India Nutraceuticals Market Size, Share, Trends and Forecast by Product, Indication, and Region, 2026-2034

India Nutraceuticals Market Summary:

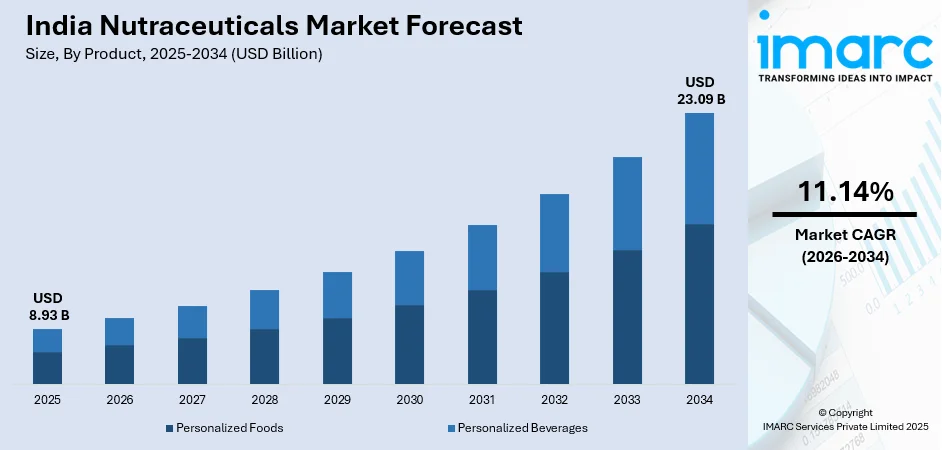

The India nutraceuticals market size was valued at USD 8.93 Billion in 2025 and is projected to reach USD 23.09 Billion by 2034, growing at a compound annual growth rate of 11.14% from 2026-2034.

The India nutraceuticals market is experiencing robust expansion, driven by heightened health consciousness among consumers and a fundamental shift towards preventive healthcare approaches. Rising demand for functional food items, dietary supplements, and personalized nutrition products is reshaping the wellness landscape. Traditional Ayurvedic formulations, combined with modern nutritional science, are fueling product innovations and broader consumer adoption across urban and rural demographics.

Key Takeaways and Insights:

- By Product: Personalized foods dominate the market with a share of 63% in 2025, driven by growing consumer preference for nutrition aligned with individual health objectives, dietary requirements, and lifestyle choices. Fortified cereals, protein-enriched snacks, and functional dairy products with added vitamins and probiotics are gaining widespread acceptance among health-conscious consumers.

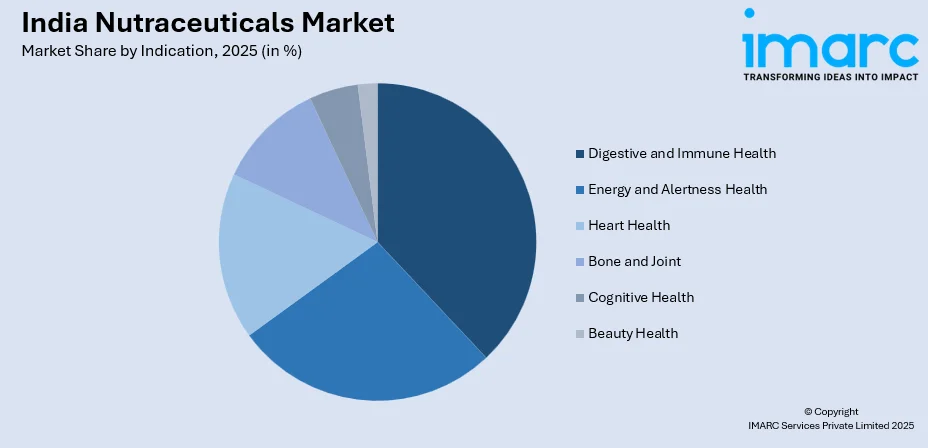

- By Indication: Digestive and immune health leads the market with a share of 38% in 2025, reflecting heightened awareness about gut microbiome's impact on overall wellness. Rising incidence of digestive disorders and focus on immunity-boosting solutions are propelling demand for probiotics, prebiotics, and herbal formulations that support gastrointestinal health and systemic immune function.

- By Region: North India represents the largest region with 35% share in 2025, attributed to high population density, increasing access to health products, strong cultural acceptance of traditional therapeutic systems, and concentration of metropolitan areas with health-conscious urban consumers driving sustained demand for nutraceutical products.

- Key Players: Key players drive the India nutraceuticals market by expanding product portfolios, investing in research and development (R&D) activities, and strengthening distribution networks. Their focus on combining traditional Ayurvedic ingredients with modern nutritional science, along with strategic partnerships and digital-first approaches, accelerates adoption and ensures product availability across diverse consumer segments nationwide.

