India Offshore Helicopter Services Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

India Offshore Helicopter Services Market Overview:

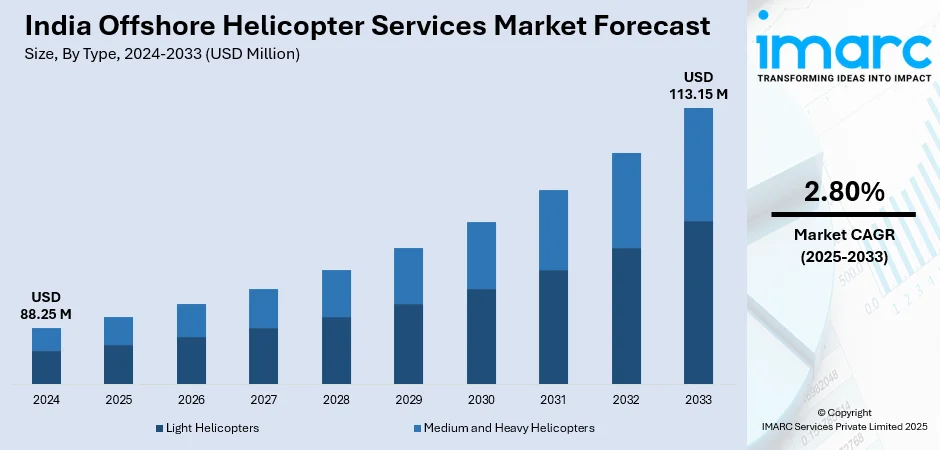

The India offshore helicopter services market size reached USD 88.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 113.15 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. At present, the demand for oil and gas exploration and production in offshore fields is increasing. Moreover, the offshore renewable energy industry, particularly offshore wind power, is growing fast in India, and it is directly impacting the market growth. Furthermore, government policies and safety standards are taking a pivotal position in expanding the India offshore helicopter services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.25 Million |

| Market Forecast in 2033 | USD 113.15 Million |

| Market Growth Rate 2025-2033 | 2.80% |

India Offshore Helicopter Services Market Trends:

Growing Demand for Offshore Oil and Gas Activity

India's offshore helicopter services sector is growing rapidly as demand for oil and gas exploration and production on offshore fields is increasing. As Indian oil and gas reserves keep depleting, players are emphasizing more on deep-water drilling, which demands helicopters to carry men and equipment. In 2025, Assam announced its plans to become the first state government in the country to take a proactive role in oil production by declaring a hydrocarbon discovery in the Namrup Borhat-1 well, located in the Dibrugarh district. Moreover, Firms are investing in sophisticated offshore drilling technologies and employing regular transportation services to serve the labor force involved in such remote operations. Helicopters are emerging as the most effective and affordable means of transporting personnel to offshore platforms, where the number of workers needed varies with the scale of the operations. The emerging interest in maximizing operations and enhancing safety performance in offshore oil and gas industries is also adding to the rising dependence on helicopter services for operational efficiency and rapid evacuation in case of emergencies.

To get more information on this market, Request Sample

Rise in Renewable Energy Investment

The offshore renewable energy industry, particularly offshore wind power, is growing fast in India, and it is directly impacting the growth of the offshore helicopter services sector. With India stepping up efforts to increase its renewable energy capacity, demand for offshore wind farms and other renewable energy assets is rising. Offshore wind farms are assisted in their logistics and personnel transport demands by helicopters. With the projects set in remote, offshore locations, helicopter services are becoming unavoidable for installation, maintenance, and inspection processes. Wind power firms are utilizing helicopters to take workers to offshore wind turbines, thus saving time and guaranteeing safety. The services are helping firms achieve their sustainability requirements while providing seamless operations for offshore renewable energy ventures. The growing emphasis on renewable energy is thus catalyzing the need for expert offshore helicopter services. In 2024, Pawan Hans, the state-owned helicopter service provider, announced that it obtained a contract lasting 10 years valued at more than ₹2,000 crore to deliver four helicopters to ONGC for ferrying its staff to offshore duty sites. According to the company, Pawan Hans will use four HAL-made Dhruva NG helicopters for ONGC offshore operations under the contract won through competitive global bidding.

