India Online Pharmacy Market Size, Share, Trends and Forecast by Medicine Type, Platform Type, Product Type, and Region, 2026-2034

India Online Pharmacy Market Summary:

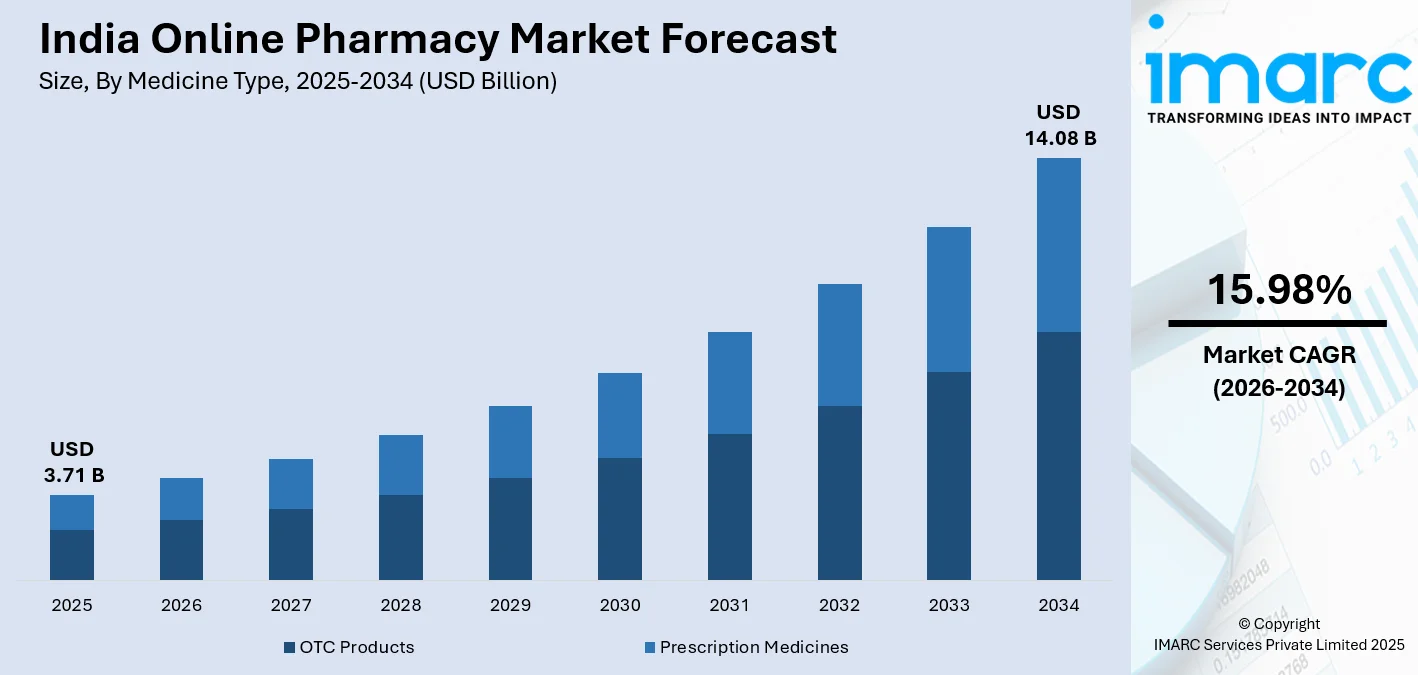

The India online pharmacy market size was valued at USD 3.71 Billion in 2025 and is projected to reach USD 14.08 Billion by 2034, growing at a compound annual growth rate of 15.98% from 2026-2034.

The India online pharmacy market is growing at a considerable pace due to growing acceptance of online services in urban as well as rural areas, increasing number of people affected by chronic diseases, and demand among consumers for effortless home delivery services of pharmaceuticals. The increasingly rapid growth of smartphone usage, enhanced internet connectivity, and increasing government support for online healthcare initiatives are inducing customers to shift from offline stores, enhancing India online pharmacy market share.

Key Takeaways and Insights:

- By Medicine Type: OTC products dominate the market with a share of 56% in 2025, driven by growing consumer emphasis on self-medication for minor ailments, increasing health consciousness, and preference for convenient access to wellness supplements and preventive care products without prescription requirements.