To get more information on this market Request Sample

The India nutraceuticals market is gaining significant momentum, as consumer priorities shift towards preventive healthcare and holistic wellness solutions. Growing disposable incomes and expanding middle-class aspirations are enabling greater investment in health and well-being products across the country. The rising prevalence of lifestyle diseases has created substantial opportunities for nutraceutical innovation targeting diabetes management, cardiovascular health, and weight management. As of March 2025, in India, the impact of non-communicable diseases (NCDs) exceeded that of infectious diseases. Approximately 5.8 Million Indians lose their lives to NCDs annually. Around one in four Indians is at risk of dying from an NCD before turning 70, driving increased consumer interest in preventive nutritional interventions. Traditional Ayurvedic and herbal formulations are being modernized through scientific validation and innovative delivery formats, including gummies, effervescent tablets, and ready-to-drink (RTD) formats.

India Nutraceuticals Market Trends:

Rising Demand for Plant-Based and Clean-Label Products

Indian consumers are increasingly gravitating towards plant-based nutraceuticals that align with traditional dietary preferences and environmental consciousness. Clean-label products featuring recognizable ingredients without artificial additives are gaining significant traction among health-aware demographics. The integration of indigenous botanicals, such as ashwagandha, turmeric, and moringa, into modern supplement formulations reflects evolving consumer expectations for natural wellness solutions. This trend is further amplified by growing vegetarian and vegan populations seeking sustainable nutrition alternatives that deliver targeted health benefits. Among all the nations globally, India had the largest proportion of vegans at 9% of its population in 2025.

Digital Transformation and E-Commerce Expansion

The proliferation of digital platforms is reshaping nutraceutical distribution and consumer engagement across India. E-commerce channels are enabling access to diverse product portfolios previously unavailable in conventional stores, particularly in semi-urban and rural areas. As per IMARC Group, the India e-commerce market size was valued at USD 129.72 Billion in 2025. Direct-to-consumer (D2C) brands are leveraging social media marketing, influencer partnerships, and personalized recommendation algorithms to connect with younger demographics. Mobile applications and subscription-based wellness services are creating new consumption patterns while enabling brands to gather valuable consumer insights for product development and targeted marketing initiatives.

Personalized Nutrition and Functional Food Innovation

Personalized nutrition solutions are emerging as a transformative force within the India nutraceuticals market growth trajectory. Consumers are seeking products tailored to individual health profiles, genetic predispositions, and specific wellness goals. Advancements in nutritional science are enabling development of targeted formulations addressing diverse needs, including cognitive enhancement, beauty-from-within solutions, and sports performance optimization. The convergence of artificial intelligence (AI) with biotechnology is facilitating creation of customized supplement regimens based on individual biomarkers and lifestyle factors.

Market Outlook 2026-2034:

The India nutraceuticals market is poised for sustained expansion, as preventive healthcare gains prominence across consumer segments. Favorable regulatory developments under the Food Safety and Standards Authority of India (FSSAI) framework are creating a conducive environment for product innovations and market entry. Government initiatives promoting indigenous wellness systems and supporting research infrastructure are strengthening the foundation for industry growth. The market generated a revenue of USD 8.93 Billion in 2025 and is projected to reach a revenue of USD 23.09 Billion by 2034, growing at a compound annual growth rate of 11.14% from 2026-2034. Strategic investments by domestic and international players in manufacturing capabilities, distribution networks, and research facilities are accelerating market maturation.

India Nutraceuticals Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Personalized Foods |

63% |

|

Indication |

Digestive and Immune Health |

38% |

|

Region |

North India |

35% |

Product Insights:

- Personalized Foods

- Bakery Products

- Confectionery

- Dairy Products

- Oil and Fats

- Snack Bars

- Others

- Personalized Beverages

- Chocolate Based FP Drinks

- Bottled Water

- Concentrates

- Energy Drinks

- Fruit Vegetable Juices

- RTD Tea

- Sports Drinks

- Others

Personalized foods dominate with a market share of 63% of the total India nutraceuticals market in 2025.

The personalized foods segment is experiencing substantial growth, as consumers increasingly seek nutrition specifically aligned with individual health objectives, allergies, and lifestyle requirements. Foods fortified with vitamins, minerals, probiotics, and bioactive compounds are transforming daily dietary choices among health-conscious populations. According to report findings released by Wonderful Pistachios in 2024, a majority of urban Indians (58%) prioritized nutritional benefits over taste in their food purchasing choices, surpassing the global average of 52%. This demonstrates significant shift towards health-oriented food consumption.

