India Mustard Oil Market Size, Share, Trends and Forecast by Packaging Type, Packaging Material, Pack Size, Application, Distribution Channel, and Region, 2026-2034

India Mustard Oil Market Summary:

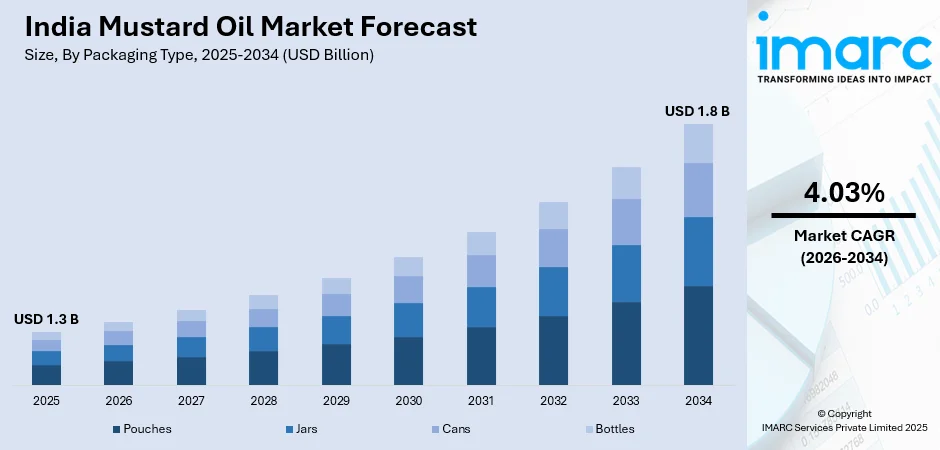

The India mustard oil market size was valued at USD 1.3 Billion in 2025 and is projected to reach USD 1.8 Billion by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The market is driven by the deep-rooted culinary traditions in Indian households, increasing consumer preference for natural and cold-pressed cooking oils, and growing awareness about the health benefits associated with mustard oil consumption. Rising disposable incomes across urban and rural areas, expanding organized retail networks, and the cultural significance of mustard oil in regional cuisines are further strengthening demand, contributing to the India mustard oil market share.

Key Takeaways and Insights:

-

By Packaging Type: Pouches dominates the market with a share of 52% in 2025, driven by cost efficiency, lightweight design, easy storage, and strong acceptance among price-sensitive urban and rural consumers seeking convenience.

- By Packaging Material: Plastic leads the market with a share of 67% in 2025, owing to durability, moisture resistance, lower manufacturing costs, lighter weight for transport, and consumer preference for transparent packaging.

-

By Pack Size: 1 litres represent the largest segment with a market share of 36% in 2025, driven by affordability, adequate quantity for nuclear families, easy storage, and strong preference among urban households.

-

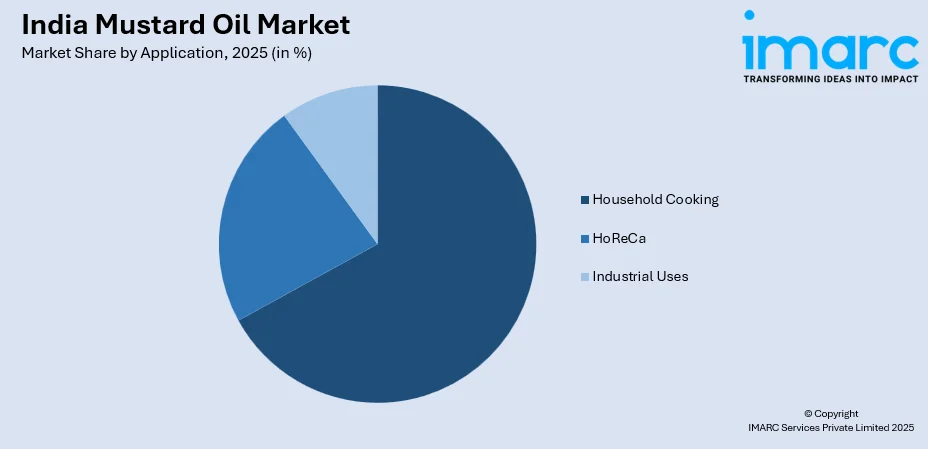

By Application: Household cooking dominates the market with a share of 67% in 2025, owing to traditional culinary practices, cultural reliance on mustard oil, perceived health benefits, and its pungent flavor enhancing food taste.

