India Non-Invasive Prenatal Testing Market Size, Share, Trends and Forecast by Gestation Period, Risk, Method, Technology, Product, Application, End Use, and Region, 2025-2033

India Non-Invasive Prenatal Testing Market Overview:

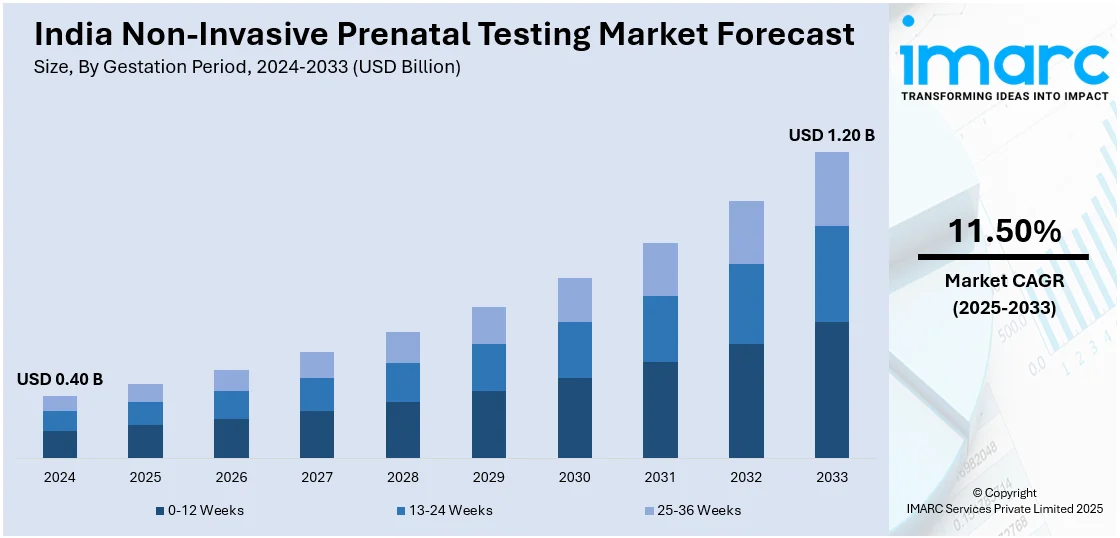

The India non-invasive prenatal testing market size reached USD 0.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.20 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is driven by rising maternal age, increasing awareness about genetic disorders, advancements in prenatal screening technology, and growing healthcare infrastructure. The demand is further fueled by reduced risks compared to invasive procedures, increasing disposable incomes, and government initiatives promoting maternal and fetal health.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.40 Billion |

| Market Forecast in 2033 | USD 1.20 Billion |

| Market Growth Rate 2025-2033 | 11.50% |

India Non-Invasive Prenatal Testing Market Trends:

Advancements in Prenatal Screening Technology

Technological innovations in next-generation sequencing (NGS), cell-free fetal DNA analysis, and AI-driven genetic screening have significantly improved NIPT accuracy, efficiency, and accessibility. Compared to traditional invasive procedures like amniocentesis and chorionic villus sampling (CVS), NIPT offers high sensitivity, early detection, and zero risk of miscarriage. Ongoing research in expanded NIPT panels—covering microdeletions, single-gene disorders, and fetal sex determination (where legally permitted)—is further enhancing the market scope. Additionally, reduced costs of genetic sequencing are making NIPT more affordable and accessible in both urban and semi-urban areas which is creating a positive India non-invasive prenatal testing market outlook. For instance, in April 2024, Strand Life Sciences, a division of Reliance Industries Ltd. and a prominent global supplier of genomic and bioinformatic services, unveiled its prenatal screening and diagnostics offerings featuring two innovative technologies: CNSeq (for detecting aneuploidies and copy number variations) and MaatriSeq (Non-Invasive Prenatal Screening). These advancements are designed to meet the unique requirements of the Indian community, providing unmatched efficiency, affordability, and precision.

To get more information on this market, Request Sample

Growing Healthcare Infrastructure and Market Expansion

India's expanding healthcare infrastructure, including specialized maternal-fetal medicine centers, genetic counseling services, and private diagnostic labs, is improving access to advanced prenatal care. Leading diagnostic providers such as MedGenome, Lilac Insights, and Apollo Diagnostics now offer NIPT services across metro cities and tier-2 towns. Collaborations between hospitals, genetic testing companies, and government health programs are increasing the availability of affordable prenatal screening options, driving India non-invasive prenatal testing market growth. For instance, in May 2024, Metropolis Healthcare Limited, India’s leading diagnostic service provider, made a meaningful advancement in prenatal care through its recent research, highlighting the significance of precise prenatal testing for expectant couples. The comprehensive three-year research, carried out from January 2021 to December 2023 with 140,528 expectant mothers, highlights the effectiveness of Pregascreen Reflex Testing and Non-invasive Prenatal Testing (NIPT) or Karyotyping in correctly identifying high-risk pregnancies. This is investing in research-driven prenatal care solutions, indicating the expansion of India’s diagnostic infrastructure for genetic testing. With insurance providers gradually covering genetic tests, NIPT adoption is expected to grow further, making it a standard prenatal care procedure for expectant mothers.

