India Nanotechnology Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Nanotechnology Market Size and Share:

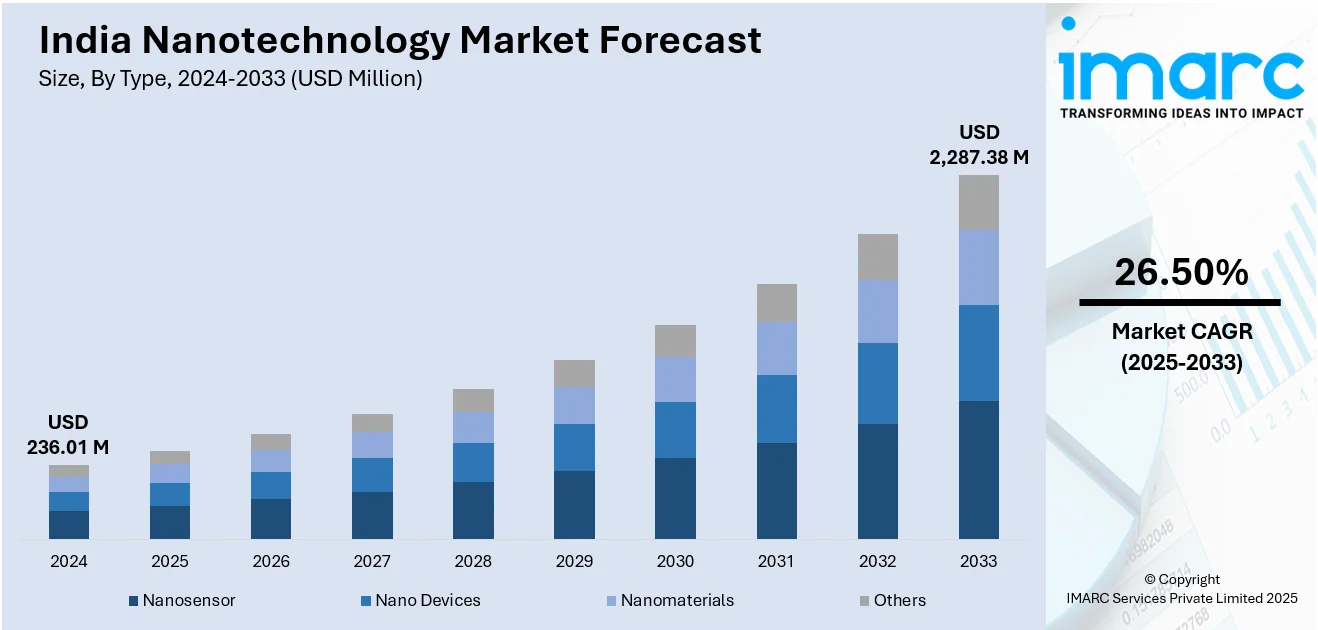

The India nanotechnology market size reached USD 236.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,287.38 Million by 2033, exhibiting a growth rate (CAGR) of 26.50% during 2025-2033. The market is expanding due to advancements in electronics, healthcare, and materials science. Government initiatives like the Nano Mission and increasing R&D investments drive growth. The rising demand for nanomaterials in drug delivery, electronics, and coatings further strengthens market potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 236.01 Million |

| Market Forecast in 2033 | USD 2,287.38 Million |

| Market Growth Rate (2025-2033) | 26.50% |

India Nanotechnology Market Trends:

Growing Investments in Nanomedicine and Healthcare Applications

The nanotechnology market in India is witnessing increased investments in nanomedicine, driven by advancements in targeted drug delivery, diagnostics, and regenerative medicine. Researchers are leveraging nanomaterials such as nanoparticles, quantum dots, and nanocarriers to enhance the efficacy and precision of treatments for chronic diseases like cancer, diabetes, and neurological disorders. For instance, as per industry reports, around 800,000 of new cases of cancer are anticipated annually across India, with tobacco being responsible for 20% cancer prevalence among women and 40% to 50% in men. Moreover, government initiatives such as the Nano Mission and collaborations between research institutions and pharmaceutical companies are further accelerating innovation in this field. The expansion of personalized medicine and the rising prevalence of infectious diseases are also contributing to the growing adoption of nanotechnology in healthcare. Additionally, the incorporation of both machine learning and artificial intelligence in nanomedicine research is improving drug formulation and disease detection. As regulatory frameworks evolve, India’s nanomedicine sector is expected to gain traction, positioning the country as a key player in the global nanotechnology-driven healthcare market.

