India Natural Gas Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

India Natural Gas Market Overview:

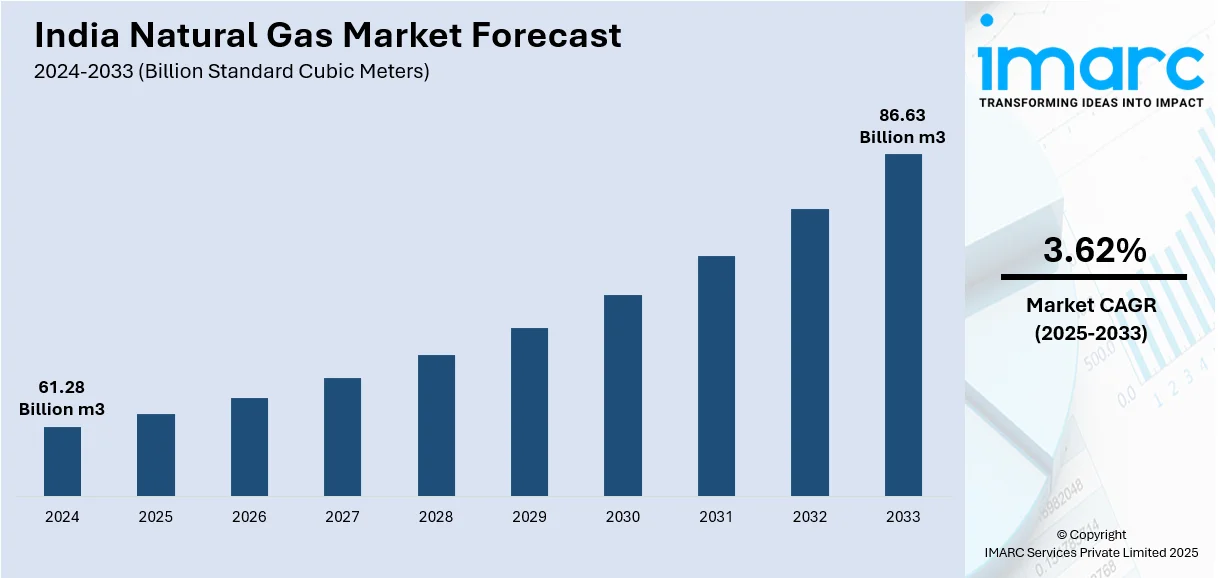

The India natural gas market size reached 61.28 Billion Standard Cubic Meters in 2024. Looking forward, IMARC Group expects the market to reach 86.63 Billion Standard Cubic Meters by 2033, exhibiting a growth rate (CAGR) of 3.62% during 2025-2033. India natural gas market is expanding due to government-backed city gas distribution, pipeline infrastructure development, and hydrogen integration, with increasing investments, regulatory support, and technological advancements driving the demand across residential, commercial, industrial, and transportation sectors while ensuring long-term energy security and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 61.28 Billion Standard Cubic Meters |

| Market Forecast in 2033 | 86.63 Billion Standard Cubic Meters |

| Market Growth Rate (2025-2033) | 3.62% |

India Natural Gas Market Trends:

Increasing City Gas Distribution (CGD) Network

Government initiatives encouraging the greater accessibility of piped natural gas (PNG) for homes and compressed natural gas (CNG) for transport are propelling infrastructure advancement. Regulatory assistance, such as supportive licensing processes and collaborations between public and private sectors, is promoting network growth in urban and semi-urban regions. Heightened user awareness and financial benefits compared to traditional fuels are promoting uptake in both residential and commercial sectors. The demand for CNG in public and private vehicles is being fueled by the push for cleaner transportation, especially in urban regions. Investments in pipeline systems and the incorporation of digital technologies for effective distribution are reinforcing supply chains. As the government establishes ambitious goals for city gas distribution (CGD) coverage, natural gas usage in residential, commercial, and transport sectors is supporting the market growth. In 2024, AG&P Pratham revealed intentions to invest Rs 80 billion to grow its city gas distribution (CGD) network throughout India in the upcoming three years. The organization intended to expand its infrastructure by adding 2,000 CNG and LNG stations and catering to 150 million clients. AG&P concentrated on growth in South India, Bhopal, and Madhya Pradesh.

To get more information on this market, Request Sample

Infrastructure Expansion and Pipeline Connectivity

The rapid expansion of natural gas infrastructure, especially pipeline links, is enhancing both accessibility and supply dependability. Investments in international pipeline systems are enabling the effective delivery of natural gas to industrial, commercial, and residential consumers. The growth of the national gas network is promoting regional stability, guaranteeing a consistent supply to areas of demand while lowering reliance on particular sources. Enhanced connectivity is likewise facilitating the incorporation of new gas fields and LNG terminals into the distribution system. Technological progress in pipeline surveillance and upkeep is enhancing operational effectiveness and reducing leaks. Government programs encouraging pipeline growth in less developed areas are further increasing domestic usage possibilities. For example, in 2025, India revealed its intentions to extend its natural gas pipeline infrastructure by 10,805 km, boosting the existing network by 62.6%. This expansion seeks to finalize the national gas network and guarantee consistent gas availability throughout the nation. The reform features a standardized tariff system designed to assist individuals, particularly in isolated regions.

