India Organic Dairy Products Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2026-2034

India Organic Dairy Products Market Overview:

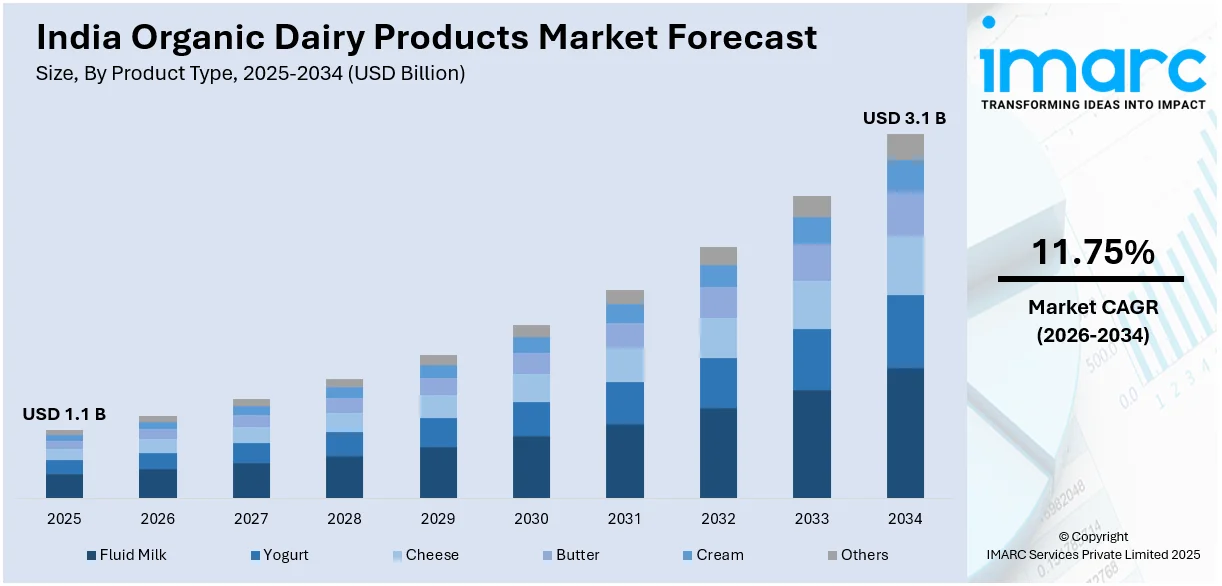

The India organic dairy products market size reached USD 1.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.1 Billion by 2034, exhibiting a growth rate (CAGR) of 11.75% during 2026-2034. The market is experiencing steady growth, fueled by growing consumer health awareness, higher disposable incomes, and a trend towards chemical-free and sustainable food options, with major players diversifying product ranges and distribution networks to meet the expanding demand for organic milk, ghee, butter, and other dairy foods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.1 Billion |

| Market Forecast in 2034 | USD 3.1 Billion |

| Market Growth Rate 2026-2034 | 11.75% |

India Organic Dairy Products Market Trends:

Growing Health Consciousness Driving Organic Dairy Demand

India's organic dairy sector is growing strong with more and more health-conscious consumers choosing natural and wholesome products. As people become increasingly aware of the advantages of organic dairy, like the absence of synthetic additives, hormones, and antibiotics, organic milk, yogurt, butter, and cheese are finding greater appeal. For instance, in December 2024, Mother Dairy ventured into the market of organic products, launching more than 20 new products such as ready-to-eat (RTE) custards, cold coffee, cookies, and organic staples with Bharat Organics. Moreover, the escalation in lifestyle-linked diseases, like, diabetes, obesity, and cardiovascular ailments, has only boosted demand. Organic dairy foods tend to be viewed as healthier and safer because of their natural processing and nutrient-dense profile. Furthermore, the shift towards overall wellness and immunity-enhancing foods after the pandemic has fortified the organic dairy market. Companies are also informing consumers through campaigns and transparent labeling, reiterating the health advantages of organic products. This change in the behavior of consumers is not merely fueling expansion but also innovation and growth in India's organic dairy market, creating abundant opportunities for the industry players.

To get more information on this market Request Sample

Clean Label Movement Boosts Organic Dairy Sales

The clean label revolution, highlighting clarity and nature-driven ingredients, is on the upsurge in India, most notably within organic dairy products. Customers pay growing attention to reading product labels and prefer offerings containing fewer ingredients that do not use artificial additives, preservatives, or chemicals. Organic dairy players are therefore refocusing attention towards clearly signifying certifications like USDA Organic and India Organic on packages. By becoming transparent, there is creation of trust coupled with appeals from wellness-focused as well as sustainability-mindful buyers. The clean label trend is also propelling demand for products with ethical and sustainable sourcing practices, such as grass-fed and cruelty-free certifications. For example, in November 2024, MorningWale, diversified its line of organic dairy products with the launch of chemical-free milk, desi cow ghee, and artisanal dairy products, focusing on sustainability and promoting ethical dairy farming practices. Additionally, brands are distinguishing themselves by providing organic dairy products that fit these requirements, achieving a competitive advantage in the market. As Indian consumers become increasingly label-conscious, the trend towards clean labels is likely to continue to be a top driver of the organic dairy segment, both in terms of purchase behavior and brand affinity.

