India Organic Beverages Market Size, Share, Trends, and Forecast by Product, Distribution Channel, and Region, 2025-2033

India Organic Beverages Market Overview:

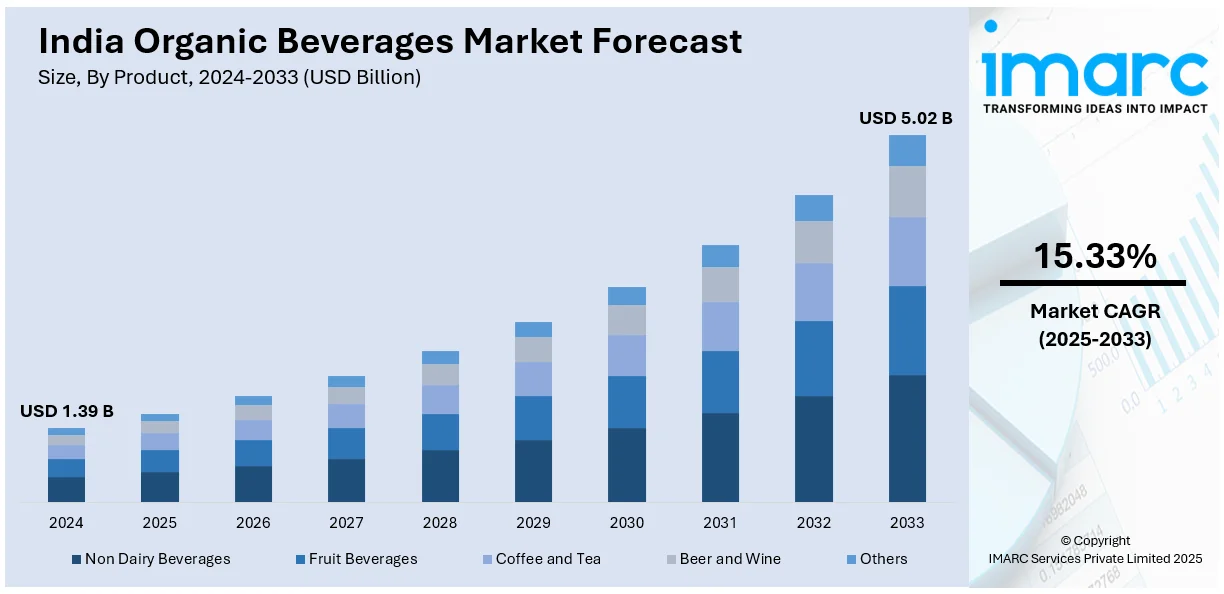

The India organic beverages market size reached USD 1.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.02 Billion by 2033, exhibiting a growth rate (CAGR) of 15.33% during 2025-2033. The market is expanding due to rising health awareness, increasing disposable income, and a growing preference for clean-label products. The demand for organic tea, coffee, and juices is surging, driven by urbanization, e-commerce growth, and government support for organic farming.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.39 Billion |

| Market Forecast in 2033 | USD 5.02 Billion |

| Market Growth Rate 2025-2033 | 15.33% |

India Organic Beverages Market Trends:

Rising Consumer Preference for Health and Wellness Products

The heightening awareness of health and wellness is significantly influencing the need for organic beverages in India. Consumers are increasingly prioritizing natural, chemical-free, and nutrient-rich products, driving the shift toward organic tea, coffee, and juices. This trend is particularly strong among urban populations, where concerns over synthetic additives, pesticides, and preservatives have led to a preference for clean-label alternatives. Organic green tea and herbal infusions are experiencing high demand due to their perceived benefits in immunity enhancement and stress reduction. The expansion of modern retail channels and e-commerce platforms has further facilitated accessibility to organic beverages, allowing brands to reach a broader audience. For instance, as per industry reports, e-commerce retail sector in India has a valuation of USD 83 Billion. In line with this, e-commerce accounts for 8% of the Indian retail segment in the year 2024. Additionally, endorsements by health professionals and influencers, along with transparent labeling and certifications such as India Organic and FSSAI compliance, are reinforcing consumer trust. As a result, organic beverage brands are investing in product innovation and expanding portfolios to cater to evolving consumer preferences.

