India Nuclear Power Equipment Market Size, Share, Trends and Forecast by Reactor Type, Equipment Type, and Region, 2025-2033

India Nuclear Power Equipment Market Size and Share:

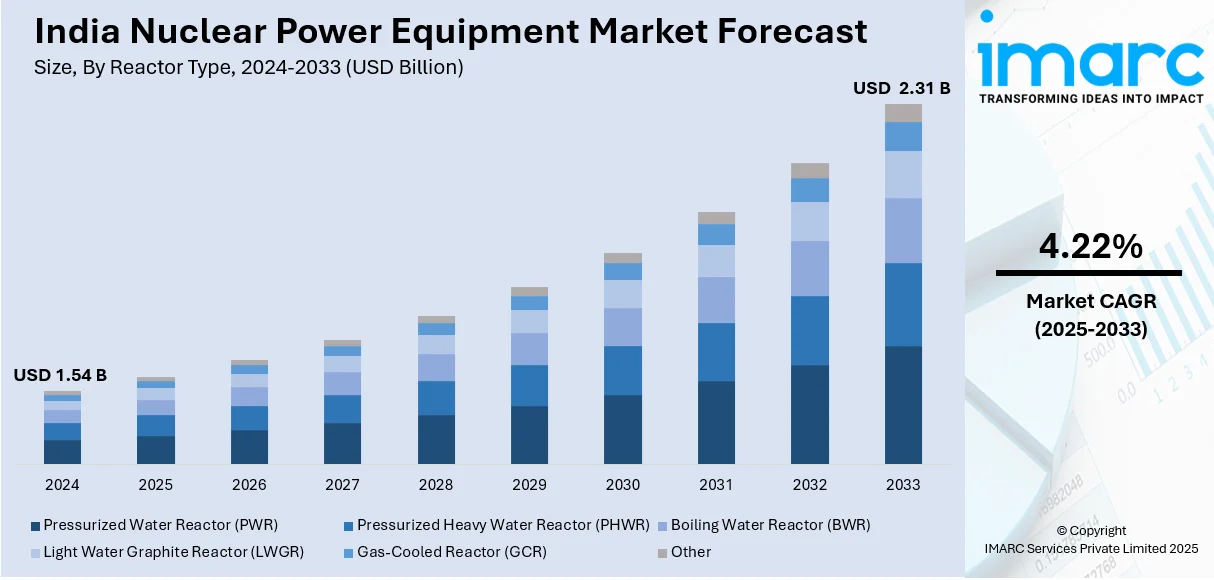

The India nuclear power equipment market size reached USD 1.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.31 Billion by 2033, exhibiting a growth rate (CAGR) of 4.22% during 2025-2033. The growing electricity utilization that requires dependable and consistent power generation and the rising advancements in nuclear reactors aimed at enhancing efficiency and maximizing performance are some of the factors impelling the India nuclear power equipment market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.54 Billion |

| Market Forecast in 2033 | USD 2.31 Billion |

| Market Growth Rate (2025-2033) | 4.22% |

India Nuclear Power Equipment Market Trends:

Rising Electricity Demand and Energy Security Concerns

In FY23, India’s power usage recorded a 9.5% increase, reaching 1,503.65 billion units (BU), according to information shared by the India Brand Equity Foundation (IBEF). India's rising electricity utilization, fueled by industrial growth and urban expansion, is driving a need for dependable and consistent power generation. Nuclear energy is becoming a crucial solution because of its significant capacity and minimal carbon emissions. The challenges of power generation from fossil fuels, including price fluctuations and environmental issues, are driving a transition to nuclear energy. Improving energy security by decreasing reliance on coal and foreign fossil fuels is a strategic focus, promoting investment in nuclear facilities. The creation of extensive energy projects necessitates effective nuclear reactors and supporting equipment. The need for grid stability and base-load power is driving the growth of nuclear capacity. Funding for small modular reactors (SMRs) and latest nuclear technologies are also influencing the market growth. The variety in the energy mix is guaranteeing lasting sustainability, highlighting the significance of nuclear power. The focus on continuous power supply is driving the need for sophisticated nuclear technology.

To get more information on this market, Request Sample

Increasing Investments in Research and Development (R&D) for Reactor Efficiency

Continuing progress in nuclear reactors aimed at enhancing efficiency and maximizing performance is supporting the market growth. Investments from the private and government sector in research and development (R&D) are advancing reactor designs, boosting energy production, and lengthening the operational lifespan of nuclear power facilities. For example, an important feature of the Union Budget 2025-26 is the introduction of a Nuclear Energy Mission, concentrating on research and development of Small Modular Reactors (SMRs). The government has set aside ₹20,000 crore for this program, with the goal of creating at least five domestically designed and functioning SMRs by 2033. In addition to this, advancements in heat-resistant substances, neutron moderation, and fuel enrichment are enhancing efficiency and lowering operational hazards. The creation of hybrid nuclear systems that work alongside renewables is improving grid stability. Investigating passive safety systems lessens dependence on active measures, decreases operational expenses, and enhances dependability. Improved cooling systems, such as air-cooled and liquid metal-cooled reactors, are facilitating implementation in areas facing water shortages. The creation of nuclear research institutes and technology parks is promoting partnership among academia, industry, and governmental agencies. New advancements in digital twin technology and predictive analytics are enhancing reactor maintenance and performance even more.

