India Non-Dairy Creamer Market Size, Share, Trends and Forecast by Origin, Type, Form, Nature, Distribution Channel, End Use, and Region, 2025-2033

Market Overview:

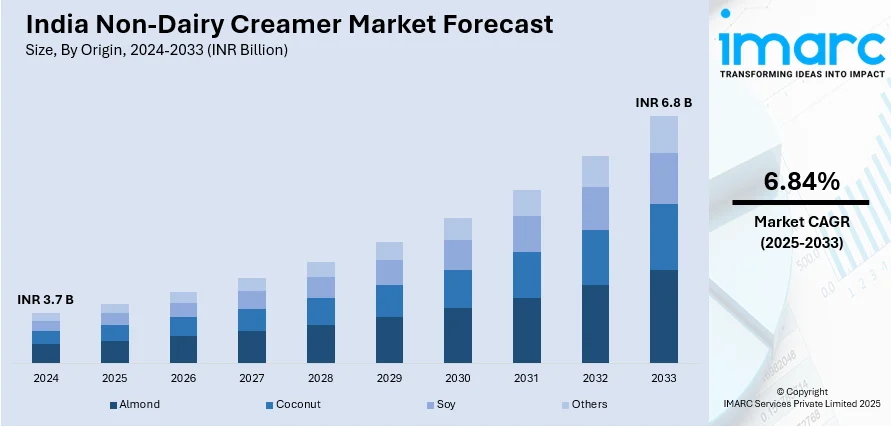

The India non-dairy creamer market size reached INR 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. The growing demand for healthy products, rising usage in preparing various dishes, and thriving food and beverage (F&B) industry represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 3.7 Billion |

| Market Forecast in 2033 | INR 6.8 Billion |

| Market Growth Rate (2025-2033) | 6.84% |

Non-dairy creamers comprise corn syrup, vegetable oil, sodium caseinate, dipotassium phosphate, mono-and diglycerides, sodium silicoaluminate, lecithin, sugars, and flavorings and they are available in liquid or powder form. These creamers also consist of whey and casein to achieve a white color. They are considered an alternative to other dairy products, such as double cream. They fulfill the processing demands for different culinary applications due to their various qualities, such as high water solubility, emulsification function, and foaming ability. They contribute to the smoothness and creamy bubbles of the milk tea while enhancing the bitterness of tea and the color of millet flour and sugar gruel. They are used in ice cream to increase its amount, keep it stable, prevent freezing and crystal formation, and provide a white and creamy texture. As they are utilized as an emulsifier to improve the structure and physical qualities of bakery goods while increasing their shelf life, the demand for non-dairy creamers is increasing in India.

To get more information of this market, Request Sample

India Non-Dairy Creamer Market Trends:

At present, there is a rise in the demand for healthy products among the masses due to growing concerns about the harmful impacts of the sedentary lifestyle. This, along with the thriving food and beverage (F&B) industry, represents one of the key factors supporting the growth of the market in India. Besides this, the increasing demand for non-dairy creamers, as they have numerous macro and micronutrients, is offering lucrative growth opportunities to industry investors. In addition, the growing utilization of non-dairy creamers in preparing various dishes, such as soup premixes, batter, bread, cake gravies, pasta, seasonings, and condiment sauces, is positively influencing the market in the country. In line with this, the rising number of hotels, restaurants, and cafes serving various cuisines is contributing to the growth of the market. Moreover, the wide availability of non-dairy creamers through online and offline distribution channels, coupled with the increasing online shopping activities in the country, is strengthening the growth of the market in the country. Apart from this, there is an increase in the adoption of veganism due to growing lifestyle ailments and the changing perception towards sustainability among individuals in India. This, along with the rising consumption of non-dairy creamers by lactose-intolerant patients, is propelling the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India non-dairy creamer market, along with forecasts at the regional level from 2025-2033. Our report has categorized the market based on origin, type, form, nature, distribution channel, and end use.

Origin Insights:

The report has provided a detailed breakup and analysis of the India non-dairy creamer market based on the origin. This includes almond, coconut, soy, and others. According to the report, almond represented the largest segment.

Type Insights:

A detailed breakup and analysis of the India non-dairy creamer market based on the type has also been provided in the report. This includes low fat NDC, medium fat NDC, and high fat NDC.

Form Insights:

A detailed breakup and analysis of the India non-dairy creamer market based on the form has also been provided in the report. This includes powdered and liquid. According to the report, powdered accounted for the largest market share.

