India Offshore Support Vessels Market Size, Share, Trends, and Forecast by Type, Water Depth, Fuel, Service Type, Application, and Region, 2025-2033

India Offshore Support Vessels Market Overview:

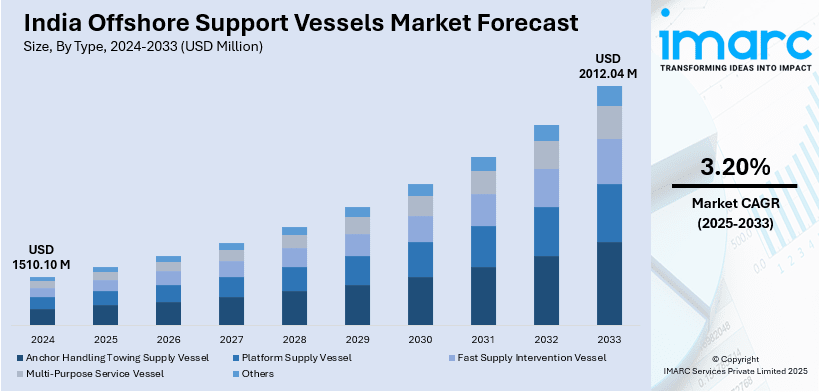

The India offshore support vessels market size reached USD 1510.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2012.04 Million by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is growing due to rising offshore exploration, renewable energy projects, and government initiatives in oil and gas. Furthermore, growing need for specialized vessels AHTS, PSVs for efficient operations supports infrastructure development and energy projects is aiding market growth significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1510.10 Million |

| Market Forecast in 2033 | USD 2012.04 Million |

| Market Growth Rate 2025-2033 | 3.20% |

India Offshore Support Vessels Market Trends:

Growing Demand for Offshore Exploration and Production Activities

India's offshore exploration and production activities have created high demand for offshore support vessels. The requirement for specialized offshore vessels has increased considerably as India elevate oil and gas exploration in the KG Basin, Bay of Bengal and the Arabian Sea. In this regard anchor handling tug supply (AHTS) vessels, platform supply vessels (PSVs) and oil spill response vessels are key vessels deployed to transportation of equipment, materials and personnel to/from offshore platforms safely and efficiently. As a result of increasing investments in deep-water exploration, development of new oil and gas fields, drilling and production operations will require offshore support vessels. For instance, in January 2024, Oil and Natural Gas Corporation (ONGC) announced the commencement of oil production from its deep-water KG-DWN-98/2 block in the Bay of Bengal, 30 km off Kakinada. This development is expected to increase ONGC’s oil and gas production by 11% and 15%, respectively, boosting India’s energy security. In addition to this, government policies to boost domestic oil production and cut down on imports are likely to further drive demand for offshore support vessels, making them a prominent segment in the Indian maritime sector.

To get more information on this market, Request Sample

Increased Focus on Renewable Energy and Offshore Wind Farms

India is experiencing a movement towards renewable power, especially offshore wind power, creating a demand for specialized offshore support ships. The concern of the government to meet its renewable energy requirements has prompted an initiative for constructing offshore wind farms in its eastern as well as its western coastlines. For instance, in February 2024, the Government of India (GOI) announced a bid invitation for the development of 4 GW offshore wind capacity off Tamil Nadu's eastern coast. The tender covers four 1 GW blocks, designed under an open-access framework to enhance direct electricity sales to consumers. In addition, offshore support vessels are essential to the installation, maintenance, and operation of these wind farms as they serve as the indispensable logistics support to transport turbines and equipment, and maintenance personnel. Additionally, they play an important role when conducting environmental assessments, and geotechnical surveys before construction starts. Furthermore, as India continues to build capacity in offshore wind energy, the offshore support vessel market will require a higher demand for vessels which are designed to support the needs unique to renewable energy projects; this will include vessels capable of high-end technology integration, and environmental protection.

India Offshore Support Vessels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, water depth, fuel, service type, and application.

Type Insights:

- Anchor Handling Towing Supply Vessel

- Platform Supply Vessel

- Fast Supply Intervention Vessel

- Multi-Purpose Service Vessel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes anchor handling towing supply vessel, platform supply vessel, fast supply intervention vessel, multi-purpose service vessel, and others.

Water Depth Insights:

- Shallow Water

- Deepwater

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes shallow water and deepwater.

Fuel Insights:

- Fuel Oil

- LNG

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes fuel oil and LNG.

Service Type Insights:

- Technical Services

- Inspection and Survey

- Crew Management

- Logistics and Cargo Management

- Anchor Handling and Seismic Support

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes technical services, inspection and survey, crew management, logistics and cargo management, anchor handling and seismic support, and others.

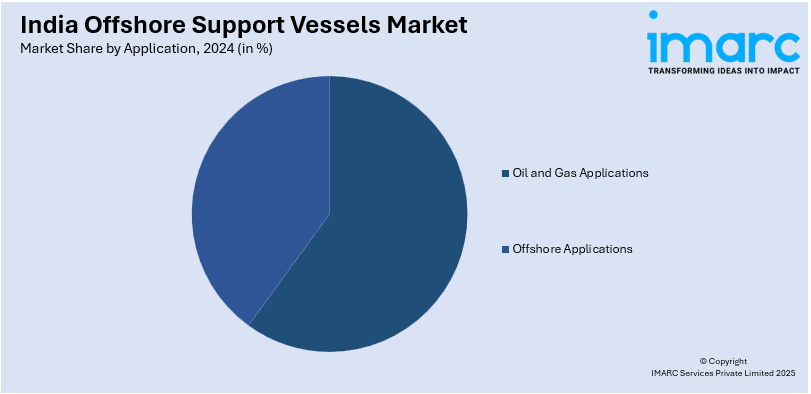

Application Insights:

- Oil and Gas Applications

- Offshore Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas applications and offshore applications.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Offshore Support Vessels Market News:

- In March 2023, the Ministry of Defence announced a contract for 11 Next-Generation Offshore Patrol Vessels (NGOPVs) with Goa Shipyard Ltd. (GSL) and Garden Reach Shipbuilders & Engineers (GRSE). The keel-laying for these vessels began in February and March 2024, with deliveries expected to start in September 2026.

- In May 2024, Cochin Shipyard Limited announced securing a €60 million contract with North Star Shipping from the UK. The agreement involves building hybrid Service Operation Vessels (SOVs) for offshore renewable energy projects, emphasizing India’s increasing significance in global shipbuilding.

India Offshore Support Vessels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, Others |

| Water Depths Covered | Shallow Water, Deepwater |

| Fuels Covered | Fuel Oil, LNG |

| Service Types Covered | Technical Services, Inspection and Survey, Crew Management, Logistics and Cargo Management, Anchor Handling and Seismic Support, Others |

| Applications Covered | Oil and Gas Applications, Offshore Applications |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India offshore support vessels market performed so far and how will it perform in the coming years?

- What is the breakup of the India offshore support vessels market on the basis of type?

- What is the breakup of the India offshore support vessels market on the basis of water depth?

- What is the breakup of the India offshore support vessels market on the basis of fuel?

- What is the breakup of the India offshore support vessels market on the basis of service type?

- What is the breakup of the India offshore support vessels market on the basis of application?

- What is the breakup of the India offshore support vessels market on the basis of region?

- What are the various stages in the value chain of the India offshore support vessels market?

- What are the key driving factors and challenges in the India offshore support vessels market?

- What is the structure of the India offshore support vessels market and who are the key players?

- What is the degree of competition in the India offshore support vessels market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India offshore support vessels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India offshore support vessels market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India offshore support vessels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)