-

By Distribution Channel: Convenience stores lead the market with a share of 43% in 2025, driven by neighborhood accessibility, immediate availability, personalized service, informal credit options, and strong rural and semi-urban penetration.

-

By Region: North India dominates the market with a share of 31% in 2025, owing to traditional consumption patterns, proximity to mustard farms, regional cuisines, and well-established local manufacturing infrastructure.

-

Key Players: The India mustard oil market exhibits a moderately fragmented competitive landscape, with established national brands competing alongside numerous regional and local manufacturers across diverse price segments, quality tiers, and geographic markets catering to varied consumer preferences. Some of the key players operating in the market include Adani Wilmar Limited, Emami Agrotech Ltd., Marico Limited, Dabur India Ltd., Patanjali Ayurved Limited, K. S. Oils Limited, Puri Oil Mills Limited, Bansal Oil Mill Ltd., NatureLand Organics.

To get more information on this market Request Sample

The India mustard oil market is experiencing sustained growth propelled by multiple converging factors rooted in cultural traditions and evolving consumer preferences. The longstanding culinary heritage across North and East Indian states continues to drive consistent household demand, as mustard oil remains an integral ingredient in regional cooking practices and traditional food preparation methods. According to sources, in September 2025, AWL Agri Business partnered with SEA and Solidaridad to establish 3,000 mustard model farms across nine districts, promoting regenerative agriculture and supporting 20,000 farmers under NMEOOS. Moreover, growing health consciousness among Indian consumers has amplified interest in natural, minimally processed cooking oils, with mustard oil gaining recognition for its distinct nutritional profile. The expanding middle-class population with increasing purchasing power has enabled greater spending on quality cooking oils. Additionally, the proliferation of organized retail channels and e-commerce platforms has improved product accessibility, while government initiatives supporting domestic oilseed cultivation have strengthened supply chain infrastructure, collectively fostering favorable market conditions.

India Mustard Oil Market Trends:

Rising Preference for Cold-Pressed and Organic Variants

Consumer inclination toward cold-pressed and organic mustard oil variants is gaining significant momentum across Indian markets. Health-conscious consumers are increasingly seeking traditionally extracted oils that retain natural nutrients and bioactive compounds without chemical processing. This trend reflects broader wellness movements emphasizing clean-label products and minimal processing interventions. Urban consumers particularly demonstrate willingness to pay premium prices for certified organic variants sourced from controlled cultivation practices. The cold-pressed segment appeals to consumers valuing authenticity and traditional extraction methods reminiscent of village-style oil production, driving manufacturers to expand their portfolios with heritage and artisanal product lines. In June 2025, Marico Limited launched the Saffola Dual Seed Cold Pressed Oils range, including a mustard variant, expanding its portfolio to meet growing consumer demand for health-focused, minimally processed cooking oils.

Expanding E-Commerce and Direct-to-Consumer Channels

Digital commerce platforms are reshaping mustard oil distribution dynamics across India's urban and semi-urban landscapes. Online marketplaces enable consumers to access diverse brand portfolios, compare pricing, and explore specialty variants previously unavailable through traditional retail channels. Direct-to-consumer (DTC) models allow manufacturers to establish brand relationships, gather consumer insights, and offer subscription-based purchasing convenience. The proliferation of quick-commerce platforms has further accelerated online oil purchases by offering rapid delivery services. As per sources, in August 2025, Anjali Gold partnered with Blinkit to enable direct-to-consumer delivery of 100% pure mustard oil, offering rapid, hyperlocal access across major Indian cities via quick-commerce channels. Moreover, this channel expansion particularly benefits premium and specialty mustard oil brands seeking nationwide distribution without extensive physical retail infrastructure investments.

