India NoSQL Market Size, Share, Trends and Forecast by Database Type, Vertical, Application, and Region, 2025-2033

India NoSQL Market Overview:

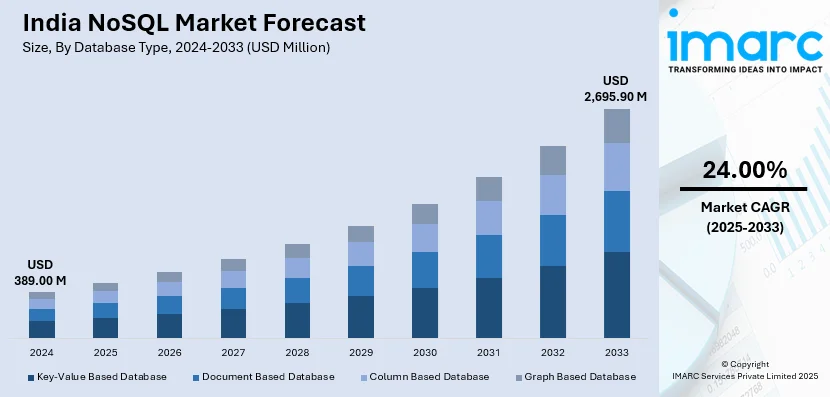

The India NoSQL market size reached USD 389.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,695.90 Million by 2033, exhibiting a growth rate (CAGR) of 24.00% during 2025-2033. The market is growing with increasing volumes of data, real-time analysis demand, and growing adoption of the cloud. Enterprises are shifting from legacy databases to scalable and adaptable NoSQL databases to manage unstructured data. The advent of AI, IoT, and e-commerce platforms further accelerates the growth of NoSQL in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 389.00 Million |

| Market Forecast in 2033 | USD 2,695.90 Million |

| Market Growth Rate 2025-2033 | 24.00% |

India NoSQL Market Trends:

Increasing Adoption of NoSQL in Cloud-Based Applications

The increasing adoption of cloud infrastructure is a major trend in the India NoSQL market. Companies are transitioning from on-premises databases to cloud-native NoSQL solutions for increased scalability, cost savings, and agility. As businesses extend their digital footprint, cloud-hosted NoSQL databases offer high availability, auto-scaling, and distributed storage support. Public cloud vendors like AWS, Google Cloud, and Microsoft Azure are adopting NoSQL products to cater to big data processing and real-time analytics. With companies emphasizing adaptive data storage, NoSQL is emerging as the go-to option for applications related to e-commerce, fintech, and AI-based platforms. The adoption of managed NoSQL databases is also increasing as businesses aim to lower infrastructure complexity and enhance performance in cloud settings. For instance, in March 2024, ZEE5 migrated from DynamoDB to ScyllaDB Cloud to enhance scalability, performance, and cost efficiency in its growing streaming business. This transition enables faster data processing and accommodates increasing traffic, with expectations to triple database demands. The cloud-agnostic infrastructure ensures seamless content streaming, improving user experience. ScyllaDB’s NoSQL database, known for its low latency and high throughput, aligns with ZEE5’s expansion strategy.

To get more information on this market, Request Sample

Rising Adoption in AI and Machine Learning Applications

The adoption of AI and machine learning (ML) solutions is fueling the NoSQL market in India, as these technologies require databases that handle large, complex, and unstructured datasets efficiently. Unlike traditional relational databases, NoSQL databases offer flexible schema models, faster queries, and seamless horizontal scaling, making them ideal for AI-driven analytics, recommendation engines, and predictive modeling. The growth of natural language processing (NLP), image recognition, and generative AI models is driving demand for document-oriented and graph-based NoSQL databases. Indian tech startups and enterprises leveraging deep learning and big data analytics are increasingly turning to NoSQL solutions to enhance real-time decision-making and customer insights. For instance, in March 2024, Aerospike, a real-time NoSQL database company, drove India's UPI growth by handling high transaction volumes efficiently. The company expanded its offerings to include JSON document models, SQL interfaces, and graph databases to address identity resolution complexities. Aerospike’s scalability and AI-driven capabilities support fintech, e-commerce, and cybersecurity applications. With a focus on sustainability, the company is integrating vector databases for AI/ML applications and optimizing energy efficiency.

