India Organic Personal Care Products Market Size, Share, Trends and Forecast by Product Type, Sales Channel, and Region, 2025-2033

India Organic Personal Care Products Market Size and Share:

The India Organic Personal Care Products market size reached USD 1.03 Billion in 2024. The market is expected to reach USD 2.87 Billion by 2033, exhibiting a growth rate (CAGR) of 11.21% during 2025-2033. The market growth is attributed to growing preference for sustainable, environment-friendly products, with companies focusing on biodegradable packaging, cruelty-free practices, and transparency, while the rising number of e-commerce channels enhance product availability, especially in smaller towns and rural areas.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into skin care, bath and shower products, color cosmetic products, and perfumes and deodorants.

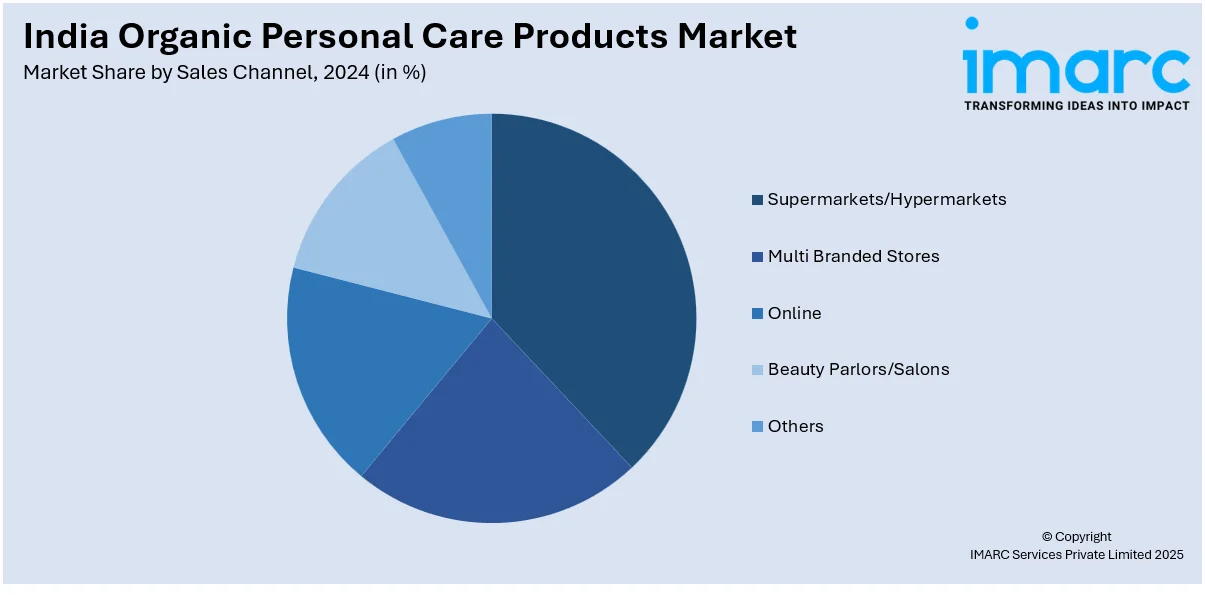

- On the basis of sales channel, the market has been divided into supermarkets/hypermarkets, multi branded stores, online, beauty parlors/salons, and others.

Market Size and Forecast:

- 2024 Market Size: USD 1.03 Billion

- 2033 Projected Market Size: USD 2.87 Billion

- CAGR (2025-2033): 11.21%

India Organic Personal Care Products Market Trends:

Increase Focus on Sustainable and Eco-Friendly Practices

With sustainability emerging as a vital trend, many people are prioritizing environmentally responsible choices in their personal care routines. This growing demand for eco-friendly products extends beyond just the ingredients to include packaging, production methods, and the overall environmental impact. Organic personal care companies are reacting by utilizing biodegradable or recyclable packaging, minimizing waste, and emphasizing cruelty-free methods to satisfy user demands. Furthermore, the environmentally aware individuals in India aims support brands that are transparent about their environmental footprint, ranging from the sourcing of raw materials to manufacturing processes. In addition, the rise of "green beauty" involves not only safer, healthier skin ingredients but also a wider dedication to sustainability. This movement towards sustainable utilization is catalyzing the demand for organic personal care products, as individuals progressively aim to match their buying choices with their principles of safeguarding the environment. A prime example of this trend is TERRA, a premium eco-conscious brand that launched its biodegradable and organic personal care products in India in 2023. Known for its biodegradable baby wipes made with pure New Zealand waters, the brand emphasized sustainability and safety with certifications from prestigious organizations. TERRA aimed to offer toxin-free, eco-friendly products for all age groups while promoting conscious living.