Nature Insights:

A detailed breakup and analysis of the India non-dairy creamer market based on the nature has also been provided in the report. This includes organic and conventional. According to the report, conventional accounted for the largest market share.

Distribution Channel Insights:

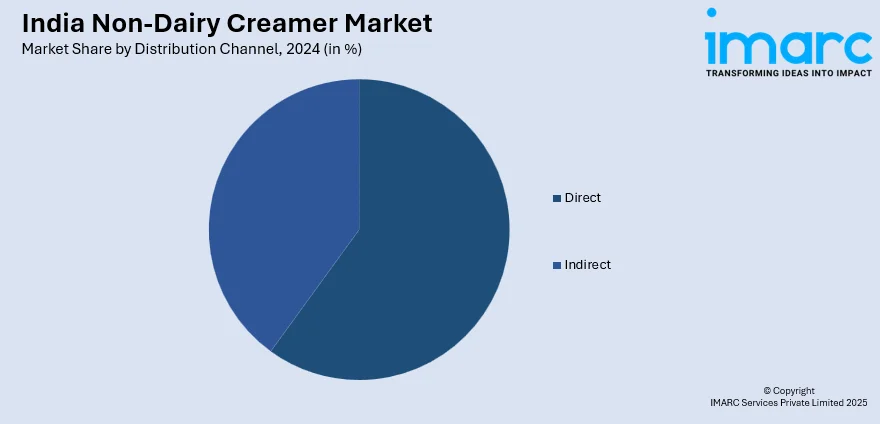

A detailed breakup and analysis of the India non-dairy creamer market based on the distribution channel has also been provided in the report. This includes direct and indirect (hypermarket/supermarkets, online stores, departmental stores and others). According to the report, direct accounted for the largest market share.

End Use Insights:

A detailed breakup and analysis of the India non-dairy creamer market based on the end use has also been provided in the report. This includes HoReCa/foodservices, food and beverage processing (food premixes, soups and sauces, beverage mixes, bakery products and ice creams, RTD beverages, infant food, and prepared and packaged food), and household/retail. According to the report, HoReCa/food service accounted for the largest market share.

Regional Insights:

The report has also provided a comprehensive analysis of all the major regional markets, which include the Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, and Others. According to the report, Maharashtra was the largest market for India non-dairy creamer. Some of the factors driving the Maharashtra non-dairy creamer market included the growing vegan population, various benefits of non-dairy creamers over dairy-based creamers, wide availability through online platforms, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India non-dairy creamer market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Amrut International, Drytech Processes (I) Pvt. Ltd., Insta Foods, Krishna Food India, Pruthvi's Foods Private Limited, Venkatesh Natural Extract Pvt. Ltd., Vinayak Ingredients (INDIA) Pvt. Ltd., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report. For the companies covered, the report provides business overview, services offered, business strategies, SWOT analysis, and major news and events.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR |

| Origins Covered | Almond, Coconut, Soy, Others |

| Types Covered | Low Fat NDC, Medium Fat NDC, High Fat NDC |

| Forms Covered | Powdered, Liquid |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered |

|

| End Uses Covered |

|

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, Others |

| Companies Covered | Amrut International, Drytech Processes (I) Pvt. Ltd., Insta Foods, Krishna Food India, Pruthvi's Foods Private Limited, Venkatesh Natural Extract Pvt. Ltd., Vinayak Ingredients (INDIA) Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non-dairy creamer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India non-dairy creamer market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non-dairy creamer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India non-dairy creamer market was valued at INR 3.7 Billion in 2024.

The India non-dairy creamer market is projected to exhibit a CAGR of 6.84% during 2025-2033, reaching a value of INR 6.8 Billion by 2033.

The India non-dairy creamer market is driven by growing lactose intolerance cases, rising vegan population, and increasing demand for convenient, shelf-stable products. Expanding coffee culture, urbanization, and busy lifestyles contribute to its popularity. Additionally, wider availability through e-commerce and retail outlets supports greater consumer access and market expansion.

Maharashtra currently dominates the India non-dairy creamer market, driven by growing health consciousness, rising demand for lactose-free and vegan alternatives, and the expanding café and instant beverage culture in urban areas like Mumbai and Pune. Increased retail availability and consumer preference for convenient, long-shelf-life products further boost market growth across the state.

Some of the major players in the India non-dairy creamer market include Amrut International, Drytech Processes (I) Pvt. Ltd., Insta Foods, Krishna Food India, Pruthvi's Foods Private Limited, Venkatesh Natural Extract Pvt. Ltd., Vinayak Ingredients (INDIA) Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)