India Nylon Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Nylon Market Overview:

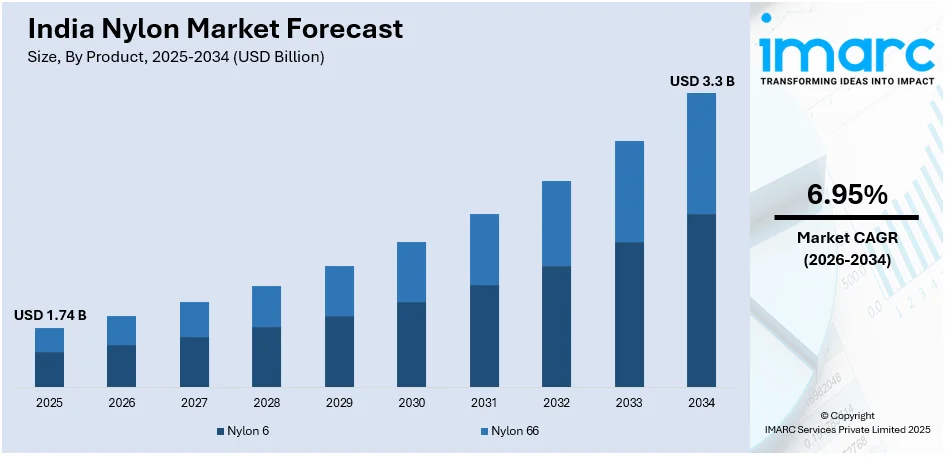

The India nylon market size reached USD 1.74 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.95% during 2026-2034. The increasing demand for technical textiles for industrial fabrics, geotextiles, and automotive components, the widespread product utilization in the home furnishing sector in upholstery, curtains, and bedding, and the rising emphasis on sustainable production practices and technological advancements are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.74 Billion |

| Market Forecast in 2034 | USD 3.3 Billion |

| Market Growth Rate 2026-2034 | 6.95% |

India Nylon Market Trends:

Rising Emphasis on Sustainable and Eco-friendly Production Processes

Environmental sustainability is increasingly shaping the future of India's nylon industry, with manufacturers actively adopting eco-conscious production methods to reduce ecological impact and meet growing global demand for sustainable textiles. Over 50% of Indian manufacturers across sectors are reportedly prioritizing investments in sustainable practices, reflecting a broader industry shift. Moreover, 93% of manufacturers are embracing Industry 5.0 to integrate sustainability with profitability, using technologies that enhance both environmental and economic outcomes. Key initiatives include advanced spinning techniques that significantly lower water and energy usage, the use of eco-friendly dyes, and comprehensive waste reduction strategies. These efforts not only address pressing environmental concerns but also align Indian nylon production with international sustainability benchmarks, enhancing global competitiveness. Furthermore, stricter regulations from environmental authorities are accelerating innovation and driving investment in greener technologies. As environmentally conscious consumers increasingly influence market trends, these sustainability-driven transformations are vital for maintaining industry relevance and securing long-term growth in both domestic and international markets.

To get more information on this market Request Sample

Expansion into New and Innovative Applications

The versatility of nylon filament yarn is driving its adoption across a range of emerging industries beyond traditional apparel, significantly expanding its market potential. Its strength, durability, and adaptability make it an ideal material for applications in automotive, home furnishings, and technical textiles. In the automotive sector, nylon is extensively used in manufacturing critical components such as seatbelts, airbags, and upholstery, owing to its high tensile strength and resistance to wear and tear. Similarly, the home furnishing industry leverages nylon for carpets, curtains, and upholstery fabrics, appreciating its aesthetic appeal, resilience, and longevity. The growing demand for technical textiles has further positioned nylon as a preferred choice in producing industrial fabrics, geotextiles, and protective clothing. This diversification is fueling both innovation and increased demand within the nylon industry. Notably, the furnishings and upholstery segment is projected to witness significant growth, driven by nylon’s suitability for premium interior décor. West India, particularly Gujarat, continues to dominate the Indian nylon filament yarn market, backed by its strong textile ecosystem and strategic logistical advantages.

India Nylon Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Nylon 6

- Nylon 66

The report has provided a detailed breakup and analysis of the market based on the product. This includes nylon 6 and nylon 66.

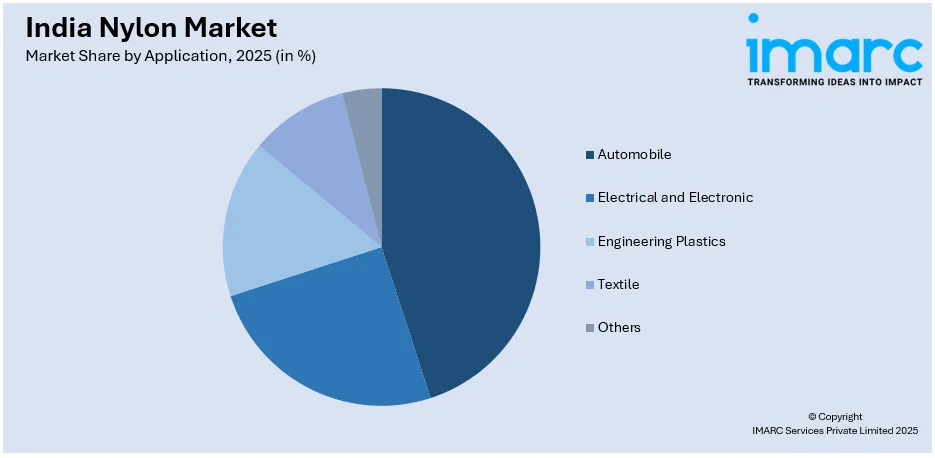

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobile

- Electrical and Electronic

- Engineering Plastics

- Textile

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobile, electrical and electronic, engineering plastics, textile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nylon Market News:

- March 2025: JPFL Films, a subsidiary of Jindal Poly Films, launched Biaxially Oriented Polyamide (BOPA) nylon films in India. It offers improved mechanical properties and an aroma barrier and will be used in various applications, including pharmaceutical, medical, FMCG, and food.

- February 2024: LG Chem and CJ CheilJedang signed a Heads of Agreement to form a joint venture focused on producing and selling eco-friendly nylon made from bio-based materials (PMDA). This collaboration seeks to enhance business competitiveness by handling the entire bio-nylon value chain—from raw material production to finished products.

India Nylon Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Nylon 6, Nylon 66 |

| Applications Covered | Automobile, Electrical and Electronic, Engineering Plastics, Textile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India nylon market performed so far and how will it perform in the coming years?

- What is the breakup of the India nylon market on the basis of product?

- What is the breakup of the India nylon market on the basis of application?

- What are the various stages in the value chain of the India nylon market?

- What are the key driving factors and challenges in the India nylon market?

- What is the structure of the India nylon market and who are the key players?

- What is the degree of competition in the India nylon market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nylon market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nylon market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nylon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)