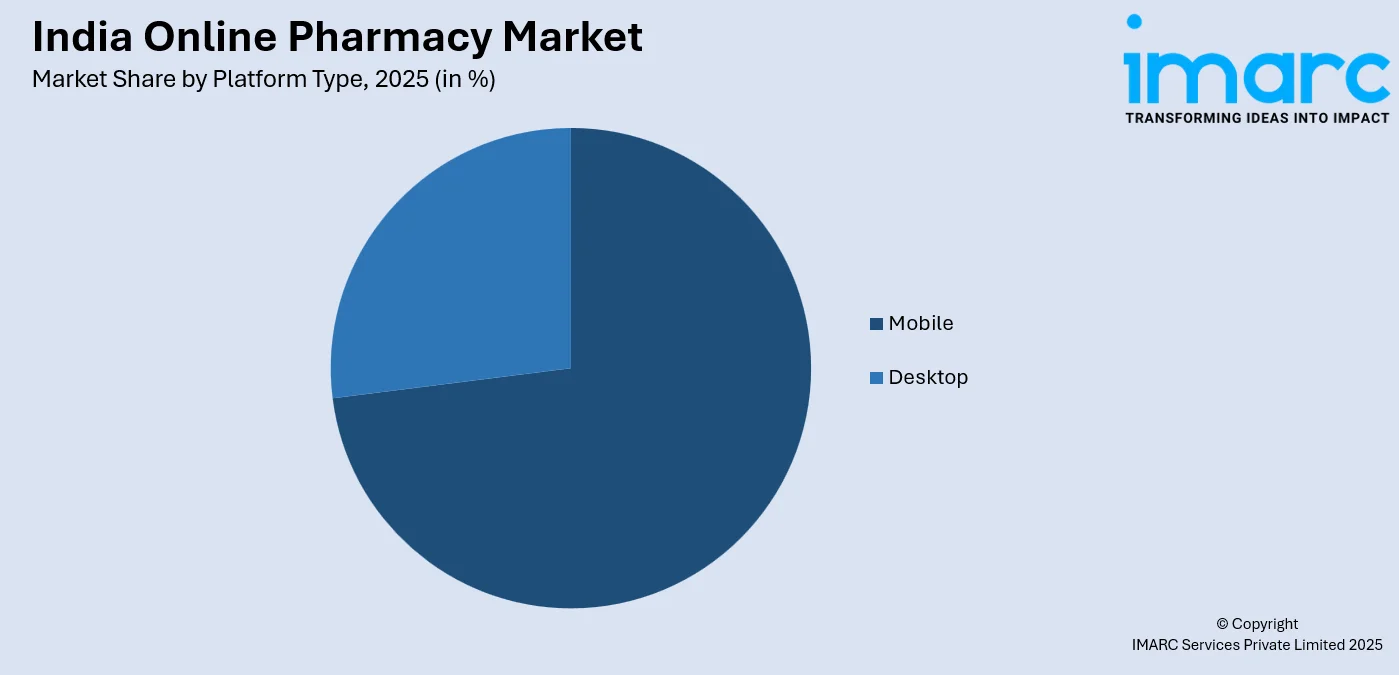

- By Platform Type: Mobile leads the market with a share of 73% in 2025, attributed to widespread smartphone adoption, user-friendly mobile applications offering seamless ordering experiences, and the convenience of accessing healthcare services through handheld devices anytime and anywhere.

- By Region: North India represents the largest segment with a market share of 30% in 2025, owing to high population density in metropolitan areas like Delhi and NCR, established logistics infrastructure, and significant concentration of digitally savvy consumers embracing online healthcare solutions.

- Key Players: The India online pharmacy market features moderate competitive intensity, with established pharmacy chains competing alongside technology-driven startups across various segments, focusing on geographic expansion, faster delivery capabilities, and integrated telemedicine offerings to strengthen market positioning.

To get more information on this market Request Sample

The India online pharmacy sector has emerged as a transformative force in healthcare delivery, fundamentally changing how consumers access medications and wellness products. In September 2025, industry leaders including major e-pharmacy platforms urged the government to frame clearer and fairer regulations for digital drug distribution to protect patient safety and build trust in online medicine sales, highlighting the need for balanced regulatory clarity. The integration of digital technology with pharmaceutical services has enabled platforms to offer comprehensive healthcare solutions including e-prescription management, automatic refill reminders, teleconsultation services, and doorstep delivery. Urban consumers particularly benefit from the convenience of bypassing traditional pharmacy queues while accessing a wider product selection at competitive prices. The sector continues to attract significant investment as platforms expand into tier two and tier three cities, establishing robust logistics networks to ensure timely medicine delivery even in underserved regions where physical pharmacy infrastructure remains limited.

