand. Furthermore, digitalization and the integration of IoT improve remote diagnostics accuracy and maintenance precision.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.23 Billion |

| Market Forecast in 2033 | USD 2.11 Billion |

| Market Growth Rate 2025-2033 | 5.67% |

India Motor Repair and Maintenance Market Trends:

Integration of Predictive Maintenance Technologies

Predictive maintenance is becoming a core strategy in the motor repair sector, driven by advancements in sensor technology and artificial intelligence. Companies are increasingly implementing IoT-enabled condition monitoring systems to detect early signs of wear, reducing downtime and optimizing asset performance. This trend is particularly prominent in industries reliant on heavy machinery, such as manufacturing, power generation, and oil & gas. By utilizing real-time data analytics, businesses can forecast potential failures and schedule maintenance activities proactively. This not only enhances operational efficiency but also extends motor lifespan, reducing overall maintenance costs. As industries in India continue modernizing their equipment, the demand for predictive maintenance solutions is expected to increase, leading to a shift from traditional reactive maintenance practices. For instance, in February 2025, ACKO General Insurance expanded its cashless repair service across India, allowing customers to get vehicle repairs at network garages without upfront payment. The service ensures transparent pricing, genuine spare parts, and real-time repair updates via digital platforms. Customers can locate a garage, book a service, approve estimates, and complete payments online or at the garage. By leveraging technology-driven solutions, these advancements streamline vehicle servicing, minimize unexpected breakdowns, and reduce downtime, ensuring efficient maintenance strategies for customers.

To get more information on this market, Request Sample

Rising Demand for Energy-Efficient Motor Solutions

With stringent energy conservation regulations and the need to reduce operational costs, businesses are focusing on energy-efficient motor solutions. Repair and maintenance services are evolving to support the retrofitting of motors with high-efficiency components, including advanced insulation, improved bearings, and optimized cooling mechanisms. Industries such as automotive, chemical processing, and water treatment are prioritizing efficiency upgrades to meet regulatory requirements and sustainability goals. Additionally, government initiatives promoting energy efficiency in industrial operations are encouraging the adoption of smart motor technologies. Service providers are adapting by offering specialized maintenance solutions tailored to energy-efficient motors, ensuring compliance with industry standards. The emphasis on reducing power consumption is shaping the market, driving innovations in repair methodologies and motor performance optimization. For instamce, in November 2024, Motul India and Zypp Electric partnered to train 10,000 mechanics in electric two-wheeler (e-2W) repair and maintenance. The initiative combines Motul’s automotive expertise with Zypp’s EV operational insights. The program enhances mechanics' skills in diagnostics, troubleshooting, and EV servicing. Participants reported a 50% improvement in repair knowledge. As EV adoption rises, well-trained professionals are crucial for diagnosing and repairing high-efficiency motor systems, ensuring optimal performance and regulatory compliance.

Expansion of Industrial and Infrastructure Development

India’s infrastructure expansion, driven by government policies and private investments, is accelerating demand for motor repair and maintenance services. The rapid growth of construction, transportation, and utilities is increasing the need for reliable motor performance and specialized servicing. Large-scale initiatives like smart cities, metro expansions, and renewable energy projects are amplifying this demand. Additionally, SMEs are adopting maintenance strategies to avoid production disruptions. As industrial automation advances, the complexity of motor systems requires specialized expertise, leading to a more structured, technology-driven servicing approach nationwide. For instance, in January 2025, HaveUs AeroTech became India’s first MRO to secure DGCA CAR 145 approval for Unit Load Devices (ULD) and Pallets, ensuring compliance with global aviation safety standards. With expansion plans in Mumbai, Bengaluru, and Kolkata, alongside a newly commissioned spares warehouse near Bengaluru airport, HaveUs AeroTech is strengthening India’s MRO industry. This approval highlights the growing need for specialized maintenance expertise in aviation, aligning with broader infrastructure development trends across multiple industries.

India Motor Repair and Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, service, and end use industry.

Type Insights:

- General Repair

- Bearing

- Stator

- Rotor

- Others

- Overhaul

The report has provided a detailed breakup and analysis of the market based on the type. This includes general repair (bearing, stator, rotor, and others) and overhaul.

Service Insights:

- On-Site Service

- Off-Site Service

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes on-site and off-site services.

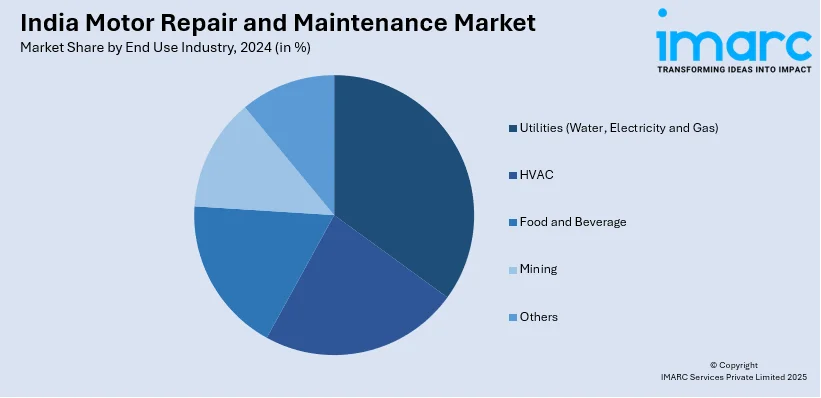

End Use Industry Insights:

- Utilities (Water, Electricity and Gas)

- HVAC

- Food and Beverage

- Mining

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes utilities (water, electricity and gas), HVAC, food and beverage, mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Motor Repair and Maintenance Market News:

- In June 2024, Cars24 launched Fourdoor, a multi-brand vehicle repair and maintenance service, addressing challenges in India's unorganized car service market. It ensures expert care, genuine parts, and transparent pricing. The platform aims to extend vehicle lifespan, reduce repair costs, and provide a structured alternative to OEM workshops and local service providers.

- In September 2024, Dassault Aviation established a Maintenance, Repair, and Overhaul (MRO) subsidiary in India to support the Indian Air Force's Mirage 2000 and Rafale fleets. This initiative aligns with India's 'Make in India' program, aiming to enhance self-reliance in defense maintenance. The MRO facility will be located in Noida, Uttar Pradesh, and will be led by an Indian national. This development underscores Dassault's commitment to strengthening its presence in the Indian defense sector.

India Motor Repair and Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Services Covered | On-Site Service, Off-Site Service |

| End Use Industries Covered | Utilities (Water, Electricity and Gas), HVAC, Food and Beverage, Mining, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India motor repair and maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the India motor repair and maintenance market on the basis of type?

- What is the breakup of the India motor repair and maintenance market on the basis of service?

- What is the breakup of the India motor repair and maintenance market on the basis of end-use industry?

- What are the various stages in the value chain of the India motor repair and maintenance market?

- What are the key driving factors and challenges in the India motor repair and maintenance market?

- What is the structure of the India motor repair and maintenance market and who are the key players?

- What is the degree of competition in the India motor repair and maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India motor repair and maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India motor repair and maintenance market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India motor repair and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)