India Oleochemicals Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Oleochemicals Market Overview:

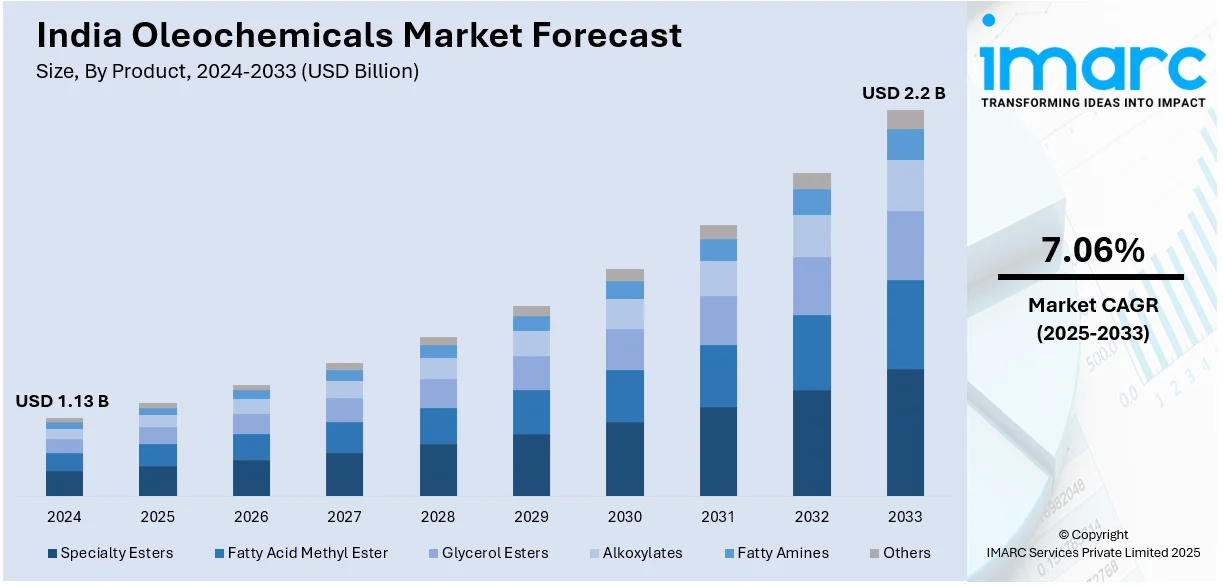

The India oleochemicals market size reached USD 1.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.06% during 2025-2033. The increasing demand for biodegradable and sustainable chemicals, rising applications in personal care, pharmaceuticals, and food industries, government support for bio-based products, expansion of industrial sectors, and the growing preference for oleochemical-based surfactants, lubricants, and biopolymers are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.13 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate (2025-2033) | 7.06% |

India Oleochemicals Market Trends:

Expansion of Oleochemical Production

The Indian oleochemical sector is experiencing significant capital infusion to boost manufacturing capacity, catering to increasing demand from personal care, pharmaceuticals, and food industries. Companies are scaling up operations in key industrial hubs like Gujarat, ensuring a stable domestic supply and reducing reliance on imports. This shift supports employment generation, with hundreds of new jobs expected in advanced production facilities. Sustainable and bio-based chemical solutions are gaining traction, aligning with global shifts toward environmentally friendly alternatives. Investments are also driving innovation, improving process efficiency, and expanding product portfolios. With rising consumer preference for natural ingredients, the sector is poised for continuous growth, reinforcing India's position as a key player in oleochemical manufacturing. For example, in January 2024, Godrej Industries Limited's Chemicals Division announced its plan to invest INR 600 Crore over four years to expand its oleochemical production at the Valia facility in Gujarat's Bharuch district. This initiative is expected to create approximately 250 jobs. The Valia plant manufactures oleochemical products for sectors like personal care, pharmaceuticals, and food industries.

To get more information on this market, Request Sample

Rising Protectionism in the Oleochemicals Industry

India is witnessing a shift toward stricter trade policies in the oleochemicals sector to safeguard domestic production. Industry bodies are advocating for higher import duties on finished products like stearic acid and refined glycerin while pushing for duty-free access to essential raw materials. This shift aims to reduce reliance on low-cost imports and strengthen local manufacturing. Authorities are evaluating policy adjustments to support self-sufficiency and enhance competitiveness. Market players are also urging a balanced approach to ensure supply chain stability without escalating production costs. As the landscape evolves, domestic manufacturers may benefit from regulatory changes, potentially driving investment in advanced processing capabilities. The emphasis remains on maintaining a competitive edge while addressing global trade dynamics in the sector. For instance, in February 2024, the Solvent Extractors Association of India (SEA) urged the government to impose import restrictions on finished oleochemical products like stearic acid, refined glycerin, soap noodles, and oleic acid, citing threats to the domestic industry from duty-free imports. It proposed placing these items on the restricted list or imposing higher import duties while advocating duty-free import of raw materials for domestic manufacturers.

India Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Specialty Esters

- Fatty Acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes specialty esters, fatty acid methyl ester, glycerol esters, alkoxylates, fatty amines, and others.

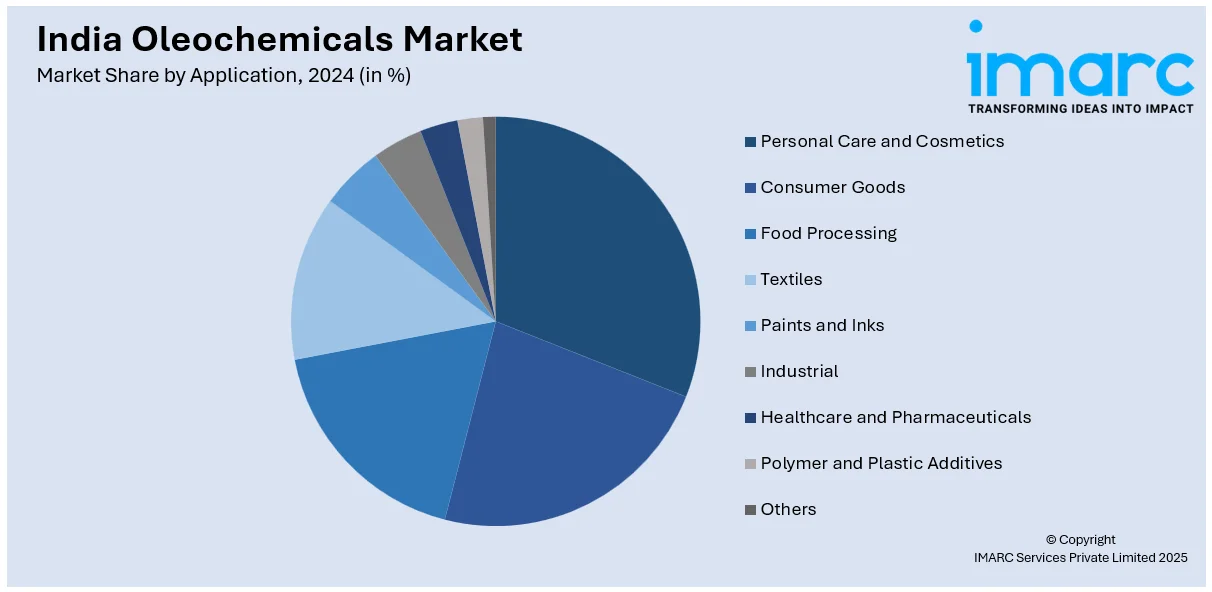

Application Insights:

- Personal Care and Cosmetics

- Consumer Goods

- Food Processing

- Textiles

- Paints and Inks

- Industrial

- Healthcare and Pharmaceuticals

- Polymer and Plastic Additives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal care and cosmetics, consumer goods, food processing, textiles, paints and inks, industrial, healthcare and pharmaceuticals, polymer and plastic additives, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Oleochemicals Market News:

- In March 2025, Godrej Industries' Chemicals Business launched 'Samagam', a platform uniting industry leaders, manufacturers, and experts. Focused on oleochemicals and their applications in-home care, beauty and personal care, lubricants, and more, Samagam addresses market trends, innovations, and challenges. The inaugural event in Ahmedabad would expand to Mumbai, Bengaluru, Delhi, and Kolkata.

- In July 2024, Adani Wilmar Limited (AWL) acquired a 67% stake in Omkar Chemicals Industries, strengthening its position in India’s oleochemicals sector. Omkar Chemicals operates a manufacturing plant in Panoli, Gujarat, with an annual capacity of 20,000 metric tons of surfactants, including oleochemical-based products. The acquisition supports AWL’s strategy to expand its specialty chemicals portfolio and enhance domestic production capabilities.

India Oleochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Specialty Esters, Fatty Acid Methyl Ester, Glycerol Esters, Alkoxylates, Fatty Amines, Others |

| Applications Covered | Personal Care and Cosmetics, Consumer Goods, Food Processing, Textiles, Paints and Inks, Industrial, Healthcare and Pharmaceuticals, Polymer and Plastic Additives, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India oleochemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India oleochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India oleochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oleochemicals market in India was valued at USD 1.13 Billion in 2024.

The India oleochemicals market is projected to exhibit a CAGR of 7.06% during 2025-2033, reaching a value of USD 2.2 Billion by 2033.

The India oleochemicals market is expanding due to the rising need for bio-based, renewable alternatives to petrochemicals in food additives and lubricants. Increasing awareness about sustainable and eco-friendly products is further driving the demand in cosmetics and household products. Additionally, government policies aimed at promoting biodiesel production and green chemistry are encouraging the use of oleochemicals derived from vegetable oils and animal fats.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)