India Non Invasive Surgery Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Non Invasive Surgery Market Size and Share:

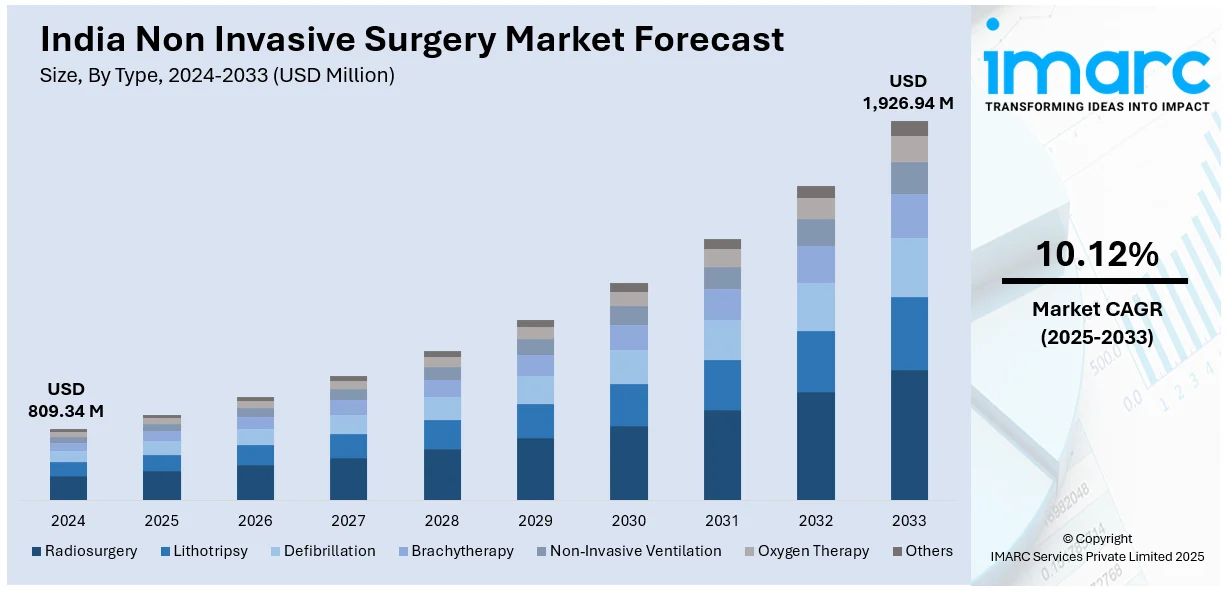

The India non invasive surgery market size reached USD 809.34 Million in 2024 Looking forward, IMARC Group expects the market to reach USD 1,926.94 Million by 2033, exhibiting a growth rate (CAGR) of 10.12% during 2025-2033. The market is driven by rising chronic disease prevalence, increasing geriatric population, ongoing technological advancements, growing medical tourism, higher healthcare expenditures, expanding insurance coverage, and a shift toward minimally invasive (MI) procedures due to faster recovery times and reduced hospital stays.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 809.34 Million |

| Market Forecast in 2033 | USD 1,926.94 Million |

| Market Growth Rate (2025-2033) | 10.12% |

India Non Invasive Surgery Market Trends:

Rising Adoption of Robotic and AI-Assisted Non-Invasive Procedures

The India non-invasive surgery market demonstrates the quick expansion of robotic and AI-assisted procedures because of developments in medical technology and patient demand for precise surgical interventions. With artificial intelligence (AI) diagnostic tools and robotic surgery assistance patients experience better outcomes while decreasing errors and achieving higher accuracy. Moreover, hospital facilities together with specialized clinics allocate substantial financial resources to robotic surgical equipment that serves cardiac, orthopedic, and neurosurgical applications. For instance, in December 2024, Pune's Noble Hospital introduced SSI Mantra, India's first CDSCO-certified robotic telesurgery system, enhancing precision, reducing recovery times, and improving patient outcomes across specialties. Additionally, the drop in technology prices and public programs that endorse digital healthcare evolution drives institutions to adopt these practices more frequently. Also, the application of AI tools for imaging in addition to real-time analytics enables more efficient preoperative planning and post-surgical monitoring which speeds up patient recovery and decreases hospital stay duration. As a result, the continuous advancements of India as a global medical tourism hub driven by AI and robotic integration in non-invasive surgeries provide advanced procedures at lower costs to both domestic and international patients, which is boosting the India non invasive surgery market share.

To get more information on this market, Request Sample

Growth in Demand for Ultrasound and Laser-Based Treatments

Non-invasive surgeries utilizing ultrasound and laser-based technologies are driving the India non invasive surgery market growth, due to their effectiveness in treating various medical conditions with minimal recovery time. In line with this, high-intensity focused ultrasound (HIFU) serves as a primary tumor removal method while treating fibroids in the uterus and prostate glands alongside extensive usage in dermatology, ophthalmology, and cosmetic medicine procedures that depend on laser technology. For example, in February 2025, Vattikuti Foundation and AIIMS Delhi launched an MR-Guided HIFU system for non-invasive Parkinson's treatment, improving precision, reducing recovery times, and enhancing patient outcomes. Concurrently, the market demand for these procedures continues to grow because patients benefit from non-surgical procedures that reduce complication rates and require less time between treatments. These technologies present affordable solutions that private clinics and multi-specialty hospitals use to expand their services to the increasing middle-class population. Furthermore, expanding government healthcare infrastructure enhancement efforts and increased public understanding of non-invasive medical procedures are significantly driving the adoption of non invasive surgery treatments. Apart from this, the market shares for non-invasive surgeries in India are expanding substantially in urban and semi-urban territories through the development of portable ultrasound devices and precision laser treatment systems, thereby enhancing the India non invasive surgery market outlook.

