India Off-Highway Vehicle Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, Demand Category, and Region, 2025-2033

India Off-Highway Vehicle Tire Market Size and Share:

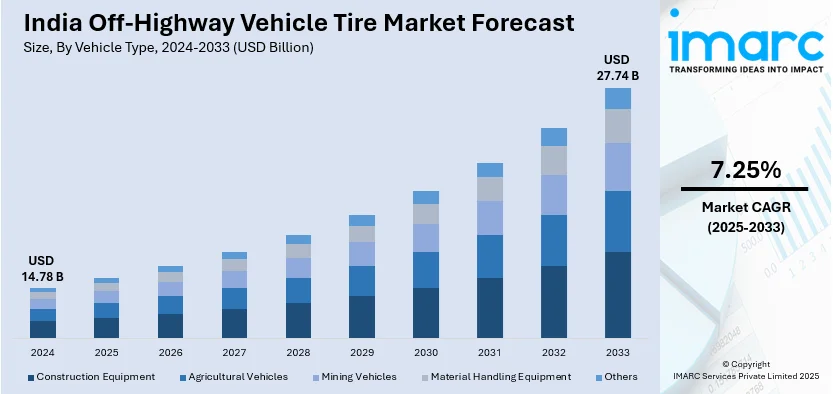

The India off-highway vehicle tire market size reached USD 14.78 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.74 Billion by 2033, exhibiting a growth rate (CAGR) of 7.25% during 2025-2033. The market is driven by expanding infrastructure projects, rising mechanization in agriculture, increased mining activities, government initiatives like "Make in India" and rural development schemes. Additionally, advancements in tire technology and growing exports contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.78 Billion |

| Market Forecast in 2033 | USD 27.74 Billion |

| Market Growth Rate 2025-2033 | 7.25% |

India Off-Highway Vehicle Tire Market Trends:

Increasing Demand from Infrastructure and Mining Sectors

India's rapid infrastructure development and expanding mining activities are significantly driving the demand for off-highway vehicle (OHV) tires. India's National Infrastructure Pipeline (NIP) aims to invest $1.4 trillion by 2025, fueling demand for heavy-duty construction and mining equipment, thereby boosting the market growth. In confluence with this, as of FY22, India had approximately 1,319 reporting mines, with 545 dedicated to metallic minerals and 775 to non-metallic minerals. This surge in mining activity has heightened the demand for large off-road tires used in dump trucks, loaders, and excavators. Furthermore, sales of construction equipment in India are projected to reach 122,000 units by 2025, up from 85,000 units in 2023, driving the OHV tire market. Manufacturers are innovating with advanced tire designs, such as radial tires with reinforced sidewalls, to enhance durability and fuel efficiency in rough terrains. Companies like Balkrishna Industries (BKT) and Apollo Tyres are expanding production capacities to cater to rising domestic and export demand.

To get more information on this market, Request Sample

Advancements in Tire Technology and Sustainable Solutions

Technological advancements in OHV tires, including smart tire technology and sustainable materials, are reshaping the market. The integration of TPMS (Tire Pressure Monitoring Systems) and IoT sensors in OHV tires is expected to grow by 20% annually from 2023 to 2025, improving safety and efficiency. In addition to this, companies are investing in bio-based rubber and recycled materials. By 2025, 30% of off-highway tires in India are expected to contain sustainable raw materials. Moreover, escalating focus on retreading that offers cost-effective and eco-friendly solutions is acting as another significant growth-inducing factor. These advancements are driven by the push for fuel efficiency, lower carbon footprints, and longer life cycles, benefiting industries like agriculture, mining, and construction.

India Off-Highway Vehicle Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, tire type, and demand category.

Vehicle Type Insights:

- Construction Equipment

- Agricultural Vehicles

- Mining Vehicles

- Material Handling Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes construction equipment, agricultural vehicles, mining vehicles, material handling equipment, and others.

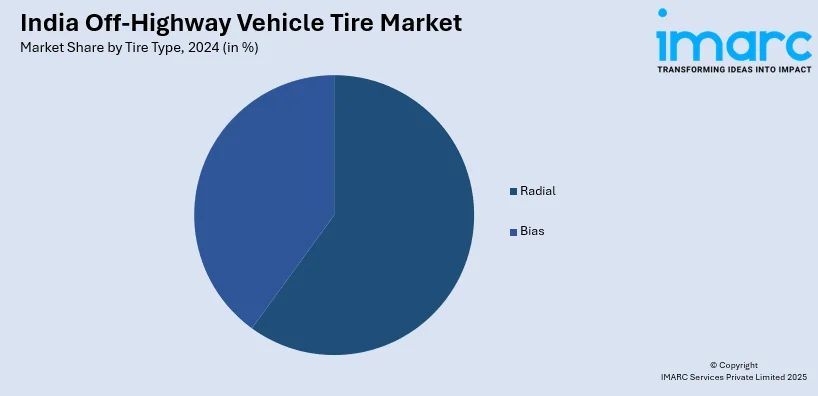

Tire Type Insights:

- Radial

- Bias

A detailed breakup and analysis of the market based on the tire type have also been provided in the report. This includes radial and bias.

Demand Category Insights:

- OEM

- Replacement

The report has provided a detailed breakup and analysis of the market based on the demand category. This includes OEM and replacement.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Off-Highway Vehicle Tire Market News:

- June 2024: Yokohama India expanded its Geolandar series with the launch of two new models: the Geolandar X-AT and the Geolandar M/T G003. Engineered for superior performance and durability, these tires cater to the diverse needs of off-road enthusiasts.

- February 2024: TVS Srichakra showcased its latest innovation, the Steel Belted Agro-Industrial Radial Tires, at The Tire Cologne 2024, a leading global trade fair for the tire industry. Displaying its advancements at Hall 6.1, Booth C050–C054, the company introduced this cutting-edge tire technology, engineered to enhance the performance of telescopic handlers, compact wheel loaders, and backhoe loaders across agricultural and industrial sectors.

India Off-Highway Vehicle Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Construction Equipment, Agricultural Vehicles, Mining Vehicles, Material Handling Equipment, Others |

| Tire Types Covered | Radial, Bias |

| Demand Categories Covered | OEM, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India off-highway vehicle tire market performed so far and how will it perform in the coming years?

- What is the breakup of the India off-highway vehicle tire market on the basis of vehicle type?

- What is the breakup of the India off-highway vehicle tire market on the basis of tire type?

- What is the breakup of the India off-highway vehicle tire market on the basis of demand category?

- What are the various stages in the value chain of the India off-highway vehicle tire market?

- What are the key driving factors and challenges in the India off-highway vehicle tire market?

- What is the structure of the India off-highway vehicle tire market and who are the key players?

- What is the degree of competition in the India off-highway vehicle tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India off-highway vehicle tire market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India off-highway vehicle tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India off-highway vehicle tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)