India Neem Coated Urea Market Size, Share, Trends and Forecast by Sales Channel, End User, and Region, 2025-2033

India Neem Coated Urea Market Overview:

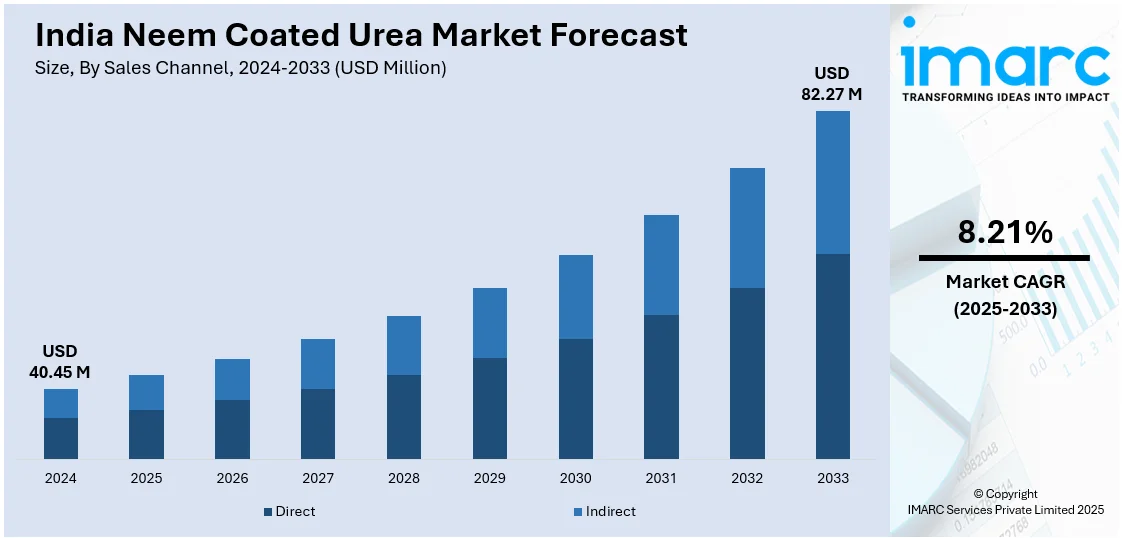

The India neem-coated urea market size reached USD 40.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 82.27 Million by 2033, exhibiting a growth rate (CAGR) of 8.21% during 2025-2033. The market is witnessing significant growth, driven by the growing adoption of sustainable agricultural practices and increasing government support and policy initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.45 Million |

| Market Forecast in 2033 | USD 82.27 Million |

| Market Growth Rate 2025-2033 | 8.21% |

India Neem Coated Urea Market Trends:

Growing Adoption of Sustainable Agricultural Practices

The market is significantly driven by awareness in sustainable and eco-friendly farming practices. With insight coming through that chemical fertilizers have their fair share of adverse environmental the overuse of urea contributing to soil deterioration, water pollution, and greenhouse gas emissions- farmers are now gradually seeking alternatives like neem-coated urea. For instance, in 2025, farmers used about 100 kg of urea per acre for paddy. With a government subsidy of Rs 1,958 per 45 kg bag, they pay only Rs 242, saving Rs 4,348 per acre. Neem-coated urea has a slow-release mechanism that ensures the gradual release of nitrogen into the soil, which not only improves the efficiency of nitrogen utilization but also reduces nitrogen losses to the environment. This contributes to less environmental pollution and healthier ecosystems. Additionally, neem-coated urea enhances soil fertility by improving microbial activity, making it an attractive option for farmers who prioritize soil health. As sustainability becomes a key focus within agricultural policies worldwide, government regulations and subsidies supporting the use of organic and slow-release fertilizers, including neem-coated urea, are contributing to the growing adoption of this product. The demand for sustainable agricultural inputs is expected to continue rising, propelling the growth of the neem-coated urea market as more farmers seek to balance productivity with environmental responsibility.

