India Music Streaming Market Size, Share, Trends and Forecast by Revenue Model, Service, Platform, and Region, 2025-2033

India Music Streaming Market Size and Share:

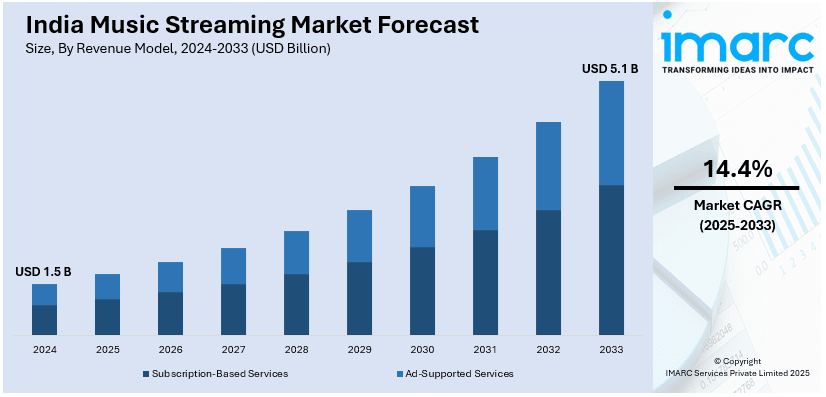

The India Music Streaming market size reached USD 1.5 Billion in 2024. The market is expected to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 14.4% during 2025-2033. The market expansion is due to rising smartphone penetration, low-cost internet, and growing regional content demand. In addition, the increasing popularity of subscription models and AI-based personalization are improving user engagement.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of revenue model, the market has been divided into subscription-based services and ad-supported services.

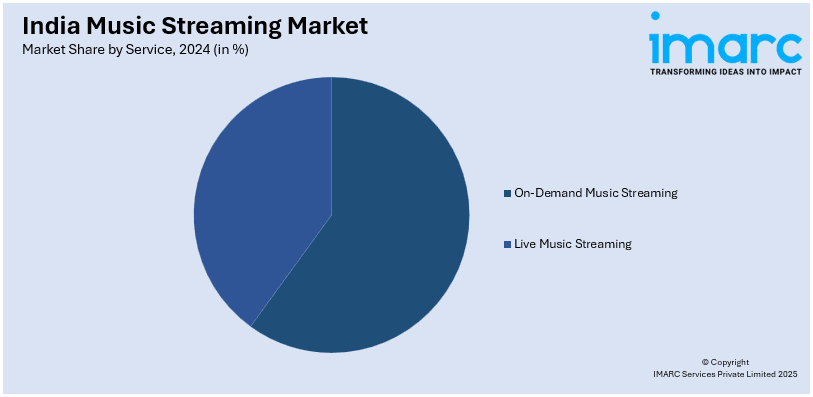

- On the basis of service, the market has been divided into on-demand music streaming and live music streaming.

- On the basis of platform, the market has been divided into application-based and web-based.

Market Size and Forecast:

- 2024 Market Size: USD 1.5 Billion

- 2033 Projected Market Size: USD 5.1 Billion

- CAGR (2025-2033): 14.4%

India Music Streaming Market Trends:

Rising Adoption of Subscription-Based Models

The India music streaming market is witnessing a significant shift toward subscription-based models, driven by increasing consumer preference for ad-free, high-quality audio experiences. As digital payments become more accessible and disposable incomes rise, more users are opting for premium plans offered by platforms like Spotify, JioSaavn, Apple Music, and Gaana. This transition is a key factor fueling India music streaming market growth, as streaming services introduce competitive pricing, student discounts, and family plans to attract paid subscribers. Exclusive content, early song releases, and offline listening options are further incentivizing users to upgrade. Additionally, telco partnerships with streaming platforms are bundling premium subscriptions with data plans, making paid access more affordable. For instance, in September 2024, Apple announced its partnership with Bharti Airtel to enhance its music and TV streaming presence in India. The deal provides Airtel's 281 million customers free access to Apple Music and Apple TV+, aiming to boost Apple's share in a competitive market. With an expanding internet user base and growing music consumption habits, subscription models are expected to play a crucial role in revenue generation, shaping the future of India’s digital music landscape.

To get more information on this market, Request Sample

AI-Powered Personalization

Artificial Intelligence (AI) is transforming the India music streaming market by enhancing user experience through personalized playlists, song recommendations, and mood-based music curation. Platforms like Spotify, JioSaavn, and Wynk Music are leveraging AI and machine learning to analyze listening habits, genre preferences, and user interactions, enabling highly tailored music suggestions. This innovation is a key factor driving India music streaming market share, as consumers increasingly engage with AI-driven playlists and automated song discovery features. Advanced AI models are also helping platforms refine algorithms for improved content discovery, increasing retention rates. Additionally, AI is being used for voice search, lyrics-based recommendations, and contextual playlist generation. For instance, in March 2024, YouTube Music launched a "hum-to-search" feature for Android enabling users to find songs by humming, singing, or whistling. The new "Song" tab, supported by AI helps generate potential matches. Additionally, an upcoming "Trim Silence" option for podcasts will skip silent periods, enhancing the listening experience. As competition intensifies, AI-powered personalization will be a major differentiator for streaming services, enhancing user engagement and monetization strategies. With continuous advancements in AI integration, the India music streaming market outlook remains promising for sustained growth.