India Online Pharmacy Market Trends:

Rising Integration of Telemedicine Services

The convergence of telemedicine capabilities with online pharmacy platforms represents a significant evolutionary trend reshaping the healthcare delivery landscape across India. In June 2025, major players like Amazon India expanded their healthcare ecosystem by integrating virtual consultations and at-home diagnostics with their pharmacy services, offering customers seamless access to lab tests, telemedicine consultations, and medicine orders through a single app interface, underscoring how digital health platforms are evolving into comprehensive care providers. Digital pharmacy platforms are increasingly bundling virtual doctor consultations with medicine ordering services, enabling patients to receive medical advice and prescriptions without visiting healthcare facilities physically.

Expansion of Quick Commerce in Medicine Delivery

The emergence of rapid delivery models promising medicine delivery within minutes represents a transformative trend gaining momentum in metropolitan markets. In 2025, quick-commerce platform Blinkit began piloting 10-minute prescription medicine deliveries in select areas of Bengaluru, offering a range of essential drugs including antibiotics and diabetes medications with ultra-fast fulfilment, highlighting how logistics innovations are being adapted specifically for healthcare needs. Online pharmacy platforms are establishing hyperlocal fulfillment centers and micro-warehouses strategically positioned across urban areas to enable swift order fulfillment.

Growing Focus on Rural Market Penetration

Online pharmacy platforms are increasingly directing expansion strategies toward rural and semi-urban markets where traditional pharmacy access remains limited. In 2025, EMedix Smart Pharmacy, a dual model franchise combining physical stores with digital pharmacy services, announced plans to accelerate its network expansion beyond Bihar and Jharkhand into neighboring states, aiming to ensure doorstep delivery of authentic medicines even in smaller towns and rural districts previously underserved by digital healthcare. Digital health initiatives supported by vernacular language interfaces, cash-on-delivery options, and simplified ordering processes are enabling platform adoption among populations previously underserved by formal healthcare retail channels.

Market Outlook 2026-2034:

The India online pharmacy market demonstrates a promising growth trajectory underpinned by evolving consumer healthcare preferences and ongoing digital infrastructure development nationwide. The alignment of favorable demographic dynamics, increasing chronic disease burden, and growing consumer confidence in digital healthcare platforms positions the sector for sustained expansion throughout the forecast period. Continued platform investments in advanced technologies, streamlined logistics networks, and diversified service portfolios are anticipated to enhance competitive strengths while elevating overall customer experience and driving long-term market penetration across urban and rural regions. The market generated a revenue of USD 3.71 Billion in 2025 and is projected to reach a revenue of USD 14.08 Billion by 2034, growing at a compound annual growth rate of 15.98% from 2026-2034.

India Online Pharmacy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Medicine Type |

OTC Products |

56% |

|

Platform Type |

Mobile |

73% |

|

Region |

North India |

30% |

Medicine Type Insights:

- OTC Products

- Prescription Medicines

The OTC products dominate with a market share of 56% of the total India online pharmacy market in 2025.

The over-the-counter products category has established clear market leadership driven by increasing consumer preference for self-medication addressing common ailments including cold and flu symptoms, pain relief, digestive issues, and skincare concerns. Online platforms provide consumers with convenient access to extensive OTC product selections encompassing analgesics, vitamins, nutritional supplements, and personal care items without requiring prescription documentation. The growing emphasis on preventive healthcare and wellness maintenance has accelerated demand for immunity boosters, dietary supplements, and health monitoring products available through digital pharmacy channels.

The accessibility advantages offered by online platforms have particularly benefited consumers seeking specialized OTC formulations that may not be readily available at neighborhood pharmacies. Digital marketplaces enable comparison shopping across multiple brands and formulations, empowering consumers to make informed purchasing decisions based on product specifications, pricing, and customer reviews. The subscription-based ordering models increasingly offered by platforms ensure regular supply of frequently consumed wellness products while providing cost savings through bundled pricing and loyalty rewards.

Platform Type Insights:

Access the comprehensive market breakdown Request Sample

- Mobile

- Desktop

The mobile leads with a share of 73% of the total India online pharmacy market in 2025.

Mobile platforms have emerged as the predominant channel for online pharmacy transactions, reflecting broader consumer technology preferences and the convenience advantages of smartphone-based healthcare access. In September 2025, online pharmacy PlatinumRx raised $6 million in funding to enhance its technology and expand mobile app capabilities, underscoring investor confidence in app-driven pharmacy services as a core part of India’s digital healthcare ecosystem. Purpose-built mobile applications offer intuitive user interfaces enabling seamless medicine ordering, prescription uploading, order tracking, and delivery scheduling through touchscreen navigation optimized for handheld devices.

