India Optical Transceiver Market Size, Share, Trends and Forecast by Form Factor, Fiber Type, Data Rate, Connector Type, Application, and Region, 2026-2034

Market Overview:

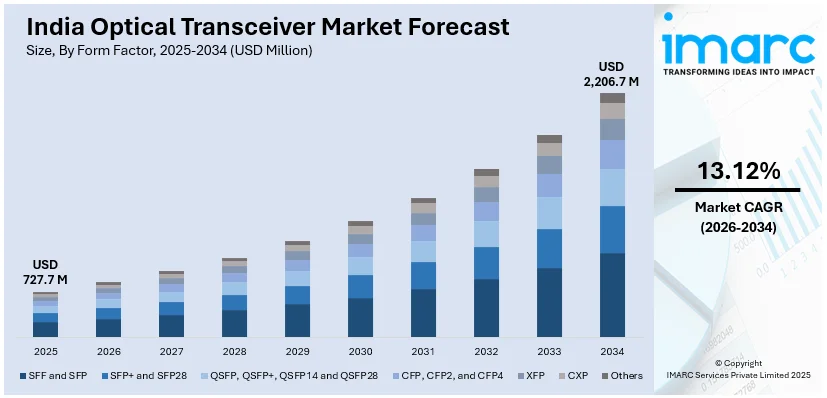

India optical transceiver market size reached USD 727.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,206.7 Million by 2034, exhibiting a growth rate (CAGR) of 13.12% during 2026-2034. The expanding telecommunications industry, along with the growing demand for 5G wireless technology to provide new services to high-speed optical networks, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 727.7 Million |

|

Market Forecast in 2034

|

USD 2,206.7 Million |

| Market Growth Rate 2026-2034 | 13.12% |

An optical transceiver functions as a module within an optic-fiber network, facilitating the transmission and reception of data. Its operation involves the conversion of electrical signals into light signals through the collaboration of a transmitter and a receiver. Optical transceivers come in diverse shapes and sizes, allowing for easy integration by plugging or embedding into various network devices. Compatibility extends to different electrical and optical interfaces, emphasizing high performance and durability. The design of optical transceivers aims to streamline wavelength management and address challenges related to fiber exhaustion. The flexibility of optical transceivers is evident in their ease of replacement or repair without requiring a power-down. They serve as crucial interfaces between networking devices like switches, repeaters, routers, multiplexers, and the cables connecting them. The global demand for optical transceivers is on the rise due to their adaptability, scalability, and cost-effectiveness, making them a preferred choice in optic-fiber networks.

To get more information on this market Request Sample

India Optical Transceiver Market Trends:

The optical transceiver market in India is witnessing substantial growth and adoption, underscoring the increasing importance of optic-fiber networks in the country's evolving telecommunications infrastructure. Moreover, available in a variety of shapes and sizes, optical transceivers in India are designed for easy integration, allowing them to be plugged or embedded into diverse network devices. Additionally, their compatibility spans various electrical and optical interfaces, emphasizing not only high performance but also robustness to meet the demands of India's expanding digital landscape. A notable feature of optical transceivers contributing to their popularity in the Indian market is their flexibility in wavelength management and their ability to address challenges related to fiber exhaustion. Besides this, as the country experiences a surge in data consumption and an increasing need for high-speed connectivity, optical transceivers serve as vital components in meeting these demands. Besides this, the demand for optical transceivers in India is propelled by their flexibility, scalability, and affordability, making them indispensable in the development and enhancement of optic-fiber-based communication systems across the nation. As India continues to embrace digital transformation, the optical transceiver market is expected to bolster over the forecasted period.

India Optical Transceiver Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on form factor, fiber type, data rate, connector type, and application.

Form Factor Insights:

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP14 and QSFP28

- CFP, CFP2, and CFP4

- XFP

- CXP

- Others

The report has provided a detailed breakup and analysis of the market based on the form factor. This includes SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, and others.

Fiber Type Insights:

- Single Mode Fiber

- Multimode Fiber

A detailed breakup and analysis of the market based on the fiber type have also been provided in the report. This includes single mode fiber and multimode fiber.

Data Rate Insights:

- Less Than 10 Gbps

- 10 Gbps To 40 Gbps

- 40 Gbps To 100 Gbps

- More Than 100 Gbps

The report has provided a detailed breakup and analysis of the market based on the data rate. This includes less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and more than 100 Gbps.

Connector Type Insights:

- LC Connector

- SC Connector

- MPO Connector

- RJ-45

A detailed breakup and analysis of the market based on the connector type have also been provided in the report. This includes LC connector, SC connector, MPO connector, and RJ-45.

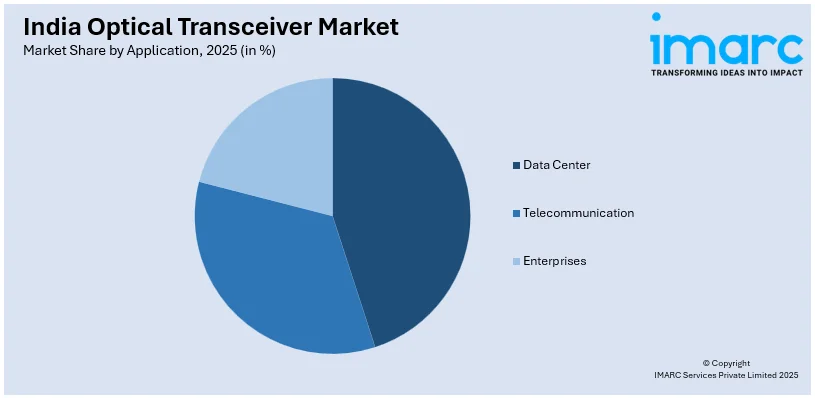

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Data Center

- Telecommunication

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the application. This includes data center, telecommunication, and enterprises.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Optical Transceiver Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Form Factors Covered | SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, Others |

| Fiber Types Covered | Single Mode Fiber, Multimode Fiber |

| Data Rates Covered | Less Than 10 Gbps, 10 Gbps To 40 Gbps, 40 Gbps To 100 Gbps, More Than 100 Gbps |

| Connector Types Covered | LC Connector, SC Connector, MPO Connector, RJ-45 |

| Applications Covered | Data Center, Telecommunication, Enterprises |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India optical transceiver market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India optical transceiver market?

- What is the breakup of the India optical transceiver market on the basis of form factor?

- What is the breakup of the India optical transceiver market on the basis of fiber type?

- What is the breakup of the India optical transceiver market on the basis of data rate?

- What is the breakup of the India optical transceiver market on the basis of connector type?

- What is the breakup of the India optical transceiver market on the basis of application?

- What are the various stages in the value chain of the India optical transceiver market?

- What are the key driving factors and challenges in the India optical transceiver?

- What is the structure of the India optical transceiver market and who are the key players?

- What is the degree of competition in the India optical transceiver market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India optical transceiver market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India optical transceiver market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India optical transceiver industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)