Growing Emphasis on Sustainable and Traceable Sourcing

Sustainability considerations are increasingly influencing consumer purchasing decisions and manufacturer sourcing strategies within the mustard oil industry. Consumers demonstrate growing interest in understanding product origins, cultivation practices, and supply chain transparency. Manufacturers are responding by implementing traceability systems, highlighting regional sourcing credentials, and communicating farmer partnership initiatives. As per sources, in October 2024, India’s Union Cabinet approved the National Mission on Edible Oils–Oilseeds to boost domestic oilseed production, expand cultivation, support farmers, and strengthen self-sufficiency in edible oils. Moreover, sustainable packaging alternatives are gaining attention as environmental awareness expands among urban consumer segments. This trend encompasses reduced plastic usage, recyclable packaging materials, and refill station concepts emerging in select metropolitan markets, reflecting broader sustainability movements influencing India's food and beverage sector.

Market Outlook 2026-2034:

The India mustard oil market is poised for steady revenue growth throughout the forecast period, supported by resilient domestic consumption patterns and expanding distribution infrastructure. Continued urbanization and rising household incomes are expected to sustain demand while enabling premiumization trends. The market revenue trajectory will benefit from innovation in product offerings, packaging formats, and value-added variants catering to health-conscious consumer segments. Regional expansion into South and West Indian markets presents incremental growth opportunities, complementing established strongholds in traditional consumption zones. The market generated a revenue of USD 1.3 Billion in 2025 and is projected to reach a revenue of USD 1.8 Billion by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

India Mustard Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Packaging Type |

Pouches |

52% |

|

Packaging Material |

Plastic |

67% |

|

Pack Size |

1 Litres |

36% |

|

Application |

Household Cooking |

67% |

|

Distribution Channel |

Convenience Stores |

43% |

|

Region |

North India |

31% |

Packaging Type Insights:

- Pouches

- Jars

- Cans

- Bottles

Pouches dominates with a market share of 52% of the total India mustard oil market in 2025.

Pouches have emerged as the leading packaging format within India's mustard oil market, commanding majority revenue share through their compelling value proposition for price-sensitive consumers. In May 2024, Adani Wilmar launched Fortune Pehli Dhaar First-Pressed Mustard Oil, introducing traditionally extracted mustard oil in bottles and pouches to cater to consumers seeking authenticity, purity, and premium taste. The flexible packaging format offers significant cost advantages over rigid alternatives, translating into lower retail prices that resonate with budget-conscious households across economic segments. Pouches require minimal storage space, facilitating convenient handling in compact kitchen environments prevalent in urban apartments and rural homes alike.

The lightweight characteristics of pouch packaging reduce transportation costs throughout the supply chain, enabling manufacturers to optimize logistics expenses and maintain competitive pricing structures. Consumer acceptance has strengthened as quality improvements in pouch materials ensure adequate barrier properties preventing oxidation and preserving oil freshness. The format particularly suits smaller quantity purchases aligned with frequent buying patterns observed among lower and middle-income households preferring fresh stock rotation.

Packaging Material Insights:

- Metal

- Plastic

- Paper

- Others

Plastic leads with a share of 67% of the total India mustard oil market in 2025.

Plastic remains the dominant packaging material in India mustard oil market due to its versatile functionality and cost-effectiveness across manufacturing and distribution. Its excellent moisture barrier properties help maintain oil quality during extended storage, while its durability prevents damage during handling and transportation across India’s diverse logistics networks. Transparent plastic containers allow consumers to visually assess oil color and clarity before purchase, supporting informed buying decisions and enhancing overall trust in product quality.

Manufacturing economics strongly favor plastic materials, enabling competitive pricing that aligns with mass-market consumer expectations. The lightweight nature significantly reduces shipping costs compared to glass alternatives, facilitating broader geographic distribution including remote rural markets. Plastic containers offer convenient dispensing features, resealability for freshness preservation, and ergonomic designs enhancing user experience. While sustainability concerns are emerging, plastic remains entrenched due to infrastructure limitations in alternative material recycling and consumer familiarity with established packaging formats.