The proliferation of affordable smartphones combined with expanding mobile internet coverage has democratized access to digital pharmacy services across diverse demographic segments and geographic regions. Mobile applications increasingly incorporate advanced features including voice search capabilities, image-based prescription uploads, and vernacular language support to accommodate users with varying digital literacy levels. Integration with digital payment ecosystems enables secure transactions through multiple payment methods including mobile wallets, UPI transfers, and card payments.

Product Type Insights:

- Medication

- Health Wellness and Nutrition

- Personal Care and Essentials

- Others

Medication forms the foundational category in India's online pharmacy market, encompassing both prescription and over-the-counter drugs addressing diverse therapeutic needs. Consumers increasingly prefer digital platforms for purchasing routine medications, chronic disease treatments, and acute care products, benefiting from convenient doorstep delivery, competitive pricing, and authentic product assurance through licensed pharmacy networks.

Health wellness and nutrition products have gained significant traction as consumers prioritize preventive healthcare and holistic wellbeing. This segment includes vitamins, dietary supplements, immunity boosters, protein powders, and herbal formulations. Growing health consciousness, fitness awareness, and emphasis on lifestyle management drive sustained demand through online pharmacy channels offering extensive product variety and expert guidance.

Personal care and essentials encompass skincare products, hygiene items, oral care, baby care, and grooming products available through online pharmacy platforms. Urban consumers particularly favor digital channels for accessing premium personal care brands, dermatologist-recommended formulations, and specialized products that may not be readily available at traditional neighborhood pharmacies and retail outlets.

The others segment comprises medical devices, diagnostic equipment, healthcare accessories, and specialized products catering to specific consumer needs. This category includes blood pressure monitors, glucometers, nebulizers, orthopedic supports, and first-aid supplies. Growing home healthcare adoption and self-monitoring trends continue driving demand for these ancillary healthcare products through digital pharmacy platforms.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 30% share of the total India online pharmacy market in 2025.

North India has established market leadership driven by the substantial consumer base concentrated in metropolitan areas including Delhi, National Capital Region, and surrounding urban centers. The region benefits from well-developed logistics infrastructure supporting efficient medicine delivery operations and established presence of major e-commerce platforms with pharmacy verticals. High smartphone penetration and internet connectivity in urban North India have created favorable conditions for digital pharmacy adoption among tech-savvy consumer populations seeking healthcare convenience.

The demographic concentration in North India includes substantial populations managing chronic health conditions requiring regular medication, driving consistent demand for prescription and OTC products through online channels. Platform investments in same-day and express delivery capabilities have proven particularly effective in densely populated urban markets where competitive differentiation increasingly depends on delivery speed and reliability. The expansion of hyperlocal fulfillment models has enhanced service responsiveness across the region.

Market Dynamics:

Growth Drivers:

Why is the India Online Pharmacy Market Growing?

Expanding Digital Infrastructure and Internet Penetration

The continuous expansion of digital infrastructure across India has created foundational conditions supporting online pharmacy market growth. Increasing internet penetration driven by affordable data plans and widespread smartphone adoption has connected previously underserved populations to digital healthcare services. In 2025, pharmacy tech startup Acintyo Local announced a pan‑India expansion of its B2B2C digital medicine delivery ecosystem, partnering with Health & Beauty Franchises (HBF) to help over 8 lakh local chemists go digital and connect to customers online, illustrating how digital platforms are empowering smaller healthcare retailers to participate in India’s growing digital health infrastructure. The government's Digital India initiative has accelerated connectivity improvements in rural and semi-urban areas, expanding the addressable market for online pharmacy platforms beyond metropolitan boundaries.

Rising Chronic Disease Prevalence and Healthcare Awareness

The escalating burden of chronic diseases including diabetes, hypertension, cardiovascular conditions, and respiratory ailments has generated sustained demand for regular medication requiring convenient procurement channels. In May 2025, Medkart Pharmacy launched an online platform that lets users compare prices of branded drugs with their bioequivalent generics, making it easier for chronic patients to find affordable alternatives and manage long‑term treatment costs digitally. Online pharmacy platforms address chronic disease management needs through features including automatic refill scheduling, medication reminders, and subscription-based ordering ensuring uninterrupted medicine supply. The growing population requiring long-term medication therapy has discovered efficiency advantages in digital pharmacy channels eliminating repeated physical pharmacy visits while maintaining consistent medication adherence.

