India Oats Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

India Oats Market Overview:

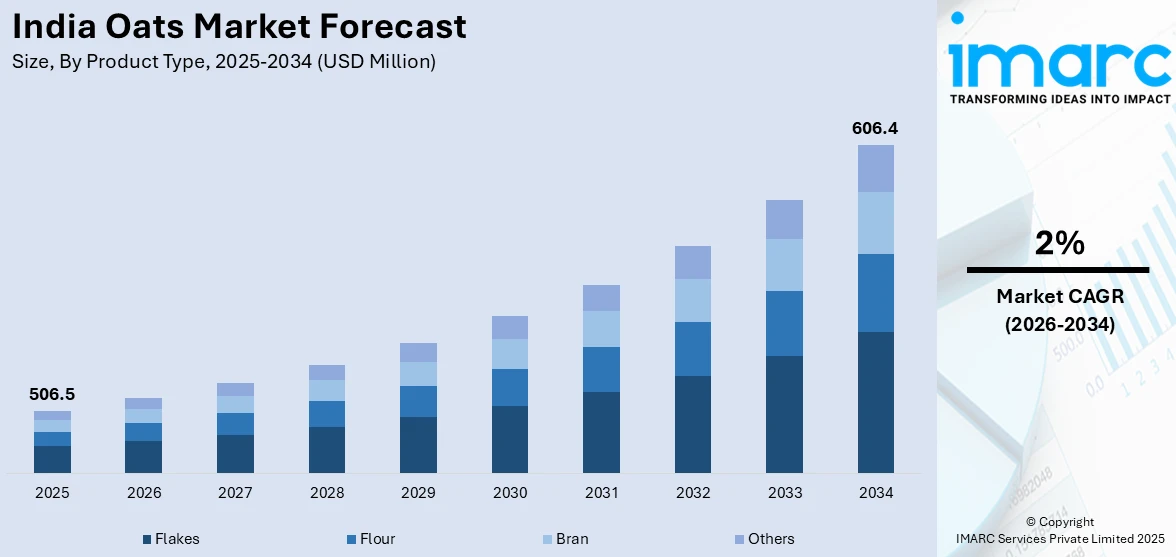

The India oats market size reached USD 506.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 606.4 Million by 2034, exhibiting a growth rate (CAGR) of 2% during 2026-2034. The India oats market is driven by increasing health awareness, government support for nutri-cereals, evolving dietary habits, urbanization-led demand for convenient nutrition, product innovations by major brands, and a rising preference for high-fiber, heart-friendly foods, particularly among health-conscious consumers and aging populations seeking better dietary choices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 506.5 Million |

| Market Forecast in 2034 | USD 606.4 Million |

| Market Growth Rate 2026-2034 | 2% |

India Oats Market Trends:

Rising Health Consciousness and Dietary Shifts

Over the last few years, there has been a significant change in the food choices of Indian consumers toward health and wellbeing. This has been catalyzing a rise in demand for healthy food products, such as oats, that are high in dietary fiber, vitamins, and minerals. The health benefits of oats, coupled with the fact that they can be added to various traditional and contemporary recipes, have contributed significantly to their popularity among health-conscious individuals. A survey reflects a rising trend toward consumption of whole grains as well as high-fiber diets, as it also shows the escalating popularity of oat intakes in daily meals. This trend is also observed in urban cities, where hectic lifestyles have favored fast but healthy food, making oats an easily accessible option. Additionally, the utility of oats in food preparation has further cemented their establishment in Indian kitchens. Consumers are now including oats in Indian breakfast dishes such as dosas, idlis, and poha, along with baked foods and smoothies, so that they are compatible with taste and nutritional needs.