India NoSQL Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on database type, vertical, and application.

Database Type Insights:

- Key-Value Based Database

- Document Based Database

- Column Based Database

- Graph Based Database

The report has provided a detailed breakup and analysis of the market based on the database type. This includes key-value based database, document based database, column based database, and graph based database.

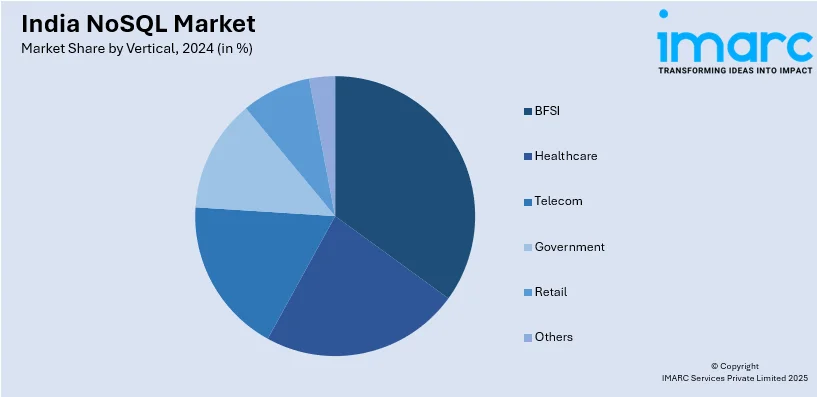

Vertical Insights:

- BFSI

- Healthcare

- Telecom

- Government

- Retail

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, healthcare, telecom, government, retail, and others.

Application Insights:

- Data Storage

- Metadata Store

- Cache Memory

- Distributed Data Depository

- e-Commerce

- Mobile Apps

- Web Applications

- Data Analytics

- Social Networking

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data storage, metadata store, cache memory, distributed data depository, e-commerce, mobile apps, web applications, data analytics, social networking, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India NoSQL Market News:

- In April 2024, MongoDB, a leading NoSQL database company valued at approximately USD 30 Billion, announced that it is expanding its presence in India, recognizing the country's potential as a significant growth engine. The company serves prominent clients like Tata Digital, Tata AIG, Canara HSBC Life Insurance, Zomato, Devnagri, Ambee, Inovaare, and Observe.AI. To support its expansion, MongoDB has established partnerships with major cloud providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- In February 2025, Aerospike released version 8.0 of its distributed multi-modal database, introducing support for real-time ACID transactions. This upgrade enhances online transaction processing (OLTP) for industries like banking, healthcare, and e-commerce. It balances consistency and availability, allowing developers to choose between high-availability (AP) and strong-consistency (CP) modes. The update simplifies multi-record transactions, reducing complexity for developers. Despite added overhead, it maintains efficiency for large-scale applications, reinforcing Aerospike’s role in high-performance NoSQL solutions.

- In November 2024, Microsoft announced the general availability of Fabric API for GraphQL, enhancing data access with Azure SQL and Fabric SQL database support. Key features include saved credential authentication, CI/CD integration, detailed monitoring tools, and deployment pipelines. The update simplifies GraphQL endpoint creation and improves security by reducing exposure to sensitive credentials. Future updates will expand support for NoSQL databases. Developers can integrate APIs with GitHub and Azure DevOps for better version control and deployment automation.

India NoSQL Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Database Types Covered | Key-Value Based Database, Document Based Database, Column Based Database, Graph Based Database |

| Verticals Covered | BFSI, Healthcare, Telecom, Government, Retail, Others |

| Applications Covered | Data Storage, Metadata Store, Cache Memory, Distributed Data Depository, E-Commerce, Mobile Apps, Web Applications, Data Analytics, Social Networking, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India NoSQL market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India NoSQL market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India NoSQL industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India NoSQL market size reached USD 389.00 Million in 2024.

The India NoSQL market is expected to reach USD 2,695.90 Million by 2033, exhibiting a CAGR of 24.00% during 2025-2033.

Market growth is driven by the increasing adoption of big data analytics, rising demand for scalable and flexible database solutions, growth in cloud-based services, and the expanding use of NoSQL databases in sectors like e-commerce, BFSI, and telecommunications for real-time data processing and unstructured data management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)