Increasing Disposable Incomes and Government Initiatives

As disposable incomes rise, middle-class families in India invest more in preventive healthcare, including advanced prenatal screening. According to industry reports, India's per capita disposable income was projected to be ₹2.14 lakh in 2023-24, up from the previously estimated ₹2.12 lakh. The push for better maternal healthcare under government programs like Ayushman Bharat is raising awareness about genetic testing and early fetal health diagnostics, fueling India non-invasive prenatal testing market share. Public-private partnerships and regulatory support are helping expand NIPT services to underserved regions, ensuring more women benefit from safe, non-invasive genetic screening. With the government's focus on reducing infant mortality and improving neonatal health outcomes, NIPT is gaining traction as a standardized prenatal screening tool in India.

India Non-Invasive Prenatal Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on gestation period, risk, method, technology, product, application, and end use.

Gestation Period Insights:

- 0-12 Weeks

- 13-24 Weeks

- 25-36 Weeks

The report has provided a detailed breakup and analysis of the market based on the gestation period. This includes 0-12 weeks, 13-24 weeks, and 25-36 weeks.

Risk Insights:

- High and Average Risk

- Low Risk

A detailed breakup and analysis of the market based on the risk have also been provided in the report. This includes high and average risk and low risk.

Method Insights:

- Ultrasound Detection

- Biochemical Screening Tests

- Cell-Free DNA In Maternal Plasma Tests

A detailed breakup and analysis of the market based on the method have also been provided in the report. This includes ultrasound detection, biochemical screening tests, and cell-free DNA in maternal plasma tests.

Technology Insights:

- NGS

- Array Technology

- PCR

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes NGS, array technology, PCR, and others.

Product Insights:

- Consumables and Reagents

- Instruments

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes consumables and reagents, and instruments.

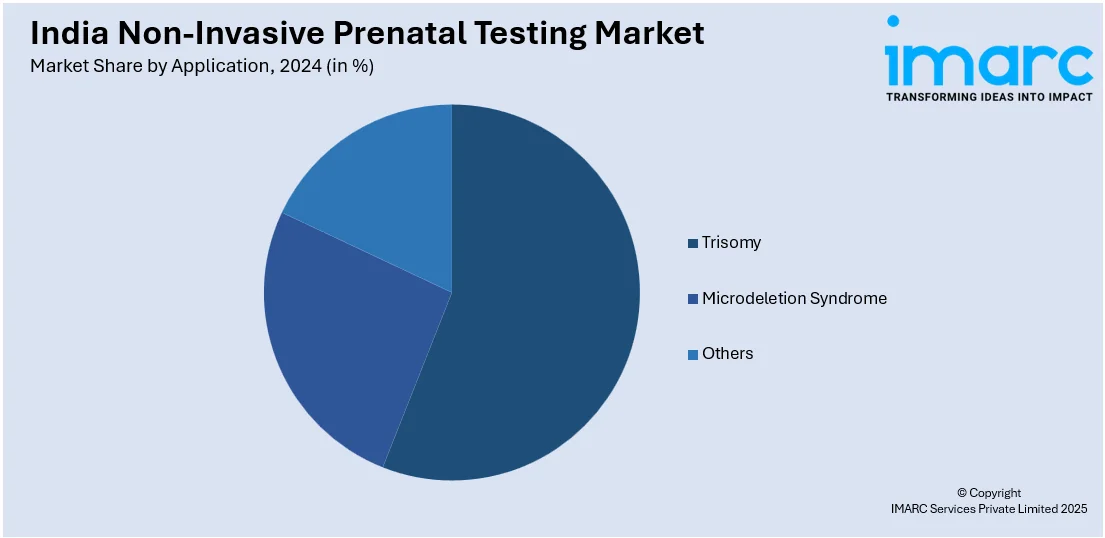

Application Insights:

- Trisomy

- Microdeletion Syndrome

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trisomy, microdeletion syndrome, and others.

End Use Insights:

- Hospitals and Clinics

- Diagnostic Laboratories

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals and clinics and diagnostic laboratories.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Non-Invasive Prenatal Testing Market News:

- In May 2024, Metropolis Healthcare Limited, an India's top diagnostic service provider, has committed to equipping expectant couples with vital information and awareness regarding the health of their unborn child as part of its continuous effort to increase awareness about women's and children's health issues. During a thorough three-year study (January 2021 to December 2023) that involved 140,528 expectant mothers, Metropolis published critical data about prenatal care using Karyotyping or Non-invasive Prenatal Testing (NIPT) in combination with PregascreenTM Reflex Testing.

India Non-Invasive Prenatal Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gestation Periods Covered | 0-12 Weeks, 13-24 Weeks, 25-36 Weeks |

| Risks Covered | High and Average Risk, Low Risk |

| Methods Covered | Ultrasound Detection, Biochemical Screening Tests, Cell-Free DNA in Maternal Plasma Tests |

| Technologies Covered | NGS, Array Technology, PCR, Others |

| Products Covered | Consumables And Reagents, Instruments |

| Applications Covered | Trisomy, Microdeletion Syndrome, Others |

| End Uses Covered | Hospitals and Clinics, Diagnostic Laboratories |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non-invasive prenatal testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India non-invasive prenatal testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non-invasive prenatal testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The non-invasive prenatal testing market in India was valued at USD 0.40 Billion in 2024.

The India non-invasive prenatal testing market is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a value of USD 1.20 Billion by 2033.

Rising awareness about prenatal health, increasing maternal age, and demand for safer diagnostics are key factors propelling the India non-invasive prenatal testing market. This growth is further boosted by reducing costs of genomic technologies, expanding healthcare infrastructure, and greater availability of NIPT in urban clinics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)