India Nuclear Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for2025-2033. Our report has categorized the market based on reactor type and equipment type.

Reactor Type Insights:

- Pressurized Water Reactor (PWR)

- Pressurized Heavy Water Reactor (PHWR)

- Boiling Water Reactor (BWR)

- Light Water Graphite Reactor (LWGR)

- Gas-Cooled Reactor (GCR)

- Other

The report has provided a detailed breakup and analysis of the market based on the reactor type. This includes pressurized water reactor (PWR), pressurized heavy water reactor (PHWR), boiling water reactor (BWR), light water graphite reactor (LWGR), gas-cooled reactor (GCR), and other.

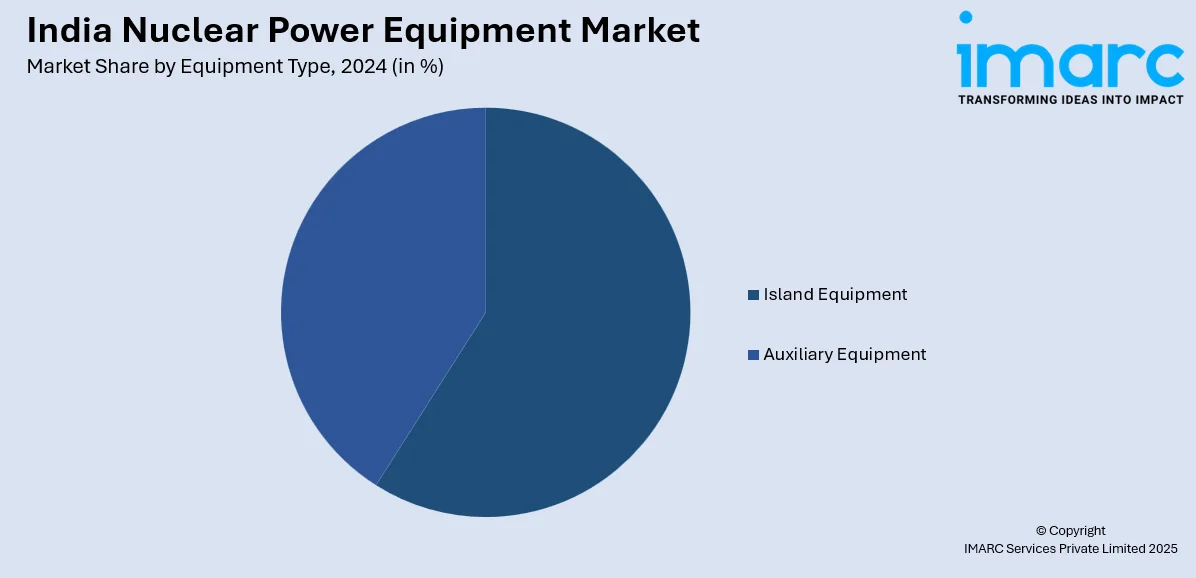

Equipment Type Insights:

- Island Equipment

- Auxiliary Equipment

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes island equipment and auxiliary equipment.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nuclear Power Equipment Market News:

- In February 2025, India and France signed a Declaration of Intent to collaborate on Small Modular Reactors (SMR) and Advanced Modular Reactors (AMR) to enhance energy security and shift towards a low-carbon economy. The agreement also includes cooperation on nuclear training, education, and the Jaitapur Nuclear Power Plant. The partnership aims to boost India's nuclear energy capacity, targeting 100 GW by 2047.

- In July 2024, the Atomic Energy Regulatory Board (AERB) granted permission for the "First Approach to Criticality" of India's 500 MWe Prototype Fast Breeder Reactor (PFBR) in Kalpakkam, Tamil Nadu. This milestone marked the initiation of fuel loading and Low Power Physics Experiments. The approval followed a thorough safety review and was a significant step toward operationalizing India's nuclear energy capabilities.

India Nuclear Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Reactor Types Covered | Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Boiling Water Reactor (BWR), Light Water Graphite Reactor (LWGR), Gas-Cooled Reactor (GCR), Other |

| Equipment Types Covered | Island Equipment, Auxiliary Equipment |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India nuclear power equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India nuclear power equipment market on the basis of reactor type?

- What is the breakup of the India nuclear power equipment market on the basis of equipment type?

- What is the breakup of the India nuclear power equipment market on the basis of region?

- What are the various stages in the value chain of the India nuclear power equipment market?

- What are the key driving factors and challenges in the India nuclear power equipment market?

- What is the structure of the India nuclear power equipment market and who are the key players?

- What is the degree of competition in the India nuclear power equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nuclear power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nuclear power equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nuclear power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)