India Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2026-2034

India Online Education Market Overview:

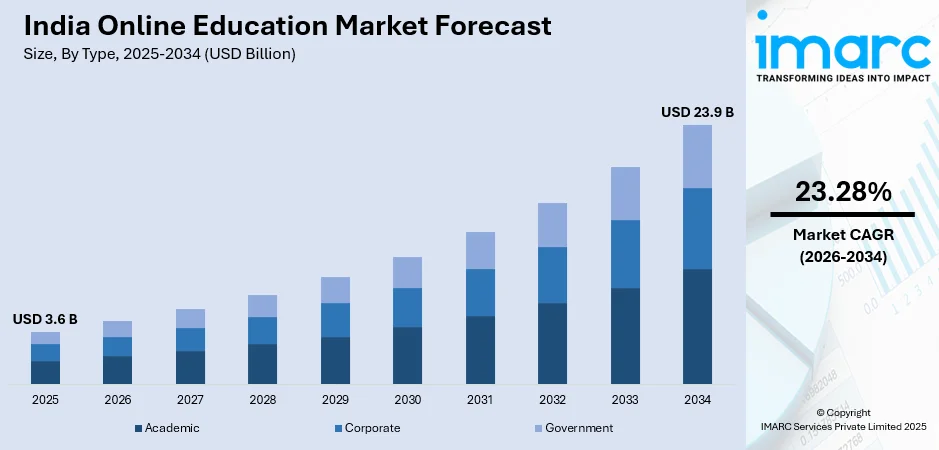

The India online education market size reached USD 3.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 23.9 Billion by 2034, exhibiting a growth rate (CAGR) of 23.28% during 2026-2034. The market is propelled by the rising demand for skill enhancement and vocational courses, and growing internet access, smartphone adoption, and digital literacy levels. Moreover, the need for cost-effective, adaptable learning options, coupled with governmental efforts to encourage e-learning is propelling the India online education market share.

Key Takeaways:

- In 2025, the India online education market was estimated at USD 3.6 billion.

- The market is expected to grow to USD 23.9 billion by 2034, reflecting a compound annual growth rate (CAGR) of approximately 23.28% from 2026 to 2034.

- Major growth drivers include increasing internet penetration, growing smartphone adoption, rising demand for flexible and affordable learning solutions, government support for digital education initiatives, and the expanding availability of diverse online learning platforms across India.

- Segmentation highlights:

- Provider: Academic, Corporate, Government.

- Technology: Content, Services.

- End-User: Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others.

- Regional Insights: Covering North, South, East, and West India, the analysis outlines promising opportunities across different regions.

To get more information on this market, Request Sample

India Online Education Market Trends:

Growth of EdTech Platforms and Mobile Learning

The India online education market growth is driven by the speedy expansion of EdTech platforms, with mobile learning being a standout trend. With growing smartphone penetration and cheap internet availability, mobiles have emerged as driver enablers for education, providing learners with flexibility to access courses anytime, anywhere. Companies such as Byju's, Unacademy, and Vedantu have experienced rapid expansion by providing individualized learning experiences that match the specific needs of students. These platforms utilize artificial intelligence and machine learning to develop adaptive learning systems that enhance user experience and learning outcomes. The need for mobile-compatible courses and apps has also increased further, particularly with the COVID-19 pandemic, where the online learning shift became necessary. As the mobile technology gets better, online education is witnessing a shift through the application of interactive tools such as gamification, live lessons, and collaborative learning among peers, which makes learning more captivating and efficient for students of different age groups.

Rise of Skill-Based and Vocational Training

India needs skill-based and vocational training with an increasing demand for the same, which is redefining the market of online education. In 2023, Varthana, the largest school loan and fastest growing student loan company in India, has shown that 12.6% of students are school dropouts, of whom 62% are school-stage dropouts. Several students dropout from school even before they are able to complete their 10th standard qualification exams, and in such circumstances, skill-based and vocational training plays a significant role in augmenting the employability of young people. With the growing competitive job market, students are now more and more relying on the internet for short-term certification, vocational education, and skills development programs. This is fueled by the need for specific technical and soft skills needed by the industry, especially in sectors such as IT, healthcare, manufacturing, and digital marketing. The platforms that offer professional courses, such as Coursera, LinkedIn Learning, and Skillshare, are addressing this demand, preparing students with employment-ready skills. Schemes such as the Skill India Mission initiated by the government are also encouraging individuals to acquire vocational skills by pursuing online education. With the expansion of the gig economy and rising demand for remote work opportunities, skill-based online learning is more critical to facilitate career progression and ensure employability in a constantly evolving workplace environment, thereby influencing the India online education market outlook.

India Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, K-12 education), corporate (large enterprises, SMBs), and government.

Provider Insights:

- Content

- Services

The report has provided a detailed breakup and analysis of the market based on the provider. This includes content, and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

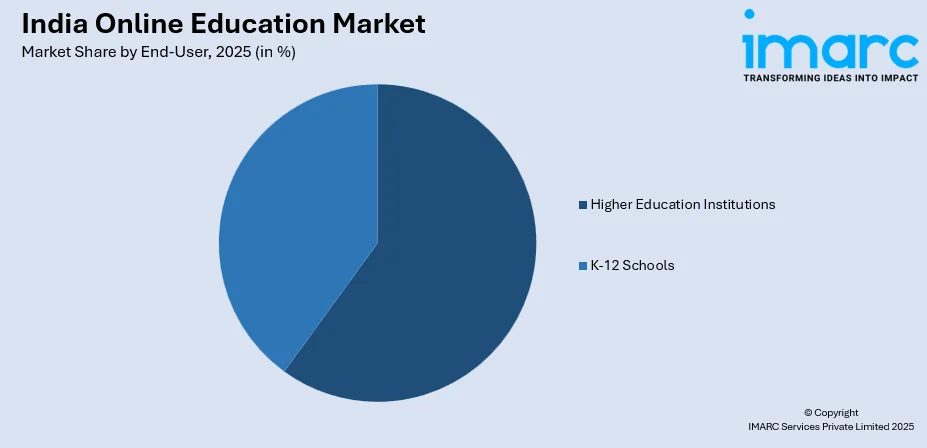

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions, and K-12 schools.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Online Education Market News:

- In September 2024, Vedantu, a prominent online education platform in India, has secured INR 19.25 crore (around $2.4 million) in a new funding round that includes both debt and equity. This action demonstrates Vedantu's calculated strategy for overcoming the obstacles the Indian edtech industry faces and setting itself up for long-term success.

India Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online education market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online education market in India was valued at USD 3.6 Billion in 2025.

The India online education market is projected to exhibit a CAGR of 23.28% during 2026-2034, reaching a value of USD 23.9 Billion by 2034.

Key factors driving the India online education market include increased internet penetration, growing smartphone usage, the demand for flexible learning, affordable education, and the rise of skill-based courses. Additionally, the shift towards digital learning due to the COVID-19 pandemic and the need for upskilling contribute significantly.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)