Gluten-free, lactose-free, and low-carbohydrate options are witnessing particularly strong demand within bakery, confectionery, and dairy categories. Fortified cereals, protein-enriched snacks, and functional dairy products are becoming integral components of Indian household nutrition. The segment benefits from the growing awareness about preventive healthcare and recognition of food's therapeutic potential beyond basic sustenance. The integration of traditional Indian superfoods with modern food processing technologies enables delivery of targeted health benefits through familiar and convenient formats appealing to diverse consumer preferences across age groups.

Indication Insights:

Access the comprehensive market breakdown Request Sample

- Digestive and Immune Health

- Energy and Alertness Health

- Heart Health

- Bone and Joint

- Cognitive Health

- Beauty Health

Digestive and immune health leads with a share of 38% of the total India nutraceuticals market in 2025.

Digestive and immune health dominates the market, driven by increasing awareness about gut microbiome's critical role in overall wellness. Rising incidence of digestive disorders, including irritable bowel syndrome, acid reflux, and inflammatory conditions, is prompting consumers towards preventive solutions. The India probiotics market reached USD 2.2 Billion in 2024 and is expected to grow significantly, reflecting substantial consumer interest in gut health products. Multi-strain probiotic formulations, synbiotics combining probiotics with prebiotics, and traditional fermented foods in modern formats are gaining widespread acceptance.

Immune health products have witnessed accelerated demand in India, as consumers prioritize preventive healthcare and systemic wellness. Formulations containing vitamins, minerals, herbal extracts, and immunomodulatory compounds are addressing growing concerns about disease prevention and health maintenance. Traditional Ayurvedic ingredients, such as giloy, tulsi, and neem, are being incorporated into modern supplement formats, combining ancient wisdom with contemporary delivery mechanisms to address evolving consumer expectations for holistic immune support.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 35% share of the total India nutraceuticals market in 2025.

North India leads the nutraceuticals market owing to heightened health consciousness, greater focus on preventive care, and escalating prevalence of lifestyle diseases among its large population base. Delhi-NCR, Chandigarh, and Punjab drive regional demand with health-conscious urban consumers and growing organic farming ecosystem. As per the United Nations Population Division, Urban population constituted 36.87% of India's total population in 2024, with northern metropolitan areas demonstrating particularly strong adoption of wellness products and supplements.

The region benefits from strong cultural acceptance of traditional therapeutic systems, including Ayurveda and natural remedies deeply rooted in local heritage. High population density, coupled with increasing disposable incomes, enables greater consumer spending on health and wellness products. The presence of leading nutraceutical manufacturers, research institutes, and distribution hubs further strengthens North India’s market leadership. Additionally, strong pharmacy networks and rising penetration of e-commerce platforms enhance product availability and consumer reach across both urban and semi-urban areas.

Market Dynamics:

Growth Drivers:

Why is the India Nutraceuticals Market Growing?

Rising Health Consciousness and Shift Towards Preventive Healthcare

Indian consumers are increasingly prioritizing preventive healthcare over reactive treatment approaches, fundamentally transforming wellness consumption patterns across the country. This paradigm shift is driven by growing awareness about the connection between nutrition and disease prevention, coupled with recognition that lifestyle modifications can significantly reduce health risks. Urbanization and associated sedentary lifestyles have amplified concerns about chronic conditions, prompting proactive adoption of dietary supplements and functional foods. According to the 2023 study by the Indian Council of Medical Research – India Diabetes (ICMR INDIAB), the number of people with diabetes was 10.1 Crore. Social media platforms and digital health influencers are accelerating dissemination of wellness information, creating informed consumer bases seeking evidence-based nutritional solutions. The aging population is particularly receptive to nutraceuticals addressing joint health, cognitive function, and cardiovascular wellness. Traditional medicine systems, including Ayurveda, provide cultural resonance for natural health solutions, facilitating acceptance of herbal supplements among diverse demographics. Educational initiatives by regulatory bodies and industry associations are improving understanding of nutraceutical benefits. Rising healthcare costs are motivating consumers towards preventive measures that potentially reduce future medical expenditures.

Growing Disposable Incomes and Expanding Middle Class

Economic development and rising household incomes are enabling broader consumer access to premium wellness products previously considered discretionary purchases. The expanding middle class is demonstrating increased willingness to invest in health optimization and quality-of-life improvements through nutritional supplementation. Urban professionals are allocating greater budget shares towards fitness, wellness, and self-care categories, including nutraceuticals and functional foods. Premiumization trends are evident as consumers trade up from basic products to specialized formulations offering targeted health benefits. The proliferation of modern retail formats, including hypermarkets, specialty health stores, and pharmacy chains, is improving product visibility and availability. Corporate wellness programs are introducing employees to nutraceutical benefits, creating sustained demand patterns. As per IMARC Group, the India corporate wellness market size was valued at USD 2.5 Billion in 2024.

