India Naphtha Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Naphtha Market Overview:

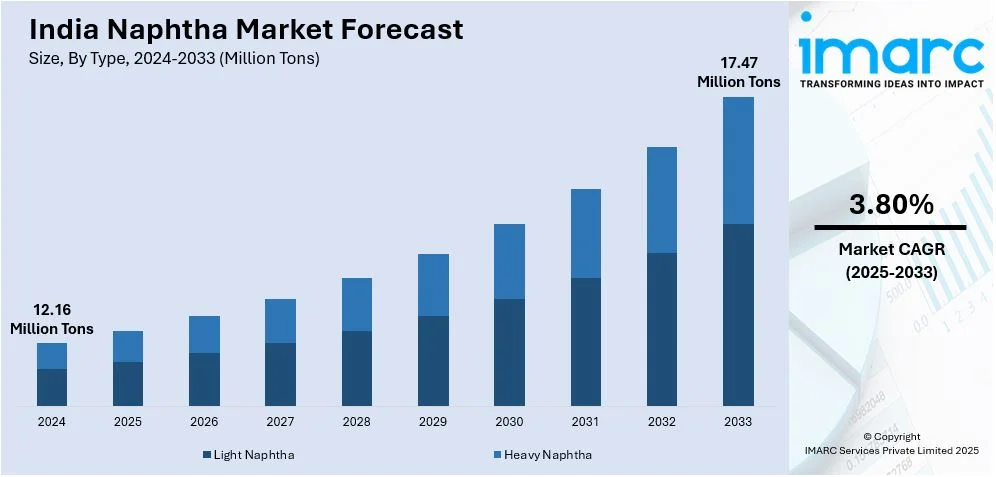

The India naphtha market size reached 12.16 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 17.47 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is primarily driven by robust demand from the petrochemical sector, where it serves as a key feedstock for plastics and synthetic materials. Additionally, growing urbanization, rising disposable incomes, and expanding industrial activities are further expanding the India naphtha market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 12.16 Million Tons |

| Market Forecast in 2033 | 17.47 Million Tons |

| Market Growth Rate 2025-2033 | 3.80% |

India Naphtha Market Trends:

Rising Demand for Naphtha in Petrochemical Production

The growing petrochemical industry is significantly supporting the India naphtha market growth. With a refining representation of approximately 256.816 MMTPA among 23 refineries and a solid petrochemical landscape, India ranks 4th globally in refining capacity. The country has 1,138.6 Billion Cubic Meters of recoverable natural gas reserves in its sedimentary basin and 651.8 Million Metric Tons of recoverable crude oil reserves. Furthermore, India's initiative enhanced planning policy with the Oilfields Amendment Bill 2024 and Hydrocarbon Exploration and Licensing Policy (HELP) aims to increase exploration area to 1 Million square kilometers by 2030. Naphtha, a key feedstock for producing ethylene, propylene, and other petrochemical derivatives, is increasingly used by manufacturers to meet the rising need for plastics, synthetic fibers, and packaging materials. With India's expanding middle class and rapid urbanization, consumption of petrochemical products continues to climb, enhancing naphtha consumption. Additionally, several new petrochemical plants and capacity expansions by major players are further fueling demand. Moreover, the petrochemical sector's reliance on naphtha is expected to remain strong in the near term, supporting steady market growth.

To get more information on this market, Request Sample

Shift Toward Alternative Feedstocks Impacting Naphtha Market

The gradual shift toward alternative feedstocks, such as liquefied petroleum gas (LPG) and ethane, in petrochemical production is creating a positive India naphtha market outlook. India accomplished successfully attaining a 15 percent ethanol blending rate in 2024, with a subsequent plan to hit 20 percent by 2025. This initiative will reduce crude oil imports by substituting 181 Lakh Metric Tons. The ethanol production capacity of the country has touched 1,623 Crore Liters and is targeted to be stepped to 1,700 Crore Liters by 2025. Such a shift from naphtha and other fossil fuels will help reinforce energy security and sustainability in the Indian market. Companies are increasingly adopting these cost-effective and efficient alternatives to reduce operational expenses and enhance margins. This shift is partly influenced by global market dynamics, where ethane-based crackers offer higher profitability. As a result, naphtha's share in feedstock usage is facing pressure, particularly in newer petrochemical projects. However, older plants still reliant on naphtha continue to sustain demand. Additionally, the Indian government's push for cleaner energy and sustainable practices further accelerated this transition. While naphtha remains a significant feedstock, its long-term demand could be impacted by these changing industry preferences, prompting refiners to explore diversified product strategies.