To get more information on this market, Request Sample

Increasing Government Support and Policy Initiatives

Government bodies are playing a pivotal role in driving the neem-coated urea market through various policy initiatives and support programs aimed at promoting the adoption of eco-friendly fertilizers. In India, for instance, the government has introduced schemes and subsidies to encourage the use of neem-coated urea, aligning with the country’s objective to reduce its environmental footprint while boosting agricultural productivity. Such policies include price caps on traditional urea, which incentivize farmers to switch to neem-coated variants. For instance, in March 2025, The Centre has supplied ample fertilizers for Telangana farmers, including 12.2 lakh metric tonnes of urea, 1.72 lakh metric tonnes of DAP, 0.95 lakh metric tonnes of MOP, and 8.57 lakh metric tonnes of NPKS. Additionally, neem-coated urea is recognized for its ability to improve soil health and reduce dependence on chemical fertilizers, which aligns with broader goals of sustainable agricultural practices and food security. As more governments adopt policies that promote environmental sustainability and organic farming, the demand for neem-coated urea is expected to increase. Furthermore, various international organizations and environmental agencies are advocating for sustainable agricultural solutions, which further encourage the use of neem-coated urea globally. With continued government backing and regulatory support, neem-coated urea is poised for significant growth, providing both ecological and economic benefits to the agriculture sector.

India Neem Coated Urea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on sales channel and end user.

Sales Channel Insights:

- Direct

- Indirect

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct and indirect.

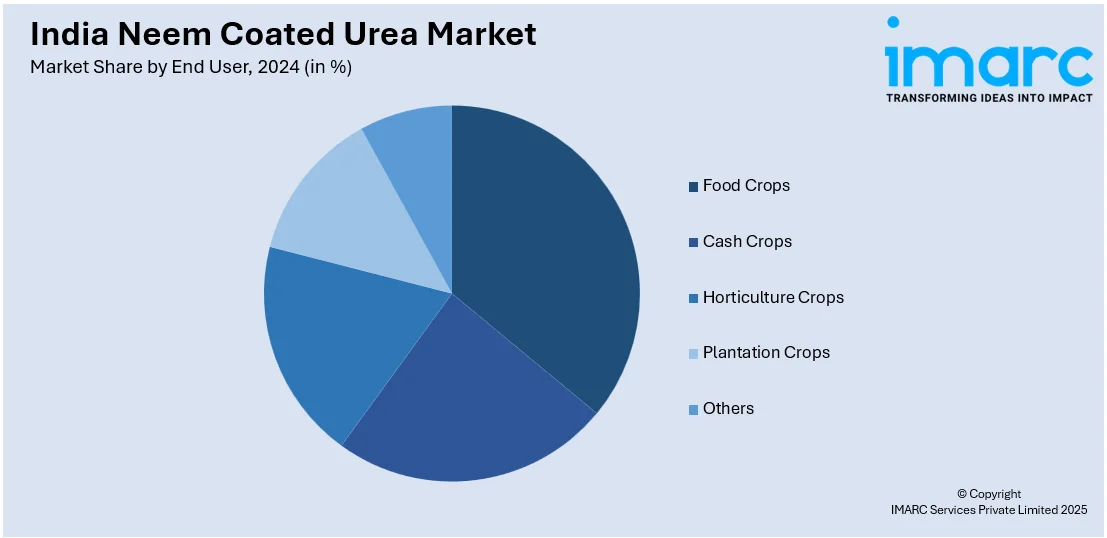

End User Insights:

- Food Crops

- Cash Crops

- Horticulture Crops

- Plantation Crops

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes Food Crops, Cash Crops, Horticulture Crops, Plantation Crops, and Others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major India al markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Neem Coated Urea Market News:

- In 2022–23, RFCL produced 8.40 LMT and dispatched 8.39 LMT of neem-coated prilled urea. In 2023–24, production rose to 11.16 LMT, with 11.09 LMT dispatched. Moving forward, RFCL aims for 100% capacity utilization, targeting 12.7 LMT annually to enhance agricultural productivity and meet growing demand.

India Neem Coated Urea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Direct, Indirect |

| End Users Covered | Food Crops, Cash Crops, Horticulture Crops, Plantation Crops, Others |

| Regions Covered | North India , South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India neem coated urea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India neem coated urea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India neem coated urea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The neem coated urea market in India was valued at USD 40.45 Million in 2024.

The India neem coated urea market is projected to exhibit a CAGR of 8.21% during 2025-2033, reaching a value of USD 82.27 Million by 2033.

The India neem coated urea market is driven by government mandates promoting its use, benefits in improving nitrogen use efficiency, and reducing urea wastage. Rising awareness among farmers, increasing agricultural productivity needs, and pest-repellent properties of neem coating further support demand, enhancing crop yields and promoting sustainable farming practices nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)