To get more information on this market, Request Sample

Expansion of Nanotechnology in Electronics and Semiconductor Manufacturing

India’s semiconductor and electronics industry is increasingly adopting nanotechnology to enhance performance, energy efficiency, and miniaturization of electronic components. The application of nanomaterials, like carbon nanotubes, graphene, and nanowires is improving transistor scalability, chip density, and thermal management in electronic devices. The government’s Production Linked Incentive (PLI) scheme and investments in semiconductor fabrication are driving local innovation and reducing dependence on imports. For instance, as per industry reports, in January 2025, India has invested USD 1.06 Billion under the PLI Scheme for promoting the production of semiconductors and other electronic components. Nanotechnology is also being integrated into flexible electronics, sensors, and next-generation display technologies, further fortifying India’s foothold in the global electronics market. Research collaborations between universities, startups, and technology firms are fostering advancements in nanoelectronics, supporting the development of high-performance computing and artificial intelligence-driven applications. As demand for compact, efficient, and high-speed electronic devices grows, India’s nanotechnology sector is expected to play a critical role in advancing the nation’s semiconductor manufacturing capabilities.

India Nanotechnology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Nanosensor

- Nano Devices

- Nanomaterials

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nanosensor, nano devices, nanomaterials, and others.

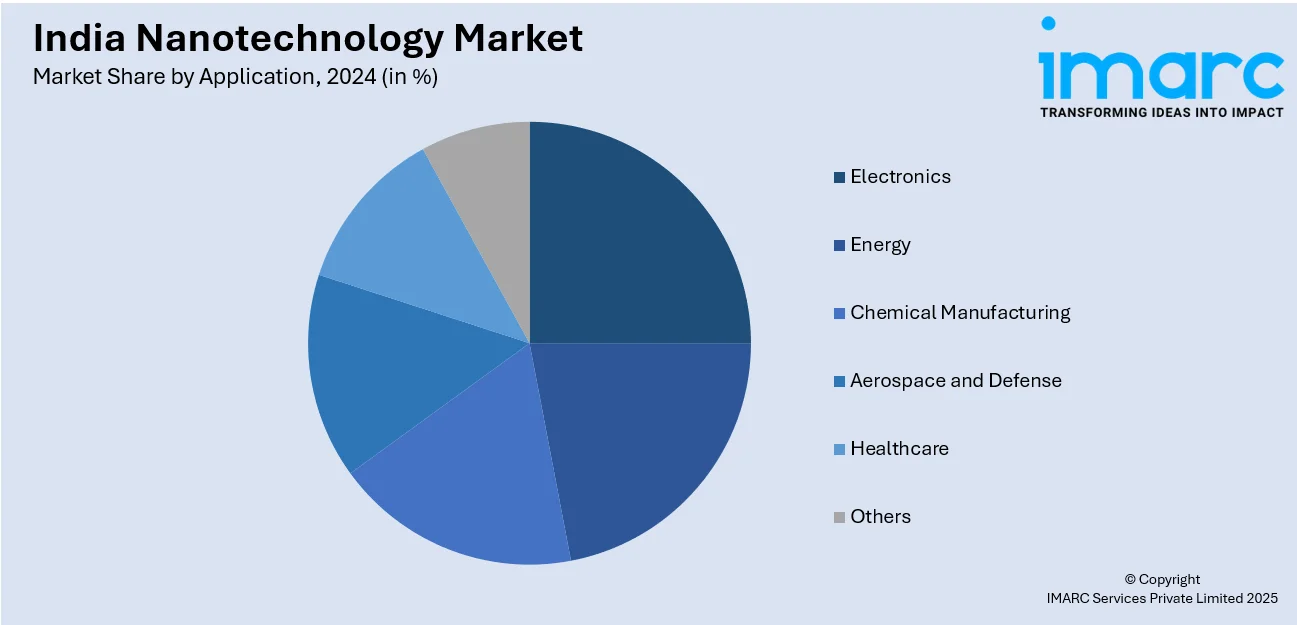

Application Insights:

- Electronics

- Energy

- Chemical Manufacturing

- Aerospace and Defense

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes electronics, energy, chemical manufacturing, aerospace and defense, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nanotechnology Market News:

- In December 2024, IFFCO, a major fertilizer producer, announced the successful formulation of nano-NPK, which leverages nanotechnology and is anticipated to be commercially launched in India by the next Kharif season.

- In May 2024, NoPo Nanotechnologies, an India-based company, announced plans to expand its manufacturing capacity. The company mainly focuses on the production of single-walled carbon nanotubes that are extensively leveraged in several applications, including EV battery designing.

India Nanotechnology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nanosensor, Nano Devices, Nanomaterials, Others |

| Applications Covered | Electronics, Energy, Chemical Manufacturing, Aerospace and Defense, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nanotechnology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nanotechnology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nanotechnology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 236.01 Million in 2024.

The India nanotechnology market is projected to exhibit a CAGR of 26.50% during 2025-2033, reaching a value of USD 2,287.38 Million by 2033.

Advancements in electronics, healthcare, and materials science, combined with government initiatives like the Nano Mission and rising R&D investments, are fueling growth. Increasing demand for nanomaterials in drug delivery, coatings, and electronics also enhances market potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)