Pack Size Insights:

- Less than 1 Litres

- 1 Litres

- 1 Litres - 5 litres

- 5 Litres - 10 Litres

- 10 Litres and Above

1 litres exhibit a clear dominance with a 36% share of the total India mustard oil market in 2025.

1 litres represent the dominant volume segment, achieving optimal balance between consumer affordability and practical utility. In July 2024, GRM Overseas launched “Gulistan Kachi Ghani Mustard Oil” in 1L bottles and 5L jars nationwide, strengthening its 10X brand portfolio and expanding consumer access across India. This quantity suits monthly consumption patterns typical among nuclear family households, offering sufficient supply without excessive upfront expenditure or extended storage requirements. Urban consumers particularly favor this format for convenient handling, efficient refrigerator storage, and manageable weight during transportation from retail outlets.

1 litres enables manufacturers to maintain attractive price points accessible to middle-income households while preserving adequate profit margins. Retailers prefer stocking this size due to favorable turnover rates and efficient shelf space utilization. The segment benefits from extensive availability across all distribution channels, from traditional kirana stores to modern supermarkets and e-commerce platforms. Consumer purchasing behavior indicates strong preference for periodic replenishment rather than bulk buying, reinforcing the one-litre format's market leadership position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cooking

- HoReCa

- Industrial Uses

Household cooking dominates with a market share of 67% of the total India mustard oil market in 2025.

Household cooking constitutes the overwhelming majority of mustard oil consumption in India, reflecting deeply embedded culinary traditions across regional cuisines. According to sources, Fortune launched its Kachi Ghani Mustard Oil campaign, celebrating the cultural significance of mustard oil in Indian households and reinforcing its connection to traditional home-cooked meals. Moreover, mustard oil's distinctive pungent flavor profile and high smoke point make it preferred for various cooking techniques including deep frying, tempering spices, and preparing pickles and preserves. Cultural significance in North and East Indian households ensures generational consumption continuity, with mustard oil considered essential for authentic regional dish preparation.

Health perceptions significantly influence household preference, with consumers associating mustard oil with traditional wellness benefits including antimicrobial properties and cardiovascular health support. The oil's warming characteristics align with Ayurvedic dietary principles, particularly during winter months when consumption traditionally increases. Household usage extends beyond cooking to include traditional massage practices, hair care applications, and home remedies, creating multiple consumption occasions that reinforce market demand stability across seasonal variations.

Distribution Channel Insights:

- Direct/Institutional Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Convenience stores lead with a share of 43% of the total India mustard oil market in 2025.

Convenience stores commands mustard oil distribution through their unparalleled accessibility and penetration across India's diverse urban and rural settlement patterns. These neighborhood retail establishments offer proximity advantages enabling frequent small-quantity purchases aligned with consumer cash flow preferences and storage limitations. As per sources, in 2025, FMCG majors including ITC, Nestlé, Tata, Dabur, Parle, and Reliance launched new trade incentives and digital tools to strengthen kirana store distribution amid rising quick-commerce competition. Furthermore, store owners typically maintain personal relationships with regular customers, offering informal credit facilities and personalized service that strengthen loyalty and repeat purchasing behavior.

The convenience store demonstrates strength in semi-urban and rural markets where organized retail presence remains limited. These outlets stock brands and pack sizes tailored to local preferences, maintaining inventory assortments reflecting community-specific consumption patterns. Operating flexibility allows extended hours and personalized attention absent in larger retail formats. While organized retail and e-commerce channels are expanding, convenience stores maintain competitive advantages through immediacy, familiarity, and embedded community relationships that ensure continued channel dominance.

Regional Insights:

- North India

- West and Central India

- East India

- South India

North India dominates with a market share of 31% of the total India mustard oil market in 2025.

