India NVH Testing Market Size, Share, Trends, and Forecast by Type, Application, End User, and Region, 2025-2033

India NVH Testing Market Overview:

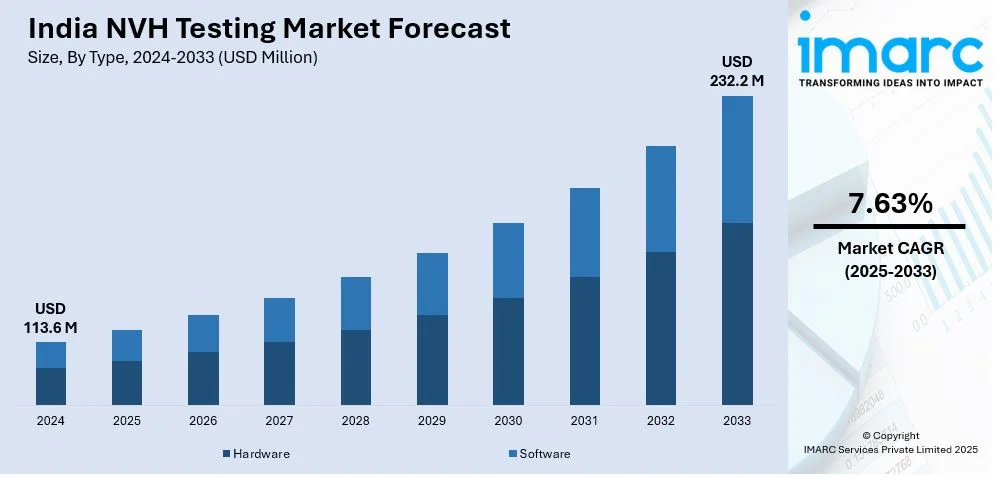

The India NVH testing market size reached USD 113.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 232.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.63% during 2025-2033. The market is witnessing significant growth, driven by increasing adoption of NVH testing in India’s expanding automotive industry and the growing integration of IoT and AI in NVH testing for real-time analysis.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.6 Million |

| Market Forecast in 2033 | USD 232.2 Million |

| Market Growth Rate 2025-2033 | 7.63% |

India NVH Testing Market Trends:

Increasing Adoption of NVH Testing in India’s Expanding Automotive Industry

The rapid growth of India’s automotive sector is driving the demand for advanced Noise, Vibration, and Harshness (NVH) testing solutions. With the country emerging as a global manufacturing hub for automobiles, stringent quality control measures and rising consumer expectations for vehicle comfort are fueling the need for precise NVH assessments. Major automakers and component manufacturers are investing in state-of-the-art NVH testing facilities to enhance vehicle acoustics, structural integrity, and ride quality. For instance, in June 2024, Sujan ContiTech AVS marks five years of success, expanding into EVs and aiming to lead India’s NVH sector by 2028 through innovation, strategic partnerships, and its Samarth 2.0 strategy. Governmental regulations on vehicle noise emissions, including Bharat Stage VI (BS-VI) norms, are further accelerating the adoption of NVH testing technologies. Compliance with these regulations necessitates advanced vibration and noise control solutions, especially in high-performance and fuel-efficient vehicle models. Additionally, the rise of electric vehicles (EVs) in India is reshaping NVH testing priorities. Unlike conventional vehicles, EVs have minimal engine noise, making other sound sources like road, wind, and electronic component vibrations more noticeable, requiring specialized NVH analysis. With increasing investments in automotive R&D and testing infrastructure, India’s NVH testing market is poised for significant expansion. The increasing integration of automation and digital analytics in testing processes is further enhancing efficiency, ensuring manufacturers meet evolving consumer preferences and regulatory requirements.

