India Ortho-Xylene Market Size, Share, Trends and Forecast by Application, End Use, and Region, 2025-2033

India Ortho-Xylene Market Size and Share:

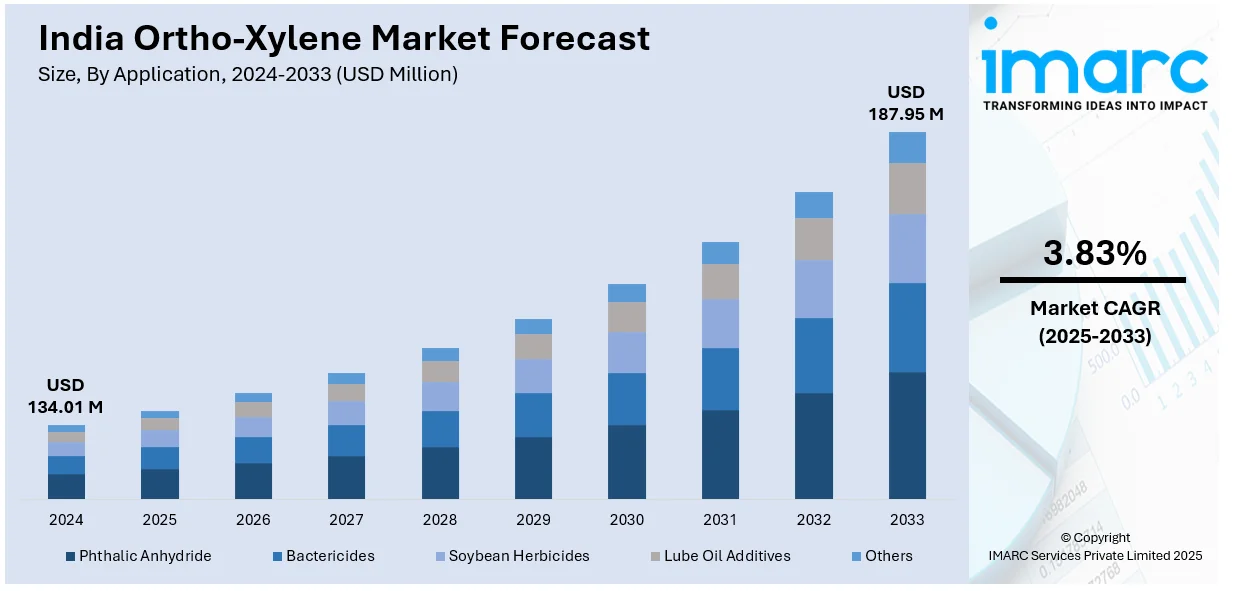

The India ortho-xylene market size reached USD 134.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 187.95 Million by 2033, exhibiting a growth rate (CAGR) of 3.83% during 2025-2033. The India ortho-xylene market share is growing due to increasing demand from the textile and apparel industry for polyester production and rising usage in agrochemical manufacturing as a key solvent and intermediate for herbicides, pesticides, and related agricultural formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 134.01 Million |

| Market Forecast in 2033 | USD 187.95 Million |

| Market Growth Rate 2025-2033 | 3.83% |

India Ortho-Xylene Market Trends:

Expansion of Textile and Apparel Industry

The swift growth of India's textile and apparel sector is a key factor driving the need for ortho-xylene. Ortho-xylene is an essential precursor in the creation of terephthalic acid (TPA), widely utilized in the production of polyester fibers and textiles. Polyester is a commonly utilized synthetic fabric, appreciated for its low cost, resilience, and simple upkeep, rendering it an essential element in the textile industry. India’s textile sector is a major contributor to the country’s economy and exports, and its growing need for polyester textiles, such as those utilized in fast fashion and home textiles, is directly increasing the utilization of ortho-xylene. As per the data provided by the India Brand Equity Foundation (IBEF), the Indian textiles and clothing market is expected to increase at a compound annual growth rate (CAGR) of 10%, potentially hitting US$ 350 billion by 2030. Moreover, The textiles and clothing sector accounts for 2.3% of the country’s GDP, 13% of industrial output, and 12% of exports. The textile sector in India is anticipated to increase its GDP contribution, growing from 2.3% to around 5% by the decade's conclusion. The rise in popularity of polyester in the production of clothing, upholstery, and industrial fabrics is aligned with the growing trend toward synthetic fibers, which are cost-effective and versatile. This is catalyzing the demand for Ortho-Xylene, which continues to be a crucial component in the manufacture of polyester fibers.