.webp)

To get more information on this market, Request Sample

Availability of E-commerce and Online Marketplaces

The rising number of e-commerce platforms in India is essential in propelling the market for organic personal care items. As online shopping is becoming more popular, shoppers easily access a diverse range of organic products that might not be found in nearby shops or local markets. E-commerce leaders and niche organic beauty sites provide a wide array of products, enabling buyers to browse various brands, compare costs, evaluate reviews, and make knowledgeable buying choices. The clarity offered by these platforms, including comprehensive ingredient lists and product details, is enabling organic personal care brands to achieve considerable growth. Online marketplaces are creating direct-to-consumer (D2C) routes, enabling smaller, emerging organic brands to connect with a wider audience that they may not have accessed via conventional retail strategies. This digital transition is broadening access to organic personal care items, increasing their popularity and making them more obtainable for a variety of consumers, particularly in smaller communities and rural regions. According to the India Brand Equity Foundation (IBEF), the D2C market of India is expected to attain US$ 60 billion by FY27. Additionally, the Indian e-commerce sector is expected to expand to US$ 325 billion by 2030, further bolstering the availability of organic personal care products online.

Green Beauty Revolution and Digital Commerce Expansion

As per the India organic personal care products market analysis, the market is experiencing a transformative wave driven by the green beauty movement, where eco-conscious products with biodegradable packaging and cruelty-free practices are becoming mainstream consumer expectations. This revolution extends beyond ingredient consciousness to encompass comprehensive sustainability practices, including ethical sourcing, carbon footprint reduction, and circular economy principles. Simultaneously, the explosive growth of direct-to-consumer (D2C) brands and e-commerce platforms is revolutionizing market accessibility, bringing organic personal care products to smaller towns and rural areas previously underserved by traditional retail channels, thereby augmenting the India organic personal care products market share. Leading platforms like Amazon, Flipkart, and Nykaa are deploying AI-driven recommendation engines and subscription models to enhance customer engagement, while specialized organic beauty websites are providing detailed ingredient transparency and educational content. The convergence of sustainability consciousness and digital accessibility is creating unprecedented growth opportunities, with the D2C market projected to reach USD 60 billion by FY27. Major organic brands and emerging players are leveraging these trends by combining eco-friendly formulations with robust online presence and direct customer engagement strategies that resonate with environmentally conscious consumers seeking authentic, sustainable beauty solutions, which is raising the India organic personal care products market demand.

Ayurveda-Modern Science Integration and Sustainable Product Innovation

The Indian organic personal care industry is witnessing remarkable innovation through the strategic blending of traditional Ayurvedic wisdom with modern scientific research, creating products that honor India's rich heritage while meeting contemporary consumer expectations for efficacy and safety. This integration manifests in new launches featuring time-tested ingredients like turmeric, neem, aloe vera, and sandalwood, enhanced through advanced extraction technologies and clinical validation processes. Companies are expanding into sustainable categories with biodegradable wipes, bamboo-based products, and organic hygiene solutions that address growing environmental consciousness. The market is experiencing significant diversification beyond traditional skincare and haircare into specialized segments including organic oral care, deodorants, and intimate hygiene products, which is fueling the India organic personal care products market growth. Innovative packaging solutions using plant-based materials, refillable containers, and minimal waste designs are becoming standard industry practices. Research and development investments are focusing on sustainable ingredient sourcing partnerships with local farmers, ensuring authenticity while supporting rural communities. This approach creates products that not only deliver superior performance through scientific validation but also maintain cultural relevance and environmental responsibility, appealing to consumers seeking holistic wellness solutions that align with traditional Indian values while meeting modern lifestyle demands.