To get more information on this market, Request Sample

Government Support and Expansion of Organic Farming

The Indian government’s initiatives to promote organic agriculture are playing a notable role in shaping the organic beverages market. Policies such as NPOP and PKVY are encouraging farmers to opt for organic practices, increasing the availability of certified organic raw materials for beverage manufacturers. Additionally, state governments are providing incentives for organic farming clusters, improving supply chain efficiency. The growing number of organic certification bodies and streamlined regulatory frameworks are enhancing consumer confidence in product authenticity. With sustainability becoming a key priority, major beverage brands are aligning with government efforts by sourcing locally grown organic ingredients and investing in sustainable packaging solutions. This synergy between policy support and industry initiatives is not only boosting domestic consumption but also fortifying India’s position in the organic beverage market globally, driving exports to regions with high demand for organic products. For instance, as per industry reports, around 1,764,677 hectares of land dedicated to organic farming, with 3,627,115 hectares being transformed for organic agriculture. In parallel, as of 2025, organic products exports of India stand at USD 573.3 Million.

India Organic Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Non Dairy Beverages

- Fruit Beverages

- Coffee and Tea

- Beer and Wine

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes non dairy beverages, fruit beverages, coffee and tea, beer and wine, and others.

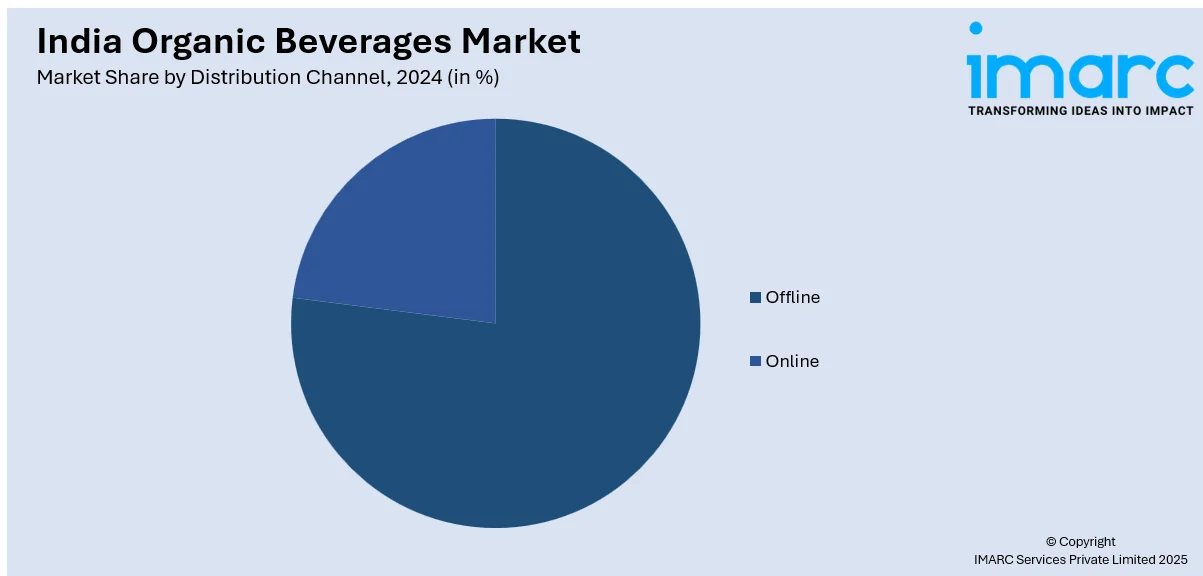

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Beverages Market News:

- In January 2024, TATA Consumer Products announced acquisition of Organic India, aiding in strengthening its presence across herbal supplements and organic food and beverages sector.

- In November 2023, Coco Cola formed a collaboration with Luxmi Group's Makaibari Tea Estate to introduce its iced green tea, a ready-to-drink beverage. This product is made of organic green tea, especially sourced from Makaibari and is offered under the brand Honest Tea.

India Organic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non Dairy Beverages, Fruit Beverages, Coffee and Tea, Beer and Wine, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic beverages market in India was valued at USD 1.39 Billion in 2024.

The India organic beverages market is projected to exhibit a CAGR of 15.33% during 2025-2033, reaching a value of USD 5.02 Billion by 2033.

The increasing health and wellness awareness, rising disposable incomes, supportive government initiatives for organic farming, expansion of distribution channels (supermarkets, specialty stores, online), sustainability and environmental concerns, innovation in product formulations (functional, botanical, probiotic drinks), and premiumization trends fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)