To get more information on this market, Request Sample

Growing Employment in Agrochemical Sector

The rising use of ortho-xylene in the agrochemical industry is another significant factor supporting the market growth. Ortho-xylene is an essential solvent and intermediate in the production of various agrochemicals, including herbicides, pesticides, and fungicides. The growing demand for agricultural products is driving the need for effective and efficient agrochemical formulations, making ortho-xylene a vital ingredient in their production. India’s agrochemical industry, in particular, is witnessing rapid growth, owing to the need to boost crop yield and ensure food security for its growing population. According to the information provided by IBEF in 2024, the Indian agrochemicals sector is expected to expand significantly with a compound annual growth rate (CAGR) of 9% between FY25 and FY28. This expansion is anticipated to raise the Indian agrochemicals market to US$ 14.5 billion by FY28, an increase from the existing level of approximately US$ 10.3 billion. As the agrochemical sector expands, the demand for ortho-xylene will continue to rise, particularly for its role in the formulation of key products like herbicides and pesticides. This increasing need for efficient agricultural solutions in tandem with India's agricultural and economic development is contributing to the market growth.

India Ortho-Xylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on application and end use.

Application Insights:

- Phthalic Anhydride

- Bactericides

- Soybean Herbicides

- Lube Oil Additives

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes phthalic anhydride, bactericides, soybean herbicides, lube oil additives, and others.

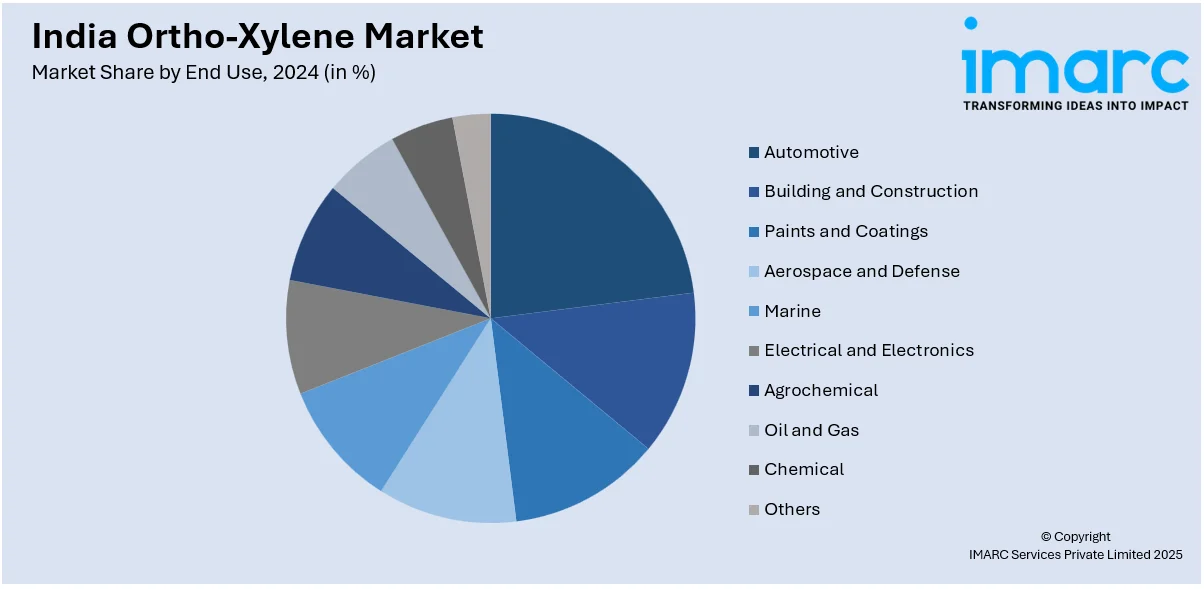

End Use Insights:

- Automotive

- Building and Construction

- Paints and Coatings

- Aerospace and Defense

- Marine

- Electrical and Electronics

- Agrochemical

- Oil and Gas

- Chemical

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes automotive, building and construction, paints and coatings, aerospace and defense, marine, electrical and electronics, agrochemical, oil and gas, chemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ortho-Xylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Phthalic Anhydride, Bactericides, Soybean Herbicides, Lube Oil Additives, Others |

| End Uses Covered | Automotive, Building and Construction, Paints and Coatings, Aerospace and Defense, Marine, Electrical and Electronics, Agrochemical, Oil and Gas, Chemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ortho-xylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ortho-xylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ortho-xylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ortho-xylene market in India was valued at USD 134.01 Million in 2024.

The India ortho-xylene market is projected to exhibit a CAGR of 3.83% during 2025-2033, reaching a value of USD 187.95 Million by 2033.

The India ortho-xylene market is driven by rising demand for phthalic anhydride used in plasticizers, paints, and resins, especially in the automotive and construction sectors. Industrial growth, expanding petrochemical capacity, and increasing applications in polymers and coatings are further supporting consistent market expansion across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)