Regulatory Support and Government Initiatives

An enabling environment created through supportive regulatory policies and procedures put forward by FSSAI is contributing to fostering development and innovations in the nutraceutical sector. Comprehensive regulations for health supplements, functional foods, and nutraceuticals act as a safeguard for manufacturers as well as consumers. Government programs promoting indigenous wellness systems, including Ayurveda, are generating renewed interest in traditional formulations and herbal supplements. National missions supporting medicinal plant cultivation and herbal product development are strengthening raw material supply chains. Foreign direct investment (FDI) policies permitting full ownership in nutraceutical manufacturing are attracting international companies and technologies. Research infrastructure investments through government-academic partnerships are advancing scientific validation of traditional ingredients. Export promotion initiatives are positioning India as a global supplier of herbal extracts and nutraceutical ingredients. Tax incentives and manufacturing support schemes are encouraging domestic production capacity expansion across the pharmaceutical and wellness sectors.

Market Restraints:

What Challenges the India Nutraceuticals Market is Facing?

Quality Control and Standardization Challenges

Ensuring consistent product quality and standardization across the diverse nutraceutical product landscape presents significant challenges for the industry. Variations in raw material sourcing, manufacturing processes, and quality control protocols can impact product efficacy and consumer confidence. The presence of substandard or adulterated products undermines market credibility and poses safety concerns. Establishing uniform testing standards and certification mechanisms remains an ongoing challenge requiring industry-wide collaboration and regulatory strengthening.

Limited Consumer Awareness in Rural Markets

Despite growing urban adoption, nutraceutical awareness and penetration remain limited in rural and semi-urban areas where a substantial portion of the population resides. Low literacy levels, limited internet access, and traditional healthcare preferences create barriers to market expansion in these regions. Misconceptions about supplement usage and skepticism regarding efficacy claims hinder consumer trial and adoption. Distribution infrastructure gaps and affordability concerns further restrict product accessibility in underserved markets, limiting overall industry growth potential.

High Product Pricing and Affordability Constraints

Premium pricing of nutraceutical products restricts access for price-sensitive consumer segments constituting majority of the population. Import dependencies for certain ingredients and advanced formulation technologies contribute to elevated product costs. Limited economies of scale among smaller manufacturers result in higher per-unit pricing compared to basic food products. Price competition from unregulated and lower-quality alternatives creates market fragmentation. Developing affordable formulations without compromising efficacy remains a critical challenge for achieving broader market penetration.

Competitive Landscape:

The India nutraceuticals market exhibits a competitive landscape with diverse participant categories, including multinational corporations, established domestic pharmaceutical companies, heritage Ayurvedic brands, and emerging D2C startups. Market players are differentiating through product innovations, scientific validation, distribution expansion, and brand building initiatives. Strategic emphasis on R&D is enabling introduction of novel formulations and delivery formats. Partnerships between traditional knowledge holders and modern research institutions are accelerating product development cycles. Companies are investing in manufacturing capabilities to achieve quality certifications and export competitiveness. Digital marketing and e-commerce strategies are becoming critical competitive differentiators.

Recent Developments:

- In June 2025, Dabur India launched ‘Siens by Dabur’, a new premium nutraceutical brand marking the Ayurvedic company's entry into the digital-first wellness segment. The range of products includes Marine Collagen, 3-in-1 Hair, Skin and Nails Gummies, multivitamins designed for men and women, Omega-3 softgels, and daily pre- and probiotics.

- In February 2025, Herbalife India teamed up with IIT Madras to unveil the Plant Cell Fermentation Technology Lab. This initiative sought to close the gap between the demand and supply of plant-based nutraceuticals, phytoceuticals, and phytopharmaceuticals, while supporting Herbalife’s wider innovation and sustainability objectives.

India Nutraceuticals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Indications Covered | Digestive and Immune Health, Energy and Alertness Health, Heart Health, Bone and Joint, Cognitive Health, Beauty Health |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India nutraceuticals market size was valued at USD 8.93 Billion in 2025.

The India nutraceuticals market is expected to grow at a compound annual growth rate of 11.14% from 2026-2034 to reach USD 23.09 Billion by 2034.

Personalized foods dominated the market with a share of 63%, driven by growing consumer preference for nutrition aligned with individual health objectives and rising demand for fortified and functional food products.

Key factors driving the India nutraceuticals market include rising health and wellness consciousness, shift towards preventive healthcare, growing disposable incomes, supportive government regulations, and expanding e-commerce distribution channels.

Major challenges include quality control and standardization issues, limited awareness in rural areas, high product pricing constraints, regulatory compliance complexity, and competition from unregulated products affecting consumer trust.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)