North India maintains market leadership anchored in centuries-old culinary traditions positioning mustard oil as the primary cooking medium across households. States including Rajasthan, Punjab, Haryana, and Uttar Pradesh demonstrate particularly strong consumption patterns rooted in regional cuisines heavily featuring mustard oil for flavor and cooking characteristics. Proximity to major mustard seed cultivation areas ensures fresh supply availability and relatively lower logistics costs supporting competitive regional pricing.

The region benefits from concentrated manufacturing infrastructure with numerous established oil mills and processing facilities serving local and national markets. Consumer preference intensity exceeds national averages, with mustard oil considered culturally essential rather than substitutable with alternative cooking oils. Seasonal consumption peaks during winter months when mustard oil's warming properties align with dietary traditions. The strong regional identity associated with mustard oil consumption creates resilient demand patterns less susceptible to competitive pressures from alternative cooking oil categories.

Market Dynamics:

Growth Drivers:

Why is the India Mustard Oil Market Growing?

Deep-Rooted Cultural and Culinary Traditions

Mustard oil's integral role in Indian culinary heritage represents a fundamental market growth driver ensuring sustained baseline demand across generations. Regional cuisines spanning North and East India extensively incorporate mustard oil for its distinctive pungent flavor profile that defines authentic dish preparation and taste expectations. This cultural entrenchment creates consumption habits transmitted through family cooking traditions, establishing early preference formation that persists throughout consumer lifetimes. Festive occasions, religious ceremonies, and traditional food preparation practices further reinforce mustard oil's essential household status beyond routine cooking applications. The cultural dimension provides market resilience against competitive pressures from alternative cooking oils, as consumer attachment extends beyond functional attributes to encompass emotional and heritage associations that substitutes cannot replicate.

Growing Health Consciousness and Natural Product Preferences

Increasing consumer awareness regarding dietary health impacts is driving favorable perception shifts toward mustard oil consumption. Health-conscious consumers recognize mustard oil's nutritional attributes including essential fatty acid composition, natural antioxidant content, and traditional wellness associations documented in Ayurvedic practices. The broader clean-label movement emphasizing minimally processed, natural food products align with mustard oil's positioning as a traditional, chemical-free cooking medium. This health orientation particularly resonates among urban educated consumers actively seeking healthier lifestyle choices and scrutinizing ingredient profiles. Growing concerns regarding refined oil processing methods have prompted consumer migration toward cold-pressed and traditionally extracted variants, expanding premium segment opportunities while reinforcing overall category growth through enhanced perceived value propositions. As per sources, in November 2025, Nutrica launched Nutrica Yellow Mustard Oil, an unrefined, natural cooking oil retaining antioxidants and authentic flavor, catering to health-conscious families and home cooks seeking clean-label, traditional kitchen essentials.

Expanding Retail Infrastructure and Distribution Networks

India's rapidly evolving retail landscape is enhancing mustard oil market accessibility and stimulating consumption growth across previously underserved geographic areas. The proliferation of organized retail formats including supermarkets and hypermarkets introduces mustard oil to consumers through modern shopping environments offering product variety and comparative purchasing opportunities. Simultaneously, e-commerce platform expansion enables nationwide distribution access, connecting specialty and premium brands with health-conscious urban consumers regardless of physical retail availability. Quick-commerce emergence facilitates impulsive and convenience-driven purchases through rapid delivery propositions. According to sources, in October 2025, AWL Agri Business reported its quick-commerce channel growing over 40% annually, reshaping edible oil distribution and expanding rapid-delivery access for staples like oil across urban and rural markets. Moreover, these channel developments complement traditional distribution strength through kirana stores and convenience retailers, collectively expanding total addressable market reach while creating differentiated shopping experiences catering to diverse consumer preferences and purchasing occasions.

Market Restraints:

What Challenges the India Mustard Oil Market is Facing?

Intense Competition from Alternative Cooking Oils

The mustard oil market faces significant competitive pressure from diverse alternative cooking oil categories actively pursuing market share expansion. Refined oils including sunflower, soybean, and rice bran oil compete on neutral flavor profiles appealing to consumers preferring milder taste characteristics. Health-positioned alternatives such as olive oil and coconut oil target premium segments with distinct wellness narratives. Blended oils offer cost advantages attracting price-sensitive consumers. This competitive intensity challenges mustard oil's market position particularly among younger urban consumers less attached to traditional cooking preferences.