Convenience Advantages and Service Innovation

The fundamental convenience proposition offered by online pharmacies has proven compelling for diverse consumer segments valuing time efficiency and service accessibility. Doorstep delivery eliminates transportation requirements and waiting times associated with traditional pharmacy visits, proving particularly valuable for elderly patients, working professionals, and individuals managing mobility limitations. Additionally, government efforts like the Ayushman Bharat Digital Mission (ABDM), an initiative to build an integrated digital health ecosystem that includes telemedicine and e‑pharmacy services, are enhancing the digital healthcare landscape by enabling secure, interoperable access to health records, teleconsultations, and online medicine procurement across platforms. The availability of round-the-clock ordering capabilities transcends traditional pharmacy operating hours, enabling medicine procurement whenever health needs arise regardless of time constraints. Service innovations including teleconsultation integration, diagnostic test booking, and health record management have transformed online pharmacy platforms into comprehensive digital health hubs.

Market Restraints:

What Challenges the India Online Pharmacy Market is Facing?

Regulatory Uncertainty and Compliance Complexities

The evolving regulatory framework governing e-pharmacy operations creates compliance challenges and business uncertainty for market participants. The absence of comprehensive national e-pharmacy regulations has resulted in operational ambiguity regarding licensing requirements, prescription verification protocols, and interstate medicine distribution. Stakeholder debates regarding appropriate regulatory approaches continue influencing policy development while creating uncertainty affecting investment decisions.

Competition from Traditional Pharmacy Networks

The extensive network of traditional brick-and-mortar pharmacies across India presents competitive challenges for online platforms seeking market share expansion. Established relationships between local pharmacists and customers, immediate product availability, and personal service interactions provide differentiated value propositions that digital platforms cannot fully replicate. Consumer segments preferring face-to-face interactions and immediate medicine access continue patronizing traditional pharmacy channels.

Data Privacy and Security Concerns

Consumer concerns regarding personal health information privacy and data security present adoption barriers for potential online pharmacy customers. The sensitive nature of medical records and prescription information heightens apprehension regarding digital platform data handling practices. Security breaches affecting e-commerce platforms have increased consumer awareness regarding cyber risks, potentially deterring engagement with online healthcare services.

Competitive Landscape:

The India online pharmacy market exhibits dynamic competitive characteristics with established technology companies, pharmacy chains, and dedicated e-pharmacy startups competing for market leadership. Major players have pursued diverse growth strategies including geographic expansion, service diversification, and strategic partnerships to strengthen competitive positioning. Investments in technology enhancement, logistics infrastructure, and customer acquisition have intensified as platforms compete for market share in rapidly growing segments. The competitive environment has fostered continuous innovation in delivery speed, service offerings, and pricing structures as players seek differentiation advantages. Consolidation activities including mergers and acquisitions have reshaped the competitive landscape while enabling resource combination for enhanced market capabilities. The entry of large e-commerce and technology conglomerates has elevated competitive intensity while bringing substantial capital and operational expertise to the sector.

Recent Developments:

- In August 2025, Quick-commerce platform Zepto has entered India’s online pharmacy market with Zepto Pharmacy, promising delivery of essential medicines within 10 minutes in Mumbai, Bengaluru, Delhi-NCR and Hyderabad. The move expands Zepto’s grocery delivery business into healthcare and heightens competition with players like Tata 1mg and PharmEasy.

India Online Pharmacy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Medicine Types Covered | OTC Products, Prescription Medicine |

| Platform Types Covered | Mobile, Desktop |

| Product Types Covered | Medication, Health Wellness and Nutrition, Personal Care and Essentials, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India online pharmacy market size was valued at USD 3.71 Billion in 2025.

The India online pharmacy market is expected to grow at a compound annual growth rate of 15.98% from 2026-2034 to reach USD 14.08 Billion by 2034.

The OTC products segment held the largest market share of 56%, driven by growing consumer preference for self-medication, increasing health consciousness, and convenient access to wellness supplements and preventive care products through digital platforms.

Key factors driving the India online pharmacy market include expanding digital infrastructure and internet penetration, rising chronic disease prevalence requiring regular medication, growing healthcare awareness, and convenience advantages offered by doorstep delivery and integrated healthcare services.

Major challenges include regulatory uncertainty and evolving compliance requirements, competition from established traditional pharmacy networks, data privacy and security concerns among consumers, logistics complexities in reaching remote areas, and building consumer trust in online medication procurement channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)