Digital Transformation and Market Evolution

The India music streaming market is experiencing unprecedented growth driven by increased smartphone penetration reaching over 750 million users and improved internet accessibility through affordable 4G and emerging 5G networks, fundamentally shifting consumer preferences toward digital content consumption. This digital transformation has accelerated subscription model adoption, with strategic partnerships like Apple-Airtel providing 281 million customers free access to Apple Music and innovative collaborations such as Spotify-IndiGo offering travelers exclusive playlists and complimentary premium subscriptions. AI-powered personalization is revolutionizing user experience through advanced features like YouTube Music's "hum-to-search" technology, mood-based curation, and intelligent playlist generation that analyze listening habits to deliver highly tailored recommendations. The growing demand for regional and vernacular music content, which now accounts for 34% of daily streams, is giving local players like JioSaavn competitive advantages while international platforms adapt by expanding their Hindi and regional language catalogs. Platforms are diversifying beyond music into podcasts, audiobooks, and live streaming to capture broader entertainment consumption patterns. Bundled experiences have become crucial retention strategies, with airlines, telecommunications providers, and OTT platforms integrating music streaming services to create comprehensive entertainment ecosystems that enhance customer value propositions and reduce churn rates across interconnected digital services.

Growth, Opportunities, and Challenges in the India Music Streaming Market:

- Growth Drivers of the India Music Streaming Market: Rising smartphone penetration and expanding 4G/5G internet infrastructure are driving mass adoption of music streaming services across urban and rural areas. Growing preference for digital content consumption and increasing disposable incomes are accelerating the shift from traditional media to streaming platforms. Strategic partnerships between telecommunications companies and streaming services are creating bundled offerings that make premium subscriptions more accessible to price-sensitive consumers.

- Opportunities in the India Music Streaming Market: The untapped rural market presents significant growth potential as internet penetration deepens and smartphone adoption accelerates in Tier 2 and Tier 3 cities. Regional and vernacular content demand offers opportunities for platforms to differentiate through local language music, giving competitive advantages to players with strong regional catalogs. Expansion into adjacent content categories including podcasts, audiobooks, and live streaming creates additional revenue streams and enhanced user engagement opportunities.

- Challenges in the India Music Streaming Market: Intense price competition and low average revenue per user (ARPU) create sustainability challenges for streaming platforms operating in India's price-sensitive market. Complex music licensing agreements and high content acquisition costs strain profitability while regulatory uncertainties around data localization and content policies pose operational risks. Market consolidation pressures are forcing smaller domestic players to shut down, with only Gaana and JioSaavn remaining as major local competitors against global giants.

India Music Streaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on revenue model, service, and platform.

Revenue Model Insights:

- Subscription-Based Services

- Ad-Supported Services

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription-based services and ad-supported services.

Service Insights:

- On-Demand Music Streaming

- Live Music Streaming

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes on-demand music streaming and live music streaming.

Platform Insights:

- Application-Based

- Web-Based

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes application-based and web-based.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- October 2024: IndiGo and Spotify announced the launch of 6E Shuffle, offering travelers exclusive playlists based on journey preferences and providing customers booking directly with IndiGo a complimentary four-month Spotify Premium subscription. This partnership demonstrates the growing trend of bundled experiences where airlines integrate music streaming services to enhance customer value propositions and encourage direct bookings.

- March 2024: The National Company Law Tribunal (NCLT) approved the merger of Saavn Holdings into Saavn Media, which operates JioSaavn streaming platform, aimed at streamlining operations and reducing costs. Jio Platforms holds an 87.65% stake in Saavn Media while the income tax department oversees tax implications, reflecting ongoing consolidation efforts in India's competitive streaming market.

- August 2024: Bharti Airtel announced the partnership with Apple to transition millions of users to Apple Music, providing Airtel customers exclusive offers for Apple TV+ and Apple Music services. This strategic move demonstrates how telecommunications companies are leveraging global partnerships rather than maintaining in-house streaming services, significantly expanding Apple's subscriber base in India.

India Music Streaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Models Covered | Subscription-Based Services, Ad-Supported Services |

| Services Covered | On-Demand Music Streaming, Live Music Streaming |

| Platforms Covered | Application-Based, Web-Based |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India music streaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India music streaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India music streaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The music streaming market in India was valued at USD 1.5 Billion in 2024.

The India music streaming market is projected to exhibit a CAGR of 14.4% during 2025-2033, reaching a value of USD 5.1 Billion by 2033.

The India music streaming market is driven by widespread smartphone usage, affordable internet access, and a young, tech-savvy population. Regional language content, personalized recommendations, and growing interest in on-demand entertainment also contribute to rising user engagement, while integration with social media platforms enhances visibility and platform growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)