Price Volatility and Raw Material Availability Concerns

Mustard seed supply fluctuations create pricing instability affecting both manufacturer margins and consumer purchasing behavior. Agricultural dependence on monsoon patterns and cultivation area variations introduces supply uncertainty impacting raw material costs. Price volatility can temporarily suppress demand as consumers shift toward more stable-priced alternatives during peak pricing periods. Manufacturers face margin compression when unable to fully pass through cost increases to retail prices, potentially constraining investment in marketing and product development activities essential for long-term market growth.

Regulatory Constraints and Quality Standardization Requirements

Evolving food safety regulations and quality standardization requirements impose compliance burdens affecting market participants, particularly smaller regional manufacturers. Regulatory frameworks governing edible oil purity, labeling requirements, and packaging standards require ongoing operational investments and process modifications. Enforcement actions against adulteration practices, while protecting consumer interests, can disrupt supply chains and create temporary market uncertainties. Compliance cost implications may disadvantage smaller players lacking resources for quality infrastructure investments, potentially affecting market diversity and competitive dynamics.

Competitive Landscape:

The India mustard oil market exhibits a moderately fragmented competitive structure characterized by the coexistence of established national brands, regional manufacturers, and numerous local oil mills serving geographically defined markets. Competition occurs across multiple dimensions including price positioning, quality perceptions, distribution reach, and brand recognition, creating diverse strategic approaches among market participants. National players leverage extensive distribution networks, brand building investments, and product portfolio diversification to maintain market presence across consumer segments. Regional manufacturers compete through localized supply chain advantages, community relationships, and price competitiveness derived from lower overhead structures. The market demonstrates ongoing consolidation tendencies as organized players expand while traditional unbranded segments gradually contract, though regional preferences and loyalty patterns sustain opportunities for locally focused competitors.

Some of the key players include:

- Adani Wilmar Limited

- Emami Agrotech Ltd.

- Marico Limited

- Dabur India Ltd.

- Patanjali Ayurved Limited

- K. S. Oils Limited

- Puri Oil Mills Limited

- Bansal Oil Mill Ltd.

- NatureLand Organics

Recent Developments:

-

In July 2025, HOAC Foods India Limited partnered with Kailash Foods to commence production of premium Pure Black Mustard Oil at a modern Dausa, Rajasthan facility with 5 lakh litre annual capacity. Marketed under the “Hariom” brand, the chemicalfree product launched in B2B channels, receiving strong initial demand in Delhi NCR, Rajasthan, and Gurugram.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Metric Tons, Billion USD |

| Segment Coverage | Packaging Type, Packaging Material, Pack Size, Application, Distribution Channel, Region |

| Region Covered | North India, West and Central India, East India, South India |

| Companies Covered | Adani Wilmar Limited, Emami Agrotech Ltd., Marico Limited, Dabur India Ltd., Patanjali Ayurved Limited, K. S. Oils Limited, Puri Oil Mills Limited, Bansal Oil Mill Ltd., NatureLand Organics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India mustard oil market size was valued at USD 1.3 Billion in 2025.

The India mustard oil market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 1.8 Billion by 2034.

Pouches held the largest market share, driven by cost-effectiveness, lightweight structure, ease of storage, reduced transportation costs, and widespread acceptance among price-sensitive urban and rural consumers seeking convenient packaging solutions.

Key factors driving the India mustard oil market include deep-rooted cultural and culinary traditions, growing health consciousness favoring natural cooking oils, expanding retail and e-commerce distribution infrastructure, rising disposable incomes, and increasing consumer preference for cold-pressed and organic variants.

Major challenges include intense competition from alternative cooking oils like refined sunflower and soybean oils, raw material price volatility affecting pricing stability, regulatory compliance requirements, quality standardization enforcement, and gradual preference shifts among younger urban consumers toward milder-flavored alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)