To get more information on this market Request Sample

Growth of the Convenience Food Segment

The Indian market for oats has been greatly impacted by the growing need for convenience food, especially in urban areas with busy lifestyles and hectic work patterns that do not leave much time for complex meal preparation. As dual-income households are on the rise and people are opting for nuclear families, consumers are readily looking for easy, convenient, and healthy meal solutions. Oats, being easy to prepare and versatile, have become a favorite. The increased demand for ready-to-eat and ready-to-cook oat products, including instant oats, flavored oats, and oat-enriched snack bars, is a testament to this trend. Major food companies have ridden the wave by launching new flavors and fortified oats with added nutrients to meet changing tastes and health needs. Furthermore, the swift growth of organized retail chains, supermarkets, and online platforms has brought oats within reach of consumers from different segments.

India Oats Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, and application.

Product Type Insights:

- Flakes

- Flour

- Bran

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes flakes, flour, bran, and others.

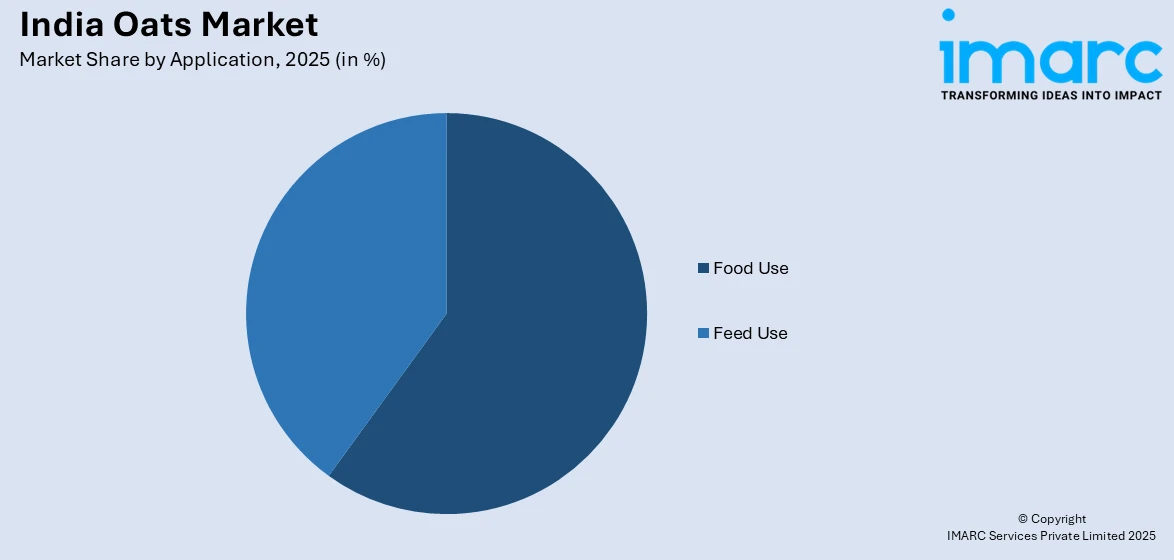

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Use

- Feed Use

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food use and feed use.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Oats Market News:

- February 2025: Marico introduced Saffola Cuppa Oats, a quick-to-prepare snack available in Magic Masala and Spicy Mexicana flavors, ready in four minutes by adding hot water. This product caters to health-conscious consumers seeking convenient, nutritious options without compromising on taste. Such innovations enhance the appeal of oats, contributing to the expansion of India's oats market.

- August 2024: ITC introduced the 'Right Shift' nutrition brand, offering products like upma, oats, and cookies made with natural ingredients, targeting consumers aged 40 and above. This initiative caters to the increasing demand for health-focused food options among middle-aged and older demographics. By addressing the nutritional preferences of this segment, ITC's 'Right Shift' line contributes positively to the expansion of India's oats market.

India Oats Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Flakes, Flour, Bran, Others |

| Applications Covered | Food Use, Feed Use |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India oats market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India oats market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India oats industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oats market in India was valued at USD 506.5 Million in 2025.

The India oats market is projected to exhibit a (CAGR) of 2% during 2026-2034, reaching a value of USD 606.4 Million by 2034.

Increased health awareness, amplified demand for functional food, and for high-fiber, low-calorie breakfast food are major growth drivers for the India oats market. Larger working populations in urban areas, new product approaches in terms of flavor and format, and growth in modern retail and e-commerce channels are improving access and propelling oats consumption in urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)