Integration of Natural Gas in Hydrogen Production

The rising emphasis on hydrogen as a future energy alternative is generating new growth prospects for natural gas in India. Blue hydrogen, developed from natural gas with carbon capture and storage (CCS), is becoming increasingly popular as an interim solution in the movement toward a hydrogen-centric economy. Government programs that support hydrogen production are fostering investments in gas-derived hydrogen technologies. Sectors such as refining, chemicals, and steel production are incorporating hydrogen to lower carbon emissions, thereby increasing the demand for natural gas. Improvements in steam methane reforming (SMR) and autothermal reforming (ATR) methods are enhancing the efficiency of hydrogen generation from natural gas. With the expansion of hydrogen infrastructure and increased policy backing, natural gas is playing a key role as a transitional fuel in hydrogen production, aiding long-term market development. In line with this trend, in 2025, Cummins Accelera revealed a partnership with GAIL (India) Limited to work together on green hydrogen and zero-emission technologies. The two firms will concentrate on producing hydrogen, blending, transporting, and storing it in industries such as transportation, energy, and steel manufacturing. This collaboration seeks to speed up the adoption of green hydrogen in India.

India Natural Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

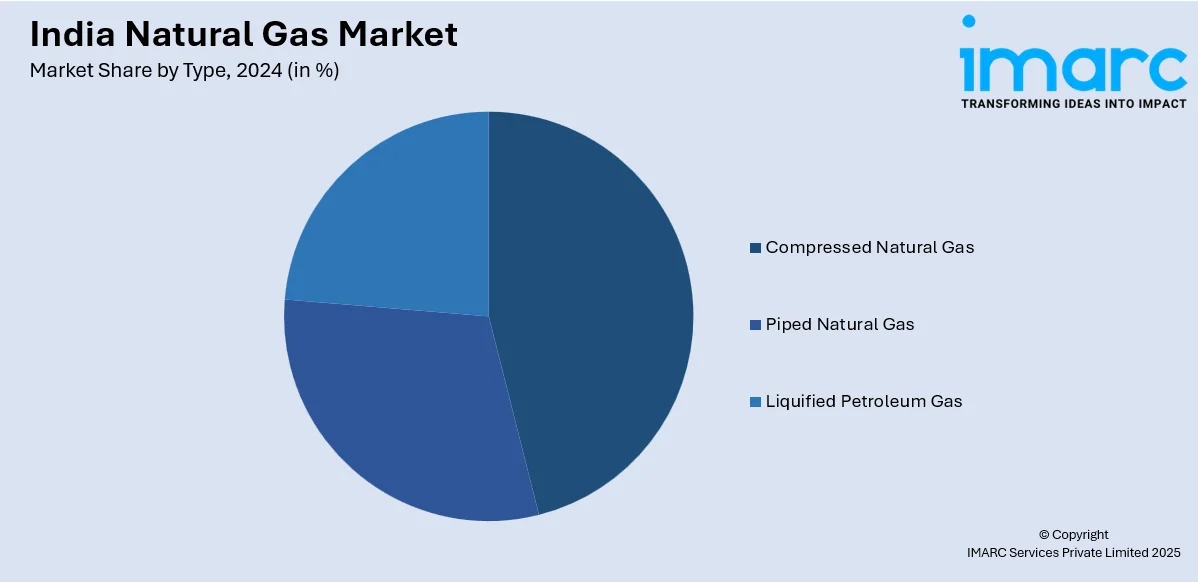

- Compressed Natural Gas

- Piped Natural Gas

- Liquified Petroleum Gas

The report has provided a detailed breakup and analysis of the market based on the type. This includes compressed natural gas, piped natural gas, and liquified petroleum gas.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Natural Gas Market News:

- In March 2025, Andhra Pradesh CM inaugurated Hero Future Energies' Rs 1,000-crore green hydrogen plant in Tirupati. The plant blends green hydrogen with LPG and PNG for industrial heating, aiming to reduce CO2 emissions and support India's clean energy transition. It is part of Andhra Pradesh's vision to lead in green energy and attract significant investments.

- In October 2024, Adani Total Gas Ltd (ATGL) began mixing 2.2-2.3% green hydrogen with natural gas in Ahmedabad, marking India's largest hydrogen-blending project. This initiative aimed to reduce emissions and promote cleaner energy.

India Natural Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Standard Cubic Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compressed Natural Gas, Piped Natural Gas, Liquified Petroleum Gas |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India natural gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India natural gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India natural gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The natural gas market in India reached 61.28 Billion Standard Cubic Meters in 2024.

The India natural gas market is projected to exhibit a CAGR of 3.62% during 2025-2033, reaching 86.63 Billion Standard Cubic Meters by 2033.

Key factors driving the India natural gas market include rising energy demand, a shift towards cleaner fuels, and government initiatives to expand gas pipeline infrastructure. Increased industrial usage, urban household adoption through city gas distribution, and efforts to reduce carbon emissions further support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)