Government Regulations and Safety Standards

Government policies and safety standards are taking a pivotal position in fueling the India offshore helicopter services market growth. As more offshore exploration is being undertaken, the government has enforced strict safety measures to protect staff, including frequent commuting of staff to and from offshore platforms. Helicopter services are becoming necessary in maintaining the standards, as they ensure efficient and safe transportation of staff. Regulatory agencies are enforcing the use of helicopters for emergency evacuation, especially in the case of bad weather or other dangerous conditions. Also, since the Government of India is focusing on sustainable offshore exploration, the use of helicopters with high-tech safety features is increasing to prevent danger. The regular application of safety protocols and conformance to global norms is prompting offshore operators to increasingly rely on helicopter services for compliance and preservation of human life.

India Offshore Helicopter Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end-use industry.

Type Insights:

- Light Helicopters

- Medium and Heavy Helicopters

The report has provided a detailed breakup and analysis of the market based on the type. This includes light helicopters, and medium and heavy helicopters.

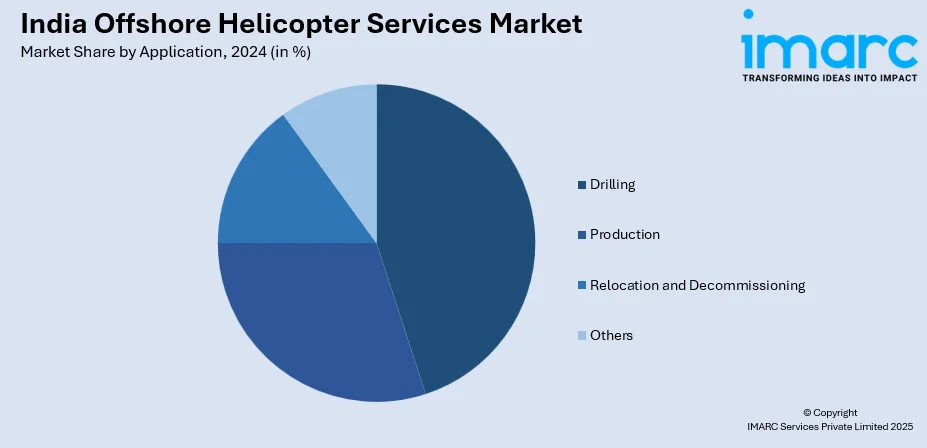

Application Insights:

- Drilling

- Production

- Relocation and Decommissioning

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes drilling, production, relocation and decommissioning, and others.

End-Use Industry Insights:

- Oil and Gas Industry

- Offshore Wind Power Industry

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas industry, offshore wind power industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Offshore Helicopter Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light Helicopters, Medium and Heavy Helicopters |

| Applications Covered | Drilling, Production, Relocation and Decommissioning, Others |

| End-Use Industries Covered | Oil and Gas Industry, Offshore Wind Power Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India offshore helicopter services market performed so far and how will it perform in the coming years?

- What is the breakup of the India offshore helicopter services market on the basis of type?

- What is the breakup of the India offshore helicopter services market on the basis of application?

- What is the breakup of the India offshore helicopter services market on the basis of end-use industry?

- What is the breakup of the India offshore helicopter services market on the basis of region?

- What are the various stages in the value chain of the India offshore helicopter services market?

- What are the key driving factors and challenges in the India offshore helicopter services market?

- What is the structure of the India offshore helicopter services market and who are the key players?

- What is the degree of competition in the India offshore helicopter services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India offshore helicopter services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India offshore helicopter services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India offshore helicopter services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)