India Natural Sweeteners Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Natural Sweeteners Market Size and Share:

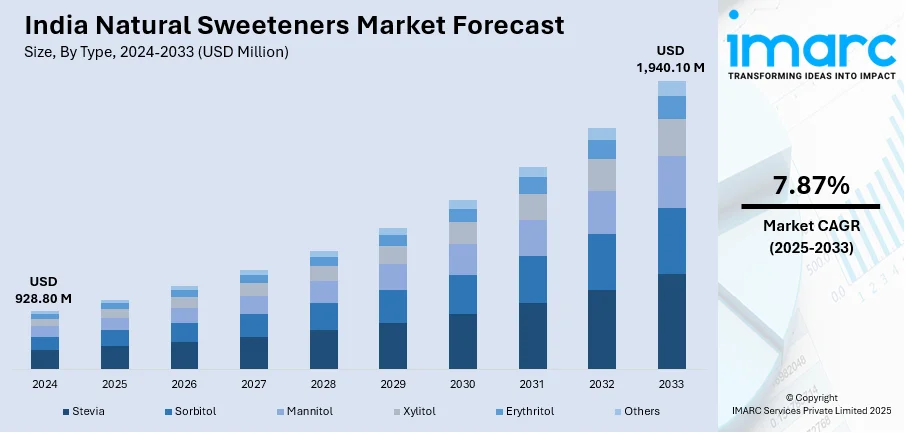

The India natural sweeteners market size reached USD 928.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,940.10 Million by 2033, exhibiting a growth rate (CAGR) of 7.87% during 2025-2033. The market is steadily expanding mainly because of rising health awareness, the demand for clean-label products, and government initiatives promoting sugar alternatives. Stevia, monk fruit, and jaggery are key segments, with growth driven by the food, beverage, and pharmaceutical industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 928.80 Million |

| Market Forecast in 2033 | USD 1,940.10 Million |

| Market Growth Rate (2025-2033) | 7.87% |

India Natural Sweeteners Market Trends:

Rising Consumer Preference for Plant-Based and Low-Calorie Sweeteners

The India natural sweeteners market is witnessing strong expansion, attributed to magnifying consumer demand for plant-based, low-calorie alternatives to refined sugar. Health-conscious consumers are actively seeking sweeteners derived from natural sources such as stevia, monk fruit, coconut sugar, and jaggery. The shift is largely influenced by rising awareness of lifestyle diseases, including diabetes and obesity, which have led to a preference for products with lower glycemic indexes. For instance, as per industry reports, 56.4% of the disease burden across India is attributed to unhealthy dietary habits. In line with this, around 70% of the population across urban areas of India are either overweight or obese. Food and beverage manufacturers are navigating this issue by integrating natural sweeteners into a broad range of products, encompassing dairy alternatives, baked goods, and health drinks. Additionally, the growing vegan and clean-label movement in India is further accelerating the product demand, as consumers prioritize minimally processed, chemical-free sweeteners. Regulatory support, including FSSAI guidelines promoting natural ingredients, is also shaping the market. With urbanization and increasing disposable incomes, the need for plant-based and low-calorie sweeteners is anticipated to strengthen further.

To get more information on this market, Request Sample

Expansion of Natural Sweeteners in Functional and Packaged Foods

The adoption of natural sweeteners in functional and packaged foods is expanding rapidly in India as consumers prioritize healthier ingredients in their daily diets. Food and beverage manufacturers are increasingly using honey, palm sugar, and agave syrup in packaged snacks, breakfast cereals, and energy bars. The functional food segment, particularly fortified drinks, herbal teas, and probiotic yogurts is integrating natural sweeteners to appeal to health-conscious consumers. The demand is further driven by the growing sports nutrition and dietary supplements industry, where artificial sweeteners are being replaced with plant-derived alternatives. For instance, as per IMARC Group, dietary supplements industry is anticipated to grow to INR 557.7 Billion by the year 2033. Clean-label product trends are prompting brands to highlight the absence of synthetic additives, reinforcing consumer trust. The emergence of e-commerce and modern retail is also playing a crucial role in expanding accessibility and availability of these products. As major brands innovate with new formulations, the market for natural sweeteners in packaged and functional foods is poised for continued growth.

India Natural Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Stevia

- Sorbitol

- Mannitol

- Xylitol

- Erythritol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes stevia, sorbitol, mannitol, xylitol, erythritol, and others.

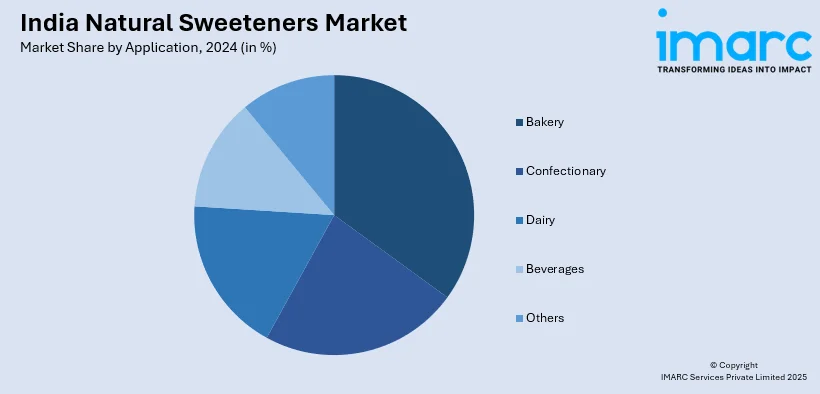

Application Insights:

- Bakery

- Confectionary

- Dairy

- Beverages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionary, dairy, beverages, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Natural Sweeteners Market News:

- In October 2024, 1-2-Taste announced that it became the only firm across India to attain FSSAI approval to purchase and sell Allulose, a low-calorie, natural sweetener. This achievement establishes the company at the forefront of catering to the intensifying need for healthier sugar substitutes.

- In February 2025, LUCOFAST announced its launch across Indian market, providing a hydration drink line that is crafted to aid immunity, energy, and recovery. It is integrated with five necessary electrolytes as well as natural sweeteners and flavors.

India Natural Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stevia, Sorbitol, Mannitol, Xylitol, Erythritol, Others |

| Applications Covered | Bakery, Confectionary, Dairy, Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India natural sweeteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India natural sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India natural sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India natural sweeteners market was valued at USD 928.80 Million in 2024.

The India natural sweeteners market is projected to exhibit a CAGR of 7.87% during 2025-2033, reaching a value of USD 1,940.10 Million by 2033.

The India natural sweeteners market is driven by increasing health consciousness, rising diabetic population, and growing demand for low-calorie and plant-based alternatives. Consumers are shifting toward natural options like stevia and monk fruit, supported by clean-label trends, government awareness campaigns, and expanding use in food, beverages, and pharmaceutical products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)