India Natural Food Ingredients Market Size, Share, Trends and Forecast by Type, Source, End Use, and Region, 2025-2033

India Natural Food Ingredients Market Size and Share:

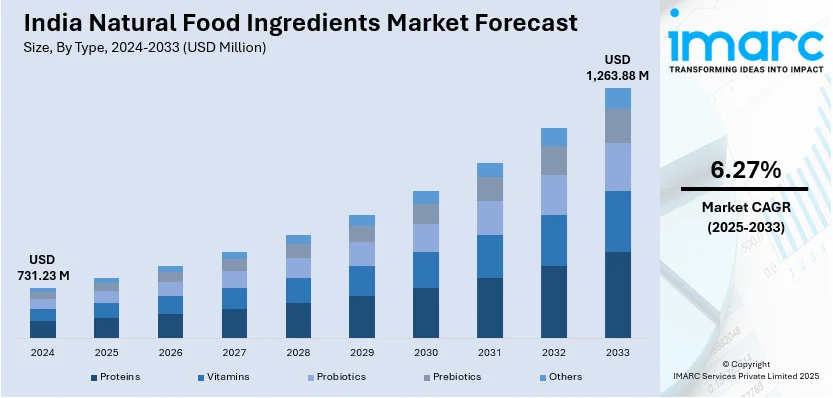

The India natural food ingredients market size reached USD 731.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,263.88 Million by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. The market is driven by increasing consumer health consciousness leading to higher demand for natural and functional foods, rapid urbanization, inflating disposable incomes of consumers, and the expanding specialty food sector that caters to diverse culinary preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 731.23 Million |

| Market Forecast in 2033 | USD 1,263.88 Million |

| Market Growth Rate 2025-2033 | 6.27% |

India Natural Food Ingredients Market Trends:

Rising Demand for Clean Label and Organic Ingredients

The growing emphasis on health and wellness among Indian consumers is driving demand for clean-label and organic food ingredients. Clean-label products, which focus on transparency and minimal processing while avoiding artificial additives, are gaining popularity. A 2023 NielsenIQ study found that 64% of Indian consumers actively seek clean-label food, reflecting a significant shift toward natural ingredients. India’s organic food market, valued at USD 1,917.4 million in 2024, is projected to grow at a CAGR of 20.13% from 2025 to 2033, reaching approximately USD 10,807.9 million by 2033. This rapid expansion is fueled by government initiatives such as the National Programme for Organic Production (NPOP) and increasing consumer awareness. Additionally, online grocery platforms like BigBasket and Amazon Fresh reported a 35% rise in organic and natural food sales between 2023 and 2024, reinforcing market growth. Consumers are particularly drawn to natural sweeteners like honey and jaggery, plant-based preservatives, and organic flavor enhancers. In response, the food industry is reformulating products to meet clean-label expectations, further accelerating demand for natural food ingredients. This trend, supported by regulatory efforts and digital retail expansion, is set to reshape India’s food industry.

To get more information on this market, Request Sample

Growth of Functional and Fortified Foods

Another major trend is the increasing use of natural food ingredients in functional foods, driven by the demand for enhanced nutrition and immunity-boosting products. Natural antioxidants (turmeric, amla), probiotics, and plant-based proteins are becoming mainstream. India's fortified and functional foods and beverages market witnessed a retail sales value exceeding $5.3 billion in 2022. This sector is projected to experience steady growth, reaching over $7.8 billion by 2026, driven by a compound annual growth rate (CAGR) of 9.8%. The rising consumer focus on health and wellness, increasing awareness of nutritional benefits, and growing demand for functional food products are key factors contributing to this expansion. Concurrent with this, a 2024 survey by FICCI found that 72% of urban Indian consumers prefer food with added health benefits, such as those fortified with vitamins and minerals, strengthening the market growth. Furthermore, companies like Tata Consumer Products and ITC have launched nutrient-rich, plant-based foods, increasing the market share of functional ingredients. This trend is particularly evident in dairy alternatives, fortified cereals, and herbal supplements, with natural food ingredients playing a crucial role in the formulation of these products.

India Natural Food Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source, and end use.

Type Insights:

- Proteins

- Vitamins

- Probiotics

- Prebiotics

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes proteins, vitamins, probiotics, prebiotics, and others.

Source Insights:

- Fruits

- Vegetables

- Grains & Cereals

- Microbial

- Animals

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes fruits, vegetables, grains & cereals, microbial, animals, and others.

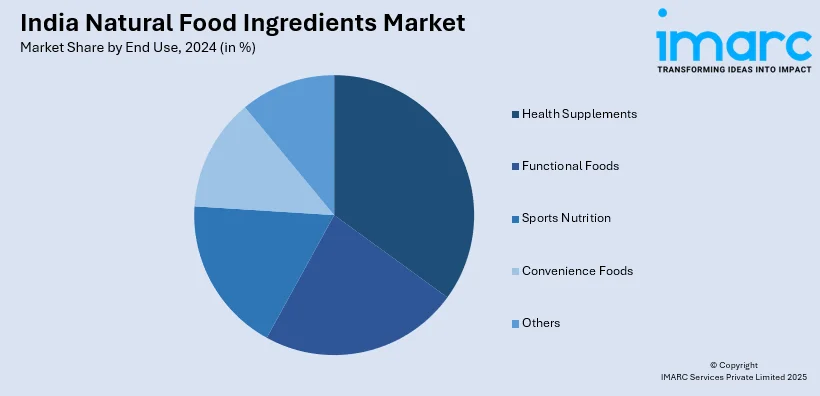

End Use Insights:

- Health Supplements

- Functional Foods

- Sports Nutrition

- Convenience Foods

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes health supplements, functional foods, sports nutrition, convenience foods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Natural Food Ingredients Market News:

- March 2025: Symega Food Ingredients Ltd constructed a new production plant in Sonipat, Haryana. The ₹20 crore facility would offer natural food components to enhance the flavor of snacks, noodles, and breakfast mixtures. The facility will allow Symega's clients to cut order lead times, resulting in speedier access to fresh, high-quality spices.

- July 2024: India launched its first 100% peanut-based protein powder, developed in the Netherlands, offering a high-quality alternative to traditional supplements. Each scoop provides 24g of protein and 5.1g of BCAAs. Made from natural ingredients, it is free from artificial additives, catering to fitness enthusiasts and health-conscious consumers seeking a clean, nutritious option.

India Natural Food Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proteins, Vitamins, Probiotics, Prebiotics, Others |

| Sources Covered | Fruits, Vegetables, Grains & Cereals, Microbial, Animals, Others |

| End Uses Covered | Health Supplements, Functional Foods, Sports Nutrition, Convenience Foods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India natural food ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India natural food ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India natural food ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India natural food ingredients market was valued at USD 731.23 Million in 2024.

The India natural food ingredients market is projected to exhibit a CAGR of 6.27% during 2025-2033, reaching a value of USD 1,263.88 Million by 2033.

The India natural food ingredients market is driven by rising health-conscious consumers seeking clean-label, minimally processed products. Growing demand for plant-based and organic ingredients, fortified foods, and functional nutrition also fuels expansion. Supportive government initiatives, expanding food and beverage industries, and increasing exports of botanical extracts and spices further accelerate market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)