E-Commerce Expands Market Reach for Organic Dairy Products

The swift growth of e-commerce websites in India has increased the business of organic dairy. With the boosting demand for online shopping, health-sensitive consumers are now preferring digital mediums to buy organic dairy products in large quantities. Doorstep delivery is provided by e-commerce, it has greater variety in products, and there is easy access to product details as well as reviews. This trend is especially prevalent among urban consumers who appreciate premium, organic products and enjoy the convenience of shopping online. Large e-commerce players as well as specialty organic and grocery delivery platforms are accelerating their organic dairy offerings, including products such as organic milk, cheese, yogurt, and butter. Furthermore, brands are leveraging digital channels to inform consumers about the value of organic dairy, driving brand awareness and consumer interaction. With digital adoption on the upswing, e-commerce will be an important channel for distribution of organic dairy items in India.

India Organic Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, packaging type, and distribution channel.

Product Type Insights:

- Fluid Milk

- Yogurt

- Cheese

- Butter

- Cream

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fluid milk, yogurt, cheese, butter, cream, and others.

Packaging Type Insights:

- Pouches

- Tetra-Packs

- Bottles

- Cans

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes pouches, tetra-packs, bottles, cans, and others.

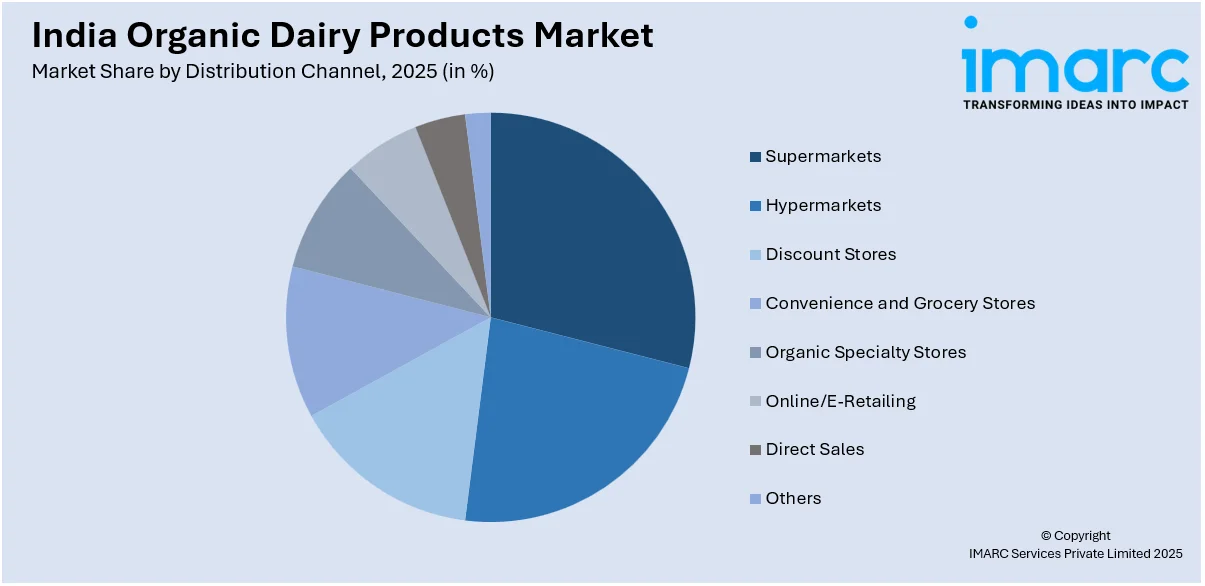

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets

- Hypermarkets

- Discount Stores

- Convenience and Grocery Stores

- Organic Specialty Stores

- Online/E-Retailing

- Direct Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets, hypermarkets, discount stores, convenience and grocery stores, organic specialty stores, online/e-retailing, direct sales, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Dairy Products Market News:

- In September 2024, HariBol Dairy Pvt. Ltd. introduced new organic dairy brands, such as pure ghee, organic paneer, and probiotic yogurt, at World Food India. With an emphasis on quality, sustainability, and rural development, HariBol presented its innovative products to industry stakeholders and consumers, reinforcing its market presence in India's organic dairy industry.

India Organic Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fluid Milk, Yogurt, Cheese, Butter, Cream, Others |

| Packaging Types Covered | Pouches, Tetra-Packs, Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discount Stores, Convenience and Grocery Stores, Organic Specialty Stores, Online/E-Retailing, Direct Sales, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic dairy products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic dairy products market in India was valued at USD 1.1 Billion in 2025.

The India organic dairy products market is projected to exhibit a CAGR of 11.75% during 2026-2034, reaching a value of USD 3.1 Billion by 2034.

The India organic dairy products market is driven by rising health awareness, increasing preference for chemical-free and natural food, and growing disposable incomes. Demand is further supported by expanding urbanization, changing dietary habits, and a shift toward sustainable and ethically produced dairy alternatives among health-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)