India Non Invasive Surgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application and end user.

Type Insights:

- Radiosurgery

- Lithotripsy

- Defibrillation

- Brachytherapy

- Non-Invasive Ventilation

- Oxygen Therapy

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes radiosurgery, lithotripsy, defibrillation, brachytherapy, non-invasive ventilation, oxygen therapy, and others.

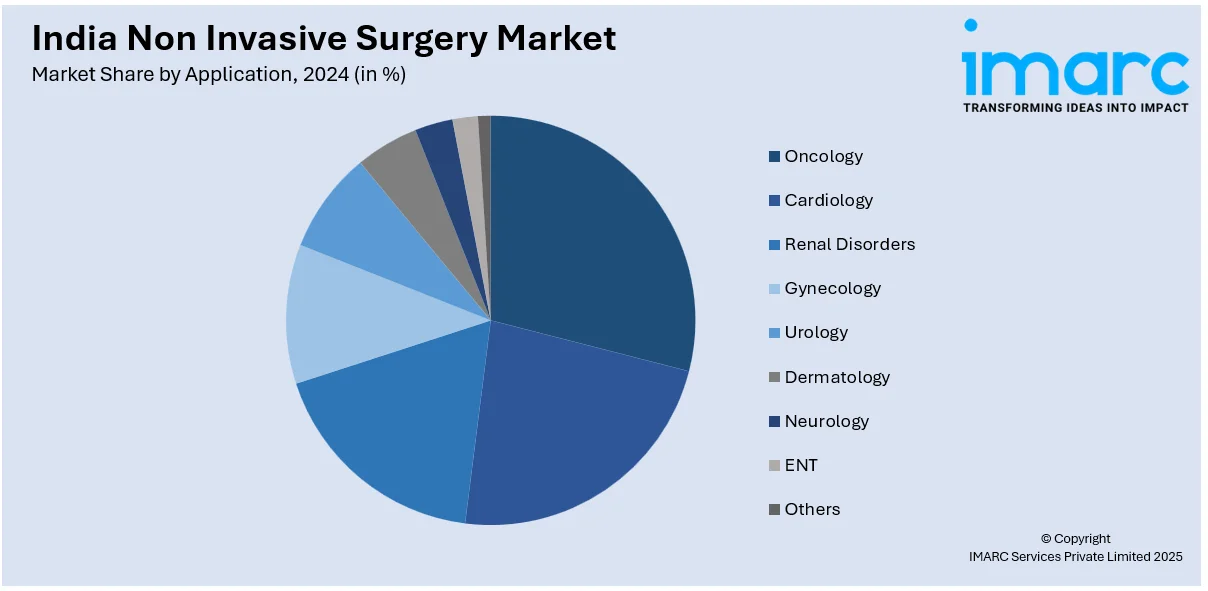

Application Insights:

- Oncology

- Cardiology

- Renal Disorders

- Gynecology

- Urology

- Dermatology

- Neurology

- ENT

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oncology, cardiology, renal disorders, gynecology, urology, dermatology, neurology, ENT, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, ambulatory surgical centers, specialty clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Non Invasive Surgery Market News:

- In March 2025, Zydus Lifesciences announced plans to acquire an 85.6% stake in France's Amplitude Surgical for €256.8 million. This strategic move aims to enhance Zydus's presence in the global medical devices market, particularly in surgical technologies for lower-limb orthopedics.

- In November 2024, the Indian government introduced a ₹500 crore scheme to bolster the medical device industry. The initiative focuses on manufacturing, skill development, clinical studies, infrastructure, and industry promotion, aiming to strengthen India's self-reliance in medical devices.

India Non Invasive Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Radiosurgery, Lithotripsy, Defibrillation, Brachytherapy, Non-Invasive Ventilation, Oxygen Therapy, Others |

| Applications Covered | Oncology, Cardiology, Renal Disorders, Gynecology, Urology, Dermatology, Neurology, ENT, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Specialty Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non invasive surgery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India non invasive surgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non invasive surgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India non invasive surgery market was valued at USD 809.34 Million in 2024.

The India non invasive surgery market is projected to exhibit a CAGR of 10.12% during 2025-2033, reaching a value of USD 1,926.94 Million by 2033.

The India non-invasive surgery market is driven by increasing demand for safer, quicker recovery procedures, growing healthcare awareness, and advancements in medical technology. Rising chronic disease prevalence, expanding medical tourism, and improved access to high-quality surgical care also contribute to the market's rapid growth across urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)