Health Consciousness and Transparency-Driven Market Evolution

The organic personal care market in India is being fundamentally reshaped by increasing health consciousness and growing awareness of harmful chemicals present in conventional products, driving consumers toward verified, ingredient-safe, and certified organic alternatives. This health-focused transformation is particularly evident among millennials and Gen Z consumers who actively research product ingredients and demand complete transparency in formulations, sourcing, and manufacturing processes. The demand for third-party certifications from organizations like ECOCERT, USDA Organic, and India Organic has become crucial for building consumer trust and market credibility. Brands are responding by implementing comprehensive transparency initiatives including detailed ingredient disclosure, sourcing story documentation, and sustainability impact reporting. Environmental and sustainability concerns are driving preference for products with minimal environmental impact, cruelty-free testing, and ethical supply chain practices. The growing awareness of issues like skin sensitization, hormonal disruption, and long-term health effects from synthetic chemicals is pushing consumers toward natural alternatives with clean ingredient lists. Companies are investing heavily in educating consumers about the benefits of organic formulations through digital content marketing, influencer partnerships, and scientific research sharing. This transparency-driven evolution is creating competitive advantages for brands that can authentically demonstrate their commitment to health, safety, and environmental stewardship while maintaining product efficacy and accessibility across diverse consumer segments.

Growth, Opportunities, and Challenges in the India Organic Personal Care Products Market:

- Growth Drivers of the India Organic Personal Care Products Market: Rising health consciousness and awareness about harmful chemicals in conventional products are driving consumer preference toward organic alternatives with clean, transparent ingredient lists. The growing influence of social media, beauty influencers, and digital marketing is educating consumers about organic benefits and driving adoption. Government initiatives promoting natural and Ayurvedic products, combined with increasing disposable incomes and urbanization, are creating sustained demand growth across diverse consumer segments.

- Opportunities in the India Organic Personal Care Products Market: Rural market penetration presents significant untapped potential as awareness and disposable incomes increase in smaller towns and villages. Integration of traditional Ayurvedic ingredients with modern formulations offers unique positioning opportunities for Indian brands in both domestic and international markets. The expanding male grooming segment and growing demand for specialized organic products like baby care and intimate hygiene create new market categories with substantial growth potential.

- Challenges in the India Organic Personal Care Products Market: Higher manufacturing costs and premium pricing compared to conventional products limit accessibility and market penetration among price-sensitive consumer segments. Intense competition from established international brands and emerging domestic players creates margin pressure and requires significant marketing investments. Regulatory complexities around organic certification, ingredient compliance, and quality standards pose operational challenges for smaller brands seeking market entry and expansion.

India Organic Personal Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and sales channel.

Product Type Insights:

- Skin Care

- Bath and Shower Products

- Color Cosmetic Products

- Perfumes and Deodorants

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, bath and shower products, color cosmetic products, and perfumes and deodorants.

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Multi Branded Stores

- Online

- Beauty Parlors/Salons

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, multi branded stores, online, beauty parlors/salons, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Personal Care Products Market News:

- January 2025: Jivada, an organic self-care brand, launched a holistic wellness range specifically targeting maturing skin, combining Ayurvedic wisdom with modern science to offer natural, cruelty-free, and toxin-free products. This launch reflects the growing trend of brands integrating traditional Indian remedies with contemporary skincare technology to address specific demographic needs.

- March 2024: The Organic World (TOW) expanded its personal care and hygiene offerings by introducing six new eco-friendly categories, including biodegradable diapers and sanitary pads. The Bengaluru-based retailer planned to add 200 more products over two years and expand across South India through franchising, demonstrating significant investment in sustainable product categories.

India Organic Personal Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Bath and Shower Products, Color Cosmetic Products, Perfumes and Deodorants |

| Sales Channels Covered | Supermarkets/Hypermarkets, Multi Branded Stores, Online, Beauty Parlors/Salons, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic personal care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic personal care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic personal care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India organic personal care products market was valued at USD 1.03 Billion in 2024.

The India organic personal care products market is projected to exhibit a CAGR of 11.21% during 2025-2033, reaching a value of USD 2.87 Billion by 2033.

Rising consumer awareness about natural ingredients, increased disposable incomes, and concerns over chemical-laden products drive India’s organic personal care market. Government support for organic farming, expanding retail distribution, and influencer marketing amplify visibility. Millennials and Gen Z prefer eco-friendly, cruelty-free formulations, while premiumization and urbanization further fuel growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)