India Naphtha Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Light Naphtha

- Heavy Naphtha

The report has provided a detailed breakup and analysis of the market based on the type. This includes light naphtha and heavy naphtha.

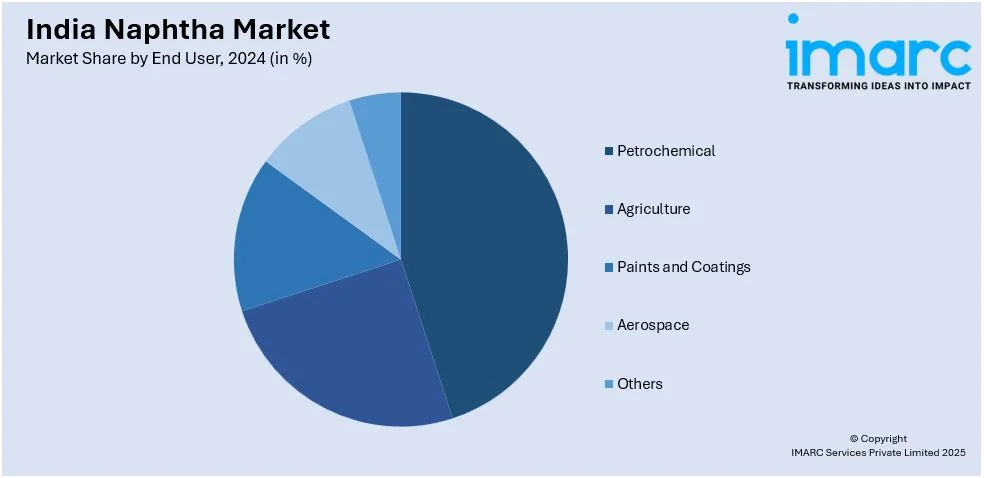

End User Insights:

- Petrochemical

- Agriculture

- Paints and Coatings

- Aerospace

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes petrochemical, agriculture, paints and coatings, aerospace, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Naphtha Market News:

- January 03, 2025, Indian Oil Corporation (IOCL) announced an investment of INR 61,000 Crore (USD 7.11 Billion) for a naphtha cracker project at Paradip in Odisha. The formalization will happen at the 'Utkarsh Odisha Make in Odisha 2025' summit. Additionally, IOCL will also set up a yarn project at Bhadrak with an investment of INR 4,352 crore (USD 0.53 Billion) and further develop India's naphtha-based petrochemical industry.

- June 15, 2024, Haldia Petrochemicals Ltd. (HPL) signed a long-term deal with QatarEnergy for the supply of up to 2 Million Tons of naphtha a year over 10 years, starting Q2 2024. The agreement, facilitated by HPL Global Pte Ltd., strengthens India's naphtha supply chain and reinforces Qatar's position as a key energy partner.

India Naphtha Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Naphtha, Heavy Naphtha |

| End Users Covered | Petrochemical, Agriculture, Paints, Coatings, Aerospace, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India naphtha market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India naphtha market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India naphtha industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The naphtha market in India reached 12.16 Million Tons in 2024.

The naphtha market in India is projected to exhibit a CAGR of 3.80% during 2025-2033, reaching a volume of 17.47 Million Tons by 2033.

The India naphtha market is propelled by increasing demand for petrochemicals in plastics, packaging, and fertilizers. Refinery capacity expansion and integration with downstream processing facilities guarantee supply reliability. Applications of naphtha in power generation and as a substitute fuel also drive the market forward. Feedstock diversification and environmental issues, though, shape strategic planning and long-term growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)