To get more information on this market, Request Sample

Growing Integration of IoT and AI in NVH Testing for Real-Time Analysis

The adoption of Internet of Things (IoT) and Artificial Intelligence (AI) in NVH testing is transforming India’s manufacturing landscape. Traditional NVH testing relied on manual inspections and post-test data analysis, but the integration of smart sensors and AI-driven analytics is enabling real-time monitoring and predictive diagnostics. For instance, in 2025, India's automotive industry entered a "smartphone era" with vehicles integrating 5G M2M connectivity and advanced AI, as highlighted in Techarc's India Connected Consumer Report 2025. This trend is particularly prominent in the automotive, aerospace, and industrial equipment sectors, where precise noise and vibration assessments are critical for performance optimization. IoT-enabled sensors are now embedded in machinery and vehicle components to continuously capture NVH data, which AI algorithms analyze for pattern recognition and anomaly detection. This predictive maintenance approach reduces downtime, improves product reliability, and enhances operational efficiency. Automotive manufacturers in India are leveraging these advancements to address early-stage NVH issues, ensuring compliance with stringent global standards while reducing production costs. Additionally, cloud-based NVH testing platforms are facilitating remote diagnostics and real-time data sharing, improving collaboration between manufacturers and research institutions. As India moves toward Industry 4.0, the integration of AI and IoT in NVH testing is expected to drive market growth by providing manufacturers with smarter, faster, and more cost-effective solutions to optimize product quality and performance.

India NVH Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware and software.

Application Insights:

- Impact Hammer Testing and Powertrain NVH Testing

- Sound Intensity Measurement and Sound Quality Testing

- Product Vibration Testing

- Environmental Noise Measurement

- Pass-by Noise Testing

- Mechanical Vibration Testing

- Noise Source Mapping

- Building Acoustics

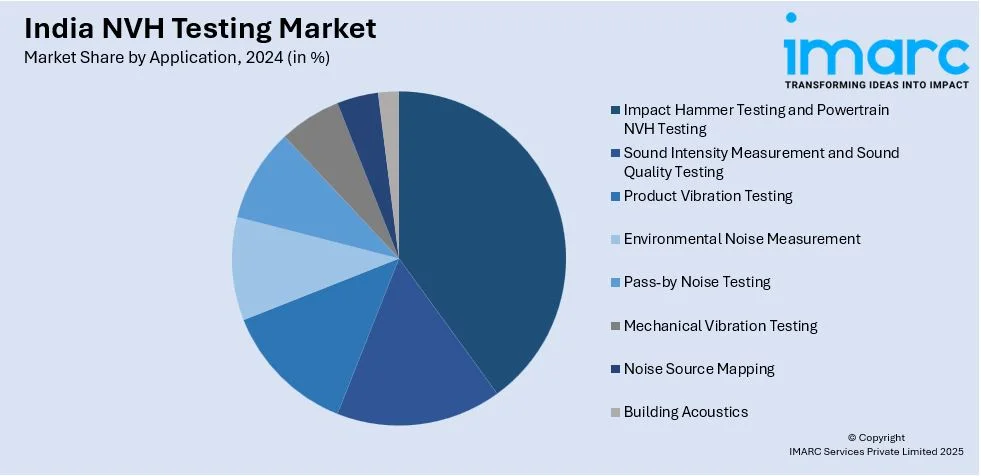

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes impact hammer testing and powertrain NVH testing, sound intensity measurement and sound quality testing, product vibration testing, environmental noise measurement, pass-by noise testing, mechanical vibration testing, noise source mapping, and building acoustics.

End User Insights:

- Automotive and Transportation

- Aerospace and Defense

- Power and Energy

- Consumer Applications

- Construction

- Industrial

- Other

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive and transportation, aerospace and defense, power and energy, consumer applications, construction, industrial, and other.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India NVH Testing Market News:

- In April 2025, Automotive Testing Expo India returns to Chennai Trade Center, showcasing innovations in automotive testing, NVH, EV evaluation, ADAS, and emissions. The event features top exhibitors like Aptiv and Keysight Technologies. New for 2025, the SAE Automotive Leadership Summit will highlight India’s advancements in manufacturing, innovation, and sustainability.

India NVH Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardware, Software |

| Applications Covered | Impact Hammer Testing and Powertrain NVH Testing, Sound Intensity Measurement and Sound Quality Testing, Product Vibration Testing, Environmental Noise Measurement, Pass-by Noise Testing, Mechanical Vibration Testing, Noise Source Mapping, Building Acoustics |

| End Users Covered | Automotive and Transportation, Aerospace and Defense, Power and Energy, Consumer Applications, Construction, Industrial, Other |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India NVH testing market performed so far and how will it perform in the coming years?

- What is the breakup of the India NVH testing market on the basis of type?

- What is the breakup of the India NVH testing market on the basis of application?

- What is the breakup of the India NVH testing market on the basis of end user?

- What is the breakup of the India NVH testing market on the basis of region?

- What are the various stages in the value chain of the India NVH testing market?

- What are the key driving factors and challenges in the India NVH testing?

- What is the structure of the India NVH testing market and who are the key players?

- What is the degree of competition in the India NVH testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India NVH testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India NVH testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India NVH testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)